Integral to the 530-page Generator Report Card is the (approx) 170 pages of detailed analysis we have included on top of the the 328-page Statistical Digest.

In this analytical component, the primary authors (with assistance from a broader range of analysts) invested time to explore a number of

To increase the readability of these insights, we separated these into three parts as follows:

Part 1 = Introduction and Executive Summary

We intentionally kept this part brief (8 pages in total) as discussed here.

Part 2 = 14 key themes

In Part 2 of the document (67 pages), we summarized up 14 key insights (grouped as themes) generated through the analytical component of this Report Card process, and informed by other insights formed by the primary authors in their involvement with the generation sector over the past 20 years (but particularly focused on the more recent years).

We specifically targeted 3-4 pages for each theme in order to make each separately digestible in a quick reading – with the readability enhanced because the themes are structured to be self-contained. In the table below we will progressively add more detail of each of the 14 key themes:

| Theme 1 | Details to be added |

| Theme 2 | In Theme 2, we explore a number of different ways in which of “The level of Risk in the NEM is escalating”.

We copied out one particular illustration of that increased risk (pertaining to bidding behaviour) into this ‘Longer-term trends of low (and high) dispatch prices…’ article on 30th August 2019. In addition to that excerpt, we’ve referenced that theme numerous times in the months and years since … such as: 1) On 9th August 2019, we posted this article that spoke to some of the analysis contained within the Report Card (but pertaining to what was reported in some of the media reports related to pricing patterns occurring at the time). 2) On 18th November 2019 we referenced this in writing ‘Analytical challenge – recognising the separate components in Risk, and their Influence’. 3) We referenced this with respect to pricing patterns on 6th July 2022. 4) On 8th September 2022 we referenced this with reference to overnight volatility in South Australia. 5) On 24th February 2023 we referenced this with reference to high demand in South Australia. 6) On Friday 23rd June 2023 we also referenced this observation with respect to oscillating LOR2 forecasts. … and plenty of other places as well. |

| Theme 3 | In Theme 3, we explore a number of different ways in which of “The fuel mix supporting the NEM is at the start of a massive transformation”.

On Tuesday 20th August we posted this commentary – which follows requests from several people at the conclusion of prior events discussing the report card. It is also worth noting that two of these three illustrations had previously been included: |

| Theme 4 | Details to be added

More details

|

| Theme 5 | In Theme 5, we explore how “the NEM is developing a them-vs-us schism” – with a particular focus on why this has come about, and what the implications

This schism was discussed briefly in this article of 8th August 2019 (and even as far back as August 2014) – and was also mentioned in Giles’ initial review of the Generator Report Card. The concept of ‘Anytime/Anywhere Energy’ was referenced in an explanation about negative prices through winter 2019 in this article “As power prices crash below zero, don’t expect it to show up on your power bill” from Stephen Letts at ABC News on Monday 9th September 2019. It will be explored further in future articles on WattClarity here. |

| Theme 6 | In Theme 6, we explore how “the NEM is becoming increasingly dependent on the weather” – with a particular focus on the breadth of these inter-dependencies (far beyond the normal relationship with high (or low) temperatures driving peak demand), and what the implications

On Thursday 22nd August, the Australian Energy Council posted “Blowing hot and cold: Weather impacts on the NEM” as an Energy Insider, referencing insights shared under this theme in our Generator Report Card. There are plenty of challenges ahead for us in this respect, so the sooner we take a more holistic approach, the more likely it is we can make the transition succeed. |

| Theme 7 | Details to be added |

| Theme 8 | In Theme 8, we explored a number of different aspects of “Thermal plant is ageing, and this brings concerns” with a focus (intentionally) heavier on coal than gas, given the much larger share of energy generated by coal-fired plant in the NEM in calendar 2018:

For instance, on 14th June 2019 we posted this article that included some introductory trends included in Theme 8 within Part 2 of the Report Card (noting that there were another 38 pages included in Part 4 about different measurements of the “dependability” – or not – of thermal generation). On 29th August 2019, the Australian Energy Council referenced some of the data compiled in Theme 8 (and the added detail in Part 4) in this Energy Insider’s note about “ESOO and reliability: What does it tell us?”. |

| Theme 9 | In Theme 9, we explored a number of different aspects of “Emerging challenges for managing system security” in Australia’s National Electricity Market (NEM)

For instance, on 12th August 2019 we posted this article including excerpts from this Theme within the Report Card, highlighting calculated values of inertia supplied by synchronous generation. |

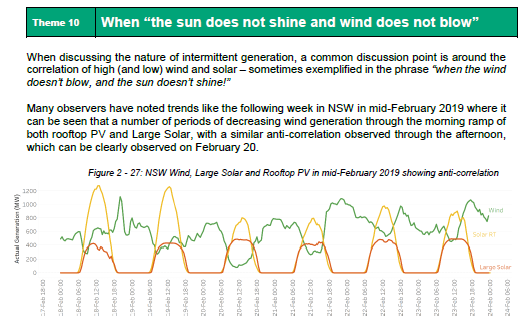

| Theme 10 | In Theme 10, we explored the challenges inherent in times “when the Sun does not shine and Wind does not blow” across all Renewable Energy Zones defined in AEMO’s Integrated System Plan 2018:

For instance, on 26th July 2019 we posted this article highlighting the analytical framework used to interpret the correlation co-efficient On Friday 27th September 2019 the Australian Energy Council’s Carl Kitchen posted this article “Integrating Renewables: An Assessment of Generation Correlation” drawing heavily on the analysis contained within this theme. |

| Theme 11 | In Theme 11, we explored how (despite what some might infer from the buzz) “it’s (only) early days in the ramp up of energy storage” – with the two technologies currently in use in the NEM being pumped hydro, and lithium batteries:

On Tuesday 10th September we posted this article in lieu of being able to speak at the Smart Energy Summit Queensland. |

| Theme 12 | Details to be added |

| Theme 13 | Details to be added |

| Theme 14 | In Theme 14, we explored a number of different examples where we have seen, and experienced, how “the transitional challenges require greatly enhanced Analytical Capability” – which was, in and of itself, one factor (other factors here) prompting us to invest in the Generator Report Card in the first instance:

On Thursday 15th August we posted this article noting how the MT PASA rule changes proposed by ERM Power are one example of the type of changes that will be required as the energy transition gains pace. This followed comments on 7th August related to the general reaction seen to AGL’s announced intention to slightly delay closure of Torrens A and Liddell stations. On Monday 2nd December we posted this article about the (ongoing/worsening?) opacity of rooftop PV, noting how we felt compelled to include such inaccuracies in the otherwise rigorous analysis contained in the Generator Report Card. |

Hence, readers might view Part 2 as a (rather lengthy) summary of key findings, in a way.

Part 4 = insights aggregated in different ways

Given the treasure trove of data we generated in our post-process “Beast” database, there’s obviously much more analysis that could be done beyond just what’s included in these 14 key themes.