From 1st February 2021 we made the Generator Statistical Digest 2020 more broadly available, after providing copies to those who had pre-ordered ahead of time. This utilised data updated to 31st December 2020, and followed on from the earlier GSD2019, which was itself inspired by what we produced as the GRC2018 a year earlier.

On 20th April 2021 we announced that we’d commenced development of GenInsights21, as a successor to the 180-page analytical component provided within the GRC2018.

As alluded to on a number of occasions in articles since then on WattClarity® we’re about 4 months behind what we envisaged at the start of the year in terms of a release date – which will be towards the end of Q4 2021 rather than the earlier date of Q3 2021 that we had been hoping for. This delay was for a variety of reasons summed up under a ‘higher priority’ heading, including:

1) Individual requirements for our growing client base; and

2) The workload that preparations for Five Minute Settlement represented for us;

3) Plus we’ve noted before how the extreme in volatility seen through Q2 2021 proved to be a big distraction as well.

(A) Re-started development

So now with Five Minute Settlement out of the way (and work in hand for a version 9.3 for ez2view in line with Wholesale Demand Response Mechanism) we’ve turned our mind back to what we’d started those months ago in relation to GenInsights21.

Barring unforeseen interruptions to this process, we envisage having this released on or around Monday 6th December 2021 … just in time for your reading list for summer 2021-22.

(B) Still in time to place your pre-order now

There’s some background to this new initiative below – but we’d like to start by inviting you to pre-order today:

| The Product | This is how you will be able to Download GenInsights21 … when it is completed | This is how to Pre-Order the GenInsights21 Report … and save on the release price that will apply when it is completed |

| GenInsights21 Electronic PDF

(targeted release ~6th December 2021) |

Clients who have already ordered will be able to download the electronic PDF of the GenInsights21 here, when it is completed:

You’ll need to set up your own unique log-in, using your organisational email address in order to access. One bound hard-copy is also being supplied as well (if we have your best postal address). . . . . . . . . |

Please complete this Order Form and send back to us:

Pre-Order Form GenInsights21 After we receive your order and after the report has been completed, we will: |

There’s still time (if you get your pre-order in soon) to engage with us about specific things you’d like us to analyse as part of the broader analytical report.

We might have time to address these!

(C) The structure we’re driving towards

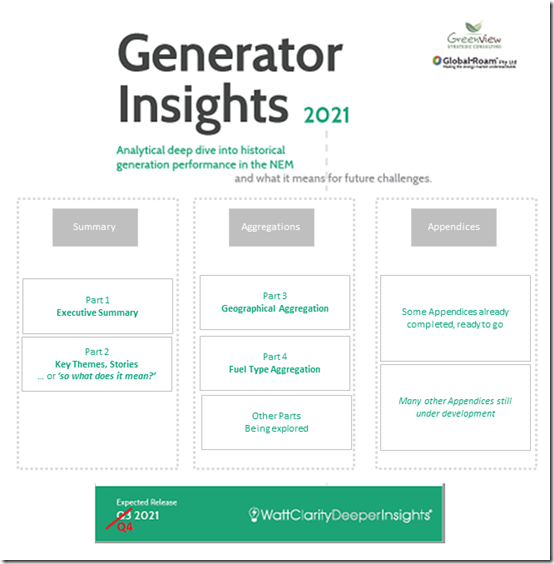

Even though we were too short of time through the past few months (May to September, really) we did consider pondering what we were driving towards, in terms of a finished product. So I thought it would be useful to present the following image to sum up how we’re aiming for three main components of value:

Working from left to right in the diagram above we’ll briefly touch on each of the three main types of deliverable in this product:

(C1) Summary

We received many compliments for the way in which the GRC2018 was structured … particularly in relation to:

(a) There was a short Executive Summary of only a couple pages …

(b) Additionally, in Part 2 we included 14 ‘Key Themes’ that walked through a number of the highlights across the diverse range of analysis presented through the larger body of work.

—

In developing GenInsights21 (and reflecting these compliments) we are focused on delivering a similar structure, at a high level … including (where we can) further tightening up in Part 2 to the point where it focuses specifically for the reader on answering the ‘So what does it mean?’ questions prompted by what’s covered in the rest of the report.

(C2) Aggregations

Given that we have already published unit-level data in the GSD2020 (and would envisage publishing a ‘Generator Statistical Digest 2021’ early in 2022) the focus of GenInsights21 won’t be individual unit level data – but rather aggregations of this unit level data in ways that help to provide more context to patterns of evolution in the market.

In Part 4 of the GRC2018 we aggregated the data by Location (primarily by Region) and by Fuel Type … but there will be others we add in, in specific instances.

(C3) Focused Analysis in discrete Appendices

It’s often said that ‘the devil is in the detail’, and this is certainly true for the challenges confronting the energy transition for Australia’s National Electricity Market (NEM).

With this in mind, we’ve started from the bottom up, preparing a significant number of Appendices (you might think of them as ‘Deep Dives’ … delving into different aspects of how the NEM has evolved such that this might help us understand where it’s headed for the future).

We’ve taken this approach in the light of both:

1) Reflections on what happened (primarily) in Part 4 of the GRC2018 … where we have recognised that the report would have been more readable had some of the more detailed content been extracted out to its own appendix

2) This approach has been necessitated, even more, by the fact that some of the appendices we have completed, and have underway, are dozens of pages in their own right … with each of particular interest to a specific subset of our those who purchase access to GenInsights21 .

Some of these appendices are discussed specifically below…

(C3a) Pieces that are already Substantially Complete

There are a couple pieces of analysis that are substantially complete – including the following:

|

Appendix Title |

Explaining the focus of this particular Appendix. |

|

Diversity of Wind, and ‘Wind Droughts’ |

Given what has been happening in the European ‘energy crisis’ currently, and with its own ‘wind drought’ as one of the contributing factors, this subject seems to have gained broader awareness than was the case at the start of 2021 when we commenced this analysis. — e started this analysis (with the gratefully received assistance of some external analysts) to follow on from the preliminary work performed with respect to wind diversity that was included as Theme 10 within Part 2 of the GRC2018: This work completed for the GRC2018 has since been referenced in a number of articles here, including 26th July 2019, 20th October 2020 and at other times. What we presented in the GRC2018 included some recommendations in terms of how to take this line of analysis further. Unfortunately in the months that have passed since the release of the GRC2018 we’ve not seen much in the way of progress on this type of analysis. So in this appendix, we have taken our own recommendations for how that study could be extended in order to identify more about such things as: 1) The pattern of wind harvest, assuming a full build-out of wind farms across the NEM; 2) How such a pattern would map with electricity consumption patterns; 3) The nature of surpluses and wind droughts; and 4) What storage might be able to deliver, as the bridge between the two. |

|

A history of Renewables Development in the NEM |

When we started mapping out GenInsights21, it became apparent that it would benefit from the inclusion of a focused description of the history of renewables development for the NEM. This has been completed, ready for inclusion. |

Other appendices are well progressed, but not yet ready to be called ‘substantially complete’.

(C3b) Underway, and still to come

As our analysis continues (and escalates towards the 6th December 2021 release date) we expect that the list of appendices included will still grow & change – with each covering different aspects of historical generator performance, and what the implications might be for this energy transition.

Here’s some of what has been identified, and currently being explored for possible inclusion:

|

Appendix Title |

Explaining the focus of this particular Appendix. |

|

A practical assessment of ‘demand’ a.k.a. What’s the changing commercial opportunity? |

I have noted many times in articles here about how measuring demand is not as easy as it might initially seem to be. — However in the context of a report focused on the splintering* supply-side of the energy sector, the questions about ‘what is electricity demand’ take on an even more complex meaning … along the lines of ‘how is the market changing, for the thing that I’d like to sell?’ * this ‘splintering’ was introduced in terms of an ’emerging schism’ in the GRC2018 and have discussed in several articles here since that time – such as on 9th March 2000 (regarding Villain #7) and 11th October 2020. There are several layers of this that we’re exploring in seeking to answer this question … and it is far more than than just looking at what is happening with peak demand and aggregate consumption (the domain of the ESOO for many years). — For instance … one aspect to be investigated is the (increasing?) ‘unpredictability for dispatch of fully Scheduled Generation’ discussed in this article on 21st April 2021. |

|

Coal Plant Performance |

With the closure of Liddell fast approaching, the closure of Yallourn now scheduled for 2028, and others to follow (or perhaps even precede), it is very timely to revisit and extend the analysis that was included in Part 4 of the GRC2018. We’ll lift it out into its own self-contained appendix, to make it more accessible and easier to read. |

|

Evolution of Bidding Behaviour |

There have been a number of different aspects through which bidding behaviour has evolved in recent times (including ‘the rise of the auto-bidder’ which I alluded to on 7th Sept 2020 and on 22nd Oct 2020).

We are endeavouring to deliver a multi-facet analysis of many of these as part of a stand-alone appendix in GenInsights21. |

|

Semi-Scheduled dispatch performance |

For a number of months through 2020 we invested time to complete analysis of the nature of collective performance of Semi-Scheduled assets with reference to their Dispatch Targets. We did this through an ‘Aggregated Raw Off-Target’ metric, as explained in this article from 27th July 2020. For GenInsights21 we have the ambition to extend and deepen this analysis … especially to see how recent developments have changed these results – such as: 1) Further increase in installed capacity of Semi-Scheduled assets; 2) The advent in use of 3rd party self-forecasts; and 3) Greater awareness of the non-trivial scale of Regulation FCAS costs, attributed to generators via the Causer Pays mechanism. |

|

FCAS, and Frequency |

Given the increased interest in system frequency, and frequency control (part of the broader ‘Keeping the Lights on Services’), some of our external analysts are seeing what they can prepare for inclusion in GenInsights21. |

|

100% Instantaneous Renewables by 2025 |

Back on 14th July 2021 in his first public address, new AEMO CEO Daniel Westerman announced his own BHAG … that AEMO needed to be ready for a grid that would supply 100% instantaneous by 2025 NEM-wide. In the plentiful discussion that ensued (which I think was part of the point of naming the BHAG in the first place) there was plenty of ‘for’ and ‘against’ arguments made – about why it could (or could not) or should (or should not) be done. Though we were not actively working on GenInsights21 at the time, we wondered what we could do as part of this release that would provide a meaningful contribution to this discussion. With the assistance of a couple of external analysts, we’re compiling this for possible inclusion as an Appendix in GenInsights21. |

|

Early insights from the operation of Five Minute Settlement |

As you know, Five Minute Settlement commenced in the NEM on 1st October 2021. Given the level of interest in this transition, it was only logical that we’d start to field questions along the lines of ‘early insights from Five Minute Settlement’. So we’re going to have a go at compiling this for an appendix in GenInsights21 … and also for an upcoming presentation to an AIE audience. |

|

Many, many more appendices |

We’ve identified many other pieces of analysis that can be conducted and included in appendices (and envisage the external analysts we’re separately engaging to contributed will also identify others). Hence there are likely to be many more appendices included in GenInsights21. |

As our analysis continues (and escalates) through to the finalisation of GenInsights21 we expect that the list of appendices included will grow & change – with each covering different aspects of historical generator performance, and what the implications might be for this energy transition.

Leave a comment