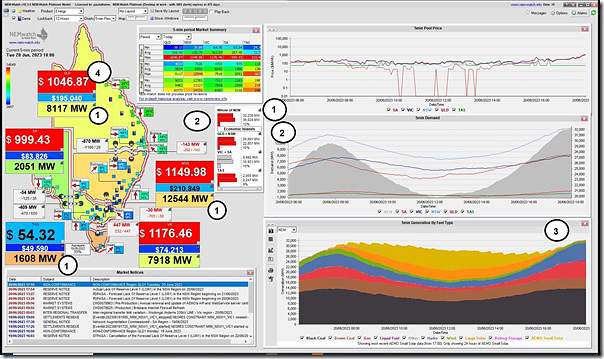

A quick article this evening with this snapshot from NEMwatch at the 18:00 dispatch interval:

With respect to the annotations:

1) Levels of ‘Market Demand’ are elevated in TAS, NSW and QLD (i.e. out of the ‘green zone’) – which also means NEM-wide ‘Market Demand’ is elevated:

(a) up at 32,238MW in the snapshot;

(b) have not trended to check, but this level is not experienced all that often these days.

2) Available Generation is ‘only’ 36,024MW:

(a) Which means spare capacity of 3,786MW;

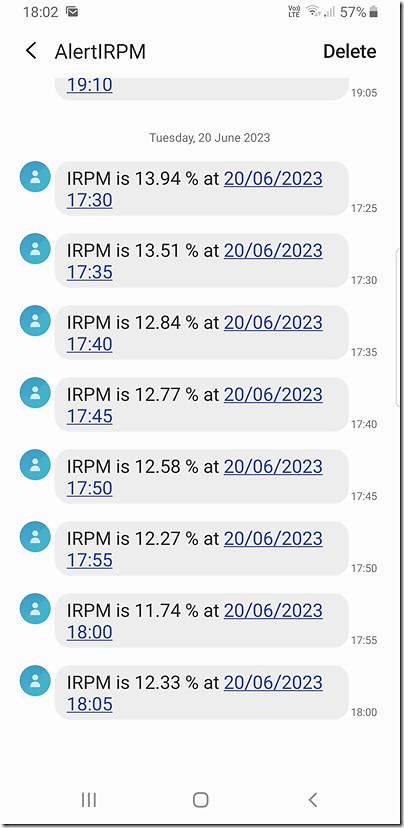

(b) Which represents an IRPM of 11.74% …

i. Rounded to 12% in the snapshot above;

ii. But shown in the string of recent SMS alarms here.

iii. Some readers might recall we’ve been tracking the Instantaneous Reserve Plant Margin more systematically in GenInsights Quarterly Updates, and posted in November 2022 this ‘Long-range trend of IRPM’ from GenInsights Quarterly Update for Q3 2022.

3) The Available Generation is low:

(a) In part because VRE yield is low:

i. use the solar yield has set for the day;

ii. and wind generation is relatively low (around 800MW at the time of the snapshot).

(b) But no doubt also due to other factors I have not had time to look into yet.

4) This is driving spot prices at $1,000/MWh in all mainland regions

5) Makes me wonder what’s happening with Aggregate Scheduled Target (AggSchedTarget):

(a) That’s not something visible until ‘next day public’

(b) But clearly, with VRE low, AggSchedTarget will be high

(c) Only on 31st May we posted ‘Digging further into ‘Aggregate Scheduled Target’, to understand what Dispatchable Capacity is actually required‘…

(d) … and this will be something we’ll update in GenInsights Quarterly Updates for Q2 2023.

PS1 … coincident with Australian Energy Week!

Quite apt that this real-time example of the energy transition challenges should emerge in the midst of the Australian Energy Week conference currently running in Melbourne.

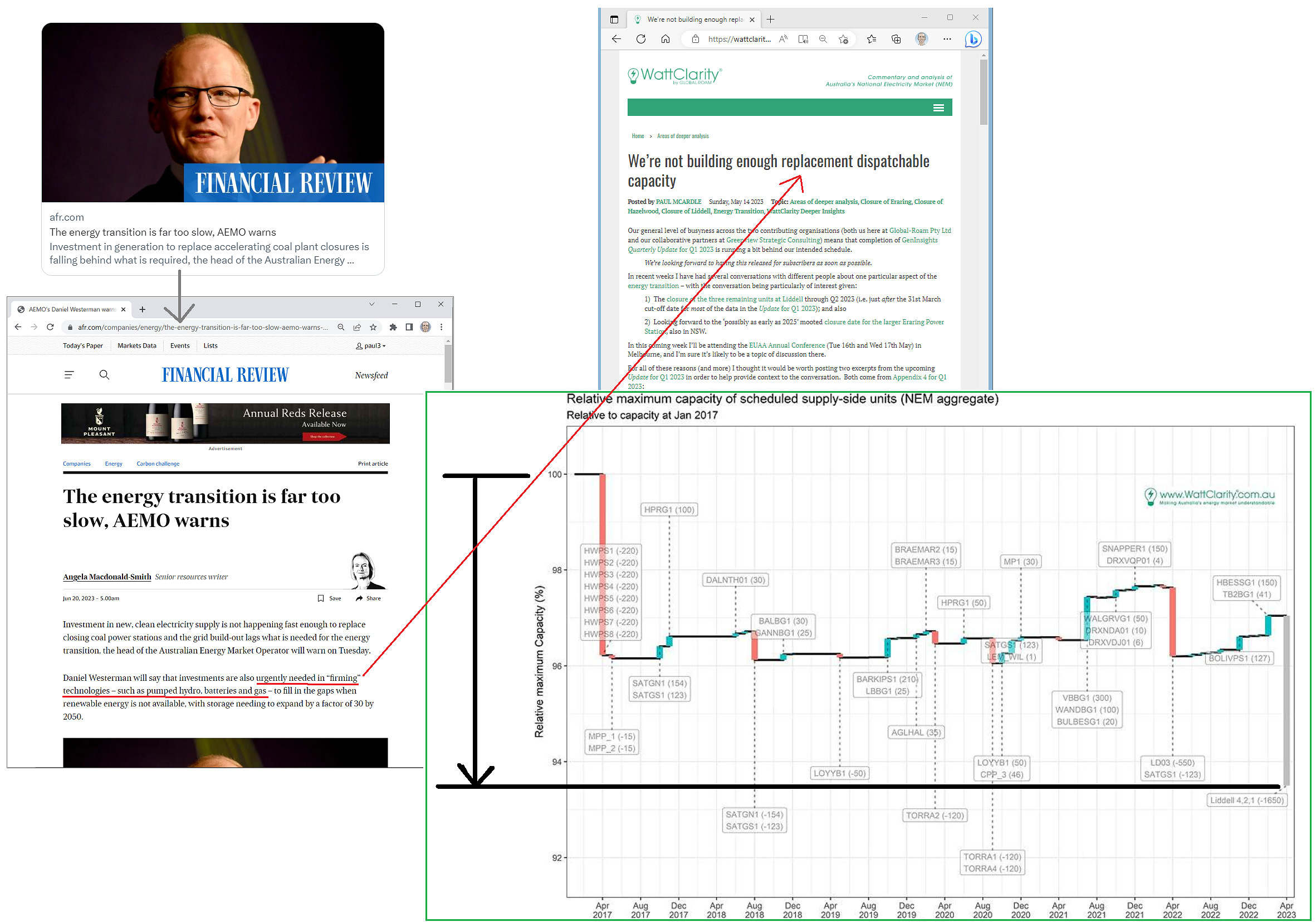

Early Tuesday morning I’d seen Angela Macdonald-Smith in the AFR had quoted Daniel Westerman ‘The energy transition is far to slow, AEMO warns’ in this talk at Australian Energy Week – so I’d shared some thoughts on LinkedIn here:

This had referenced an earlier article on WattClarity where we’d written about how ‘We’re not building enough replacement dispatchable capacity’ (Daniel had called this ‘firming’). Quite appropriate (or ironic) that on the same day (that evening) we’d experienced a real time illustration of why that firming would continue to be required into the future.

Years ago now (when compiling the very widely read GRC2018) we’d written about an ’emerging schism’ between two types of services, which we termed:

Service 1 … being ‘Anytime/Anywhere Energy‘

Service 2 … being a collection of ‘Keeping the Lights on Services’ (including, but not limited to, this firming capacity).

On Tuesday evening (with VRE production quite low in aggregate) we saw an illustration about the need for this firming capacity … merely hours after the AEMO CEO spoke about how we’re well behind the required build out rate for replacement firming capacity to enable coal to close.

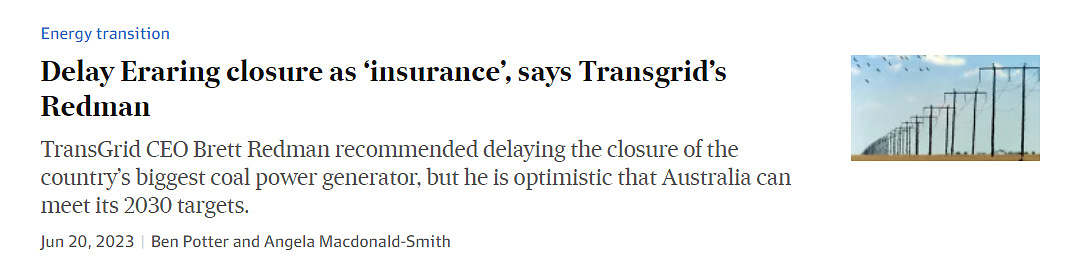

PS2 … possible delay to Eraring Closure?

Is it any wonder that TransGrid CEO, Brett Redman spoke later at the same conference about the possible need to delay the closure of Eraring Power Station – as reported in the AFR as ‘Delay Eraring closure as insurance, says TransGrid’s Redman’?

The concern here is the time of the IRPM ie after the sun has set. So when the chemical batteries are discharged in a few hours and there is low overnight wind then what? The 2 GW Snowy 2.0, 2 GW Borumba Pumped Hydro and 5 GW Pioneer-Burdekin Pumped Hydro will be post 2030. The NEM is desperately short of LONG duration energy storage that can operate for days (or weeks) if need be. The IPCC have said that climate change could cause global stilling in the decades to come. Australia’s east coast is one area that could be impacted by reduced wind speeds. A 10 percent drop in wind speeds could drop wind generation by 30 percent. Will be interesting to see how the proponents of these massive pumped hydros intend to return the water to the top reservoir if the IPCC are right and global stilling does eventuate. The NEM has to be resilient to climate change which requires a mix of generation. Geothermal according to IRENA is 0.5% of global renewables but could it be more. Japan and Korea sit on the Pacific Rim of Fire and Queensland has potential that has so far resulted in failed geothermal projects in western Queensland.