Market players have been poking the bear, and the bear has responded which will destroy future value for private entities, and the high energy prices place the economy at risk, at a time when it can least afford it.

Market players have pushed electricity forward market prices and to a lesser extent gas prices, to levels that are unprecedented and by doing so have provoked a response from the bear (i.e. governments). For private entities, greater competition from more direct and indirect Government participation, will lead to the destruction of future shareholder value.

In this article we walk through:

- The angry bear response

- The action of the tone-deaf market players

- Why the sudden price increase?

- Consequence of outcomes

The angry bear response

In the last 4 weeks, the market players have been tone-deaf to the angry bear that has unleashed the largest set of reforms for the industry since deregulation began in the mid 1990’s. The reforms include a spend of about $70bn, more ambitious renewable targets and the establishment of Government direct participation. To recap, the angry bear has announced:

- On 20 October, the Victorian government announced as part an election plan to re-birth of the State Electricity Commission of Victoria (SECV). Under the plan – backed by the clean energy sector – an initial investment of $1bn will be spent to deliver 4.5GW of power through renewable energy projects. A third of the state’s energy would be publicly owned.

- The Victorian Government also announced they would legislate that the State must achieve 95% renewable energy status by 2035. The implications for Loy Yang B brown coal generator, the youngest of the brown coal fleet due to be retired is uncertain.

- The previous day on 19 October, the Commonwealth Government announced along with the Victorian and Tasmanian governments they will take 20% equity in the $3.8bn Marinus Link between Tasmania and Victoria. The Clean Energy Finance Corporation will provide debt funding for the further 80% of the capital.

- Accompanying Marinus Link there is a further $1bn from the Commonwealth to aid in the development of the deep pump storage in Tasmania (Battery of the Nation project) and further funds to provide the necessary transmission. In other words, the new Marinus Link will now have the additional energy to transport to Victoria.

- The Victorian Network Interconnector (VNI) linking northern Victoria to southern parts of the State will be accelerated to support additional renewable generation in the northern part of the State.

- The Victorian Government announced a new renewable energy storage target of 6,300MW by 2035, enough to meet half of Victoria’s demand. In other words, the Government will facilitate further competition to existing players.

- On 28 September, the Queensland Government announced the $62bn Queensland Energy and Jobs Plan. It will set a new renewable target of 70% by 2032 and 80% by 2035. A Queensland SuperGrid will facilitate a vast array of solar, wind and battery and hydrogen projects. The largest pump storage systems in Australia will be built. All Queensland Government owned coal generators will be converted to clean energy hubs.

- The NSW Government had already announced its Electricity Infrastructure Roadmap to transform the sector to achieve a capacity target of at least 12 gigawatts of renewable energy generation, and two gigawatts of long-duration storage by 2030.

By funding Marinus Link and by accelerating the VNI, the Commonwealth government has facilitated competitors (i.e. HydroTas and other renewable power stations) to compete against it’s 100% owned and heavily debt-laden Snowy Hydro. Does the Commonwealth Government care?

No – the bear is too angry.

The action of the tone-deaf market players

Meanwhile, while these commitments were announced, the market players have continued to push-up market prices which stands to only aggravated the bear further.

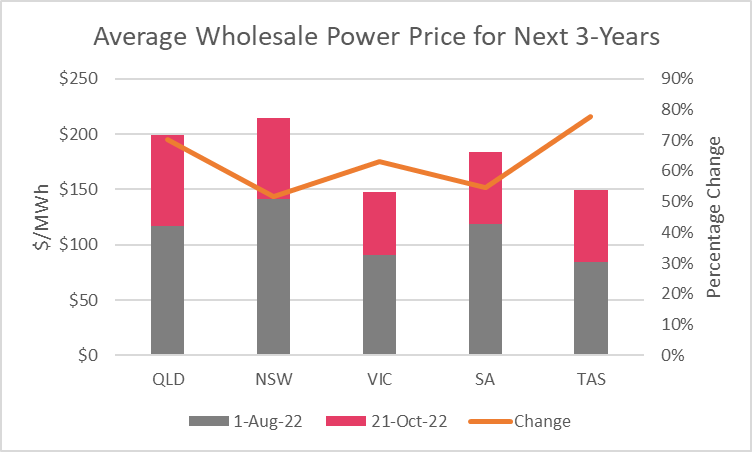

Since the beginning of August, power prices for the next 3-years have increased by 70% in Queensland, 52% in NSW, 63% in Victoria, 55% in SA and not to be excluded, 78% in Tasmania. A staggering movement to staggering levels.

Gas prices have not followed suit with the power prices. Over the last couple of months, there was a small gas price increase in Victorian futures gas price for 2023 of 8% rising to $28/GJ while 2024 has risen from about $20/GJ to $25/GJ (about 25%). Market players have been offering these price levels for large gas users, despite the ACCC LNG Asian forward prices continuing to be much higher over the next 2-years.

ACCC LNG Asian forward gas price is about $52/GJ for 2023 and has decreased from about 67/GJ over the last 2-months. Also, the 2024 LNG Asian price has softened by about $10/GJ over the last few months to $39/GJ.

Why the sudden price increase?

When wondering what has caused the sudden rise in market prices, the Ukranine invasion and the impact on global energy prices is the frequent catchcry. However, such a claim is far from compelling.

Gas Market

Since earlier in the year every domestic gas molecule has been re-valued as if it can be transported to Gladstone, frozen and then packed on an available ship to the global markets. It is not practical for this to be true.

A better way to describe what has happened, is the gas trading strategies of some organisations led some to rely upon spot gas market purchases. Gas powered generation without gas contracts were caught short and were forced to reset their offers based on an escalated input cost.

There were also two groups where the value of domestic gas was re-valued:

a) Gas Producers

When global prices escalated, the gas producers thought to themselves why would I sell the gas molecule to the domestic market at a far lower value than the export market? Consequently, they re-valued their price.

Gas producers with uncontracted gas, had thought all their Christmas’ had come at once. Furthermore, they poked the bear and the bear did not get angry.

The recent gas deal done between the suppliers and the Commonwealth Government has assured the market there will be enough molecules for next year, offers very little price protection except for the assurance it will be less than global prices. At current price levels for 2023 in particular, there is plenty of headroom for an increase.

However, this poking the bear strategy, is risky.

If the bear becomes sufficiently angry the gas suppliers will have no one to blame if the Government invokes a mechanism to restrict or prevent gas exports, introduces a super-profit tax, imposes a gas reservation, or accelerates new gas supply fields.

Government’s love the role of being Father Christmas and offering Christmas presents to all, sharing the proceeds of the super-profit tax is a job most Governments would relish. The downside for the economy is that this approach is inefficient as the gifts are not shared in the same proportion as the harm caused.

It is like the gas suppliers are watching their Christmas present sitting under the Christmas tree grow bigger every day, not realising that the ATO is looking over their shoulder, ready to swoop if called upon.

b) Gas Powered Generators

For those gas-powered generators who had previously purchased gas contracts for a much lower fixed price, also thought why would they sell at the old price level, when they could:

- sell the gas at an elevated spot price, or

- push the gas through the power turbine and alter the asking price to match others?

Either way, they capture the value.

Coal Market

The thermal coal market has also undergone a similar re-valuation.

Every tonne of thermal coal consumed in Australia, has been revalued as if it is the premium grade thermal coal that can be transported to Newcastle or Gladstone and shipped overseas. Not only is the coal used by Australian generators a lower grade coal, it would be logistically impossible to export all the coal. However, that did not prevent the massive revaluation.

Risk management practices for coal has also been characterised by some players purposely buying thermal coal from the spot market who were then caught short when the thermal coal price escalated. Over winter, some generators were also impacted by coal supply issues caused by coal-mine flooding. But once again, it wasn’t only those players with a short coal position that shifted their offers from the traditional $50 to $100/MWh range to the $100 to $300/MWh range, but also those who shadowed priced short coal-powered stations and gas-powered generators. The net consequence is the underlying floor price of the market shifted to the $100 to $300/MWh price range for the black-coal dominated States of NSW and Queensland.

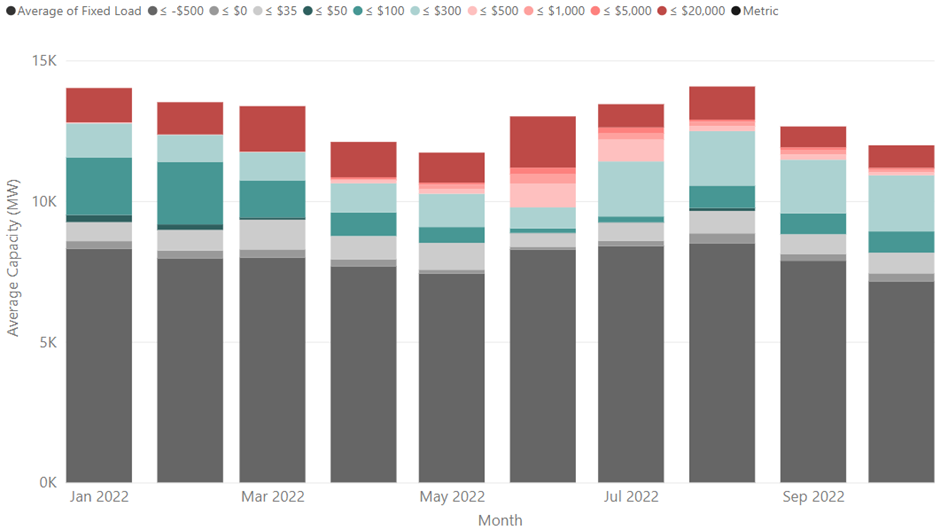

The chart below shows the generator offer stack from black coal generators in the market since January this year. The key colours in each of the bars are the green tones. Back in January 2022, there was a slither of offers between $35 to $50/MWh (dark green), this is now a distant memory.

The next price band is the $50 to $100/MWh band which is the traditional black coal domain. This mid-green band has shrunk appreciably from March onwards, and currently is a small resemblance of its former self.

Finally, the next green price band is the $100 to $300/MWh band which is the new norm for black coal generators marked as light green. It is the dominant price sector for the elevation of the underlying spot prices and has an increased representation for each month, most notably since July.

Consequence of outcomes

It is surprising that the market players have continued to prod the bear, before and during these announcements. History has shown that when the bear gets angry, Government and Regulatory changes have an impact for decades. This set of recent announcements are no different.

Instead of managing the market price so that it is a sustained price outcome that provides secure ongoing returns for a capital-intensive industry, the industry has poked the bear that will now strip value out of privately owned entities.

Each of these announcements create greater competition and will likely increase the influence of CleanCo and other Government entities in Queensland, as well as the re-birthed State Electricity Commission of Victoria.

Market purists hate the prospect of Government direct involvement in competitive markets citing they have a poor record in managing their own costs and frighten-off private investment. If you were a true believer of this hypothesis, then why would you poke the bear so aggressively and for so long?

Out of pure frustration, Governments have acted which will lead to more direct involvement and will create more competition for privately owned entities. Not only that, but the new competitor is fully capitalised, motivated and writes the market rule-book.

Major shareholders of the private entities should be calling for the brakes to be applied and try to slow or shape these Government announcements. Private entities should be striving for a sustained healthy dividend rather than a sugar-coated Christmas present that fades quickly.

For the Queensland Government, there is now a compelling case to repeat history and instruct the Government owned entities to sacrifice a dividend in order to reduce the price pressure on the Queensland economy. The potential economic destruction and stress on the business and general community is far greater than the extra dividend.

If the Brisbane Olympics were held in 2024 instead of 2032, the Australian Olympic Committee would have to run the opening ceremony in darkness, as it would not be able to pay the power bill.

This article was originally posted on EnergyByte. Reproduced here with permission.

About our Guest Author

|

Carl Daley is a co-founder of SavvyPlus and Empower Analytics with over 25 years of experience in energy market analytics, with key skills in mathematical modelling and risk management.

You can find Carl on LinkedIn here. |

Leave a comment