In conjunction with our release of the GSD2022 on 31st January 2023, we published Allan’s article ‘Farewell Liddell’ to mark the fast-approaching end of service life for the 3 remaining units at AGL Energy’s Liddell power station.

… this was one analyst article written with the utilisation of the wealth of performance metrics, some quite complex, provided in the GSD2022. Other articles have been published (e.g. by Dan, David and Nick), with some more still to come – all examples of how clients can use the Statistical Digest to form their own views and make their own decisions about particular assets, or broader groups of assets.

Since the release of the GSD2022 the orders have continued to flow in (including some from organisations we’d never heard of, so it seems that awareness of the Statistical Digest has been building over time). In conjunction with the team at Greenview Strategic Consulting, with whom we have collaborated on these initiatives since 2017, we (at Global-Roam Pty Ltd) appreciate the opportunity to serve in this way.

(A) Media Speculation

Since the publication of Allan’s article, there’s been a fair bit of media coverage about different aspects of:

Discussion Point #1)

… about the extent of possible delays to various generation (and transmission!) projects under development – with this past weekend being no exception:

(a) as expected, there was ongoing coverage about challenges with Snowy 2.0,

(b) a little different this time, there was also discussion in both the Australian and the AFR writing about expected operations date for Tallawarra B – an important addition expected to be in time for summer 2023-24:

| In the Australian (Sunday 19th February 2023) |

In the AFR

(Monday 20th February 2023) |

|---|---|

|

Yesterday evening (Sunday 19th February), Perry Williams wrote ‘EnergyAustralia’s Tallawarra gas power plant expansion on pressure deadline’. |

This morning (Monday 20th February), Angela Macdonald-Smith writes ‘EnergyAustralia gas plant on track despite Clough collapse’. |

Discussion Point #2)

… about the extent of government intervention warranted and necessary in the market … including:

(a) with the re-elected Dan Andrews VIC Government re-establishment of the SECV in some form; and

(b) more recently with the NSW Labor opposition proposing the establishment of an Energy Security Corporation (such as noted in the ABC on Sunday 19th February)

… with Matthew Warren highlighting one significant difference between these two approaches.

Discussion Point #3)

… about what this might mean for looming closure of coal, essentially in three different time horizons:

Time Horizon #1 = April 2023

Some articles mention the imminent closure of the remaining units at Liddell Power Station – but, as Allan’s article highlights, that’s all over for that station but for the fat lady singing.

Time Horizon #2 = around 2025

This is the focal point for the confluence of two significant factors:

1) The current expectation for when Eraring Power Station might close; and

2) The impact of delays in Snowy 2.0.

+ potentially other factors as well

Time Horizon #3 = beyond 2025 … through until 2030 and beyond

Beyond the nearer term concerns about 2025 there’s the challenge-that-will-be-with-us-for-a-decade-or-more in properly managing both:

1) Progressively closing coal units, whilst also addressing challenges of rising unavailability of coal units (explored further in GenInsights Quarterly Update for Q4 2022) through until they close; whilst at the same time

2) Replacing all the services provided by these coal units via:

(a) Development of more VRE to supply the ‘anytime/anywhere energy’ component; but also

(b) More firming and interconnection (plus more!) capacity to deliver the ‘keeping the lights on services’ that are also going to be required.

… in the GenInsights Quarterly Update for Q4 2022 released last week we explore more of this (and had some interesting discussions in an Executive Briefing to another client about this earlier today).

(B) AEMO to produce an update to the 2022 ESOO

In conjunction with the above, it’s been reported (in several media articles) that the AEMO would release an update to its 2022 ESOO this week.

This was noted by AEMO on 23rd January when it published the latest NEM generation data:

‘Changes of note that will be included in the February Update to the ESOO include the Waratah Super Battery Network Augmentations and System Integrity Protection Scheme (SIPS) in New South Wales. This project provides a virtual transmission solution that unlocks latent capacity in the existing transmission system, allowing electricity consumers in the Sydney, Newcastle and Wollongong demand centres to access more energy from existing generators.

In addition, the Bolivar power station in South Australia also progressed to the committed phase with known commissioning dates, adding another 123MW of generation capacity to the power system. AEMO has also been informed of potential delays of 12 months to the Snowy Hydro 2.0 project from December 2026 to December 2027 and the Kurri Kurri gas generator project from December 2023 to December 2024.

AEMO considers this new information meets the need to update the Electricity Statement of Opportunities (ESOO) and provide an updated reliability assessment. ’

So we (like many) will look forward to seeing what the AEMO modelling suggests … but again would point readers to what we discussed in GenInsights21 when we asked the importantly-not-rhetorical question ‘What’s the purpose of the ESOO?’

(C) AEMO’s current expectations, for scheduled closure dates

So because of the above (and because we’re testing out a pre-release copy of ez2view v9.6 that contains several related enhancements) I thought I would have a quick look at the AEMO’s current expectations in the MT PASA DUID Availability data (with eternal thanks to the ERM Rule Change) for both the Liddell and Eraring Power Stations:

(C1) Current expectations for closure Liddell Power Station

As noted in Allan’s article, it’s curtains for Liddell’s 3 remaining units within weeks – and there are good reasons for doing so … but useful for all readers here to understand the implications of the fact that we’re closing Liddell imminently at a time when NSW has consistently been a net importer of energy from VIC and QLD.

… this was Key Observation #2 within the GenInsights Quarterly Update for Q4 2022 released last week

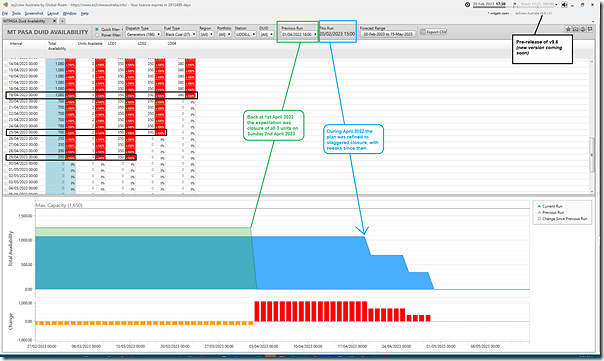

Using the ‘MT PASA DUID Availability’ widget in ez2view, we see the following:

About a year ago, the expectation was that all three units would be closed on one day (Sunday 2nd April 2023).

… this was probably always seen as a placeholder, subject to refinement later as closure moved closer.

During April 2022 the expectation was updated at AEMO (via advice from AGL Energy in their bids) that there would be a staggered closure, with some further refinement progressively since that time. The current expectation (as at 15:00 NEM time on Monday 20th February 2023) would be that the units would close as follows:

(a) Unit 4 closes first … on Wednesday 19th April 2023

(b) Unit 2 closes next … on Tuesday 25th April 2023

(c) Unit 1 closes last … on Saturday 29th April 2023.

Let’s wait to see what actually unfolds…

(C2) Current expectations for closure Eraring Power Station

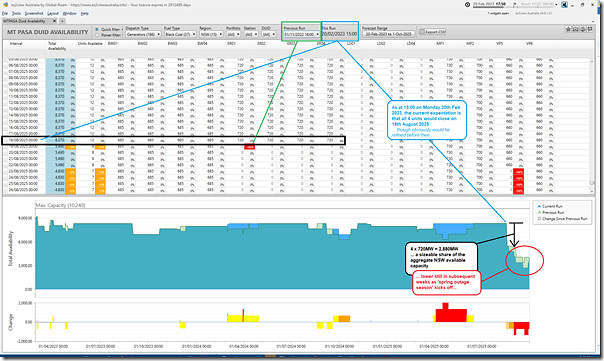

Below is a similar view from the ‘MT PASA DUID Availability’ widget in ez2view, just:

(a) extended out till 2025 to take in the current expectation on the closure of Eraring; but also

(b) Showing in the chart the aggregate level of availability from all coal units in NSW.

The ‘earlier closure’ announcement for Eraring was made by Origin Energy in February 2022 (now a year ago) – having read through the announcement at the time it always seemed to me (as noted here at the time) that there was more uncertainty about the closure date than what many stakeholders had inferred from the statement at the time. That’s one reason why we’re going to be particularly interested in what unfolds at Eraring.

With respect to the chart note the following:

Note 1) Note that the current expectation is that all 4 units would close at the end of 18th August 2025.

… though (it seems obvious that) this would be refined and probably staggered (such as shown for Liddell above) in the lead-up to this milestone.

Note 2) This expectation has not changed much at all from what the AEMO saw on 1st November 2022 (so is the same as shown on 23rd January in this article).

Note 3) The closure of 4 x 720MW (i.e. 2,880MW in total) at the time places a big dent in installed capacity of coal (compare this to the much smaller drop at the start of the chart for 3 x de-rated Liddell units)

… which is, of course, the whole point of climate policy

Note 4) But it’s important to remember that it’s available capacity not installed capacity that’s more important:

(a) In this case, the step change down is larger in relative terms.

(b) Of particular interest is the (even) lower points of expected available generation capacity from coal units across NSW as the normal ‘spring outage season’ kicks off in September 2025 … after the closure of Eraring.

With both SA and VIC regions experiencing dispatch intervals with levels of grid inertia below AEMO’s ‘Secure Limit’ for short periods of time (discussed in GenInsights Quarterly Update for Q4 2022 released last week) this points to challenges of replacing another of the ‘keeping the lights on services’ currently supplied by Eraring prior to that time. If that does not happen in plenty of time to enable prudent go-ahead for retirement, I can’t see how the station could be allowed to retire. The analysis in Appendix 1 within GenInsights Quarterly Update for Q4 2022 is particularly useful for understanding some implications.

A lot of this talk feels like re-arranging the deckchairs on the Titanic because there appear to be three principles that constitute something like an Iron Triangle of Power Supply.

1. The grid needs continuous input to meet 100% of the demand.

2. Nights with little or no wind break the continuity of wind and solar input.

3. For the foreseeable future there will be no effective way to store enough power to bridge the gaps.

Conclusion: We need to keep enough conventional power, mostly coal power, to meet the highest levels of demand at dinnertimes in high summer and deep winter, until we have nuclear power on deck.

In the meantime people need to appreciate that wind and solar can DISPLACE coal but they can’t REPLACE it.

https://www.flickerpower.com/index.php/search/categories/renewables/21-7-intermittent-solar-and-wind-power-can-displace-coal-but-cannot-replace-it

The rate of exit from coal is not accelerated by increasing penetration on good wind and solar days, it is limited by the lowest level of output on nights with little or no wind, as a convoy travels at the speed of the slowest vessel, the water penetrates the levee at the lowest point, a chain is only as strong as the weakest link and stock get out of the yard through gaps in the fence even if the rest of the fence is built to the sky.

South Australia has proven you can replace coal with renewables. But getting rid of gas is more problematic.

On the NEM, existing hydro is also available to help meet demand during times of low wind & solar.

You might want to look at AEMO’s ISP to see how we can get nearly all our electricity from renewables. Or you can look at my own simulations here:

https://reneweconomy.com.au/a-near-100-per-cent-renewables-grid-is-well-within-reach-and-with-little-storage/

South Australia that has to import fossil fuel power from Victoria to keep the lights on and when they can’t they have a week long blackout?

Not a great example.

The concerns are over-blown. Does anyone seriously think parts of Australia will be facing blackouts in the 2020s and 2030s?

I mean seriously. Of course not.

This is overblown fear-laden rhetoric based on nothing.

Both Tasmania and South Australia had a week long outage last year and things are only going to get worse as fossil fuel generation is removed from the sytem and replaced with unreliable renewables.

SA did suffer a transmission outage due to a downed tower near Tailem Bend but this did not lead to a supply outage.

Funny how these outages are becoming more common as we demonise domestic fossil fuel generation and rely on importing fossil fuel power over significant distances from other states.

https://www.abc.net.au/news/2022-11-14/sa-blackouts-compared-to-2016-electricity-cut/101649566