Back in July 2017 I was asked to provide a forecast at the CEC’s Clean Energy Summit in Sydney … and I did so (but perhaps not quite what they were thinking when they asked me to speak?!).

(A) Gaining a sense of the future of the NEM

Following that presentation we’ve continued to explore what actual historical data is teaching us about what’s coming down the track as the energy transition picks up pace:

1) We released the Generator Report Card 2018 at the end of May 2019;

2) We’ve sporadically posted about the types of Villains we see threatening to derail the train journey … such as the following:

| Villain #1 |

First and foremost, I see the long-running failure of our “emperors with no clothes” as a huge (and perhaps the biggest) driver of our energy transition train wreck … |

| Villain #2 |

… however our political class have been aided and abetted by us, the voting public, in that we have been seemingly unable to deliver stable support for the complexities inherent in such a large transformation … |

| Villain #3 |

Both politicians and public alike have been pulled from both extremes by an increasingly loud shouting match that’s emerged across both extremes of the Emotion-o-meter. |

| Villain #4 |

With participants at all points on that scale (including us as a company, and yours truly) suffering from the yawning gap that’s emerging between required and current “Energy Literacy”. |

| Villain #5 |

We see a number of instances where there seems to have been a tendency of not focusing on the real problems at hand. Some examples of these were posted later: Villain 5a) Not accounting directly for a price on carbon Villain 5b) Focus on changing rules, rather than addressing underlying structural issues Villain 5c) Too much focus on COST and not enough on VALUE Villain 5d) Obsessing about Negawatts, and losing sight of Demand Response. Villain 5e) Still other examples to follow… |

| Villain #6 |

Back on 8th November 2018 I wrote about how we see Villain #6 was ‘reaching for (or believing in, a ‘Magic Wand’, with a few examples of this provided in subsequent articles. Some examples of these were posted later: Villain 6a) An obsession about ‘base load’ Villain 6b) Latching onto ‘storage’ as a magic cure-all Villain 6c) Believing that ‘Demand Response’ is a cure to any gap in the supply/demand model Villain 6d) A simplistic belief that ‘diversity will cure it all’ in relation to extremes in variability Villain 6e) Still other examples to come… |

| Villain #7 |

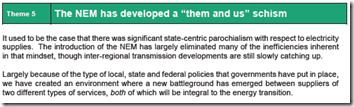

Back at my presentation in July 2017 I spoke about this … and it was discussed since in a number of forums. For instance, in the GRC2018 we included discussion about how the NEM has been developing a schism … as Theme 5 within Part 2 of the 180-page analytical component of the GRC2018: This Theme was picked up in some of the comments made after release in May 2019. Approximately 15 months ago (on 9th March 2020) we wrote about how how it seems the form of support for Wind and Solar developments has been leading to consequences perhaps not fully thought through when these forms of support were implemented…. hence the article title ‘We’ve been killing New Entrants with kindness?’. ———- Perhaps topical to reflect on this one given that only last Friday RenewEconomy wrote how ‘Australian wind projects grind to a halt in face of grid hurdles and falling prices’ … and with the exit of many of the initial investors in both Wind and Solar projects as the realities of the ‘long, skinny’ transmission network are recognised belatedly? |

| Villain #8 | So today I write about Villain number 8…. |

3) We’re in the process of preparing Generator Insights 2021 as an update of (and extension on) the 180-page analytical component in the GRC2018 (with assistance from a range external analysts).

—

Coincidentally, July 2021 is just around the corner now and (fingers crossed that the latest spike in COVID cases in Sydney is under control quickly and it goes ahead) we’ll look forward to having four of our team attend the CEC’s 2021 version of the Clean Energy Summit on 13th and 14th July:

1) All going well, I will be there along with our two Melbourne-based employees (Marcelle Gannon and Linton Corbet) and also with our first Sydney-based software engineer (Adam Kent, who has just joined).

2) No presentations from any of us this time, though!

(B) Introducing Villain #8 … the ‘Invisible Man’

So today we’re introducing you to Villain number 8 … the latest addition to the list of Villains above:

Introducing the Invisible Man!

I’ll start this post off today by noting a couple examples of how we’ve been seen to exhibit this sort of behaviour with respect to the energy sector transition. As time permits, I’ll post separately about other examples, and link them into the table below…

| Date added | Example of Villain #8 | Brief discussion

|

| Initial (17 June 2016) | Villain 8a =

The opacity of rooftop PV |

Way back on Friday 17th June 2016 I wrote about ‘The opacity of distributed, small-scale solar PV output’…. and I followed this up with a subsequent article on 2nd December 2019 when I wrote about ‘The (ongoing!) opacity of distributed, small-scale solar PV output’.

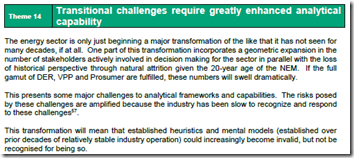

As noted in that second article, this was discussed further in Theme 14 within Part 2 of the 180-page analytical component of the GRC2018: Let’s call this instance Villain 8a. |

| Earlier (7th August 2019)

… but also today (21st June 2021 here) |

Villain 8b =

The invisibility of generator outage plans |

On Thursday 15th August 2019 we posted this article noting how the MT PASA rule changes proposed by ERM Power are one example of the type of changes that will be required as the energy transition gains pace.

This was another example of what was discussed further in Theme 14 within Part 2 of the 180-page analytical component of the GRC2018: The 15th August article followed comments on 7th August 2019 related to the general reaction seen to AGL’s announced intention to slightly delay closure of Torrens A and Liddell stations. Let’s call this instance Villain 8b. —- Thankfully, the AEMC acted to eliminate this transparency … albeit only partially. From early 2021 there have been a number of articles published on WattClarity that have used the new ’MT PASA DUID Availability’ widget in ez2view that has been made possible with the rule change: 1) Using Google search, you can find some of these articles here. Licensed users of ez2view can access this widget in version 8 and newer. 2) The market says a big thank-you to AEMC (and ERM Power (now Shell Energy) for proposing) for this! 3) In particular I’d like to draw your attention to this coincident article today ‘Using ‘MT PASA DUID Availability’ widget in ez2view to compare unit availability with expectations prior to Q2 2021’ that flags where the Invisible Man still lurks. Why, oh why, was the rule not also extended to cover Semi-Scheduled generators!? |

|

Initial (7th August 2019) |

Villain 8c =

The invisibility inherent in Negawatts being used as a supply-side dispatch option within the WDRM |

The Wholesale Demand Response Mechanism (WDRM) is commencing operations in October 2021.

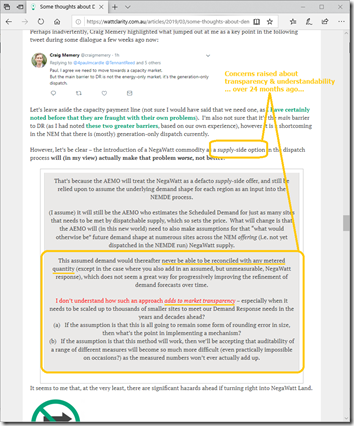

It’s quite well known that I have already voiced some concerns about what’s being implemented with the WDRM on 5th March 2019 and 21st October 2019 and 24th November 2020. From these articles I’d like to highlight the following: 1) When I wrote ‘Some thoughts about Demand Response …’ back on 5th March 2019 I noted significant concerns about Villain number 8 in what was proposed at the time … with the concerns still present in what’s being implemented: 2) On 24th November 2020 in the article ‘All aboard the Negawatt Express…’ I noted (with reference to the AEMC’s own Assessment Framework) the following: I have significant concerns that this implementation of a Centralised Negawatt Dispatch Mechanism will end up making transparency/understandably worse … especially when implemented in conjunction with Tripwire number 3.

Let’s call this instance Villain 8c. |

|

Initial (10th June 2021) |

Villain 8d =

The new (mostly) ‘invisible’ 5 minute Trading Period with the introduction of Five Minute Settlement |

A bit over a week ago (on Thursday 10th June 2021) I wrote about ‘the invisible 5-minute Trading Periods’ that we’re introducing as a result of the path chosen to implement Five Minute Settlement by 1st October 2021.

This we called ‘Potential Tripwire #1’ and followed up with ‘Potential Tripwire #2’ and ‘Potential Tripwire #3’ . It seems ironic (reflecting on the set of three new tripwires looming) that the pace of change is such that we’re adding in more sources of invisibility and confusion in the market rather than reducing them in these particular instances!

Let’s call these largely invisible 5-minute trading periods Villain 8d. |

| Later | More to come… | We’ll add more examples later… |

I’m sure that some of our readers will have encountered other examples of how Villain #8 has manifest itself in the energy sector through this transition process.

Feel free to add your examples as comments below, or provide us your feedback directly/confidentially – or just give us a call!