Ancillary Services Matter! No longer just realm of electrical engineer or energy trading boffins, ancillary services (and particularly Frequency Control Ancillary Services or FCAS which will concentrate on today) have become front and centre in so many ways that barely a day goes by without market observers referring to grid stability, inertia or frequency management. FCAS has always (and will continue to be), a vital component of any large power system. In the past, few would understand the inner workings of FCAS and most traders would not give it the time of day because the prices were very low and the impact marginal – they were effectively provided for free. Today, that is far from the case, with boardrooms across the country from energy utilities and major consumers, through to politicians and media outlets, discussing something that has always been there, but rarely seen or understood.

So, in conjunction with a presentation at the CEC Wind Industry Forum, where FCAS formed a central element of the day, I thought I would take a deeper look into and explain a few of the pieces that form the FCAS puzzle.

What is FCAS?

FCAS is a NEM-specific name applied to a group of services that help maintain our power system at 50Hz. As demand for electricity changes continuously across the power system, the generation (from whichever source!) is adjusted to keep these two items matched. Too much demand without enough generation, and the frequency will fall. Too much generation for the given demand and frequency will rise. If the frequency falls outside the 47-52Hz range, the power system will begin to collapse to protect the equipment and we will have blackouts as occurred in South Australia in September 2016. One of AEMO’s primary responsibilities is to manage the power system and market such that these types of events are avoided. My friends at Global Roam help put this GIF together to show the continual movement and change that occurs between generation, demand and frequency (this GIF is for illustrative purposes only).

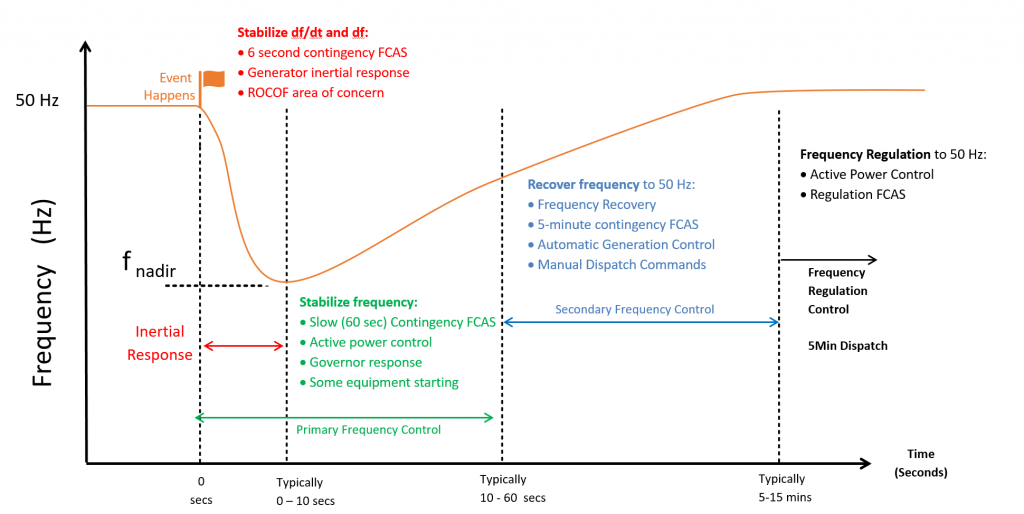

In order for generation to be in a position to continually adjust its output, the FCAS markets were created to send a price signal for the value of those services in conjunction with the corresponding energy price. The FCAS markets comprise of two distinct types of services; regulation and contingency. Contingency (or system stabilisation as they are known elsewhere) services are locally enabled at the plant equipment level and will respond to the frequency without a central command or instruction. The FCAS Contingency services are broken down into raise and lower components across a fast (6 second), slow (60 second) and Delayed (5 minute) time frame – 6 distinct service requirements and market prices for each region. You will also hear discussion at the moment around very fast frequency response (or FFR) capability which AEMO is considering as part of its Future Power System Security work. A crucial element here is that the Raise services are paid for by generators in the NEM, whereas customers/loads pay for Lower services.

The other frequency service is Regulation (or load matching), which are again broken into raise and lower elements for each region. Unlike contingency services that are locally enabled/installed on sites, regulation services are managed by an AEMO signal that is updating every 4 seconds via the Automatic Generation Control (AGC) control system. As the power system moves between 49.85Hz and 50.15Hz (the Normal Operating Frequency Band), a small adjustment of up or down (raise or lower) is sent from AEMO to enabled generators (and loads) to alter their output, thereby keeping the frequency at 50Hz. An important element of the regulation services is the concept of Causer Pays Payment Recovery, which is dealt with in Harley’s post.

All the regulation and contingency services come together continuously to act to keep frequency at 50Hz: 24 hours a day, 7 days a week all year round. This is represented in the below image which shows how the numerous services work together to bring frequency back to 50Hz following an event (I have chosen to use indicative charts here instead of real event data just to avoid those ‘finger-pointing’ exercises that have dominated recent discussions on this topic).

Are renewables killing the grid and making it unstable?

No. Yes wind and solar are intermittent generation sources and their generation continually changes, but as anyone who has kept an eye on Watt Clarity over the years will have noticed, the generation on the grid is changing all the time and is designed to handle changes. As Allan O’Neil noted recently about the 3rd March, a plant failure in the Torrens Island switchyard in South Australia caused nearly 600MW to trip on protection settings in less than a second; I’m not aware of too many wind farms in the NEM that decrease output like that all the time! I bring this up to highlight that as the grid changes, the need to manage the operating envelope will change, which in turn will change the market pricing of the FCAS (and energy) within the technical boundary.

I hear lots of people talk about how wind and solar generation sources do not provide ancillary services. Actually, this is not isolated to wind and solar generation as many gas-fired plant do not provide FCAS either because the commercial economics in recent times did not warrant it. After several high FCAS-pricing events in South Australia in late 2015, both Quarantine 5 and Osbourne power stations installed and commissioned the necessary equipment in 2016 to provide regulation services: the market signal worked.

Similarly, as was recently announced by ESCOSA, AEMO, ARENA, ESCOSA and Neoen will come together to conduct a trial at Hornsdale 2 wind farm to provide FCAS, and I have little doubt there will be more announcements to come in this space.

Other places around the world are using wind farms (and increasingly solar plant too) to provide FCAS. A couple of sites I highlighted in the CEC forum include:

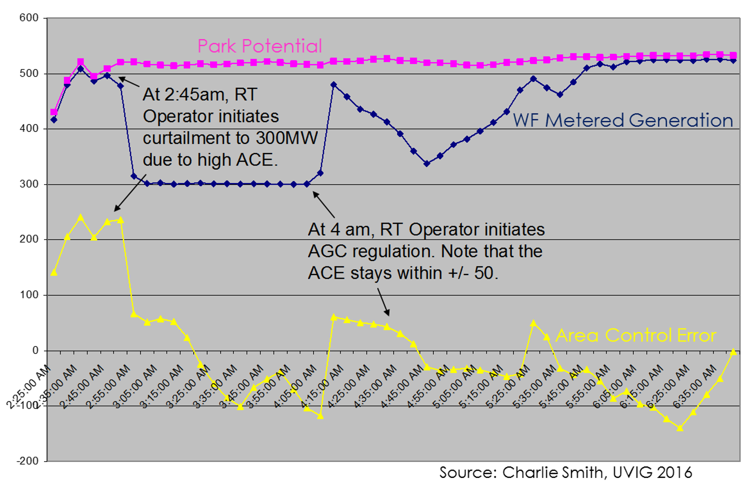

- Within the PSCO balancing authority area in the MidISO grid in the US, where wind penetration at times is up to 60% (in a 7000MW system), over 2000MW was enabled for regulation services by Dec 2015 (see Figure 3). You will note the ‘Park Potential’ label, a concept that is currently being discussed in the NEM as ‘Estimated Power’ as part of improvements to the Australian Wind Energy Forecasting System (AWEFS).

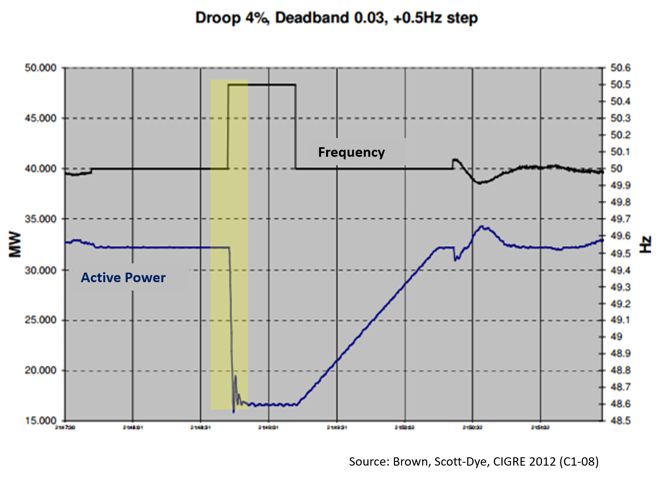

- In the North Island of NZ, the Te Uku plant is capable of providing contingency services in response to frequency step-changes (see Figure 4)

The above two examples are only a few of the many places around the world where FCAS services are provided by a variety of different plant types. Therefore, I think we can stop the rhetoric that renewable sources cannot do it – they (and many other plant in the NEM) are not providing some of these services because it did not make economic sense to do so! As always, it is rarely a case of technical feasibility but rather one of business value.

Recent Market Events

There are far too many recent FCAS market events that I will save that over to another post, which will be centred on FCAS Co-optimisation and how the FCAS and energy markets interact in each 5-minute dispatch interval. However, I thought it worth pointing out how the business value for FCAS providers of the future might look given current market outcomes. Looking back a few days to Tuesday 21 March 2017 in SA, with the energy price at -$1000/MWh for large periods throughout the day, and the FCAS Raise Regulation and FCAS Lower Regulation price near $10,000/MWh for large periods of the afternoon, an FCAS provider would be optimising their portfolio well by ensuring they were fully enabled in the FCAS Regulation markets, even if that meant reducing their output in the energy market. The pricing signal for FCAS is well and truly among us!

Wrapping it up …

So some key points on FCAS:

- FCAS has always been around, and always will be; Ancillary Services matter!

- The power grid is a dynamic system with generation and load changing all the time; frequency is the measure of how in balance the system is!

- Wind (and Solar) plants can and do provide ancillary services and will undoubtedly be enabled within the NEM in the near future, as long as the commercial value is suitable to the service provider

About our Guest Author

|

|

Jonathon has 18 years practical experience in the Australian NEM, having held senior operational and trading roles in participant organisations and now as the Director of a specialist market consulting organisation, with a specific focus on renewable energy integration. Some of his current clients include one of Australia’s largest integrated utilities, market regulatory organisations, transmission system operators and not-for-profit market observers. Jonathon has spent considerable time working with AEMO, Australia’s energy market operator.

As a former member of the NEM’s Dispatch and Pricing Reference group, Jonathon’s intricate knowledge of power system dispatch and security, coupled with practical, on-site experience with power system operations across all forms of electricity generation, allows him to bring operational and energy trading realities to strategically significant strategic and policy discussions. Jonathon has degrees in Engineering and Management, and is a member of the Australian Institute of Company Directors, CIGRE and IEEE. You can find Jonathon on LinkedIn here. |

The author’s unambiguous ‘no’ to the question whether wind and solar will make the system unstable is not correct. Sure, power systems are designed to deal with variability, but traditionally that variability has arisen from the demand side, as well as contingency events. Intermittent wind and solar add an additional source of variability. The evidence from overseas market is very clear that intermittency requires additional high frequency reserves to be held.

Thanks for the comment Sabine,

Can you clarify the comment “requires additional high frequency reserves”, either here or via email.

Thanks

A substantial amount of spinning reserve (inertia) will be removed from the national electricity market with the closure of Hazelwood.

It would make for an interesting comparison of say frequency drop rate of change before and after Hazelwood closure upon an event such as a 660MW’s separating from the grid followed in close succession of another 660MW’s

I await the next Bayswater type separation event for comparison.

MrCyberdude

Thank you for this very well explained article re FCAS. Who said electricity is dull. Like any other piece of communication, it depends on how it is delivered Great article.

Stefano

Thanks for the article Jonathan, found it very informative. I’m wondering if you might have come across a company called Faraday Grid, and what you might think about their products / claims if you have read anything about them? They claim to have developed power flow control devices called “Faraday Exchangers” (I believe they replace existing transformers) that autonomously maintain voltage, frequency and power factor efficiently in distribution and transmission networks. The Exchanger is also said to generate its own inertia providing greater security in a grid that is increasingly reliant on VRE. I wonder if you think the “Faraday Exchanger” could revolutionise NEM infrastructure, as they seem to claim, and could displace ancillary service providers? Keen to hear your thoughts!

Thanks for great article

If I participate in the FCAS service, but happen to encounter a situation where I cannot provide the quantity as bid, will there be a fine? Is there any documentation on the penalty regulations? Thank you.