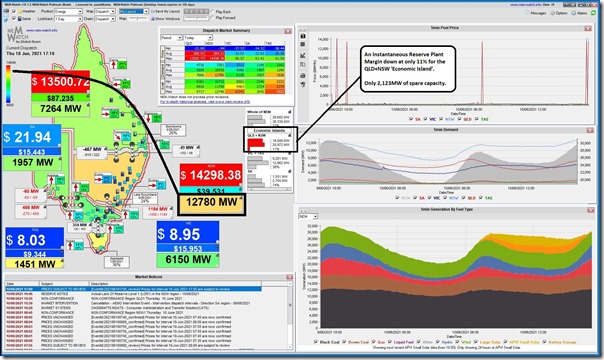

A short article early this evening after the second dispatch interval (17:10, following 17:00) that saw extreme prices for ENERGY – as captured in this snapshot from NEMwatch v10 at the time:

As with other recent evenings, there’s not much spare capacity at any price (and, as discussed with that client this afternoon walking through yesterday via Time Travel with ez2view, it only takes one participant to rebid to achieve a price spike in both regions).

Also highlighted is that NSW Scheduled Demand, at 12,780MW is up in the ‘orange zone’ scaled against historical high points and low points (it was forecast that it was going to be high).

Nothing more to add now…

————

PS at 07:40 on Fri 11th June 2021

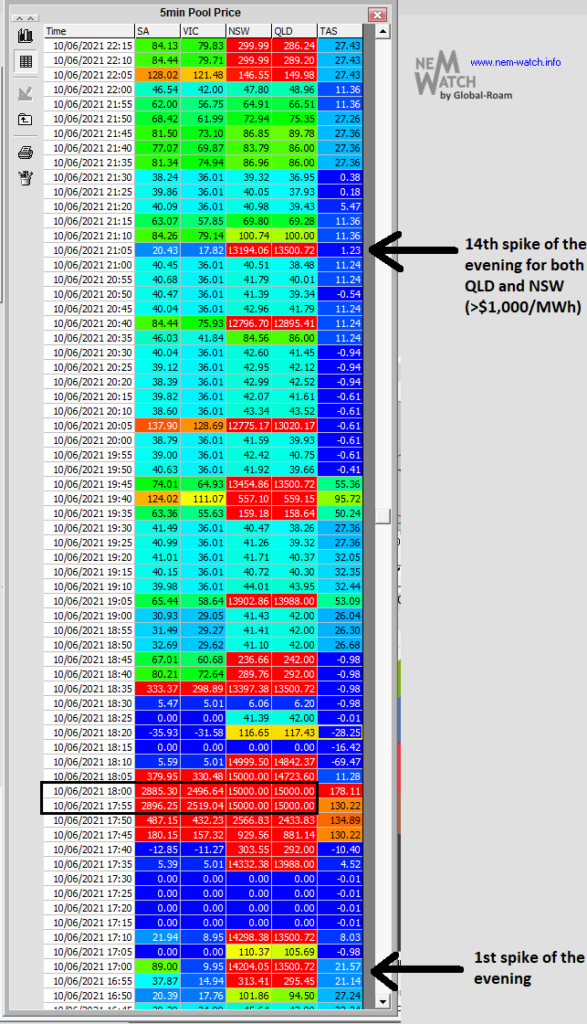

A number of evenings since the Callide C4 Catastrophe have seen a price spike or two occur – yesterday evening saw more than that, with 14 discrete dispatch intervals (from 17:00 to 21:05) when prices in QLD and NSW were more than $1,000/MWh, including many up near the Market Price Cap.

Because of the way Thirty Minute Settlement works, that means 10 sequential Trading Periods (17:00-21:30) saw trading prices above $2,000/MWh.

This table extracted from NEMwatch this morning shows the sequence:

Note in particular the 17:55 and 18:00 dispatch intervals that had QLD and NSW at the Market Price Cap – but with VIC and SA also well above $1,000/MWh as well.

Leave a comment