A week ago, we attended (and I spoke on 8th October at) the NEMdev conference in Brisbane, and it was a good experience:

1) Dan Lee’s already written highlighted the ‘Three themes from NEMdev 2025’ that jumped out to him

… at some point I might add some more thoughts, in a separate article (but that’s dependent on time permitting).

2) With respect to my talk, I covered a few things (including some considerations about the draft report of the Nelson Review):

(a) … and had promised the audience I’d post more details in subsequent articles;

(b) Now this has taken more impetus because:

i. Slides are being circulated to attendees (and, like PDF slides generally, mine are dry – and lack context)

ii. But also (unfortunately) both Tim Nelson and Phil Hirschhorn could not stick around for my graveyard shift at the end of the conference – so hoping these thoughts here add a bit more context for the Panel’s consideration.

Some ancient history

Some readers might recall the history of our company (Global-Roam Pty Ltd) that I played a small role in the establishment of what was a sister company (Roam Consulting):

1) though my involvement ended (as an investor) ~2007; and

2) ROAM Consulting grew on its own journey to become EY ROAM maybe 10 years ago.

Partly drawing on that background (and what I had seen since):

1) in 2016 that I wrote ‘Forecasting is a Mug’s Game’ (highlighting the 3 Major Flaws), and

2) and then provided this forecast of sorts for the CEC’s national conference in 2017, complete with some villains.

(a) though perhaps not the forecast that Kane was envisaging when he asked me to speak

(b) and flagging some of the concerns that fed through the Finkel Review and then into the Nelson Review.

Drawing on a close working relationship with the team at Greenview Strategic Consulting (which has recently joined the Azzo Group):

1) After considerable effort through 2018 and early 2019, we released the GRC2018 on Friday 31st May 2019.

2) And then followed this up with (intensive effort through 2021 and then) the release of GenInsights21 on Wednesday 15th December 2021.

During my talk at NEMdev 2025, I drew from a number of the 22 x Key Observations included in Part 2 of GenInsights21. For readers here, I thought it would be useful to highlight two of them here:

| 22 x Key Observation in GenInsights21 |

Details in these two observations |

|---|---|

|

Observation #6 What’s next for market modelling? |

On Sunday 2nd March 2025 in this article we shared some of the context that had been written into this Observation approaching 4 years earlier.

Winding forward to the NEMdev conference (and with another 7 months having since passed) and: 1) During the conference, we noted some of what was written in this key observation; 2) And have subsequently determined that it would be worthwhile to publish this observation in its entirety here [link added belatedly] … as a belated and back-dated article (with the date of the article reflecting the publication date of GenInsights21). Those who attended NEMdev 2025 will note: 1) the similarities in the points raised during my presentation (and that of others!) during the conference; 2) and, sadly, that some of these challenges highlighted 4 years ago are still not resolved … are we all poorer as a result of this?

|

|

Observation #8 What’s the purpose of the ESOO? |

As noted when we wrote this observation:

‘We understand that this is a provocative title – one that might be misinterpreted by some readers as implying that the authors think that the ESOO has no purpose. So let us be very clear, up front, that the title is meant to speak to what’s essentially the opposite problem.’ To help a broader range of readers understand what we were writing about (i.e. beyond those who’d purchased the full >500 page GenInsights21 publication) we decided (on 12th April 2022) to publish this observation in its entirety here.

We published that extract at that time because the AEMO was only days away from publishing its interim update to the ESOO 2021 to address the changed outlook in relation to: 1) earlier-than-previously-expected closure of Eraring Power Station (at that time slated for ‘as early as 2025’). 2) earlier-than-previously-expected closure plans for Bayswater Power Station.

In the ~4 years since our release of GenInsights21, however, it does not seem that we’re really any closer (as an industry) to resolving that underlying question: 1) Which (of the various different potential purposes the ESOO seems to strive for at different times) should be its primary purpose? 2) So, as noted during the NEMdev conference, perhaps this is something that the Nelson Review panel should be considering for its final report? |

Recent history, with modelling

As noted ~2 months ago, the ‘AEMO released 2025 ESOO on Thursday 21st August 2025’.

Following from (and in parallel with) the release of this edition of the ESOO, we’ve been investing some time in performing various types of analysis – including the following (which were discussed at NEMdev 2025):

| Changes in Scenario Ranking | … how firm are these projects anyway? |

|---|---|

| A couple years earlier, we’d noticed that the AEMO had started to take a different approach to that which had been the staple for the ESOO over perhaps 20 years.

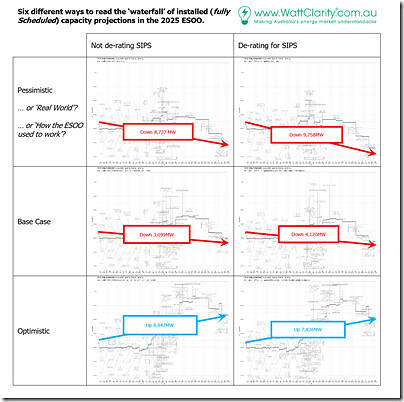

In order to illustrate this, we wrote about ‘Six different lenses to view the ESOO 2025 … giving wildly different perspectives’. In that article, we’d presented the following image to sum up the vastly different outcomes that each of these 6 lenses represent: Click on the image for a larger view Whilst understanding that there’s no ‘most correct’ view, because we’re speaking here about probabilities, our sense is:

… and we wondered if this is the type of initial response that the current start of the supply-demand balance should be eliciting?

|

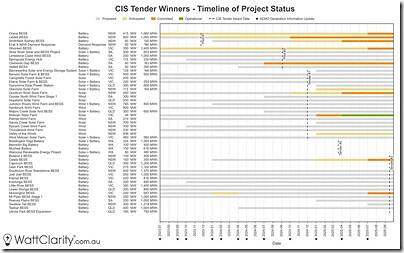

In parallel with the realisation that a form of switch-a-roo had occurred, we’ve become increasingly concerned

… which might (in the end) be having a counter-productive effect than those who made the change might have been intending. Back in June 2024 (in anticipation of the 2024 ESOO but referencing the 2023 ESOO), Dan wrote ‘Who’s who in the ESOO’ and noted: ‘On page 44 of the original 2023 ESOO, the AEMO clarified that ‘anticipated’ projects had begun to be included in the reliability forecast (Central scenario), this was a shift as projects with this category had not been included in this forecast in previous years. As anticipated projects may not have submitted an expected completion date in their survey submission, the AEMO states that a modelling assumption was made in those cases, such that each is assumed to be completed at T-3 years (July 1st 2027).’ So, amongst the things that we have done recently, Dan Lee has prepared a 4-part series of articles

Click on the image for a larger view That article was followed by 3 more in the series now…

… which, at the end of the day, is partly why the Nelson Review is considering something different (the ESEM). |

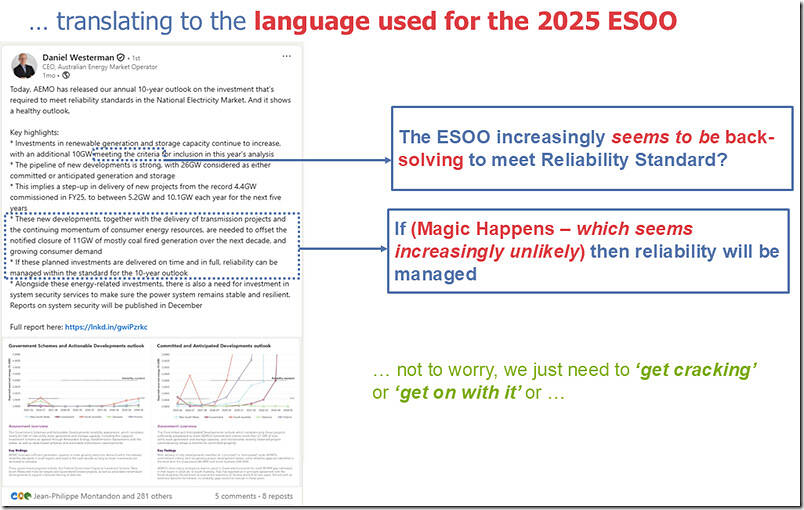

Drawing from the above, I used this image to highlight our growing sense of some of the challenges presented in both:

- The way in which the ESOO modelling has been framed and conducted;

- But also in terms of how its being reported … and perhaps the (lack of sufficient emphasis on) the the caveats included in the assumptions.

Readers on WattClarity would not have been surprised (if in the audience at NEMdev 2025) to see these drawn together using this LinkedIn update by Daniel Westerman that was posted on the day of the release of the 2025 ESOO.

With the above (both ancient, and recent) history covered through the NEMdev conference, I moved onto providing some suggestions for consideration by the Nelson Review panel.

Some suggestions, for the Nelson Review panel.

Readers should recall that (in our review of the draft Report from the Nelson Review), our reading has been framed with respect to these ‘3 high-level questions, for considering the draft report of the Nelson Review’ that we posed back on 30th September. Specifically:

- Did the Nelson Review panel see such issues in scope (or out-of-scope); and

- Are the recommendations relating to yesterday’s problems rather than tomorrow’s;

- or, conversely, are no recommendations given (based on yesterday’s paradigms), rather than considering tomorrow’s (emerging) problems?

With respect to what’s suggested here, we’ll constrain the comments just to the ‘forecasting’ frame of reference (and not to Operational Forecasting, either).

… other articles will follow with respect to other aspects of what’s proposed (and not proposed!) in the the draft Report from the Nelson Review

Mapping to AEMO’s language, there’s three forward-looking (and non operational) time-frames we have in mind:

‘Medium Term’

Readers might note that there already exists some mild confusion here in relation to what ‘medium term’ actually means … for instance:

1) Does it relate to:

(a) the window over which ASX Energy Futures Contracts (or other hedging contracts) are actively traded?

(b) or the window that the Nelson Review draft report speaks to with respect to the period before the ‘tenor gap’ kicks in

2) Or does it related to the time-frame of MT PASA … noting that:

(a) The MT PASA DUID Availability data set is currently set (following the ERM Rule Change) out 3 years into the future;

(b) But the full MT PASA modelling only extends 2 years out.

… and we note that the Nelson Review recommendations (in particular Recommendation 7) which might end up providing more permutations on the interpretation of what the meaning of ‘medium’ actually is!

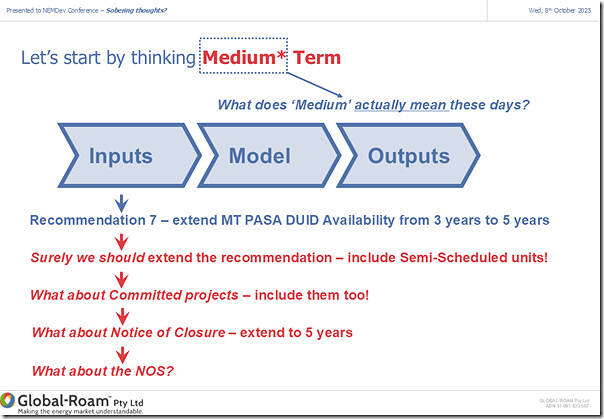

With respect to Medium Term, during the NEMdev 2025 I presented the following slide:

Briefly, with respect to the comments:

1) I don’t have a particular view on what the specific time-frame should be … but my sense is that (whatever the final decision is) then as much as possible, the medium term instruments should all be aligned at the same length.

2) With respect to supply-side capacity projections (and noting that negawatts have been implemented as supply-side additions (a.k.a. Tripwire #3)):

(a) It seems glaringly obvious that the (what seems to me to have been a myopic – a.k.a. yesterdays problems) decision at the AEMC to exclude Semi-Scheduled units is going to become increasingly detrimental to market transparency and functioning.

i. as Linton demonstrated in ‘Trended physical/technical availability of Semi-Scheduled units’, there clearly is a sizeable amount of installed capacity of VRE that is technically unavailable at any given point in time (i.e. before even considering the energy resource that feeds into the UIGF).

ii. it seems downright crazy that we have no forward projection of what that technical unavailability is currently expected to be per DUID.

iii. especially when we’re counting on the ‘Anytime/Anywhere Energy’ supplied by this plant to meet the Nelson Panel’s ‘Bulk Energy’ needs … with just a bit of Shaping, Firming and Insurance on top of that.

(b) Furthermore, learning from the ‘switch-a-roo in the ESOO’ approaches in recent years, it would seem prudent to implement an approach whereby:

i. A requirement is made that any project that is deemed sufficiently worthy to be included in the ‘Base Case’ model in the ESOO should already be appearing with their expected COD in the MT PASA DUID Availability data set.

ii. Having appeared in the MT PASA DUID Availability data set, these units would then be required to update their expected operations date – either if their construction and commissioning slips, or advances quicker than anticipated.

(c) Rounding out the requirements on the supply-side, the AEMC’s currently mandated 3-year notice of closure would need to be extended to the same time horizon (if 5 years, than 5 years).

3) On the slide above I included the open question ‘What about the NOS?’ in order to flag the key importance of

(a) But note that I don’t have a good answer for what practical improvements might actually be made;

(b) Given the inherent difficulties of even planning network outages 13 months in advance … such as what led to the suspension of the MIC component of STIPS earlier in 2025.

‘Long Term’

With respect to this time-frame, I’m referring to what is currently the 10-year window modelled in the ESOO … though perhaps that window is too short given the increasing asset churn?

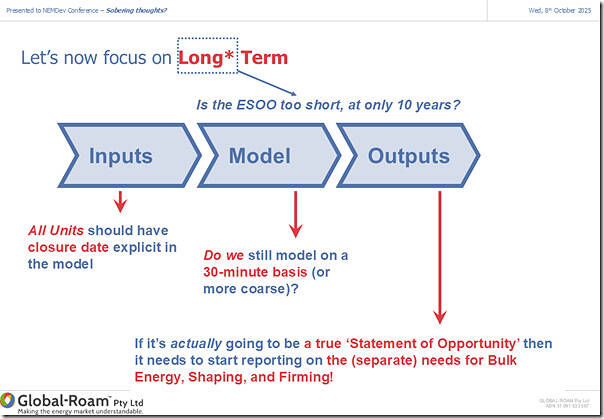

With respect to Long Term, during the NEMdev 2025 I presented the following slide:

Briefly, with respect to the comments:

1) Remembering back to the unresolved question ‘what’s the purpose of the ESOO?’ I would recommend that:

(a) The Nelson Review Panel form a view of what the primary purpose is of the ESOO … and:

(b) Depending on their view:

i. If the purpose is to actually deliver a ‘Statement of (Commercial) Opportunities’, then follow the steps at (2).

ii. If the purpose of what’s currently known as the ESOO is not what the name implies, then:

> The current document should be re-named to better reflect that other purpose; and

> the ESOO name should be reclaimed and re-directed to some other modelling report (from the AEMO or someone else … like the ESEM Administrator perhaps) to actually deliver on the promise of a ‘Statement of (Commercial) Opportunities’.

2) Either way, this new (or reclaimed) ‘Statement of Commercial Opportunities’ should clearly provide results in the frame of all of the services that are required to deliver energy and keep the lights on. For clarity this would include (in the language of the draft Report of the Nelson Review):

(a) The ‘Bulk Energy’ … which we earlier referred to as ‘Anytime/Anywhere Energy’.

(b) The whole bundle of ‘Keeping the Lights on Services’, including:

i. Related to ENERGY:

> Shaping

> Firming

> Insurance (i.e. the out-of-market reserves).

ii. Relating to Essential System Services

3) With that established, the Nelson Review panel might give some thought to whether the 10-year horizon for the Statement of (Commercial) Opportunities needs to be longer?

… for instance if the horizon of the ESEM administrator contracts are going to be out 15 years, then does this suggest that the modelling that supports this should also share the same time horizon?

4) With that longer term time horizon (and even feeding further into the future, with the ‘least cost’ model that supports the ISP) then it stands to reason that all units should have explicit closure dates included in the model

(a) Pages 43-45 of the draft Report of the Nelson Review did a great job in calling out, and collating, Six ‘Technological changes’:

i. They echoed the ‘Increasing weather dependent’ … which we’d noted as Theme 6 in Part 2 within the GRC2018;

ii. They’d flagged ‘Less dispatchable capacity’ … which we’d written about in May 2023 and August 2024;

iii. They’d flagged ‘Less visible and less scheduled resources’ … noting we named ‘The Invisible Man’ as Villain #8;

iv. They’d flagged ‘Energy limited’; … which we’d noted as ‘the rise of Just-in-Time’ as Observation 5/22 in GenInsights21;

v. They’d flagged ‘Less able to provide Essential System Services’ … as in, recognising ‘the Schism’.

vi. They’d flagged ‘Changing nature of marginal costs’ … which is one of the factors driving less volume ‘bid in green’.

(b) But one significant change that was missed is the change (i.e. a significant reduction) in the expected lifetime of most new supply-side assets (i.e. with the exception of a hydro facility or two)

… that’s one we’d also not noted in either the GRC2018 or GenInsights21 either!

i. It was ~10 years ago (at the time I provided this forecast of sorts for the CEC’s national conference in 2017) when I was asked by one of the audience ‘what’s the #1 thing you think we need?’ … to which I replied ‘a schedule for closure of coal’.

ii. Now, the Nelson Review talks about an ‘Orderly Exit Management Framework’ for coal

… i.e. capitalised, as if it exists as some formal program – whereas to me it still does not seem very holistically thought through and orderly!

iii. In a related way, the Nelson Review should consider how we should catalog (and publish!) an expectation on closure dates for all assets.

> for the nearer term, the ‘Notice of Closure’ requirement in the rules would provide for this;

… and the timeframe might be extended as well (there are pros and cons to such consideration)

> for the longer term, it might be sufficient to require AEMO (and/or the body producing the Statement of (Commercial) Opportunities) to explicitly assume, and publish, a reasonable closure date.

… so at least a reasoned discussion could be held about whether the assumptions are reasonable, or not (e.g. how long till we need to replace new wind assets, given some of the early ones are already retiring?)

Even if the (re-focused) ESOO had its time horizon extended to 15 years, there’s a need to look further out in a different style of planning document …

‘Very Long Term’

In this respect I’m speaking about what’s currently a ~25 year time horizon out to ‘net zero by 2050’, and the time horizon used in the Integrated System Plan.

On this front, I’d just note the following:

1) At the start of September 2025 at the 2025 QCES there were a number of speakers call into question the credibility of the 2024 ISP:

(a) Amongst them, Oliver Nunn called out how ‘the ISP Step Change Scenario is divorced from reality’; and

(b) David Dixon also spoke about how ‘we’re moving fast, but not fast enough’;

c) And there were other comments from others as well.

2) At NEMdev 2025 it was no different, with other speakers also asking real questions about the ISP:

… and I’ll share more later, in a different article.

Leave a comment