In the last year and a half, market bodies have increasingly focused on how best to ensure that the NEM can be operated in a secure and reliable manner, particularly as we transition from a system dominated by large synchronous generators to more renewable energy and storage distributed across the system. Several rule change processes co-ordinated by the AEMC and the ESB’s post-2025 market design reform have been centred around starting to explicitly procure and value certain system services. These are services beyond the provision of energy that are needed to ensure that the power system can be operated within its technical limits. One of the system services that are currently being explored by the AEMC and the ESB is the provision of operating reserves.

What are reserves?

Balancing supply and demand of electricity is one of the many tough jobs that AEMO has. Whilst 5-minute market dispatch attempts to do this in the most economic way, the power system is dynamic and changes at every instant. Renewable and conventional generation move around their generation targets, there’s error in demand and renewable energy forecasts, and unexpected plant or network faults and trips can lead to supply-demand imbalances, load-shedding and even cascading failures that result in blackouts.

Reserves help AEMO manage these events, and securing upward reserves (i.e. those that address a supply deficit) is of particular concern. In shorter timeframes within a dispatch interval (milliseconds to a few minutes), AEMO procures frequency-responsive reserves (generators providing mandatory PFR and resources providing FCAS) to help them achieve supply-demand balance and ensure that system frequency is as close as possible to 50 Hz. However, over longer timeframes that stretch past a 5-minute dispatch interval, AEMO relies on the availability of reserve capacity that has been offered into the market but not dispatched.

Source: Reserve services in the National Electricity Market Directions Paper, AEMC.

These reserves are called in-market reserves and are linked to Lack of Reserve (LOR) conditions. LOR declarations enable AEMO to signal tight supply conditions to market participants and, should the situation become dire, bring in emergency resources and/or shed load. In-market reserves can come from dispatchable and flexible plants that can be started relatively quickly (e.g. some gas units and batteries) or in the form of spare generation capacity of a partially-loaded unit (otherwise known as headroom).

What is an operating reserve service?

What’s currently being discussed is explicitly procuring and valuing these reserves through what I’ll refer to as an operating reserve service. A couple of service design options were suggested by the AEMC in their Directions Paper on the subject which all essentially require a resource to provide a combination of two distinct but somewhat interrelated resource-specific capabilities:

- Ramping capability that enables resources to meet unanticipated, anticipated or all ramping requirements. The horizons (the period over which ramping may be required) being discussed are available capacity in the next dispatch interval (i.e. 5 minutes), or over or after a number of successive dispatch intervals (e.g. over the next 30 minutes or with a 30 minute notice period).

- Reserve capacity that is either online or offline and realisable. The latter means that reserve capacity can be converted into energy generation within the reserve horizon. While this is dependent on the ramping capability of the resource, it also requires resources to maintain headroom.

Operating reserves are typically procured from dispatchable generation (i.e. coal, gas, hydro) and storage. However, within the limits of their energy source availability, wind and solar can be operated in a flexible manner and could also provide reserves (a great study that models operating solar in a flexible manner from the U.S.). It is also worth noting that loads can provide upward reserves by curtailing their consumption through demand response. However, though demand response providers have been players in the NEM’s FCAS markets for many years, demand response following actual LOR2 or LOR3 conditions has traditionally been triggered as a part of the activation of emergency “out-of-market” reserves (RERT). Demand response will likely play a bigger role in the energy market (and potentially in determining the level of in-market reserves) following the implementation of the Wholesale Demand Response Mechanism in October this year.

Why do we need an operating reserve service?

Although the sufficient availability of in-market reserves is linked to AEMO potentially intervening in the market, these in-market reserves are not explicitly procured or valued. So far, the implicit incentive for offering in-market reserves is that they can be brought in when spot prices are expected to be high to help participants defend contract positions. If a contract position would expose a participant to paying out large amounts during periods of expected high spot prices, it’s likely they’d want to make sure they could generate and sell energy during these periods (i.e. be physically hedged).

There are a couple of reasons why we might want to explicitly procure and value reserves through an operating reserve service in the NEM:

- The AEMC seemed to be concerned in its directions paper that participant-managed reserve provision becomes risky when there are unexpected changes in the supply-demand balance. Unexpected changes including forecast errors, which could grow in magnitude as more renewable energy is installed in the NEM, and lower probability, high consequence system security events that aren’t necessarily accounted for by AEMO’s security assessment (e.g. the Callide PS fire and subsequent trips). For dealing with these issues, procuring a shorter reserve horizon might be more efficient as uncertainties generally decrease as the system gets closer to real-time. Furthermore, a shorter horizon is a stronger price signal for faster and more flexible resources, although there might be fewer resources that are currently able and willing to act on such short notice and thus may lead to higher prices for procuring more flexible operating reserves.

- AEMO supports an operating reserve service with a horizon of 30+ minutes so that they have certainty around reserve availability. Procuring reserves 30+ minutes ahead might reduce the need for intervention or, at the very least, give AEMO more certainty around how they should intervene.

- As noted by Infigen in their rule change proposal, valuing reserves (through something like an operating reserve demand curve) can act as a “price-adder” and enable a demand-side preference for reliability to be better reflected in the spot price. While work is underway to move towards a more “two-sided” market, energy users have limited opportunities to participate and actively bid into the wholesale market. One consequence of this is that although our spot market price cap is relatively high compared to similar markets elsewhere in the world (~$15,000/MWh), it is well below the estimated value of customer reliability across states and sectors in the NEM. However, using an operating reserve service to address this gap is a suboptimal solution because some energy users will likely be happy to be curtailed rather than pay for that reliability – something that can be better facilitated by making the market more two-sided.

Some questions we had and our work

A couple of us at UNSW’s Collaboration on Energy and Environmental Markets have been thinking about the question of operating reserves in the NEM. The questions we have are:

- Do we need an operating reserve service? This depends on the purpose of the service, but also on the availability of in-market reserves both now and in the next few years. This is an important question because it is likely energy users will pay for it.

- If we need one, what reserve horizon is appropriate? Again, it depends on the purpose, but many stakeholders co-optimised reserves with either a 5-minute or 30-minute horizon.

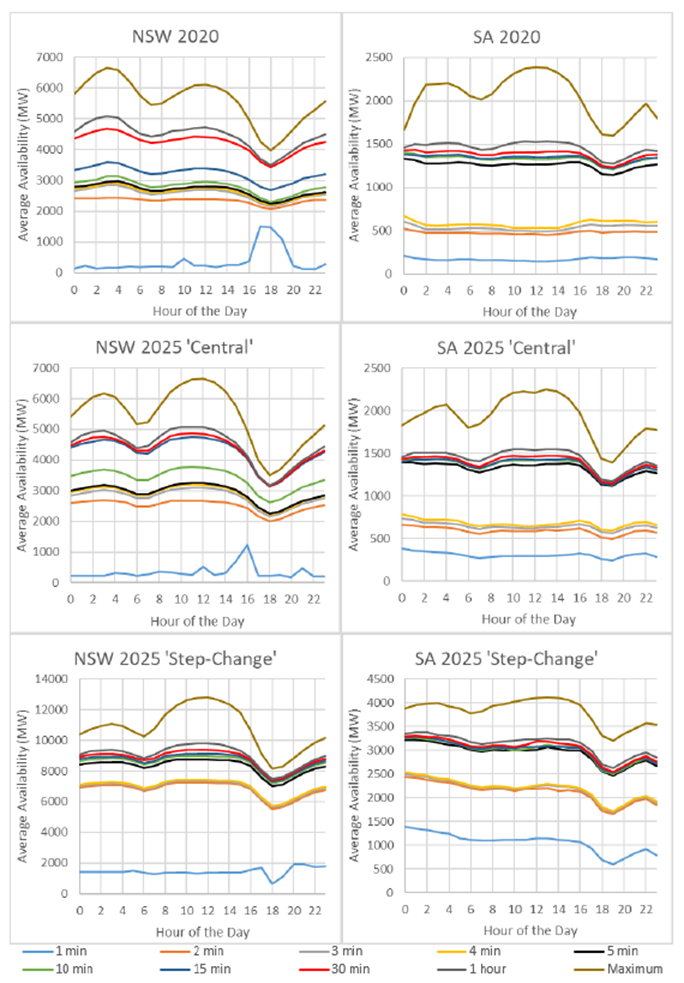

To answer parts of these questions, we did some preliminary market modelling of the NSW and SA regions in 2020 and 2025 (loosely based on ISP scenarios) in PLEXOS. In particular, we were interested in how much and when reserves are available across different horizons (i.e. reserves that can be converted to generation in 1 minute, 2 minutes, 5 minutes, etc.) after generation is dispatched against regional demand. We made several simplifying assumptions, all of which are listed in our submission to the ESB Options paper, but here are the more material ones:

- We modelled these states assuming they are isolated (due to interconnector limits or due to regional reserve requirements).

- We have not modelled the FCAS markets. There is likely some overlap between the reserve capacities from our model and reserve that would be offered into the FCAS markets.

- We did not model demand response.

- Given the challenges of modelling battery operation, we used a relatively simple battery model (PLEXOS’ “daily arbitrage”).

- We have simplified market dynamics by assuming static participant offers across 4 bands.

The figure below shows the average realisable reserve capacities across a range of reserve horizons for a given hour of the day. Our model seems to suggest that reserve capacity is scarcer during evening peaks, and that reserve availabilities seem to be clustered based on the reserve horizon. For example, in the NSW 2020 and NSW 2025 ‘Central’ scenarios, the amount of realisable reserve capacity is similar across reserve horizons from 2 minutes to 10 minutes. While our assumptions make it easier for us to comment on the profile of reserve availabilities than the actual quantities, there also seems to be, on average, a reasonable amount of 5+ minutes reserve available in both regions and across scenarios.

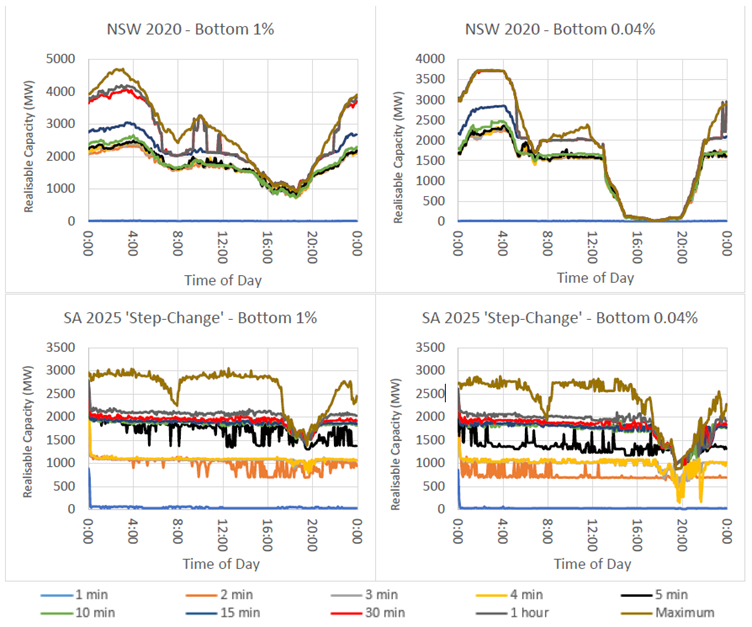

However, we were particularly interested in looking at “extreme” periods. To do this, we created “synthetic extreme days”, where we took the bottom 1% and bottom 0.04% of reserves available in each 5-minute window across a day and “stitched” those values together (see figure below). As such, these are not days that actually occurred in our models, but they represent a “worst-case” for each and every 5-minute interval. What we saw from these “synthetic extreme days” is that whilst reserves are still clustered by availability for most of the day, the evening peaks generally see capacity with reserve horizons between 5 minutes to an hour converge as total reserve capacity becomes scarcer. This is likely due to:

- Relatively inflexible but cheaper capacity being ramped up through dispatch to meet expected changes in scheduled demand, which leaves…

- More flexible but more expensive capacity as reserves across both shorter and longer reserve horizons.

This suggests that the provision of operating reserves at these times of scarcity may come from more flexible resources anyway, regardless of whether the service specifies a shorter or longer horizon. As a result, concerns about limited providers are not necessarily exclusive to shorter reserve horizon service specifications during periods of operating reserve scarcity.

Our thoughts and takeaways

We have only scratched the surface with our analysis, but to us, these are the main takeaways and areas for further work:

- More analysis is required to justify implementing an operating reserve service, particularly as consumers will likely bear the costs. While we have focused on the next couple of years, it is important to remember that the scheduled or expedited retirement of thermal generation will change the reserves available in the NEM. Demand response and flexible operation of distributed and utility-scale renewables and storage may fill these gaps, particularly as some regions like SA see more periods of low operational demand, low prices and few dispatchable generators committed (i.e. started, synchronised and ready to generate).

- A 5-minute service might act as a “price-adder”, with resources being managed as they are now to capture expected high prices for energy and operating reserves. A 30-minute horizon would do much the same but instead allows the reserve price to be captured prior to the reserve being needed. This might allow time for participants to commit resources, but the commitment is now an obligation. So both horizons are likely to incentivise commitment. The key difference might be in investment timeframes – a shorter reserve horizon is a better signal for more flexible resources sooner as the NEM faces greater variability and uncertainty.

- We have explored availability within certain timeframes, but not the potential duration of reserves. Reserves provided by some types of generation could be sustained provided their primary energy source is available. However, demand response providers may prefer to not remain curtailed for an extended period. Reserve provision through interconnection depends on how interconnectors are operated through dispatch. There appear to be some circumstances under which AEMO might use higher (thermal) short-term interconnector limits.

- We have talked a lot about upward reserves but not much about downward reserves. Many thermal generators have minimum stable generation levels, and more renewable energy in the NEM might see them pushed closer to those limits. This may mean we need slack in the system to turn down as well as up.

We are interested in your thoughts, so please feel free to get in touch via email or leave a comment!

——————————————-

About our Guest Author

|

Abi Prakash is a PhD candidate within UNSW’s Collaboration on Energy and Environmental Markets.

You can find Abi on LinkedIn here. |

|

Rohan Ashby is a Research Assistant at UNSW’s Collaboration on Energy and Environmental Markets.

You can find Rohan on LinkedIn here. |

|

Dr. Anna Bruce is a Senior Lecturer in the School of Photovoltaic and Renewable Energy Engineering at UNSW and the Collaboration on Energy and Environmental Markets’ Engineering Research Coordinator.

You can find Anna on LinkedIn here. |

|

Dr Iain MacGill is an Associate Professor in the School of Electrical Engineering and Telecommunications at UNSW and Joint Director (Engineering) for the University’s Collaboration on Energy and Environmental Markets (CEEM).

You can find Iain on LinkedIn here. |

Be the first to comment on "Let’s Talk About (Operating) Reserves"