Last Friday was another stark reminder that the NEM is becoming increasingly dependent on the whims of mother nature. With the AEMO signaling for potentially record-breaking market demand (i.e. total demand) for QLD in the preceding days, many were gearing up for extreme supply/demand tightness.

On the supply side, relatively low wind output and cloud cover were looking likely to impact the output of wind and solar farms throughout the state. On the demand side, two main factors were contributing to high demand:

- SEQ was plagued by uncomfortably hot and muggy conditions with the apparent temperature in Brisbane hitting 37°C at midday on Friday.

- Scattered cloud cover was also affecting the performance of rooftop solar generation – a variable that sits on the demand side of the equation.

In the end, a late storm over Wivenhoe approaching Brisbane’s west eventually helped dampen temperatures and humidity to more manageable levels, albeit still relatively high. Earlier on Friday afternoon, the RERT was triggered, and then dispatched, but Linton Corbet’s forensic analysis on WattClarity estimates that only 31MWh of electricity was dispatched through this mechanism.

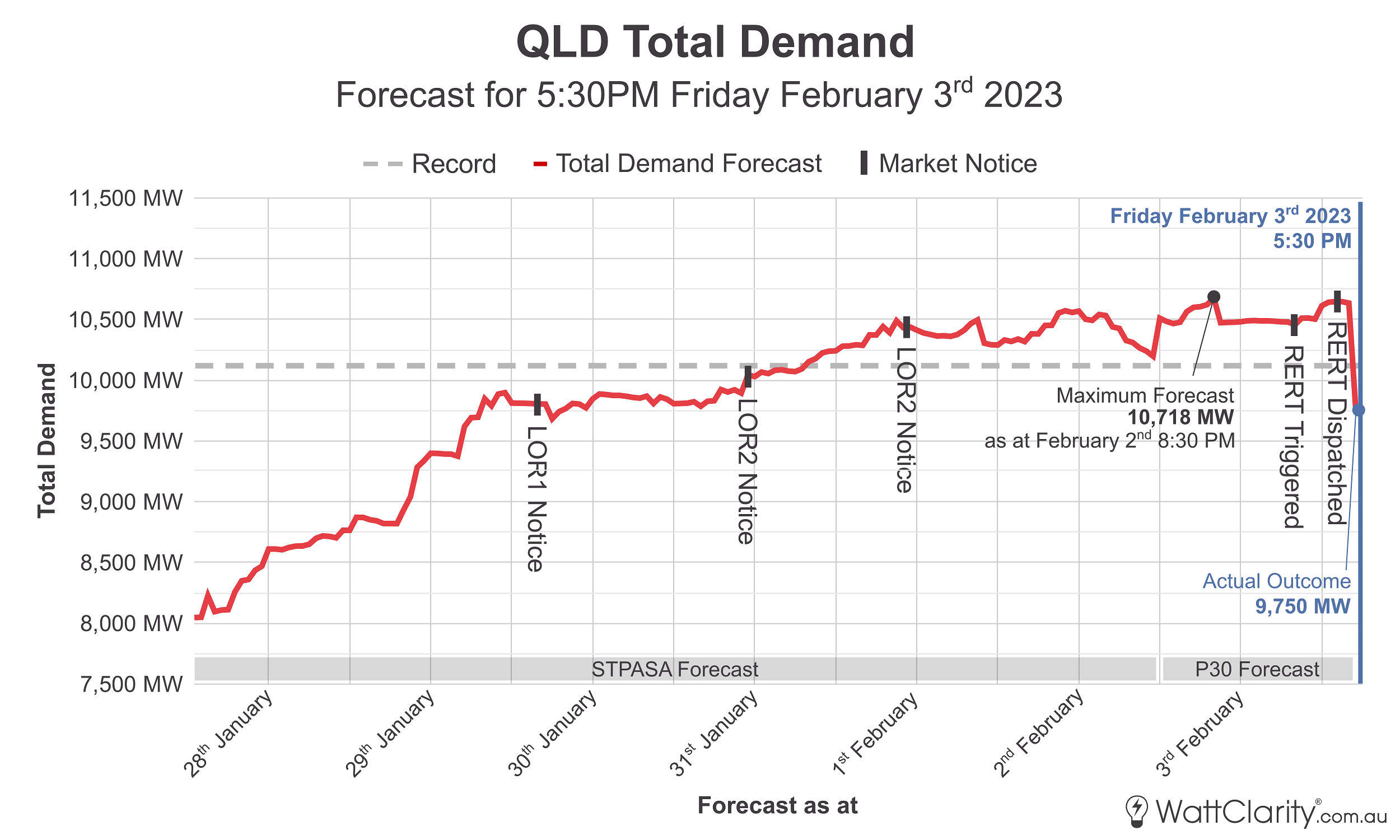

Prior P30 forecasts from the AEMO indicated that demand for Queensland could be as high as 10,718 MW at 5:30pm on Friday – which would have broken the all-time QLD demand record by some margin – but the final figure eventuated at 9,750MW.

That’s a difference of almost 1,000MW between the actual outcome and the maximum forecast, and a difference of around 650MW from what was forecast only an hour before the fact.

A slow rise in the QLD demand forecast was followed by a late and sudden dip.

On Wednesday last week I posted a chart tracking the rising trend in the record demand that was being forecast. Above I have updated the chart to fill in the rest of the timeline to track the convergence on the actual outcome.

Operational forecasting is a tricky but necessary evil as the published data is a critical input into the planning and decision-making process of system operators and market participants – which is essential for maintaining system security.

Last Friday’s events should serve as yet another example of the inherent difficulty of electricity market forecasting, due to the inherent difficulty of weather forecasting. Demand projections in particular are exceptionally sensitive to small changes in humidity and temperature, which becomes exacerbated in Australia’s extreme summers.

Whilst for everyone’s sake the actual outcome last Friday was more favorable than expected, at some point, it seems just as likely that we see an inverse outcome. Of course it is a slight overstatement, but as supply and demand in the NEM become increasingly dependent on wind, sunshine, heat, and humidity – I find it appropriate to paraphrase Homer Simpson:

South Australia, today 9th Feb approx. 7pm AEMO-time, spike of $15,500/MWh. Should we be surprised?

Coincidentally, as noted here, Scott:

https://wattclarity.com.au/articles/2023/02/09feb-spot-volatility-and-an-actual-lor1-in-south-australia/

In terms of ‘should we be surprised’, there’s several levels to your question.

In our widely read GenInsights21 report we illustrated how there were a number of drivers towards increasing volatility into the future. Hence the answer’s ‘no’.

Pretty interesting outcome last Friday in QLD I thought. I was wondering if some of the demand degradation might be driven by tariff 31 and tariff 33 whereby retailers can turn down residential load via heat-pumps and other energy intensive devices during the peak?