It’s Monday 31st October 2022, which means that it’s now a month since the conclusion of Quarter 3 (1st July to 30th September 2022) – and so:

1) we’ve completed the compilation of our 204-page GenInsights Quarterly Update for Q3 2022; and

2) we’ve contacted those who are already subscribers to let them know where they can access the report.

This is the second in a series, but the first time we have noted about the release in an article here on WattClarity.

(A) Background (i.e. why we’re producing these Quarterly Updates)

On the 15th of December 2021, (following a major effort across a both Global-Roam and Greenview Strategic Consulting, and with assistance of others) we were pleased to officially release GenInsights21.

That 622-page report (provided as PDF and bound hard copy) was very widely read, and well received – exploring many different aspects of this energy transition with the deep review of 23 years of market history in Australia’s National Electricity Market. Soon after release we posted about some of the early media coverage that followed.

Following from GenInsights21, we were increasingly asked to provide regular updates to the analysis contained therein … so in 2022 we launched GenInsights Quarterly Updates.

(B) What’s in this Q3 update?

The report (which is designed to be read in parallel with AEMO’s QED for the same period) contains:

(1) An Executive Summary including 6 Key Observations; and

(2) Seven appendices which each explore different aspects of the energy transition through the detailed analysis of historical data.

These 8 components are explained more below:

| . | About this Component |

| Executive Summary

12 pages |

The Executive Summary includes 6 x Key Observations that have been gleaned from what has been observed through the evolution of Q3 2022. These Key Observations follow in the vein of:

1) the 22 x Key Observations included in GenInsights21, and 2) the 14 x Key Themes in the earlier GRC2018. |

| Appendix 1

30 pages |

NEM Heartbeat

In this appendix we take a look at a number of different ‘heartbeat’ metrics that help to identify the overall health of the NEM, including: 1) Weather factors (like temperature) 2) Prices 3) System inertia … such as briefly noted in this article. 4) Frequency Performance 5) Instantaneous Reserve Plant Margin (IRPM) … new for this Q3 update … some of what was discussed in this report was shared more broadly on Sunday 6th November in the article ‘Long-range trend of Instantaneous Reserve Plant Margin (IRPM) and focus on Q3 2022’ published Sunday 6th November 2022. … and others. |

| Appendix 2

15 pages |

The changing shape of Grid Demand

In this appendix we take a look at the changing nature of Grid Demand, which necessitates looking into: 1) Grid Demand 2) Rooftop PV 3) Underlying Demand … and also Market Demand. |

| Appendix 3

43 pages |

Wind and Large Solar

In this appendix we take a look at different aspects of the performance of Wind and Large Solar assets (separately and together), including: 1) Production 2) Commercial Performance 3) Curtailment 4) Self-Forecasting 5) ‘Forecast Convergence‘ for Large VRE Capability (i.e. Wind & Large Solar) 6) Aggregate Raw Off-Target … and more. |

| Appendix 4

26 pages |

Dispatchable Capacity

In this appendix we take a look at different aspects of the performance of (fully) Scheduled assets (at various levels of bundling), including: 1) Performance specifically through Q3 2) Aggregate Scheduled Target (AggSchedTarget): (a) In absolute terms (b) Ramping from one Dispatch Interval to the next 3) ‘Forecast Convergence‘ for AggSchedTarget |

| Appendix 5

31 pages |

Coal Units

The 47 x coal units still operational in the NEM in this quarter are a special subset of dispatchable plant that have been addressed in more detail in this particular Appendix – because: What this contains includes: 1) Performance specifically through Q3 2) Changing levels of Unavailability 3) Three different metrics that help to indicate the changing rate of ‘Sudden Failure’ 4) Categorisation of Outages through Q3 into Planned and Forced 5) ‘Forecast Convergence‘ for Aggregate Coal Unit Availability across the 47 units operational in this quarter. |

| Appendix 6

22 pages |

Network Dynamics

In this Appendix, we look at: 1) Inter-regional interconnectors (flow and congestion, etc) 2) Marginal Loss Factors. … and in future Editions will add in other aspects. |

| Appendix 7

19 pages |

One year on from Five Minute Settlement

Five Minute Settlement commenced on 1st October 2021 (i.e. twelve months before the end of Q3 2022), so it was a nice milestone from which to look back on the 12 months that has elapsed to see what was visible in the data, in terms of how the NEM has evolved. |

Please let us know if you have questions?

(C) How to access this Q3 update?

Instructions for downloading the report (or placing your order, if not already) are here:

| The Product | This is how you can Download GenInsights Quarterly Updates

… to gain the benefits now |

This is How you can Order GenInsights for Q3

|

| GenInsights

Q3 2022 (released 31st October 2022) |

Clients who have already ordered will be able to download the electronic PDF of the GenInsights 2022 Q3 here:

https://downloads.wattclarity.com.au/#/ You’ll need to set up your own unique log-in, using your organisational email address in order to access:

|

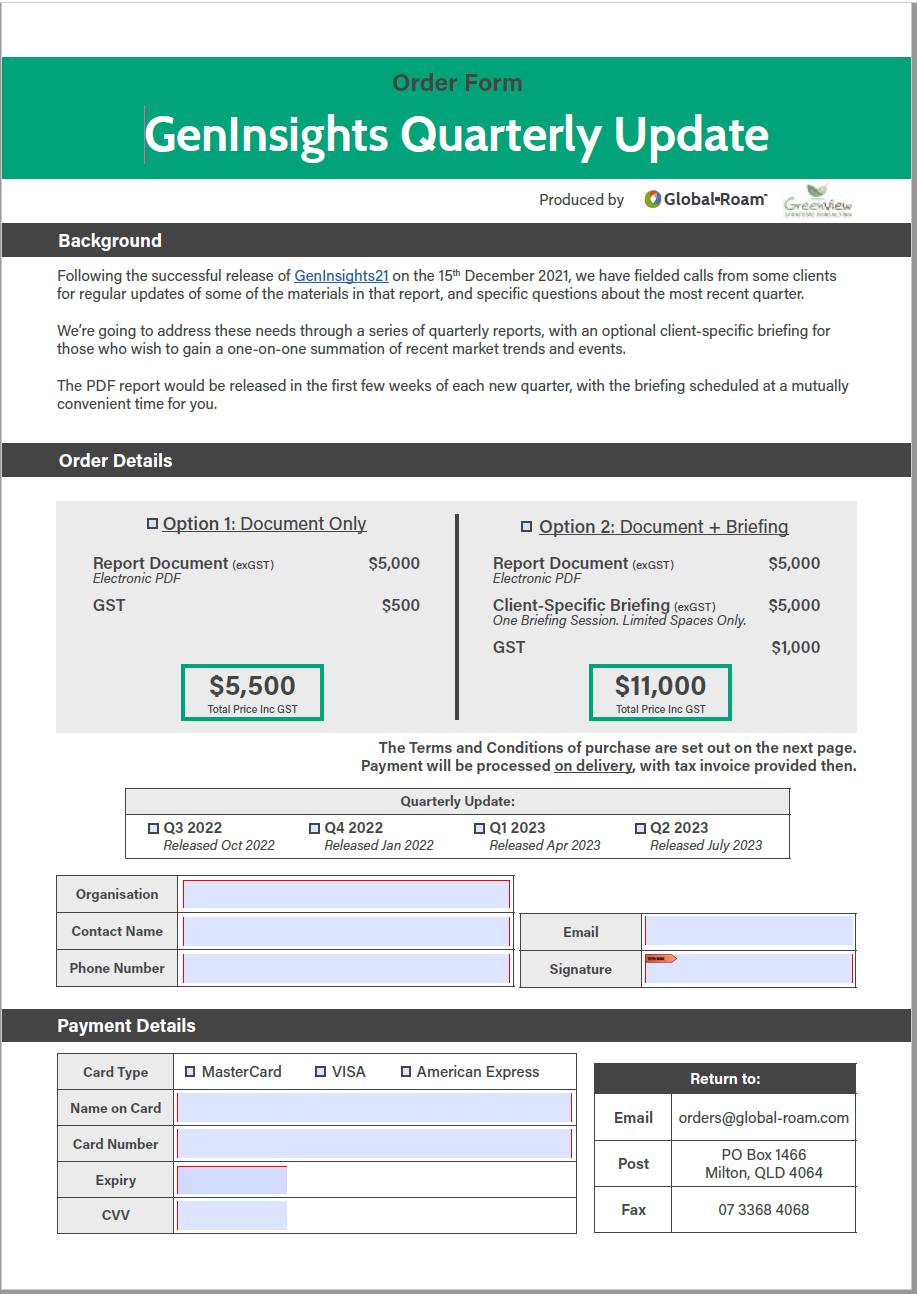

Please complete this order form and return to us to secure your order, remembering to flag which option you prefer:

Option 1 = Document only (as integrated PDF); or Option 2 = Document + Executive Briefing (subject to availability): We look forward to receiving your order

|

We look forward to hearing from you – and appreciate being able to serve our clients in this additional way.

Leave a comment