It was 8 days ago when I posted this ‘Discussion about electricity prices – following the Callide C4 Catastrophe’ … and since that time we’ve had flooding issues affecting coal supplies to Yallourn power station.

Also since Monday 7th June we have seen a continuation of spot price volatility, mainly in QLD and NSW, and including:

5) Tuesday morning (15th June 2021) … and the evening, as well.

Whilst acknowledging that Yallourn is one of three remaining brown coal-fired units, and in Victoria, I particularly want to focus on the black coal plant in QLD and NSW … as that’s where the volatility has primarily been occurring…

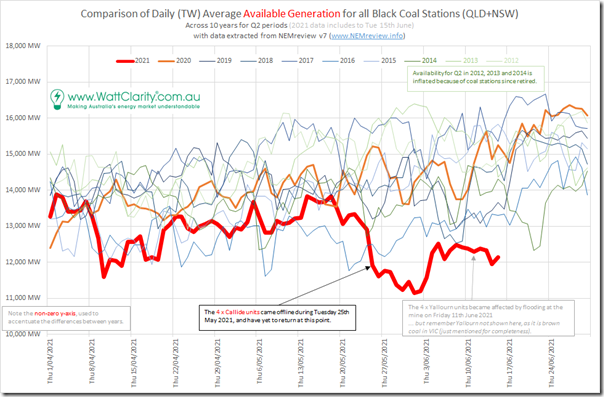

(A) Availability of Black Coal units through Q2 2021

It’s plain to see that it’s not been a great quarter for the black coal units across NSW and QLD … not just in terms of the Callide C4 Catastrophe that has meant we’re still without all 4 x Callide units now, more than 3 weeks since the event occurred.

Last week on Friday it looked like Callide B1 would be back on minimum load yesterday … but no sign of it (yet?) on Wednesday morning 16th June.

As noted on 7th June there was volatility (moreso in NSW, but also QLD) that pre-dated the 25th May 2021 when Callide C4 had its problems. So this morning* I pulled off some numbers for the aggregate availability over the Q2 2021 period and compared this with the preceding 9 years:

* keep in mind that data for Tuesday 15th June is the last data point for Q2 2021 thus far.

Note that:

1) This data in the early years have AvailGen inflated by:

(a) The closure of Redbank in August 2014;

(b) The closure of Wallerawang in April 2014;

(c) The closure of Swanbank B in June 2012; and

(d) The closure of Collinsville in May 2012.

2) … so the first 3 years (2012, 2013 and 2014) are not directly comparable.

Also note that the expectation is that availability climbs through Q2 as plant come out of maintenance to be ready for the cold snaps and evening demand peaks of mid winter (July), but this has obviously not happened in Q2 2021.

(B) Updating the Numbers, on the ‘Dependability’ of Coal units in GenInsights21

We’ve been crunching the numbers more broadly to update the much-referenced analysis we completed on coal plant availability that we included in the Generator Report Card 2018 (with data only to 31st December 2018).

As part of Part 4 within the 180-page analytical component in the GRC2018, we included discussion about 5 different aspects of the ‘Dependability’ of the remaining 48 x operational coal units:

1) Which were (when we put the GRC2018 together) critically important to balancing supply to meet demand … given that these units contributed through calendar 2018 ‘75% of the “grid energy” supplied by the NEM’; but

2) With obvious concerns (dating as far back as this article in December 2014, and even before that point) that the ‘Dependability’ would deteriorate as these units both:

(a) Accumulate more technical wear and tear; but also

(b) Find their operations increasingly challenged, commercially, by the ongoing energy transition.

With the upcoming GenInsights21 update we’re looking forward to revealing what our independent updated review of these types of metrics will reveal.

As part of this process, we’re investing time to see what we can derive in terms of (changing?) forced outage rates particularly for these units based on data that’s published in the MMS.

Let us know if you have a particular interest in this analysis!?

(C) Regular review of Q2 pricing

For a number of years we’ve been reviewing the pattern of Q2 pricing, with the idea being that Q2 has been the traditionally ‘boring’ quarter, after the excitement of Q1 volatility.

… for instance, this was the review of Q2 2020 that we published on 9th July 2020…. coincident with a Vestas forum that I’m not sure is running again this year?

This year (2021) the roles have been reversed …

1) with Q1 2021 pretty non-eventful (particularly compared to the Four Headline Challenges of summer 2019-20); and

2) with Q2 2021 anything but ‘boring’!

I’ll look forward to running the numbers in early July 2021 to see how the entirety of Q2 2021 compares (last Q2 period with 30-minute trading prices before Five Minute Settlement, as well!)

Leave a comment