With the sequential closure of the three remaining units at Liddell now only days away, it seems an increasing number of eyes are turning to the implications … and then to Eraring’s possible (though never guaranteed, at least in my reading) closure ‘as early as’ 2025.

Late Monday, at the end of the long weekend, Samantha Hutchinson wrote ‘Electricity bills no higher as Liddell powers down in NSW: Sharpe’ in the AFR, reporting that the new Energy Minister for NSW is…

‘insisting the closure of AGL’s Liddell power station this month will not push prices higher.’

Frequent readers here will recall a number of articles written about Liddell over the years … including four more recently:

1) On 31st January 2023, valued guest author Allan O’Neil used the newly released GSD2022 to explore the varied ways Liddell has been a problematic station to keep operating in its twilight years in ‘Farewell Liddell’.

2) Then on 6th March 2023 I wrote about how ‘Unavailability of coal units hits 24% across calendar 2022 (but they are *not* collectively tripping more often)’ drawing from GenInsights Quarterly Update for Q1 2023 covering all remaining 44 coal-fired units (i.e. the ones that will remain after the 3 Liddell units close).

3) On 20th February 2023 I also wrote about ‘Current expectation for closure dates of Liddell and Eraring Power Stations’ noting two things:

(a) I noted that the closure dates at the time for the Liddell units were as follows:

i. Liddell unit 4 closes first … on Wednesday 19th April 2023

ii. Liddell unit 2 closes next … on Tuesday 25th April 2023

iii. Liddell unit 1 closes last … on Saturday 29th April 2023.

… note that these dates may have shifted slightly since then, but I have not checked – as it won’t have been by much (if at all).

(b) but I also noted that:

‘As noted in Allan’s article, it’s curtains for Liddell’s 3 remaining units within weeks – and there are good reasons for doing so … but useful for all readers here to understand the implications of the fact that we’re closing Liddell imminently at a time when NSW has consistently been a net importer of energy from VIC and QLD.

… this was Key Observation #2 within the GenInsights Quarterly Update for Q4 2022 released last week’

4) On 16th March in the article ‘Reviewing what happened in NSW and QLD on Thursday 16th March 2023 (with Actual LOR2, Volatility and Reserve Trader almost triggered, etc) … part 1’ I made the comment:

‘At Monday 6th March 2023, the scheduled closure of Liddell Unit 4 on Wednesday 19th April 2023 was 44 days away (with unit 2 and then unit 1 to follow in rapid succession).

… Just over a week later (on Thursday 16th March) the NSW and QLD region experienced more severe stresses:

1) With both QLD and NSW experiencing ‘Actual LOR2’-level Low Reserve Conditions; and

2) Significant price volatility; and

3) AEMO geared up to pull the trigger on Short-Notice RERT …

… which, whilst that did not actually eventuate, should still resonate with readers as a pretty extreme measure, and a reflection of what we wrote a number of years ago now (in the GRC2018) about ‘the level of risk is increasing in the NEM’.

As noted here on the day, it was then with only 34 days till the closure of Liddell unit 4. As I hit publish now, we’re only 29 days till the closure of Liddell unit 4.

Whilst there are very good reasons why Liddell is closing (including emissions, but also those Allan wrote about here with reference to the GSD2022), what’s happened this week could be seen as reinforcement of the fact that we in the energy sector, collectively, have not covered ourselves in glory in the 7 years since AGL first announced the closure of Liddell was scheduled for 2022.’

As a result, it’s no surprise to me that politicians (especially state Energy Ministers) are being asked tough questions just days out from the closure of Liddell … and only days into their first term as Energy Minister.

So I thought I would have a quick look at recent operations at Liddell to see what the data suggests about what prices might do after the closure of Liddell….

(A) What will happen to Spot Prices?

Let’s start with the wholesale spot market – though readers are urged to keep in mind that this is only one aspect of the broader ‘market’.

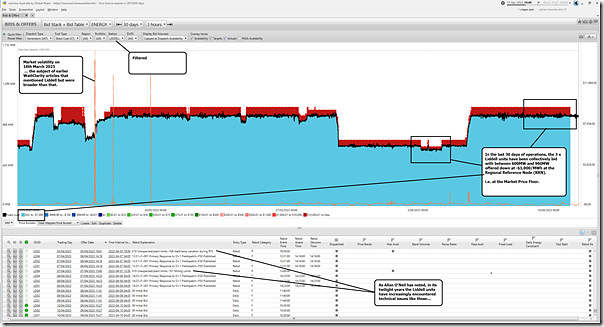

Here’s a view of how the Liddell station has been bid, and been dispatched, over the past 30 days – using the ‘Bids & Offers’ widget in our ez2view software:

We can clearly see in the trend that:

1) Almost as a ‘last hurrah!’ the three remaining units have been running fairly consistently over the past 30 days, albeit at output well below their aggregate Maximum Capacity due to well documented approach of lower boiler pressures to protect problematic boiler tubing.

2) At all times during this period we see between 600MW and 960MW of aggregate capacity offered down at the –$1,000/MWh Market Price Floor at the Regional Reference Node.

Of course the devil is in the detail*, but readers could be understood for thinking that the removal of this ‘cheap’ priced capacity will mean that the spot price would rise from where it’s currently sat.

1) For a start, one would need to assume ‘all else being equal’ – which, of course is never the case (and a simplistic assumption) as participants in the market will respond to the closure (e.g. there might be capacity out on maintenance that will be back to coincide with Liddell units coming offline).

2) The devil is really in the detail here:

(a) For instance is is probable that at least for some of this 30-day window there’s been wind and or solar in NSW curtailed due to negative prices (such as we saw on Easter Sunday with new low point for minimum demand) that might otherwise operate. In cases like this it might be reasonable to assume that the price might barely change when this ‘spilled’ solar and/or wind capacity comes in to replace the energy otherwise produced by Liddell.

(b) But that replacement capacity was not available in the evening of 16th March 2023, for instance.

(c) ‘The Answer’ to that ‘what would happen to prices’ question will really vary from one dispatch interval to another.

(B) Retail prices

It’s much less clear, however, any extent to which this will flow through into wholesale contract prices – and hence into retail prices (or whether it’s already been factored in).

In the first instance it would be fair to assume that the forward curve has had ample time (up to 7 years!) to price in the long-scheduled closure of the Liddell units, and so there should be no change there, or in retail prices. What’s more important would be to consider what’s unexpected that has recently happened in relation to this closure, such as:

1) Unexpected developments that would contribute to a tightening of the supply-demand balance (such as delays to the development of dispatchable capacity seen as replacement); and also

2) Unexpected developments that would contribute to a loosening of the supply-demand balance:

(a) are there any new supply sources that are opening ahead of schedule?

(b) on the residential Distributed Energy Resources front, what’s happened with the development of rooftop PV, and deployment of batteries, and how does this compare to what was anticipated a year or more ago (when wholesale hedges were secured)?

I don’t have time to think more at this point, but will clearly be amongst many that watch with interest at what unfolds.

Yes, when we have extremely low demand and high renewables (like over the Easter weekend), we’re likely to see little change (fewer renewables constrained off). But that was never the concern. The concern is every shoulder and evening peak since we will have 600-960 MW of bids lost. And it doesn’t have to be 16-March levels of demand for it be translate to higher spot prices.

It should be relatively simple to understand that prices will rise as we saw with Victorian prices after the closure of Hazelwood.

You can’t remove continuous generation capacity and expect a more volatile system to provide the same reliability and thus the same pricing.

It’s only going to get worse as Queensland progresses with it’s coal plant closures.