Last week (on 14th April and then 17th April) I made reference to the fact that we’d commenced development of a new analytical report that we’re calling ‘Generator Insights 2021’, and intending to release sometime in Q3 2021. This article today is intended to provide more focused information specifically about this new release (which we’ll also refer to by the shortened name ‘GenInsights21’).

(A) Invitation to pre-order

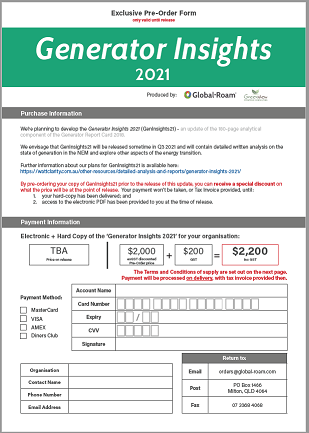

There’s some background to this new initiative below – but we’d like to start by inviting those who are interested* to pre-order today:

* this might be particularly the case for those who have experienced the breadth & depth of what we delivered previously in the GRC2018.

| The Product | This is how you will be able to Download GenInsights21 … when it is completed |

This is how to Pre-Order the GenInsights21 Report … and save on the release price that will apply when it is completed |

| GenInsights21 Electronic PDF (targeted release during Q3 2021) |

Clients who have already ordered will be able to download the electronic PDF of the GenInsights21 here, when it is completed:

You’ll need to set up your own unique log-in, using your organisational email address in order to access. One bound hard-copy is also being supplied as well (if we have your best postal address). . . . . . . . . |

Please complete this Order Form and send back to us:

After we receive your order and after the report has been completed, we will: —- We will not do anything (other than confirm receipt of your pre-order form) prior to completing the report and delivering you access. |

We’ll look forward to engaging with you when you pre-order, to see if there are specific things you’d like us to analyse as part of the broader analytical report!

(B) Background to GenInsights21

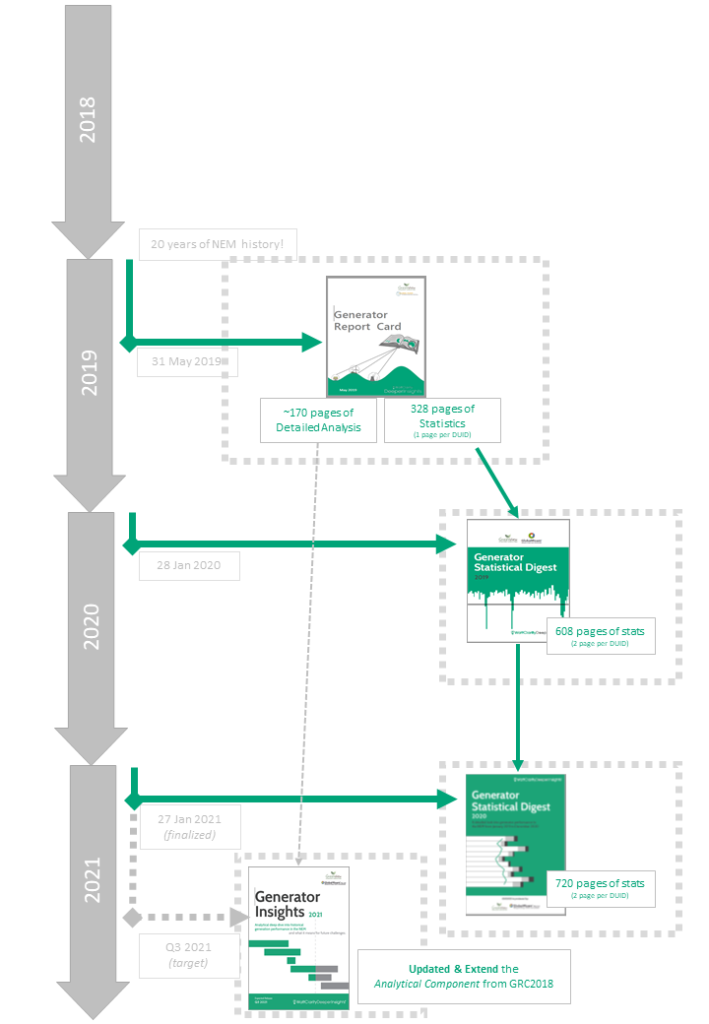

Our journey (from GRC2018 to GSD2019 and GSD2020 and then into GenInsights21) is illustrated here:

In particular, it’s worth highlighting the following:

| Prior to GenInsights21 | Developing GenInsights21 |

|

We released the Generator Report Card 2018 (GRC2018) on 31st May 2019, and it was a very well received compilation of two main components of value: Value Component #1 = the GRC2018 contained ~180 pages of analysis (spread across Part 1, Part 2, Part 4 and Part 5) that explored 20 years of NEM history (specifically focused on Generator Performance) to inform the ongoing energy transition. Value Component #2 = the GRC2018 also contained a ~330 page statistical compendium of various performance statistics (one page per DUID) of all the units that had been operational in the NEM to 31st December 2018 (i.e. Part3), with statistics defined in a Part 5 Glossary We then determined to tackle these value components separately in future instances – which would enable us to expand and enhance each: … for Value Component #2 (the statistics): (a) We then took the statistical component of the GRC2018 and expanded it into an update/extension that we called the Generator Statistical Digest 2019 (released 28th Jan 2020). (b) This same format was updated again with a Generator Statistical Digest 2020 (released 1st Feb 2021) with data to 31st December 2020…. and later a GSD2020 Data Extract. (c) We’re aiming to make this Statistical Digest an annual publication released around January each year. … which brings us to Value Component #1 (in-depth analysis of a diverse range of generator operational + commercial performance, both singularly and collectively)… |

… with the statistical component of the GRC2018 now separated out into an annually produced ‘Generator Statistical Digest‘ we can focus our attention specifically on updating the analytical component in a report we’re calling the Generator Insights 2021. (a) This will utilise data since the start of the NEM up until Q3 2021 (b) We envisage* a release sometime in Q3 2021 (i.e. prior to the start of Five Minute Settlement). * the use of the word ‘envisage’ is deliberate – because we are specifically focused on delivering as much value as we possibly can in this new compendium of analysis … hence we are set on having a particular date for release of GenInsights21. In today’s initial article we announce the commencement of development, and extend the invitation to pre-order your copy at this point – which can offer you some benefits: Pre-Order Benefit #1) Given that we’ve not completed development, you could speak with us about particular aspects of generator performance (individual or collective) that you think we should analyse for GenInsights21. We have a significant number of jobs to complete already – but we may be able to take your suggestions onboard. Pre-Order Benefit #2) You’ll also save on what the release price will be, when the report is completed (we’ve not finalised what that will be – but it will be more than the (only!) $2,000exGST price to pre-order. Other status updates will be posted here on WattClarity (as the separate pieces of analysis come together), so you might want to ensure you are subscribed to remain updated. will be . . |

(C) Current* idea for the structure of GenInsights21

Given that GenInsights21 will build on the diverse range of insights delivered in the GRC2018, it’s logical that the structure of the document would build on the structure of the GRC2018 (albeit without the statistical component, now extracted into the annual GSD).

We’re currently* envisaging something like this:

* note, in particular, the deliberate use of the words ‘currently envisaging’. It is almost certain that these ideas about the structure of the document will evolve as our analysis continues – so please read the following as a guide to our general intentions.

| Section | What’s envisaged as the focus of the section … within GenInsights21 |

||||||||||||||

| Section 1 Executive Summary |

In the GRC2018, we included a short Executive Summary that accompanied the bulk of the analysis. This we will also do in GenInsights21.

. |

||||||||||||||

| Section 2 Key Themes |

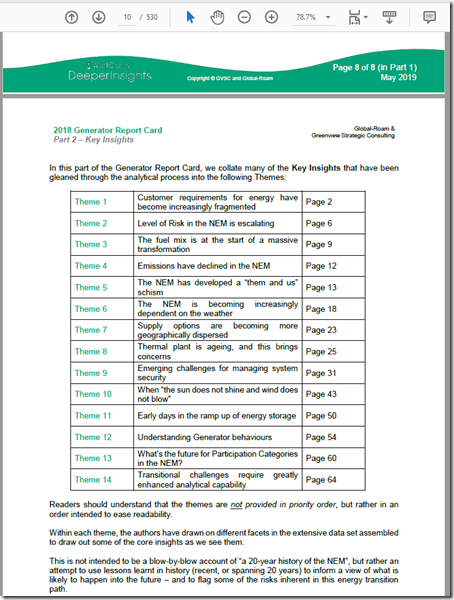

In the GRC2018 we included 14 x Key Themes that explored (over several ‘bite-size’ pages each). Here’s how they were introduced:

Since the release of the GRC2018 on 31st May 2019, we have discussed some of these themes in various articles here on WattClarity – for instance: ************************************************************************

We envisage including the same type of structure in GenInsights21 – with the (potentially different) Key Themes we identify extending on, and adding to, the 14 x Themes above. |

||||||||||||||

| Section 3 Analysis Geographically/Locationally |

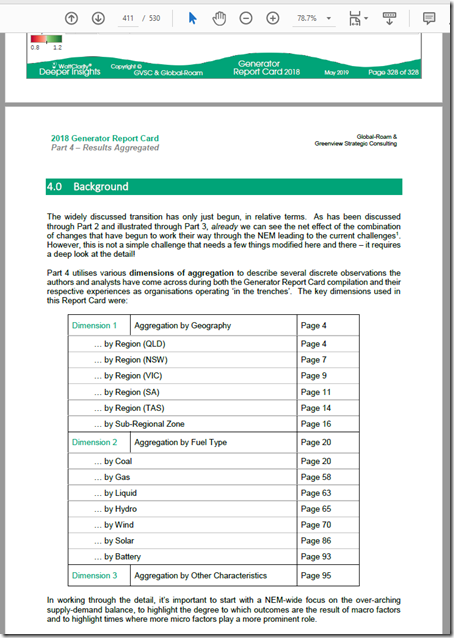

As part of Part 4 within the GRC2018 we included some analysis of data sets aggregated by geographies, as noted here in the index page:

Over 16 pages in the GRC2018 we included a range of different analysis by geographical space (including by Region, but also by sub-regional TNSP zone). Based on this analysis (and feedback and insights gathered since that time) we have sketched different pieces of analysis that will be included with different locational aggregations. |

||||||||||||||

| Section 4 Analysis by Fuel Type |

As can be seen from the extract from the GRC2018 above, we also delivered 74 pages of analysis of various aspects of generator performance (separately and collectively) aggregated by fuel type. Given the expanded set of statistical data now aggregated for the purposes of the GSD2020, we will be able to expand on the analysis provided 2 years ago in the GRC2018 in various interesting ways.The analysis published by Marcelle Gannon about solar farm performance provides just one example of the types of things we can deliver: 1) On 17th March Marcelle compared Spot Revenues by Solar Farms fully operational through 2020. 2) Then Marcelle added to that by also considering LGC Revenues on 26th March. 3) Finally, on 1st April Marcelle was able to also rank solar farms by their FCAS costs. … it should be fairly easy for readers to envisage how this type of thing could be done for other fuel types, or extended further back into the past and trended. |

||||||||||||||

| Other Sections? Analysis by Other Aggregations |

In the GRC2018 we included a few pages in which we analysed bidding behaviour on several different dimensions.For GenInsights21, it is entirely plausible that we will include other sections in which we will include analysis with data aggregated by different dimensions. Possibilities include: 1) By Participant 2) By Registration Category 3) By Type of technology used (with some of the technologies we are interested in are auto-bidders, and self-forecasting algorithms). |

||||||||||||||

| Appendices (or ‘Deep Dives’) |

On reflection after its completion, we recognised that some of the detailed content provided in the GRC2018 would have been better extracted from the main body of the analysis and placed in dedicated (and largely self-contained) appendices.

For GenInsights21, we will be undertaking to do this – with the following being some of the Appendices we already know will be included:

As our analysis continues (and escalates) through to the finalisation of GenInsights21 we expect that the list of appendices included will grow & change – with each covering different aspects of historical generator performance, and what the implications might be for this energy transition.

|

Naturally, the structure of the report will evolve as an increasing amount of the analysis we complete (and that is supplied to us by our external analysts) comes together. Hence the above should be read as a guide to our intentions (and not as what will be the final structure).

(D) Parties involved in the development

As with those products which have come beforehand (GRC2018, GSD2019 and GSD2020) we would like to highlight that:

1) The GenInsights21 will be a collaborative effort between our team at Global-Roam Pty Ltd and Jonathon Dyson‘s team at Greenview Strategic Consulting; but also

2) That we look forward to also incorporating valued input by a range of other specialists in a model similar to what the collaborative approach used in developing the GRC2018 as noted here.

2a) We have already identified a number of external specialists we will be using in the process, and they are underway with what we have asked them to do;

2b) If you would like to suggest to us especially competent Analysts who can work with us to make ‘GenInsights21’ an even better product:

i. Please let us know … or ask them to contact us.

ii. It might be that they work internally with us, or that we engage them externally to assist (we’re happy to consider either).

We appreciate the opportunity to work with this range of people to produce a product that’s of great value to a diverse range of clients.

Leave a comment