We’ve ticked over into July 2021, and so have left Q2 behind us … now with 2 units at Callide back in service, and also 3 units at Yallourn as well (though Yallourn unit 4 missed its expected return to service on Wednesday 30th June). Let’s hope prices continue to settle down.

(A) Looking back over prior Q2 periods

I’ve promised a few people that I would publish my review of Q2 prices (as I have in previous years) in order to sum up the pricing activity for a quarter that has been ‘anything but boring’.

Longer-term readers might recall that I chose Q2 deliberately, in order to look more at underlying patterns of outcomes (hence have some insight into fundamentals) – less affected by seasonal variables like summer heat prevalent in Q1 and the occasional winter chills of Q3. This line of questioning has been continuing for a number of years, as noted below:

| Q2 2016 |

Back (what seems a lifetime ago) on 4th July 2016 I posted this review of spot prices for energy in Q2 2016 where I’d noted about some changes to the underlying patterns that had persisted (pretty stubbornly) for at least a decade beforehand. At the time I labelled the change in pattern ‘truly remarkable’. |

| Q2 2017 |

We picked up the same theme in July 2017 to review Q2 prices for 2017 and concluded that “price outcomes for Q2 2017 were off the chart”. These thoughts were picked up in various news media organisations, including in the AFR: |

| Q2 2018 |

A year on from all the news media attention, we saw that prices had backed off somewhat from the extreme outcomes of Q2 2017 – though we cautioned that ‘we’re far from out of the woods, yet’! Enhancement 1 = I added in prices for the electricity market in south-western WA (i.e. the ‘WEM’); Enhancement 2 = I used the access we have to end-of-day clearing futures prices for QLD, NSW, VIC and SA to see what the expectations had been for Q2 prices in 2018; Enhancement 3 = we looked at the rising incidence of negative prices (in part because of the ‘wind correlation penalty’ particularly in South Australia and the ‘solar correlation penalty’ particularly in QLD). I did not have time to complete the analysis started on FCAS prices. |

| Q2 2019 |

I took a break from this line of analysis in 2019 with so much else on, including being swamped by what followed on from the release of our inaugural Generator Report Card 2018 , which proved exceptionally popular. |

| Q2 2020 |

For a variety of reasons, including the presentation to a Vestas audience about ‘NEM merchant pricing – is this the new normal?’, I picked up this line of questioning again for Q2 2020 here. Top of mind in review of Q2 2020 was that the quarter: 1) occurred in the aftermath of a massive summer 2019-20 period with extremes in temperature and demand, and the repetitive incursions of bushfires; and 2) was been beset by the flow-on impacts of COVID-19. |

| Q2 2021 |

Through Q2 2021 we were busily occupied with the development of new versions of our dashboard-style software to take account of Five Minute Settlement that begins at the end of Q3 2021: 1) there’s NEMwatch v10 (the entry-level dashboard); and 2) ez2view (higher-end dashboard), 3) But there’s also the deSide® displays (specifically configured for energy users participating in demand response via spot exposure). … so there’s been plenty of distractions this quarter with both the Callide C4 Catastrophe (from 25th May 2021) and the Yallourn flooding (from 11th June 2021) ratcheting up further what had already been escalated spot pricing compared to Q1. It certainly was not a boring quarter! Amongst this all we’ve also been pressing forward with GenInsights21, looking forward to a Q3 release. More on that later – but, for now, let’s share this overview of pricing patterns for Q2 2021. This will be our last review published for Q2 with thirty minute pricing in the NEM! |

| Q2 2022 |

Looking ahead a year (to Q2 2022) we’ll be able to change our analysis of how Q2 to see how the move to Five Minute Settlement has impacted on price outcomes in the physical and financial markets! |

Given the keen interest in what’s been happening through Q2 2021 amongst our readers, it was with considerable interest that I’ve powered up NEMreview v7 to have a look at just how different Q2 2021 has ended up being, compared to Q2 2020…

(B) Pattern of prices for ENERGY in Q2 2021

Like in prior years, for this year we’ve only had time to look at the pattern of prices for ENERGY – FCAS will have to wait for Q2 2022 (though there will certainly be a focus on FCAS in Generator Insights 2021!

1) Average prices for Q2 have jumped back up, compared to Q2 2020

Starting at the top of the NEM and working our way around, we see that time-weighted average prices jumped significantly (compared to Q2 2020):

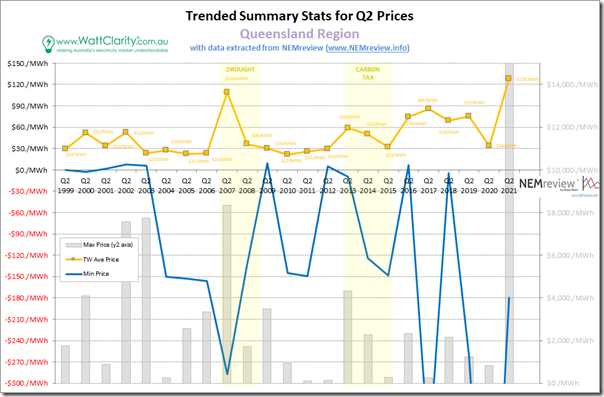

1a) Trended Stats for QLD

It’s clear to see that (in terms of Q2 outcomes) price outcomes for QLD in Q2 were the highest they have ever been since the start of the NEM:

Clearly it is understandable that the Callide C4 Catastrophe (from 25th May 2021) played a significant role … as we will see below.

1) Highest trading price in the quarter ($15,000/MWh) was up at the Market Price Cap.

There were three half hours (17:00, 17:30, 18:00) on 25th May 2021 that ended up being up at that level.

2) The lowest trading price in the period was down at –$179.81/MWh (11:30 on 21st April 2021 … a few hours before this spike).

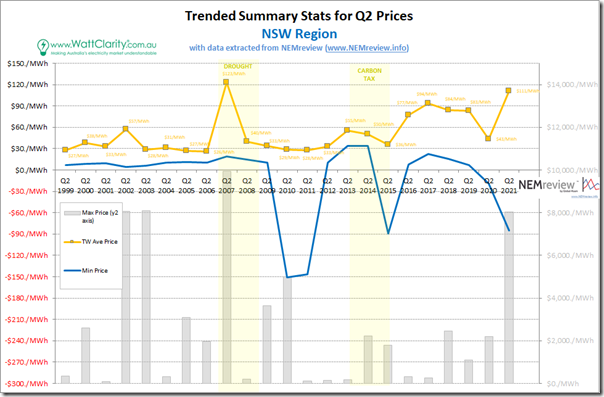

1b) Trended Stats for NSW

Moving south of the border we see a similar pattern in NSW:

In this case we see that the time-weighted average price ($111.18/MWh) was exceeded only in one other year in the 23 year time range shown – that of Q2 2007 (the year that the ‘Millennium drought’ impacted the NEM):

1) The highest trading price seen in the quarter was $8,022.05/MWh (at 18:00 on 10th June 2021);

2) The lowest trading price seen in the quarter was just below zero, at –$85.28/MWh (at 17:30 on 11th June 2021, a day after the highest price … and also following this spike for the 17:00 dispatch interval).

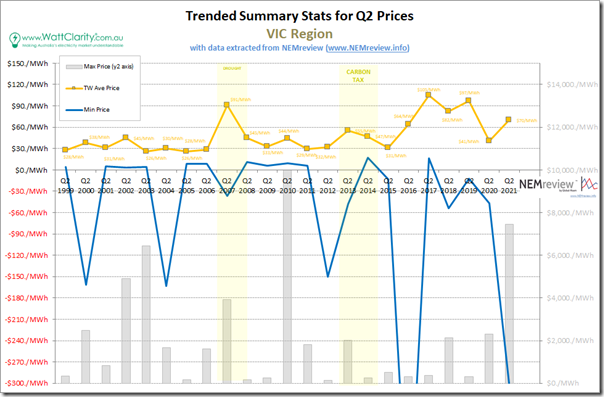

1c) Trended Stats for VIC

Further south into Victoria we see average prices were up again, but not to the same extent as in QLD and NSW …

Simple time-weighted average price at $70.11/MWh was the 5th highest in the 23-year historical range – helped along later in the quarter by the impact of Yallourn flooding event:

1) The highest trading price seen in the quarter was $7,443.23/MWh (18:30 on 18th May 2021 – no article on that day); whilst

2) The lowest trading price seen in the quarter for VIC was –$299.76/MWh (17:30 on 2nd June 2021 – following the 17:05 spike in NSW and QLD in a quirk of the 5/30 issue).

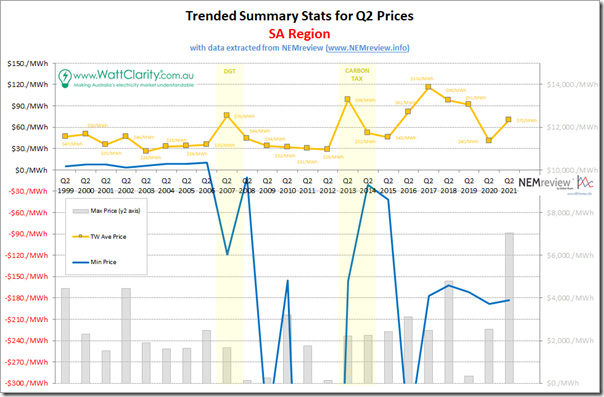

1d) Trended Stats for SA

Taking a turn west into South Australia, we see the same underlying pattern, layered with South Australia’s own uniqueness …

The simple time-weighted average for the quarter in SA was (at $69.87/MWh) was beaten in 6 other years:

1) The highest trading price seen in the quarter was $7,038.75/MWh (at 18:30 NEM time on 18th May 2021 – same as for the VIC region above);

2) The lowest trading price seen in the quarter was down at –$183.33/MWh (at 11:00 NEM time on 7th June 2021).

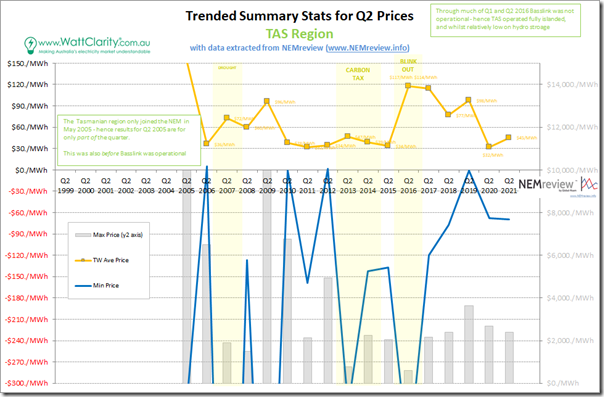

1e) Trended Stats for TAS

Upping anchor and sailing down to Tassie over Bass Strait, we see that Tasmania continues to sing its own tune at times …

Though up on Q2 2020, the simple time-weighted average for the quarter in TAS for Q2 2021 (at $45.11/MWh) was well below prior ‘bad’ years in the Apple Isle:

1) The highest trading price seen in the quarter was $2,386.31/MWh (at 17:30 on 21st June 2021 – prior to this NEM-wide spike captured for the 17:40 dispatch interval);

2) The lowest trading price seen in the quarter was below zero, at –$69.49/MWh: (at 07:00 on 19th April 2021)

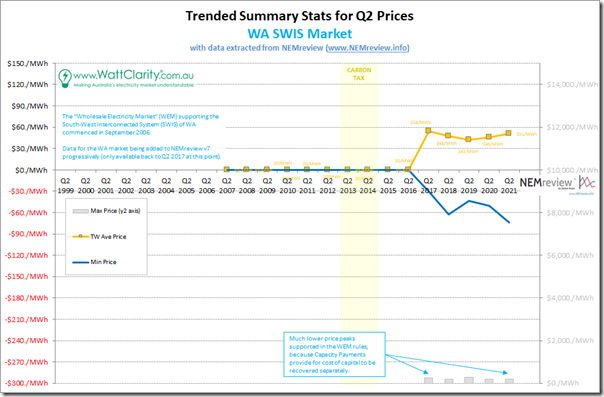

1f) Trended Stats for WA SWIS

I noted in the report for Q2 2018 that we had commenced the process for the addition of data into NEMreview v7 for the spot market of the South-Western Interconnected System (SWIS) in WA.

It’s not been our focus to fill out the data sets available for that market, yet. Let us know if you would like to speak with us about what we could do with respect to the SWIS?

However we can show you how pricing patterns have progressed over the two subsequent Q2 periods:

In this case we see that Q2 average prices have been fairly consistent with other recent years (at $50.62 for Q2 2021) – which is understandable given that capacity payments should be covering any scarcity premium that would exist in an ‘energy only’ market like the NEM:

1) The highest price for the quarter was (understandably) low, at only $182.77/MWh (at 19:00 NEM time on 22nd April 2021); but

2) The lowest price in WA was similar to the NEM regions, at –$73.83/MWh (at 14:00 NEM time on 3rd June 2021).

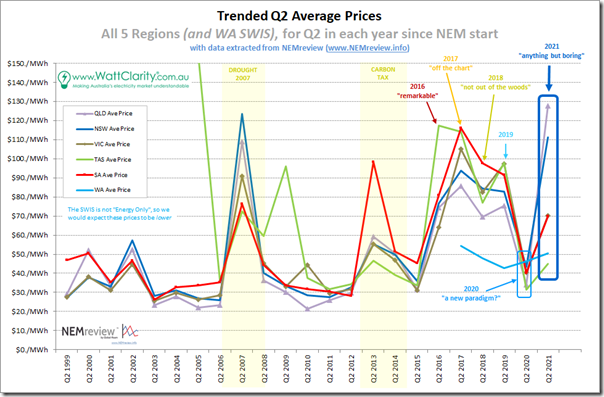

2) Simple time-weighted averages up again in Q2 2021 (c/w Q2 2020)

So here’s the summary trend:

We see prices are up in all regions (and in WA) compared with Q2 2020 – but especially so in QLD and NSW.

There will certainly have been some winners and losers created by the volatility … particularly as it was unexpected in the ‘market consensus’ as shown below.

3) How have the distributions of prices changed over time?

We’ve noted before on WattClarity® ‘the NEM is a complex place’ – and as Allan stated in January 2020, ‘the NEM is a market where the details matter’.

Whilst time-weighted averages are easily calculated, and readily digestible, for an increasing number of stakeholders they are less and less relevant (including most Semi-Scheduled generation operators). It’s for this reason that we started taking a closer look at the distribution of prices back in 2016 – and in 2020 we noted that ‘a new paradigm’ appeared to be emerging.

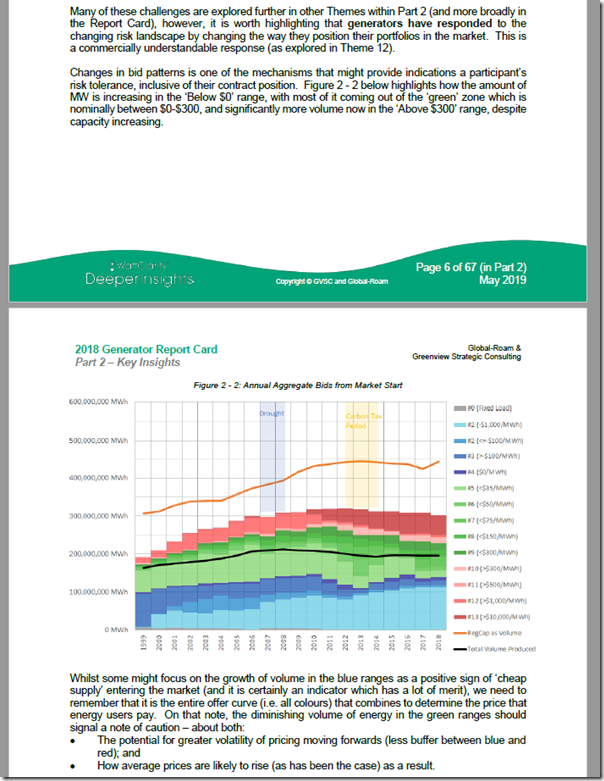

One of the fundamental reasons for this new paradigm was discussed in the Generator Report Card 2018 – in which we wrote how ‘the level of Risk in the NEM is increasing’:

This was done as Theme 2 within Part 2 of the 180-page Analytical Component.

One of the illustrations of this increased risk came where we highlighted that there is less and less volume of capacity offered in the ‘green’ range of prices (above $0/MWh but below $300/MWh):

This is a NEM-wide phenomenon … and it means that the contingency size required to have the price shooting from very low to very high is reducing in size. Or, in other words, the NEM is becoming more volatile.

What we saw happen in Q2 2021 makes sense, understanding this, because we saw pricing outcomes ‘up at both ends’… in other words:

1) More high prices; but also

2) More low prices as well

3) … which means fewer prices inside the ‘normal’ range.

Makes it more important to ensure you hit the high prices and avoid the low prices if you are a spot-exposed generator (or the inverse, if you are a spot-exposed energy user). Makes for accelerating divergence of LWA Prices, as discussed in other articles on WattClarity.

We’re looking forward to publishing updates to these trended, aggregated bid stack views to incorporate the most recent 30 months of history in GenInsights21 …

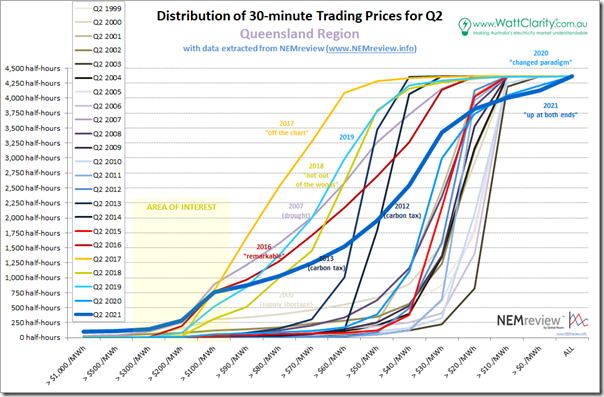

3a) Distribution for QLD

Again, we’re starting at the top of the NEM to work our way around:

In the strange inverse world that was 2016-2019 we can clearly see uplift in ‘everyday high prices’ that (combining also with a spike in prices above $100/MWh) delivered the much higher average prices for the Q2 periods over those 4 years. We see that 2020 saw a different paradigm start to emerge, with an increase in the number of negative prices.

In 2021, in contrast, we see a combination of two factors:

(i) Too Low for Zero

As noted on 17th February 2021 (i.e. part-way through Q1 2021), there is an accelerating rise of Negative Prices in the NEM. This is causing all sorts of challenges in commercial operations … and leading to some changes to NEM Rules as well.

We can clearly see in the chart above (top-right corner) that this trend has continued … summed up also below.

(ii) High Price incidence

The incidence of prices above $100/MWh is somewhat lower than some earlier crazy years.

However the incidence of prices above $1,000/MWh was the highest it has ever been!

… i.e. truly ‘up at both ends’!

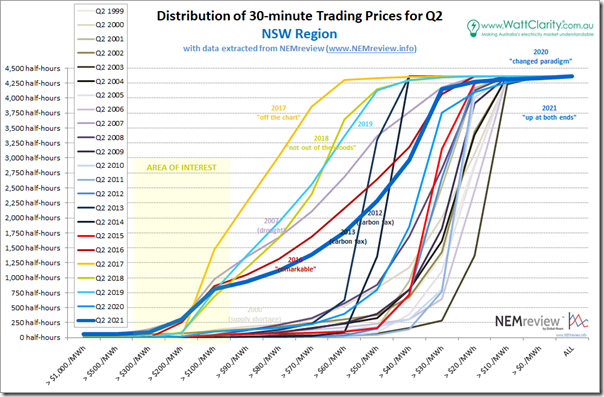

3b) Distribution for NSW

Moving into NSW, we see a similar story unfolding:

Reviewing the two extremes in this chart:

(i) Sub-Zero

It’s a noticeably flatter curve at the lower-priced end compared to QLD for Q2 2021 (i.e. fewer low and negatively prices trading periods). This makes sense, given that NSW is strongly interconnected on both sides so somewhat immunised from this latest malaise.

We wonder how this will start changing as the Liddell units begin to retire in the not-too-distant future?

(ii) Higher-end Prices

For Q2 2020 we saw 809 half-hours with trading prices in NSW above $100/MWh:

1) Which is almost 10x the number of half-hours above that mark in 2020 (i.e. 99 half-hours);

2) Though it is still below the massive 1,474 half-hours experienced above that level in Q2 2017 (the largest of the three years with higher incidence than Q2 2021).

… but watch for the discussion below of incidence of trading prices > $1,000/MWh (i.e. a ‘high-high’ level).

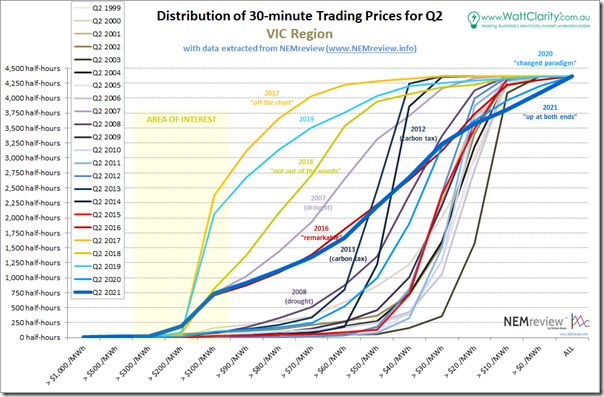

3c) Distribution for VIC

Further south into Victoria the ‘up at both ends’ picture is similar:

The same pattern can be clearly seen, with 2007 (drought) and 2016-2019 being clear outliers, with distribution curves shunted to the left (i.e. higher price end). As is the case for QLD and NSW we see that there’s a distinct tail at either end of the curve for VIC in Q2 2020 (104 half-hours above $100/MWh and 170 half-hours below $0/MWh).

Adding in Q2 2021 we see that it neatly overlays the distribution for Q2 2016 … with the exception that there are many more instances of low and negative prices. One might think that this would mean the time-weighted average for Q2 2021 would be lower than Q2 2016 as a result … but that is not the case, for reasons discussed below.

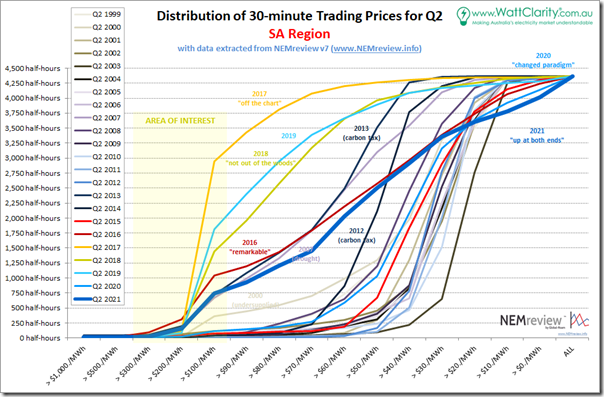

3d) Distribution for SA

In South Australia we see a similar sort of picture emerging:

Again, the distribution is generally similar to the ‘remarkable’ Q2 2016 … except:

1) Like VIC, there are many more instances of low and negative prices for Q2 2021 (almost 3x as many);

2) Unlike VIC, there are fewer instances of prices >$100/MWh compared to Q2 2016.

3) This does mean (unlike VIC) that the time-weighted average price for SA in Q2 2021 was below that for Q2 2016.

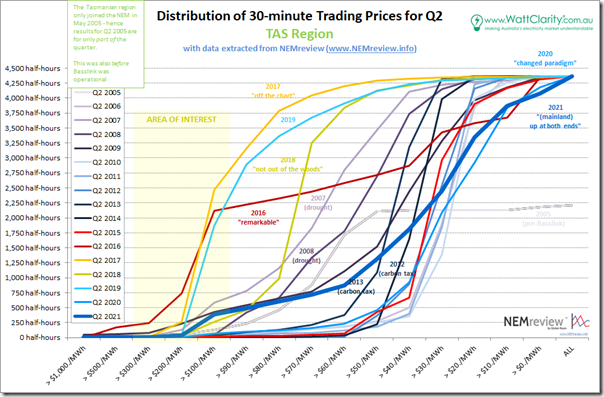

3e) Distribution for TAS

Down in the apple isle there is the same type of underlying pattern, but with its own Tassie style …

As was the case for Q2 2020, TAS saw the second highest incidence of negative price (290 half-hours, second to SA at 355 half-hours) in the quarter of all NEM regions (WA actually managed second on a Australia-wide basis).

It was also the lowest incidence of of prices above $100/MWh in the NEM (388 half-hours), but again was pipped by WA on an Australia-wide basis (lower, at 339 half-hours).

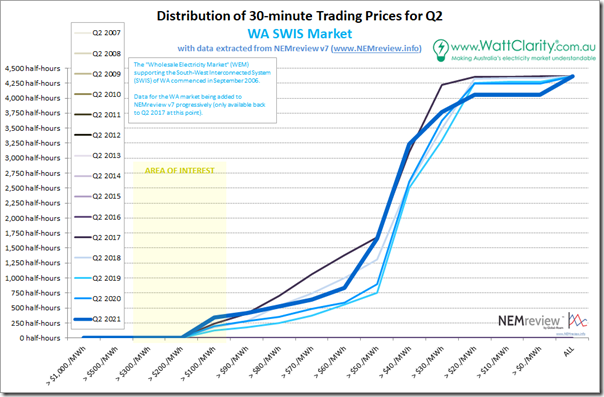

3f) Distribution for WA (SWIS)

Over in the west, we still have not yet compiled a longer-range history for the WEM in the SWIS. What we have is shown here:

Intriguingly (given their Capacity Market) the market there showed the highest incidence of prices above $100/MWh (i.e. 339 half-hours) in the 5 years for which we have compiled history to date – though (as noted above) this incidence was lower than any NEM region.

It also had a decent number of negatively prices periods (308 half-hours, which was approximately 10x the incidence in NSW, and higher than the other NEM regions).

Let us know if WA is of particular interest to you?

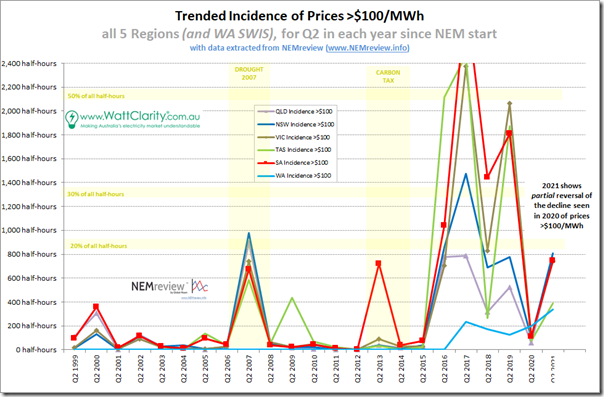

4) Trend of price excursions

I’ve noted above how the pattern of Q2 2021 was generally ‘up at both ends’ (i.e. increased incidence of high price – and increased incidence of low price … which means a hollowing out of the middle (one artefact of the increased risk we’re facing in the NEM)).

Let’s have a look at the high and low extremes…

4a) Trend of HIGH price excursions

Looking at the number of times the trading price period exceeded $100/MWh, we see a particular pattern:

As it did last year, the first thing that jumps out in review of these trends is that the levels in Q2 2020 have reduced markedly from the sky-high levels seen in the preceding four years (2016-2019), and are also lower than in the drought year (2007).

However for Q2 2021 we see that the incidence has increased for all regions from the Q2 2020 low point – but particularly for QLD, NSW, VIC and SA.

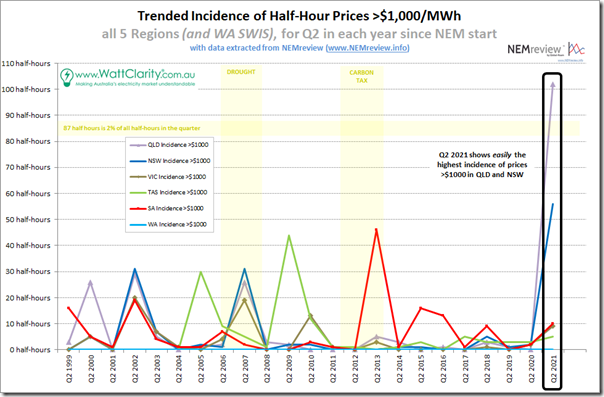

4b) Trend of HIGH-HIGH price excursions

However it’s when we set a higher benchmark (trading prices exceeds $1,000/MWh) that we see something much more pronounced:

We see here that:

1) For the QLD region, the incidence (highest in the NEM, at 102 half-hours … or more than 2 days solid, in total!) is more than 3x higher than the next highest years – which were the drought period of Q2 2007, the Q2 2002 year, and the ‘not yet AC interconnected’ period of Q2 2000. There will surely be some winners and some losers in that!

2) For the NSW region, the incidence is almost 2x as high as the previous high points – again the drought affected Q2 2007 and Q2 2002.

3) For VIC, SA and TAS, the incidence was up a little on Q2 2020 but not to the point of historical maximums.

4) As we would expect there are no price spikes above $1000/MWh in Western Australia (its capacity market means a lower Market Price Cap is possible).

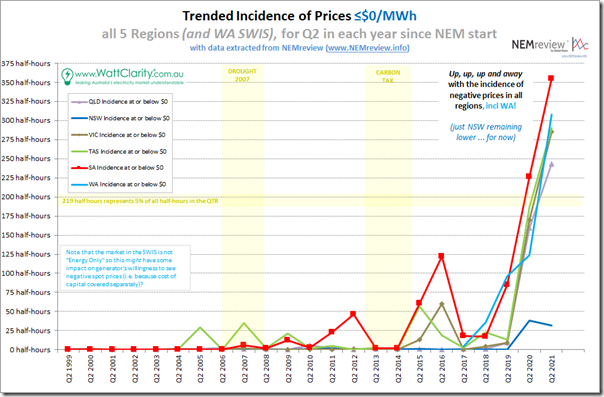

4c) Trend of LOW price excursions

Looking at the number of times the trading price period dropped to, or below, $0/MWh, we see a pattern that’s common to all regions:

It truly is looking like ‘up, up and away!’ with the incidence of negative prices in all regions (and WA as well) … except for NSW.

1) For those 5 affected regions, we’ve accelerated past 5% of all trading periods and the pattern of plant development would suggest that this trend is not going to change soon.

2) These increased instances of negative prices are one reason that average revenue ($ per MW installed) are suffering for Wind and Solar Farms outside of NSW – as Marcelle noted on 17th March 2021 for Solar Farms … and for Wind Farms on 18th May 2021.

Time permitting, we would look forward to extending this analysis further, and (for instance) trending over a number of years via GenInsights21.

3) It would seem to be only a matter of time for the pace of cannibalistic renewables development in NSW to catch up (relative to the higher demand level) and force the same outcome there as well).

5) Expectations from the futures pricing?

As noted above, there will be some winners and some losers in the jump in spot prices seen in the time-weighted averages for Q2 2021 above in all regions.

However these winners (and the losers) may not be who you would initially expect to be lining up on either side of that finish line – and this will be, at least in part, because of the varying expectations that they might have had in advance of this quarter. Performing a function that’s similar to the ‘Forecast Convergence’ function in the ez2view software, I’ve extracted some data for 4 regions from NEMreview v7 and give you a view of ‘Futures Convergence’ to illustrate the point:

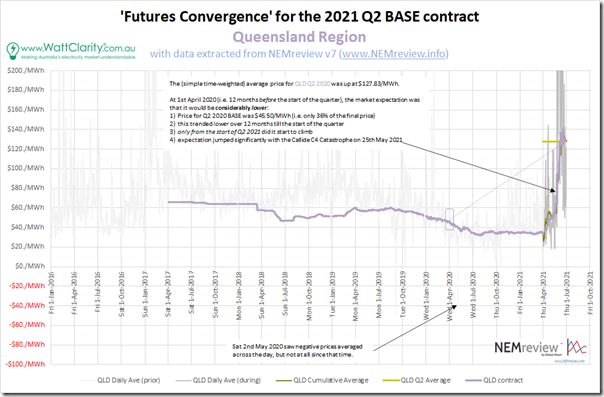

5a) Clearing Prices for QLD Base Contract Q2 2021

Again from the top of the NEM, we’ll start with Queensland and work our way around:

As highlighted in this progression, the bulk of the market was clearly surprised by where the huge increase in where time-weighted average price for Q2 2020 actually landed. This suggests that there are a number of stakeholders who ended up considerably out of the money.

1) Remember that there are a number of causes in this escalation:

(a) The Callide C4 Catastrophe was clearly a significant cause … just look at the steep jump that followed 25th May 2021;

(b) However also note that prices had already been climbing through the quarter because of other challenges that pre-dated Callide … such as the lower black coal unit availability discussed on 16th June.

2) In the example given, if you were an energy user who’d purchased cover for Q2 2021 back in April 2020, you would be thanking your lucky stars that you had hedged at that point (or really any time up until the end of Q1 2021) instead of buying on spot. Of course, this simplistic comparison does not account for all factors (like risk), but it is illustrative.

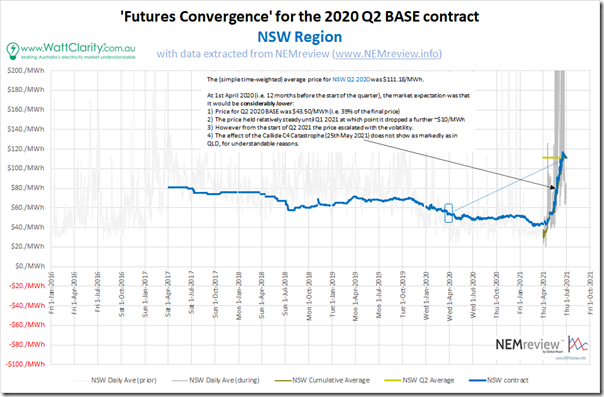

5b) Clearing Prices for NSW Base Contract Q2 2020

Moving into NSW, we also see a steep (and unexpected) escalation during the quarter:

I don’t have time to explore currently (perhaps a knowledgeable reader can explain why) but I note that the expected price dropped further during Q1 2021 … before escalating sharply when issues (such as these) became apparent. We’ll also see the same for VIC and SA below as well?!

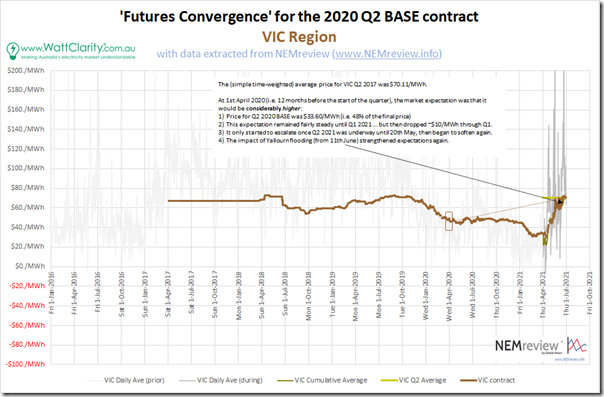

5c) Clearing Prices for VIC Base Contract Q2 2020

Further south into Victoria the chart is very similar:

We noted above that the time-weighted average price for Q2 2021 was lower in VIC than NSW and QLD (which means the BASE hedge settled lower as well). However there is still:

1) The dip in Q1 2021;

2) Followed by the escalation through Q2 2021.

3) Interestingly as well, I’ve noted on the image that the futures price hit a temporary peak on 20th May (at $69/MWh buoyed high daily averages on Monday 17th May (TWA $248.37/MWh) and Tuesday 18th May (TWA $411.28/MWh)) … but then subsided somewhat, only to be accelerated again by the Yallourn flooding.

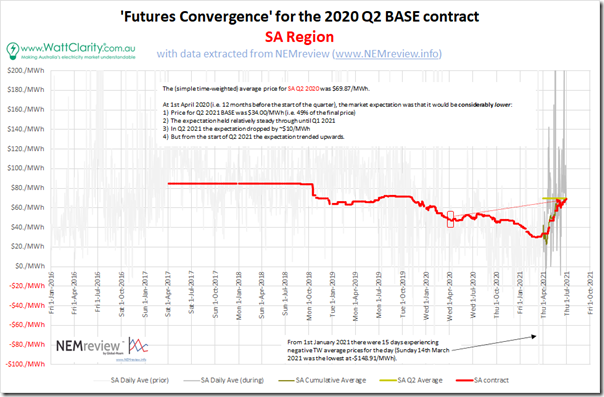

5d) Clearing Prices for SA Base Contract Q2 2020

In South Australia we see the following:

Again we see that:

1) Where the time-weighted price cleared for Q2 2021 was significantly above where it was expected to be at Q1 2020.

2) That expectation softened up until the end of Q1 2021 … and particularly inside of that quarter.

3) But then escalated from the start of Q2 2021.

This again begs the question … what was it that ‘the market consensus’ missed so significantly in

5e) Clearing Prices for TAS Base Contract Q2 2020

The ASX does not offer hedge contracts for the Tasmanian region, so we do not have visibility of the markets prior expectations for the quarter just passed.

5f) Clearing Prices for WA SWIS Base Contract Q2 2020

The ASX does not offer hedge contracts for the SWIS, so we do not have visibility of the markets prior expectations for the quarter just passed.

6) Why was the market so blindsided by where average spot ended up for Q2 2021?

It’s not all that often that we see quarters in which the market has been so completely wrong, in terms of how where prices ended up being, compared to expectations.

(a) This was the case even (or, more accurately, especially – for NSW, VIC and SA (given the softening of expectations through Q1)) right up to the start of the quarter!

(b) This will be worth drilling into this at a later point in time…

|

PS added Friday 2nd July 2021. On Friday evening I posted later ‘Here’s one reason why the market was blindsided by high average prices in Q2 2021’. Perhaps you can think of others?. |

(C) Alas no FCAS Price Analysis for Q2 2021

In prior years I have endeavoured to complete analysis of FCAS pricing … but not quite found the time.

Given everything else we have going on in 2021 I knew right at the start this would not be possible – though we have started to pull together some interesting analysis of the FCAS services for GenInsights21 that we’ll look forward to sharing in that report.

Leave a comment