Four weeks ago (on Tuesday 20th April 2021) we announced that development was underway for ‘Generator Insights 2021’ – which will be an update to, and extension of, the 180-page of analysis in the Generator Report Card 2018*

The GRC2018 was very well received – and the many compliments we received at its release, and questions we’ve received since that time (including about when we would update it) have been part of our motivation to invest a non-trivial amount of time in an already busy year to extend it further.

We’re aiming for a release sometime during Q3 2021 (adding to an already busy quarter for us, with 5MS and WDRM both fast approaching).

Since that time, we have appreciated the opportunity to speak with a variety of people about what we plan – and would look forward to the opportunity to speak with you, if you have something you would like to contribute?

We included there a skeleton outline of how GenInsights21 would be structured. Part of what was noted there was (under ‘Other Sections’) ideas for how we might collect, collate and analyse data identified by various types of stakeholders – such as those noted below…

——————-

Caveat:

To be clear – we’re not promising to be able to cover all of the categories below in GenInsights21, but moreso stating an intention to make a serious attempt to identify what is possible to complete, in the light of various constraints we have (not the least of which is time constraints!).

Clarification:

All readers need to be very clear that we are unable (and would never intend) to reveal confidential information that we are aware of as a result of that various roles the Authors (and their staff), and other Contributors, are privy to.

Rather, we are keen to explore what opportunities exist to collect and collate information from the public domain in various ways.

——————-

With these comments in mind, here are some of the Categories of Stakeholder we have identified as what would be of interest to us to analyse…

(A) ‘Generators’

At first glance it seems simple to categorise assets (i.e. DUIDs) by ‘Generation Company’ – however in our experience we’ve found that not to be the case. For instance:

1) In our NEMreview v6 software, we enable the client to aggregate data by 3 different dimensions of stakeholder (Bidder, Trader and Owner), because each has different purpose.

2) In our ez2view software, we provide visibility of both Registered Participant (at the AEMO) and also a more ‘plain English’ Portfolio categorisation.

3) This challenge is one of the reasons that has spurred us to the creation of Asset Catalog as a more central ‘single source of truth’ (though that project is still a work in progress).

For GenInsights21, therefore, we are grappling with what dimensions to use in aggregating statistics for DUIDs up to stakeholder level … and would welcome your input!

(B) Bidding System Providers

One of the areas in which there has been significant innovation in recent years has been the evolution of approaches to bidding (including, but not limited to, the development of algorithmic auto-bidding).

In prior articles I have commented on our desire to include a section on ‘The Rise of the Auto-Bidder’ inside of GenInsights21. It’s a hot area of the market – for instance:

1) During the past week, for instance, I noticed that Seyed Madaeni from Fluence (formerly AMS before its acquisition) announced:

“I’m proud to announce that only 7 months after acquisition by Fluence we have added 1.5 GW of power assets on our AI enabled trading platform, bringing total assets to 3.4 GW!!”

… and linked to a blog post that clarified that the 1.5GW of assets was in Australia – naming Spark Renewables and BJCE as two new clients.

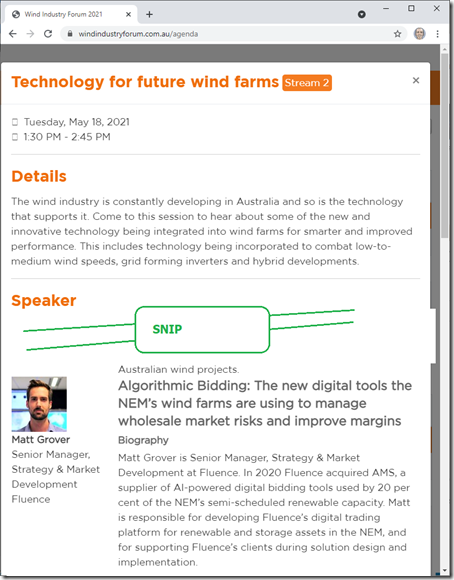

2) Tomorrow (Tuesday 18th May) at the CEC’s Wind Industry Forum I note that Matt Grover (now also at Fluence) is speaking about their technology:

We have been pleased to serve several different vendors of auto-bidders through the past couple years (and separately are pleased to be helping a particular client with our own particularly-focused bid submission system).

Similarly, we look forward to seeing what can be collated and discussed from information in the public domain.

(C) Self-Forecasting Providers

Another area of recent innovation has been the growth of self-forecasting providers for Semi-Scheduled Wind and Solar Farm operators. For instance:

1) On 28th April, Sophie Vorrath wrote about Fulcrum 3D (one of a growing number of vendors) in RenewEconomy article “Sydney solar and wind forecasting start-up seeks funds to tap booming global market”

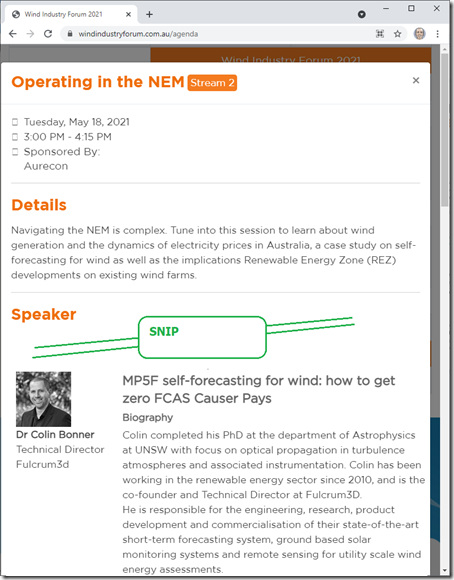

2) Also on Tuesday at the CEC’s Wind Industry Forum I see that Dr Colin Bonner from Fulcrum 3D is speaking (focusing heavily on ‘zero FCAS Causer Pays’ as an understandable sales proposition):

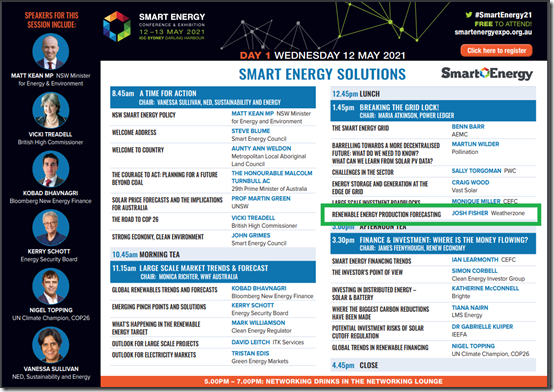

3) There are a growing number of other vendors around – for instance I saw Josh Fisher from Weatherzone talked about ‘Renewable Energy Production Forecasting’ at the Smart Energy Conference and exhibition last week in Sydney:

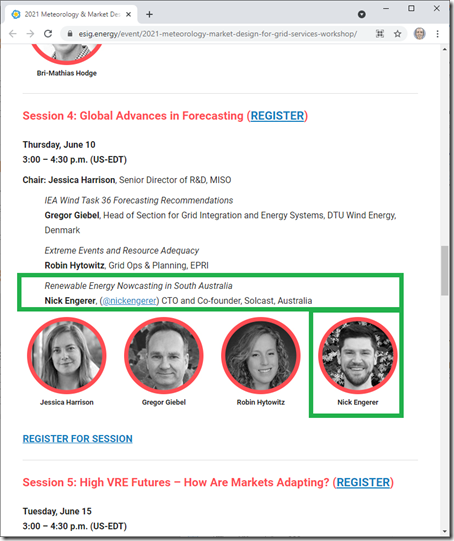

4) I also noted that Nick Engerer (CTO of Solcast, another vendor) is speaking about ‘Renewable Energy Nowcasting in South Australia’ in the upcoming ESIG virtual forum on Friday 11th June (Oz time):

There are other vendors, as well, and we’re keen to explore what we can do to collate and analyse data (from the public domain) about the current situation.

(D) Dispatch System Providers

Particularly for Semi-Scheduled assets, the NEM has developed to the point where there are a number of options for dispatch system providers. Understanding what we can do to collate and analyse data (from the public domain) is something on our list.

(E) Others?

Are there other categories you’d like to read about in our upcoming GenInsights21?

If so, please let us know!

(F) Pre-orders welcome

Don’t forget that we’d welcome your pre-order (at this discounted price) anytime up until the release date of GenInsights21:

| The Product | This is how you will be able to Download GenInsights21 … when it is completed |

This is how to Pre-Order the GenInsights21 Report … and save on the release price that will apply when it is completed |

| GenInsights21 Electronic PDF (targeted release during Q3 2021) | Clients who have already ordered will be able to download the electronic PDF of the GenInsights21 here, when it is completed:

You’ll need to set up your own unique log-in, using your organisational email address in order to access. One bound hard-copy is also being supplied as well (if we have your best postal address). . . . . . . . . |

Please complete this Order Form and send back to us:

After we receive your order and after the report has been completed, we will: —- We will not do anything (other than confirm receipt of your pre-order form) prior to completing the report and delivering you access. |

We’ll look forward to engaging with you when you pre-order, to see if there are specific things you’d like us to analyse as part of the broader analytical report!

Be the first to comment on "Exploring several categories of Stakeholder in ‘Generator Insights 2021’"