It’s Thursday 16th February 2023 and spot prices have escalated past $1,000/MWh in the 16:45 dispatch interval for both the VIC and SA regions, and above $10,000/MWh for 16:50.

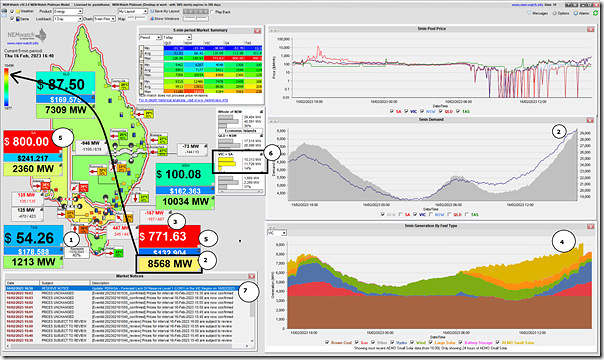

Here’s the immediately preceding dispatch interval (i.e. 16:40) snapshot from NEMwatch with a number of annotations:

With respect to the numbering:

1) NEMwatch shows elevated temperature across VIC and SA (and parts of NSW);

2) This is driving Market Demand in VIC out of the ‘green zone’ on a sliding scale set by historical min and max range (SA demand not quite so high, in relative terms);

3) Note that imports from NSW are constrained south at only 167MW … and also imports from TAS via Basslink as well.

… this leaves VIC+SA economically fending for themselves in an ‘Economic Island’.

4) It’s late in the day, so summer solar is on the decline, and there’s not much wind this evening in VIC as well, meaning gas and hydro are ramping up to meet the peak (energy supply from batteries is much smaller … barely visible in the pink).

5) This has driven the VIC price to $771.63/MWh and SA to $800/MWh

6) The IRPM of the ‘SA+VIC’ Economic Island is down at 14%

7) AEMO has published progressive Market Notices about forecast LOR1 tight supply-demand for VIC and SA today.

Nothing further, at this point.

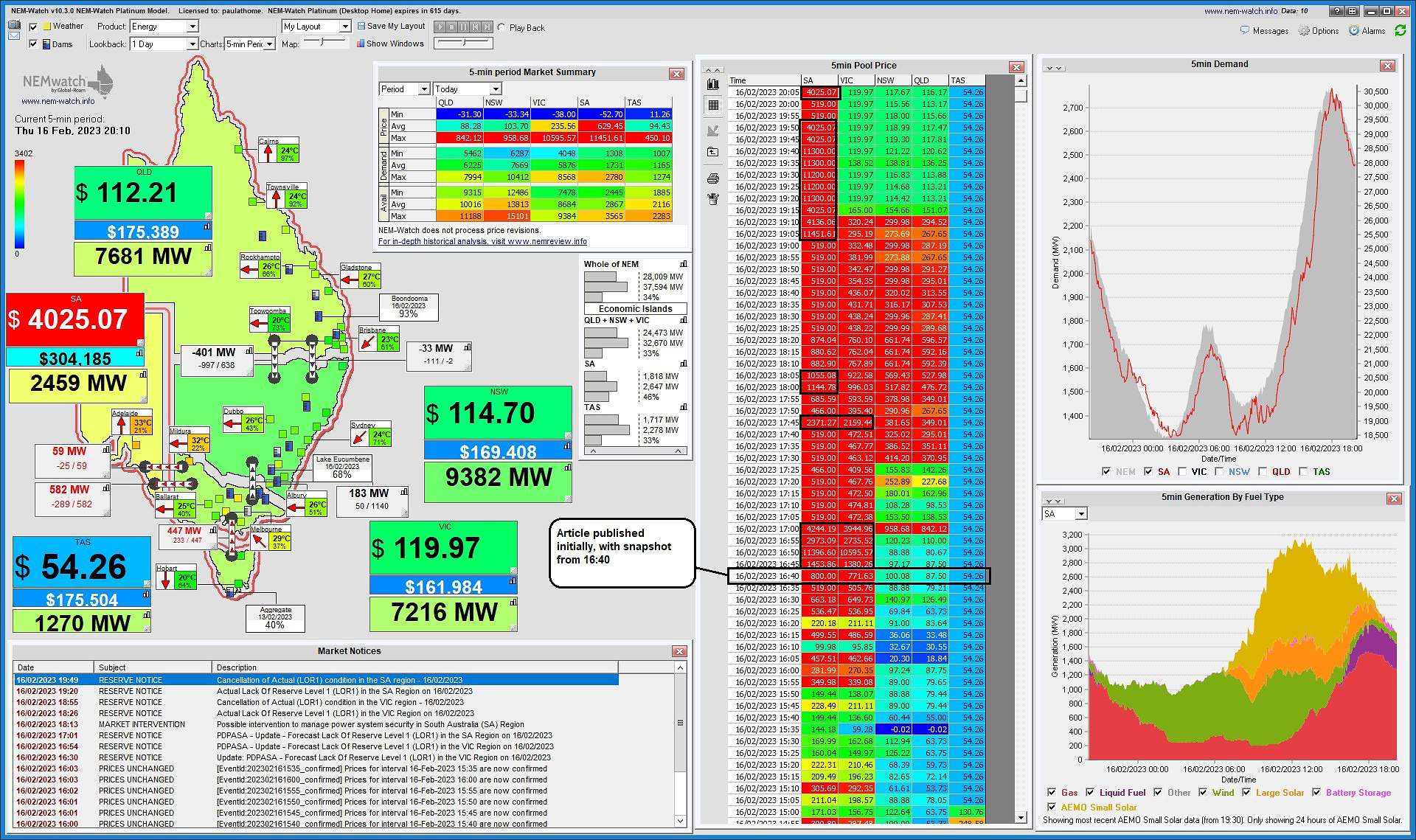

PS1 at 20:10 later that evening

Turns out that there’s been a prolonged run of volatility this evening – in Victoria, but primarily in South Australia. Here’s a snapshot from NEMwatch at 20:10 highlighting some of the history:

We can see:

1) The Market Demand in SA climbed as high as 2,780MW (compared with the all-time maximum of 3,402MW) and has fallen away at the time of the snapshot.

2) There was declaration of ‘Actual LOR1′ for both VIC and SA at different times, but both have been cancelled at this point.

3) The production from VRE in South Australia is minimal at this point in time.

SA and VIC prices are mostly hard to work out. SA has had the diesel gen sets pumping out over 300Mw for well over an hour yet the price is only $500. One would think to get any kind of return on diesel gen sets you would need a bit more than $500.

Also of note, almost everyday SA have gas running, yet the price is often very negative. They must have cheap gas somewhere. Maybe they have found a new kind of Gas turbine and finance system?

SA prices are currently $4000. All fossil have been online.

Gas running when prices negative are because of AEMO system security requirements to have two synchronous generators in SA. The minimum output from gas is 80MW.

Hello Alex,

So does that mean SA does not operate like all other markets and gas because it has to run does not get costed in.

As I understand it, the last bid for the market set the price, this cannot be happening in SA unless gas is not bidding a lot of the time.

The cost of FCAS (grid stability services) is not factored into the wholesale spot prices, but is applied through the additional costs similar to the transmission and distribution costs. The amount of standing fossil gas operating in SA has decreased due to the relatively new synchronous condensers providing that service at a lower cost. In the future there will be no requirement for standing fossil gas generators to provide inertia to the SA grid as this will be provided at a lower cost by big batteries and the EnergyConnect interconnector to NSW.

So the cost of something that is deemed to be needed is not costed into the cost to run the grid in SA, yet we are fed thats its wholesale price is much less than anywhere else. Hmmmmm.

The SA Big Battery was not helping much. It took me a while to find it in the plot (top right purple).

SA was importing 600MW (23%) at the time.

The Big Battery (HPR) is mainly there to provide grid stability services, so if one of the other generators falls over or the interconnector fails, then it can keep the system stable while that generator or transmission line with the problem either comes back online or another generator fills the gap.

When the additional big batteries come online there will be additional capacity in the system to provide more battery supply during evening peaks.

The diesels should achieve about 36-38% efficiency so 3.9 kWh of generation/litre at a tax free price of $1.40 that is 35c/kWh or $350/MWh + $10-15 in other variable costs, $500 is a good contribution to overheads

Hi Peter,

I agree, if you owned it and you got that for it every day for a few hours maybe, but when it sits around for long periods and only runs every now and then, $500 is not what it needs. Very miss priced, not reflecting the actual cost to have such a thing, in your energy mix.

On Thursday there were periods where the diesel generators were receiving more than $4,000 per MWh. The standing capital costs of diesel generators aren’t that high, nor are the maintenance costs. It cost is all about the fuel. It doesn’t take long at $4,000 per MWh to cover the standing costs for the year.

Hello Craig,

I would have thought things should get run to make money?. Are these Genset’s there for simply a backup and to make sure SA has power?.

If that is the case its yet another thing thats very different about how the price in SA is being arrived at.