June 2022 was a turbulent month in the NEM.

The AEMO has identified at least eight contributing factors for the extreme price outcomes that eventuated throughout the month, including:

- Rising global commodity prices;

- La Niña weather conditions – affecting both electricity supply and demand; and

- Several expected and unexpected plant outages

This culminated with the market operator suspending the market for nine days, an unprecedented move that made headlines across even the mainstream media.

Despite all of this, significant load-shedding was avoided and the lights stayed on across the five states that the NEM serves (QLD, NSW, VIC, SA and TAS). However only now is the picture becoming progressively clearer about what it all cost.

Below I have attempted to calculate each component of the system costs that occurred throughout June in order to provide an overall estimate. These calculations should act as a basis so that readers can begin to understand the total cost of what could be one of, if not the, most expensive months for wholesale electricity in this country.

Timeline of events in June 2022

In this article I will outline the six major components of the total cost for June. The table below outlines the sequence of events that occurred and the dates for which each component is applicable.

|

Component of Cost |

|||||||

|

Event |

1 |

2 |

3 |

4 |

5 |

6 |

|

| 1st June | |||||||

| 2nd June | |||||||

| 3rd June | |||||||

| 4th June | |||||||

| 5th June | |||||||

| 6th June | |||||||

| 7th June | |||||||

| 8th June | |||||||

| 9th June | |||||||

| 10th June | |||||||

| 11th June | |||||||

| 12th June | Administered Pricing commences in QLD. | ||||||

| 13th June | Administered Pricing commences in NSW, VIC and SA. | ||||||

| 14th June | RERT dispatched in NSW. | ||||||

| 15th June | Market suspended. RERT dispatched in NSW. RERT dispatched in QLD. |

||||||

| 16th June | |||||||

| 17th June | RERT dispatched in NSW overnight. | ||||||

| 18th June | |||||||

| 19th June | |||||||

| 20th June | |||||||

| 21st June | |||||||

| 22nd June | Administered Pricing ends in SA. | ||||||

| 23rd June | Administered Pricing ends in QLD, NSW and VIC. | ||||||

| 24th June | Market suspension ends. | ||||||

| 25th June | |||||||

| 26th June | |||||||

| 27th June | |||||||

| 28th June | |||||||

| 29th June | |||||||

| 30th June | |||||||

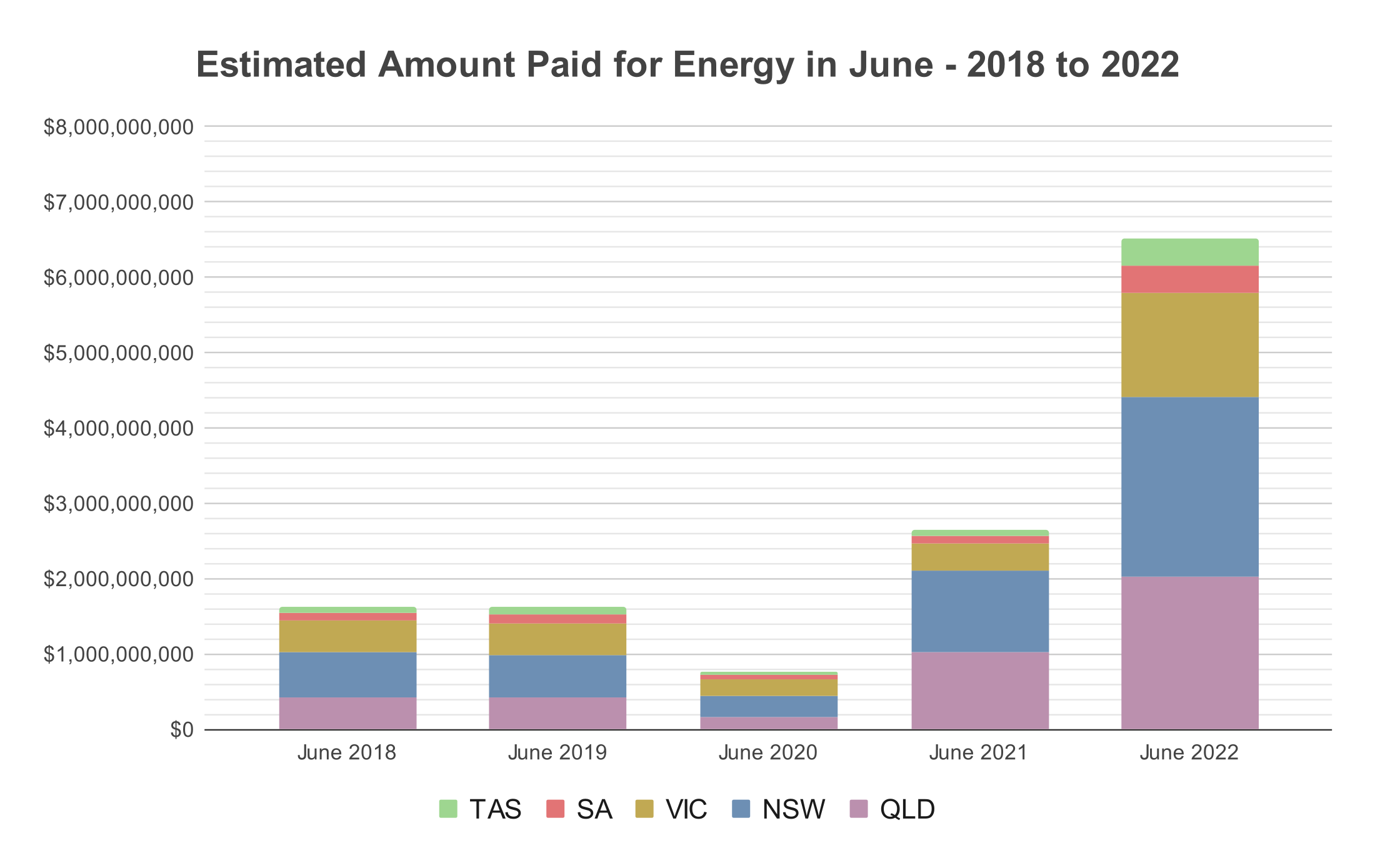

Component 1: Amount Paid for Energy

To begin let’s look at the largest contributor to total cost – the amount of money paid to generators for producing electricity through the spot market. While there are other commodities and markets (as I’ll briefly touch on later), this is the primary market that the AEMO operates and is referred to simply as the ‘energy’ market.

The financial return of an individual generator is usually not known, and may not match what they receive in spot revenue, due to the complexity and confidential nature of PPAs (Power Purchase Agreements), other hedging arrangements, etc.

However, we can reasonably accurately sum up the cost of energy that has passed through the spot market. To do this I have taken the MWh volume of energy generated for every unit in each region and then multiplied this by the region’s RRP (Regional Reference Price) to find the aggregate revenue total for each 5-minute dispatch interval. I then summed together all regions and intervals to get a final estimate for the entire NEM over the month of June.

I calculated this number to be approximately $6.52 billion for June 2022.

The ~$6.52b paid to generators for energy in June 2022 was almost 2.5 times that of June last year, and more than eight times that of June 2020.

Source: Data extracted from NEMreview

The chart above shows how this $6.52b compares when using the same calculation for the previous five June months. To further put that into number into perspective, the total energy spot market turnover for the entire 2014 calendar year was roughly $9.1b using the same methodology.

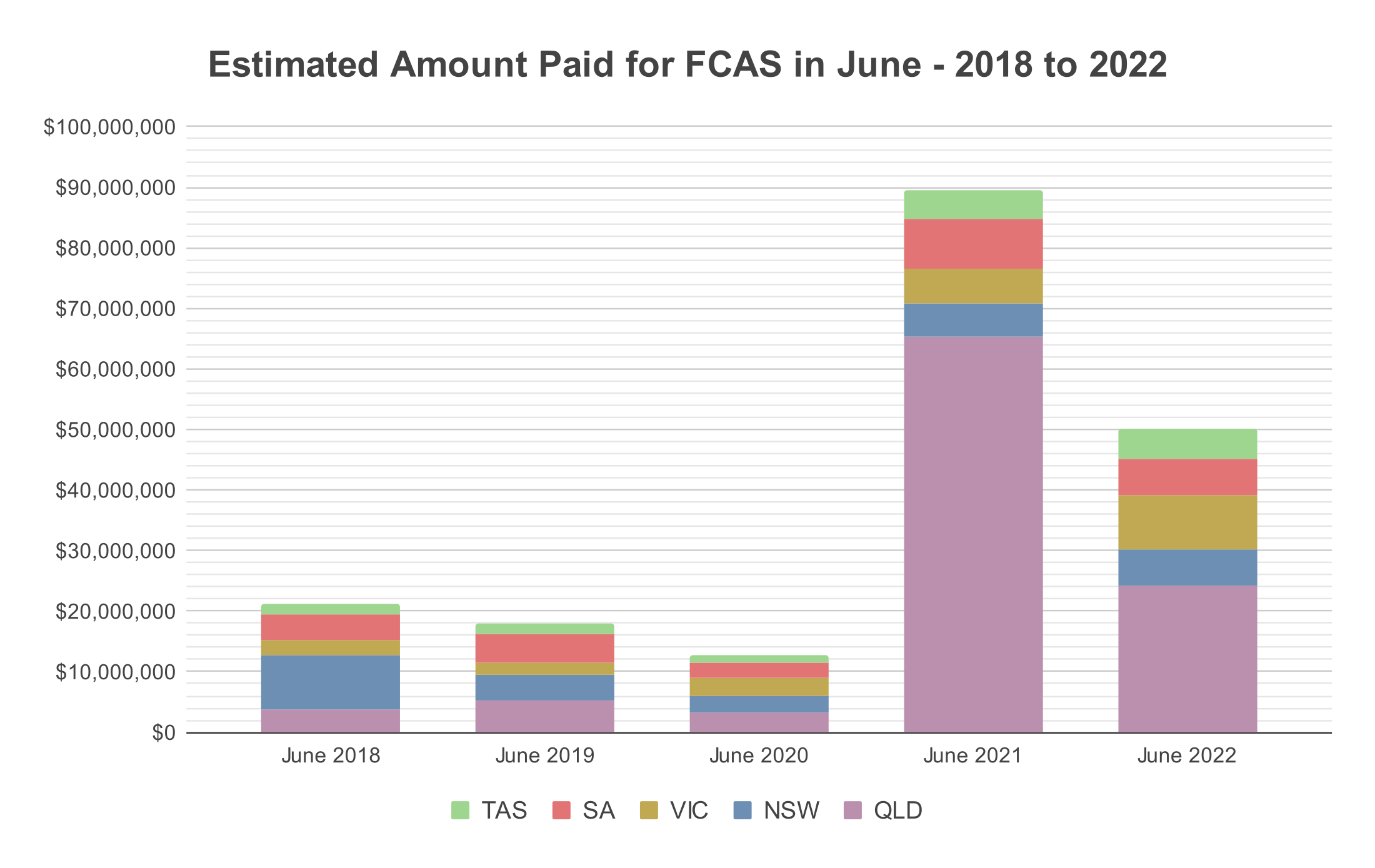

Component 2: Amount Paid for FCAS

FCAS (Frequency Control Ancillary Services) relates to the eight commodities that are used to maintain system frequency. In addition to the primary energy spot market, some generators (and loads) can offer enablement into these FCAS commodity markets. Jonathon Dyson has provided an explainer on how this works in his article ‘Let’s Talk FCAS’.

To calculate the total amount paid to settled via the spot market for FCAS, I’ve taken the MWh volume of enablement for each of the eight FCAS commodities, and then multiplied each by the corresponding RRP to find the aggregate cost of each commodity at each interval. I then summed together all regions, commodities and intervals to get a final estimate for the entire NEM for June.

The final number at the end of this calculation was roughly $50 million for June 2022.

The ~$50M of FCAS costs in June 2022 was down from last year – where there were historically high FCAS contingency prices in QLD following the Callide C4 explosion in late May – but still considerably higher than in other more recent years.

Source: Data extracted from NEMreview

Keeping in mind that the y-axis on this chart is at a smaller scale to the previous chart, this graph shows some context to how this amount compares to the past five years.

In June 2021 and June 2022, just two commodities in one region – the 6Sec and 60Sec Contingency Raises services in QLD – amounted alone to $62.82M and $19.32M respectively.

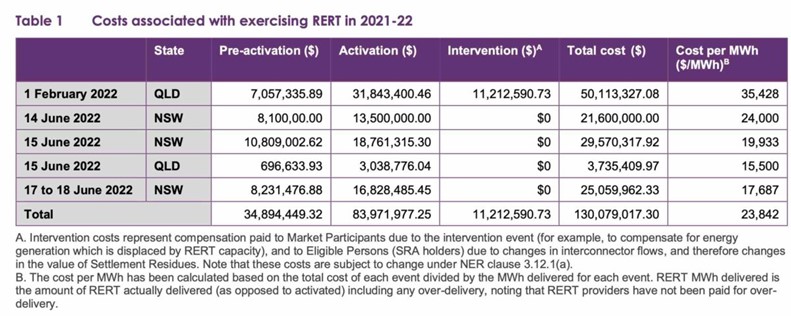

Component 3: RERT

The RERT (Reliability and Emergency Reserve Trader) is a mechanism that the AEMO can use in extenuating circumstances in order to maintain power system reliability. When AEMO assessments indicate a need for RERT to be procured, they begin to engage with market participants to purchase and secure reserve generation and/or demand reduction contracts.

Over the course of June 2022, the AEMO activated the RERT a total of four times – three times in NSW and once in QLD. The AEMO has recently updated prior estimates by publishing its RERT End of Financial Year 2021-22 Report which contained the following table of the total cost of each activation of this mechanism.

Adding the four relevant rows in the table above together, we can attribute the total cost of the RERT in June to be approximately $80 million.

Component 4: AEMC Compensation

A compensation scheme exists for generators who were affected by the APC (Administered Price Cap). The APC came into effect in QLD once the CPT (Cumulative Price Threshold) was hit on the 12th of June, the APC was then applied for the other mainland regions one day later when the CPT was hit in NSW, then VIC and SA. This scheme is assessed by the AEMC and is designed to cover when a participant’s direct and/or opportunity costs become higher than the revenues under the APC (which is currently set at $300/MWh) when it is in effect.

The total amount of the claims under this scheme is yet to be published.

The current AEMC Compensation Guidelines states that the amount paid under this scheme is considerate of “the value of other sources of compensation” that “arises out of the same events and covers the same costs and opportunities foregone”. The first receipt notice (claims received by the AEMC up until 22nd of June) were almost entirely in relation to costs incurred between 12th to 15th of June (i.e. before the market suspension). The second receipt notice (claims received up until 1st of July) included pending claims that overlapped with the market suspension period.

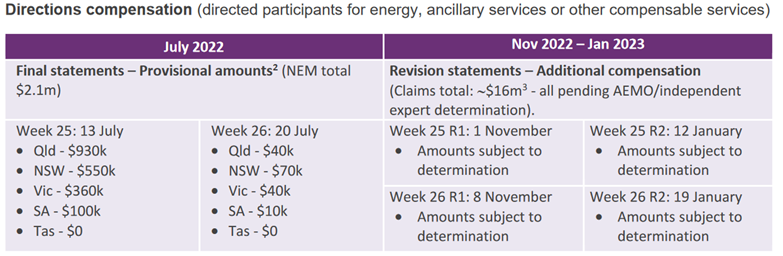

Component 5: AEMO Directions Compensation

On several occasions throughout June (outlined in the timeline above) the AEMO deemed it necessary to direct some generators to make capacity available to maintain system reliability and security. Clause 4.8.9 of the NER (National Electricity Rules) dictate that affected generators must be compensated for the associated cost of these directions.

The table below has been taken from the AEMO’s June 2022 NEM Events Update that was released on August 15th. Note that the dates in the table refer to the market billing periods (and not the date for which the compensation related to).

The total of provisional amounts and pending claims is $18.1 million.

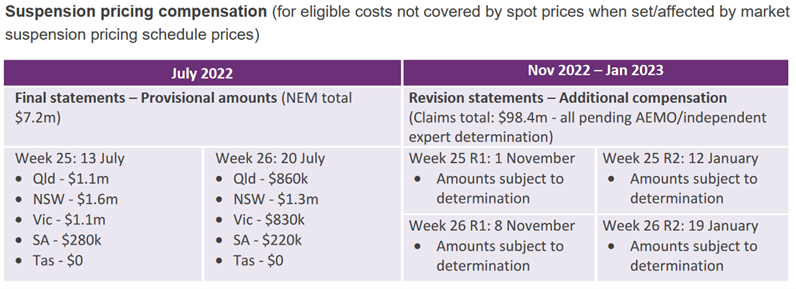

Component 6: AEMO Market Suspension Compensation

Clause 3.14.5A of the NER stipulates that the AEMO must pay and recover associated costs not covered by spot prices for participants that are affected by a market suspension. The NER states that the first objective of this rule is so that an incentive remains for “scheduled generators to supply energy”.

The Market suspension began on the 15th of June and concluded on the 24th of June. The AEMO update referred to earlier also contains the following table relating to these claims for June 2022:

The total of provisional amounts and pending claims is $105.6 million for June 2022.

Estimated Total Cost

Adding together the numbers I have stated above, my preliminary estimate of the total cost of June 2022 is $6.77 billion. This figure excludes the yet-to-be-published AEMC compensation figure, but does include the total amount from pending claims under the two AEMO compensation schemes (which are provisional, hence yet to be finalised).

This number should serve as a gauge of how much money has begun to flow through the various market mechanisms to recoup total costs – the majority of which will eventually be paid for by electricity end-users. It should not be confused with the underlying profits of generators as I have not touched upon the cost of production for generators over this period.

Final Conclusions

At this interim stage, spot revenue through the energy market is the most significant contribution to total cost despite some of the initial media attention focused on the cost of the various compensation schemes.

In July, the AFR reported that the total compensation bill would top $1b with one commentator providing an ‘educated guesstimate’ that the amount could be as high as $1.7b. Similarly, the Sydney Morning Herald published an article claiming that households would pay $1.5b for these schemes.

However now that the dust has begun to settle, it would seem that the final figure of compensation is projected to be much smaller than anticipated earlier.

Independent consultant, Allan O’Neil, has recently posted on LinkedIn stating “based on the size of claims for operation under suspension schedule pricing it’s hard to imagine that claims for operation under administered pricing are going to be enormously larger” and “the total compensation bill should come in significantly lower than the $1 billion+ estimates that were being thrown around at the time of administered pricing/suspension.”

In mid-August, the AEMO published a media release that the market operator’s suspension totals were lower than initially expected with CEO Daniel Westerman stating “While the claims we’ve received are considerable in value, the total is well below external expectations, which is positive for consumers and market participants already facing challenging conditions”.

Author’s Note: June exhibited many ‘firsts’, and I was amongst the many onlookers who were struggling to catch up and understand these corner cases. Compiling this article was a good learning opportunity for me to understand the complexities of these outlier events – if you have any corrections or feedback on anything stated below, please feel free to leave a comment, or reach out to me directly on LinkedIn.

Great summary. Thanks Dan & team

Thanks Jeremy!

Do you have a cost stack graph by region by year from June 2018?

Hi Jennifer, I haven’t done that analysis but you would be able to extract the data to calculate this using NEMreview.

Useful summary of the different elements, thanks. One important distinction between the spot price revenue and everything else is that buyers of energy (retailers/large users) can hedge spot prices. So unless they have rashly left themselves exposed, the net cost to them of energy is likely to be well below the $6.52 bn.

By comparison, the everything else figure of $250m (plus successful claims through the AEMC process) cannot be hedged. While some FCAS costs are part of normal market charges, most of the rest is unusual and will be a sting in the tail for whoever ultimately bears these costs. Who that is is not entirely clear. Roughly speaking, i’d expect that many C&I customers would be on contracts that allowed the retailer to pass through such costs, whereas small customers wouldn’t be (and so won’t directly bear these costs). Whether retailers build in some contingency for similar future events in their market offers in the future, i don’t know. Happy to be told i’m wrong about all this if anyone knows better.

would be interested to know how much the $250m works out as a $/MWh figure. I would guess it’s in the region of a $10-$15/MWh uplift on top of energy costs. That is not insignificant.

A very useful piece of analysis. Obviously, the main contributor was high spot prices, it would be interesting to know what composed the $6.62 Bn price outcome. Higher demand, plant outages and higher gas prices were the dominant effects, the impact of gas prices seems to be less important unless gas producers were forcing gas bids to be higher by a substantial factor.

The question of what happens next year in my mind prices will be lower but gas prices would still remain high. However, all the planned outages would not go ahead and if demand was lower then market total revenue are likely to be a lot lower.