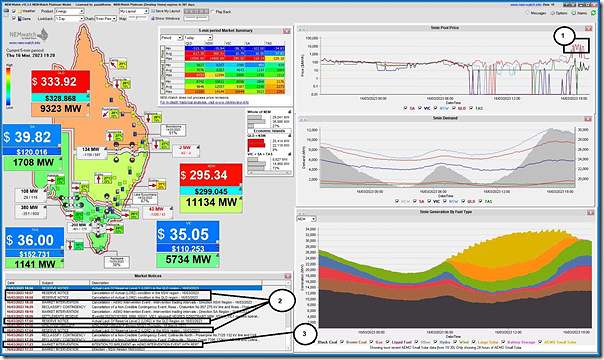

Last article this evening (I hope) with a snapshot from NEMwatch at 19:20 dispatch interval (NEM time) to highlight three main things:

With respect to the numbered annotations:

1) There was a string of highly volatile prices in QLD and NSW, sometimes as high as the $15,500/MWh Market Price Cap, from 17:45 to 18:50 … and we can see in the above that they’ve not totally subsided even now.

2) Both the NSW and QLD regions experienced periods of ‘Actual LOR2-level’ Low Reserve Conditions:

(a) The NSW region from 17:50 to 18:55;

(b) The QLD region from 17:30 to 18:55.

3) Despite the fact that the ‘AEMO has entered into a reserve contract’ as announced at 17:23 in Market Notice 106713 (noted here on WattClarity earlier) it looks like the AEMO determined that they did not actually need to trigger the Reserve Trader.

… albeit that there’s probably cost been incurred (*) just for contracting the Reserve.

———————-

* Update 17th March 2023

The good people at AEMO have clarified that no availability payment was required to be made as a result of the process on 16th March 2023 of going to short-listed candidates for supply of Short Notice RERT. Payments would only have been required if the RERT had been needed to be dispatched.

The RERT page of the AEMO website contains more information … particularly ‘SO_OP_3717: Procedure for the exercise of the RERT’, which provides useful context.

———————-

All of this and it’s only 34 days from the scheduled closure of Liddell unit 4 on Wednesday 19th April 2023 (with unit 2 and then unit 1 to follow in rapid succession). I expect there will be a number of direct conversations happening about all of this in the coming days within Market Participants, Energy User Representatives, Government Departments and so on…

Paul

It looks like a significant driver of the volatility (in addition to high demands and generation outages in NSW and Qld) were constraints on the New South Wales 132kV network which limited flows from the south on the main 330kV route from southern NSW & Victoria. Check out the N>>NIL_998 and N>NIL_999 system normal constraints for more detail. Hard to say without deeper analysis but could have been a “tail-wagging-dog” or “gateway” effect where limits on a peripheral flow path throttled the adjoining higher capacity path (but I don’t know by how much). If so, another argument for getting the transmission system in better shape to deal with changes in where generation is concentrated.

Allan

Thanks Allan

You’ll note I have referenced your comment in the article ‘Reviewing what happened in NSW and QLD on Thursday 16th March 2023 (with Actual LOR2, Volatility and Reserve Trader almost triggered, etc) … part 1’.

Will explore VIC1-NSW1 and these two constraints (and others) in a subsequent article.

Paul

There was a spike to $1000 in SA at 0410-0415 as well, obviously unrelated but an interesting time for a price spike nonetheless.

A lot of focus is rightly placed on high demand situations; my question is whether there is value for “dispatchable demand” in high generation/low demand situations?

I have developed a manufacturing device that converts electricity to plant food; it is profitable to operate even if on only 2 hours a week on average, if the electricity coming in is under $0.02/kWh. It can turn on/off in the 5-10 second time frame.

Is this type of capability of value for a grid operator, or I should just focus on being a consumer?

c1ue, under the Wholesale Demand Response Mechanism you can be paid to turn off. It’s also possible for smaller consumers to get wholesale-linked pricing through retailers like Amber (so you can turn your plant on and off depending on the current wholesale price) or very large consumers to directly participate in the wholesale market as a dispatchable load.

Kevin,

Thanks – I have looked at this type of setup in Texas.

What I am wondering though, is just how well this will work as curtailment amounts and %time negative/zero electricity prices increase due to duck curve mismatches with solar PV/wind generation?

Large scale industrial users of electricity – their biz models and tech simply don’t work in an intermittent usage setup.

So I guess my question is whether there is value to having dispatchable industrial demand at scale vs. simply turning off plants/generation.

I do know Tesla is trying something along those lines using coordinated Powerwall recharging, but I really doubt just how much dialable demand can be aggregated this way.