There’s been some chatter on our internal Slack channel overnight with respect to forecasts for this Thursday (29th February 2024) in NSW, so I thought it might be time to update this article posted on Sunday early afternoon.

Updated forecasts for LOR2 for NSW

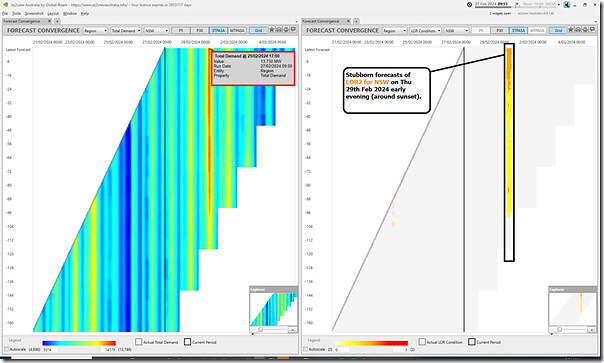

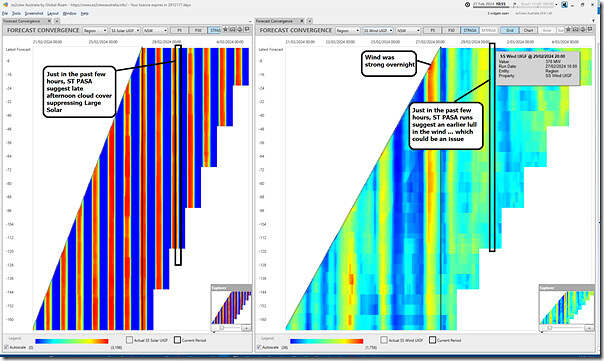

Here’s an updated view of the ‘Forecast Convergence’ widget (two views of it) from ez2view at the 09:55 dispatch interval Tuesday morning 27th February (i.e. ~56 hours out from the time in focus):

‘Looking up a vertical’, we can clearly see the stubborn forecasts for LOR2-level low reserve condition for NSW for Thursday evening.

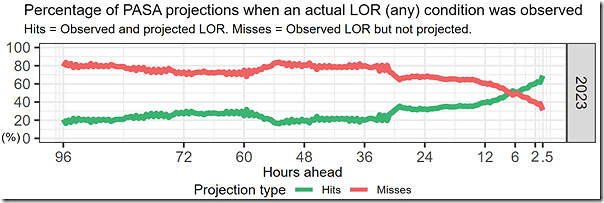

Linton’s the analyst who’s been looking in more statistically at forecasts for LOR as part of Appendix 1 in the GenInsights Quarterly Updates series. Based on that analysis, Linton’s made a comment that ‘According to our GenInsights, when an LOR is forecast 3 days ahead, the chance of it occurring is around 20-30%’.

Linton’s helpfully lifted this chart out of a bigger artefact included in the (under development) GenInsights Quarterly Update for 2023 Q4 … so including data now for the full 2023 calendar year, which is the focus for ‘hits’ and ‘misses’ here:

Before any readers falls down that rabbit hole of the ‘accuracy of forecasts’, remember that the AEMO’s predispatch and ST PASA processes are designed to elicit a market response … so the fact that ‘only’ 20-30% of forecast Low Reserve Condition actually persist to the point of dispatch should be viewed as a good thing (and ideally should be lower than that!)

High Forecast Demand

On the left panel, we see forecasts that ‘Market Demand’ could be significantly over 13,500MW … which would be exceptional for summer 2023-24.

Possible Issues at Eraring?

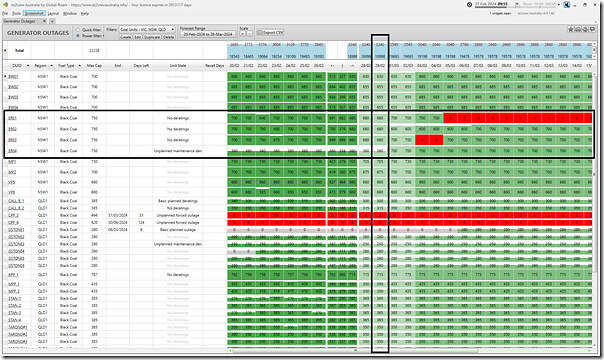

On the other side of the supply-demand balance equation, it’s worth flagging that it appears that Eraring might have a few units struggling at present – at seen in this snapshot from ‘Generator Outages’ widget in ez2view:

I’ve highlighted the 4 x Eraring units – and have also highlighted Thursday 29th February (the day of particular concern).

This data has been published as a result of a concerted effort by several at ERM (now Shell) to provide better visibility of supply-side outage plans. It’s much better than what was there beforehand (which was nothing), and it was further enhanced with changes that went live on 9th October 2023, but it’s still not ‘perfect’ visibility.

1) Case in point in this article is that that the data for Thursday 29th February is now ‘stale’, having been last published for 18:00 last Saturday 24th February 2024.

2) Other issues include the ongoing invisibility of Semi-Scheduled units, and also the invisibility of Loads

Working with what we have, and focusing on each unit in turn:

Eraring unit 1

This unit has slated an ‘Unplanned Maintenance Outage’ (coloured red in ez2view) to start on Tuesday 5th March.

Without knowing the specific reasons for this unplanned maintenance (e.g. I’ve not checked recent rebid reasons to see if that might indicate anything), there’s natural questions about how firm that start date might be – or if circumstances might arise where it needs to be brought forward (of especial concern if that impacted on Thursday 29th February).

Eraring unit 2

This unit is the one showing green all the way … albeit that there’s some slight reductions in capacity offered on some days (perhaps due to high temperature de-rating, which affects almost all types of technology in the electricity sector).

Eraring unit 3

This unit also has an ‘Unplanned Maintenance Outage’ … but it’s important to note that:

1) This unit appears with this Unit State on Sunday 3rd and Monday 4th March – based on data submitted by Origin Energy for 09:00 this morning (Tue 27th Feb 2024).

2) But it’s not clear when it actually is slated to begin, because the data up until Saturday 2nd March is ‘stale’, as noted above.

So there is more concern that whatever the issues might be with this unit might impact on this Thursday?

Eraring unit 4

This unit has no outage planned, but has been running with a significant de-rating (i.e. 360MW maximum availability) for many days. Again, I have not investigated further to understand reasons at this point.

Trajectory of forecast Available Generation

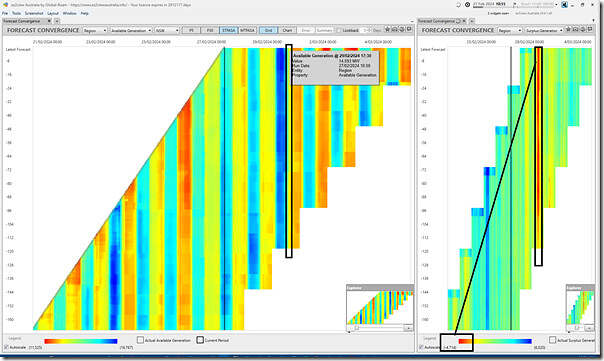

Flipping back to the the ‘Forecast Convergence’ widget at the 10:55 dispatch interval I’ve flipped the view to show:

1) Available Generation in NSW on the left; and

2) Surplus Generation in NSW on the right (noting this is only published in ST PASA, not P30 Predispatch).

Here it is:

Keep in mind that NSW is, on average, a net importer of energy (i.e. heavily relies on imports from QLD and VIC) … which makes it no surprise that it’s going to have a deficit of local generation on a high demand time like Thursday evening.

… but forecasts for a deficit of –4,714MW still clearly stand out, in terms of the week!

‘Looking up a vertical’, on the left panel in the area marked, at least there’s no stark colour changes in terms of forecast Available Generation in aggregate for NSW

… it’s not really getting better (i.e. bluer = larger), but it’s not growing worse, either.

Trajectory of forecast UIGF for Solar, and for Wind

Using the same window, I’ve now flipped the the ‘Forecast Convergence’ widget at the 10:55 dispatch interval to show:

1) Forecast UIGF for Solar in NSW on the left; and

2) Forecast UIGF for Wind in NSW on the right.

Here it is:

Unfortunately in both pictures there appear to be unwelcome news:

1) On the left, we see the top few rows in the grid (i.e. most recent forecasts) suggesting late afternoon cloud cover suppressing yield from Large Solar farms … and presumably rooftop solar as well.

2) On the right, we see that the blue (i.e. low wind yield) cells have shifted more to the left (i.e. into the times of peak demand in NSW on Thursday afternoon-evening).

This helps to explain these updates from the AEMO …

Market Notices from AEMO

At 10:17:34 this morning, the AEMO published MN115201 to give an update on the forecast LOR2 for NSW for this Thursday:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 27/02/2024 10:17:34

——————————————————————-

Notice ID : 115201

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 27/02/2024

External Reference : STPASA – Update of the Forecast Lack Of Reserve Level 2 (LOR2) in the NSW Region on 29/02/2024

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

The Forecast LOR2 condition in the NSW region advised in AEMO Electricity Market Notice No. 115197 has been updated at 0900 hrs 27/02/2024 to the following:

From 1430 hrs to 2100 hrs 29/02/2024.

The forecast capacity reserve requirement is 1329 MW.

The minimum capacity reserve available is 364 MW.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

AEMO Operations

——————————————————————-

END OF REPORT

——————————————————————-’

… and a little earlier this morning, the AEMO published MN115195:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 27/02/2024 08:26:49

——————————————————————-

Notice ID : 115195

Notice Type ID : RECALL GEN CAPACITY

Notice Type Description : Recall Gen Capacity

Issue Date : 27/02/2024

External Reference : Request for Generator Recall Information for 29/02/2024 for NSW Region

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Refer to AEMO Electricity Market Notice no. 115193.

Please provide Generator Recall Information for the period 29/02/2024, by 1200 hrs 28/02/2024 via the Generator Recall communication system, in accordance with clause 4.8.5A of the National Electricity Rules.

SO_OP_3719 Procedure for Submitting Generator Outage Recall Information is available at:

https://aemo.com.au/-/media/files/electricity/nem/security_and_reliability/power_system_ops/procedures/so_op_3719-procedure-for-submitting-recall-information-scheduled-generator-outages.pdf

Procedure on how to use Generator Recall in the EMMS Markets Portal is available at

http://www.aemo.com.au/-/media/Files/Electricity/NEM/IT-Systems-and-Change/2018/Guide-to-Generator-Recall-Plans.pdf

AEMO Operations

——————————————————————-

END OF REPORT

——————————————————————-

At the same time the AEMO had published MN115196 about Generator Recall Information for QLD Region, as well.

The modern Irish proverb for the NEM?

Paraphrasing a conversation on our internal chat said …

‘May the boiler tubes not leak, the wind pick up when the sun sets, and the network not be constrained!’

Leave a comment