A quick article (whilst the day is still unfolding) to note that the bottom’s fallen out of NEMwide demand today as a result of:

1) mid-20’s temperatures pretty much everywhere; and

2) 10GW or more of rooftop PV.

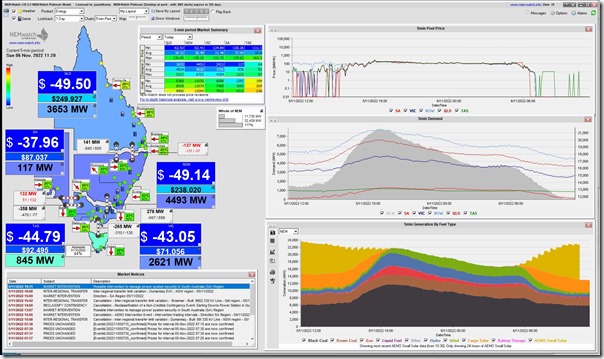

Here’s a snapshot from NEMwatch at 11:20 (NEM time) this morning with NEMwide ‘Market Demand’ demand down at 11,730MW (note it was lower at 10:40, being 11,607MW):

Already at this point it’s lower than the 12,113MW reached on 25th September 2022 – and:

1) I thought it might advance lower through the middle of the day;

2) But that turned out to not be the case (see PS1 below).

With respect to the snapshot above, it’s worth noting from the snapshot above:

1) The negative prices everywhere;

2) This is probably one additional driver for low wind production NEMwide (under 500MW) that was not present on Friday.

3) and it’s probably leading to some curtailment of Large Solar as well…

… though we’d need to wait for the ‘Next Day Public’ data to see more clearly.

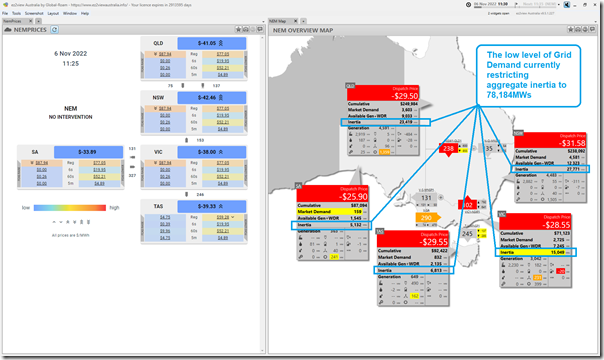

Since the release of ez2view v9.5 we’ve been able to track in real time the level of inertia in the grid – which, for the 11:30 dispatch interval aggregates to only 78,814 megawatt-seconds across the whole of the NEM:

In ez2view above we’ve included the data which the AEMO has only recently started publishing itself.

Even prior to that point, our analytical collaborator (Greenview Strategic Consulting) has been deriving an estimation of the level of inertia in the grid from synchronous machines for many years. These estimates have been tracked through the GRC2018, GenInsights21 and into the GenInsights Quarterly Updates :

1) With those estimates, the lowest point for Q3 2022 was seen to be on 4th September 2022 – those clients with a copy can see more at p28/204 of the Q3 Report.

2) The level of inertia on Sunday 6th October will be discussed in the GenInsights 2022 Q4 Report, which is scheduled to be released late January 2023.

Might have time later to come back and report lowest points for the day…

PS1 results as they appear towards the end of the day

Towards the end of the day, it appears that the low points were:

1) If your reference is the MMS data point ‘TOTAL DEMAND’ (which we call ‘Market Demand’) then it was 11,607MW at 10:40 as noted above

2) If your reference is the AEMO ‘Operational Demand’ data field (which might be thought of as ‘Grid Demand’) then it was 11,892MW in the half hour ending 11:00 NEM time

3) If your reference is the MMS data point ‘DEMAND AND NON SCHEDULED GENERATION then it was 12,782MW at 10:40

All three measures were lower than what was seen on 25th September 2022… but it probably won’t be too long till they are lower still.

Thanks to one keen reader pointing out that a look at rooftop solar PV production through the day (based on the AEMO estimates) shows some cloud cover might have prevented grid demand dropping even further.

PS2 confirmation from AEMO?

Will have to wait longer for this…

This will be celebrated by the RE community but it is very seriously misleading, like the new Renewable Penetration tab on the AEMO data dashboard.

The green transition is just a massive waste of money until there is some way to lift the delivery of RE on windless nights. As long as these gaps in RE supply persist we will need all the coal and gas capacity that we have at present to keep the lights on.

Pity about that, because it means that prematurely connecting intermittent providers to the grid will be seen as the biggest policy blunder in our history.