Two new markets live on the 9th

October 9, 2023, will see the start of two new Contingency FCAS markets in the Australian National Electricity Market (NEM):

- Very fast Raise contingency FCAS.

- Very fast Lower contingency FCAS.

The “very fast” refers to the 1-second timeframe for a participant to deliver its response when triggered.

For this reason the markets are also commonly referred to as “R1” / “L1” or “1-Second Raise” / “1-Second Lower”.

The other existing and continuing contingency categories are fast (6-seconds), slow (60-seconds) and delayed (5-minutes).

When we include the the two frequency regulating markets and energy, the two new markets bring the total number of commodity markets in the NEM to 11 (eleven)!

Contingency FCAS is used to bring the frequency back to within the normal range

For added context and detail on FCAS services let’s talk about FCAS is worth reading, and covers who pays for the services.

In relation to the new markets, there are two points we should keep in mind (referencing AER Contingency FCAS Compliance Bulletin October 2022):

Contingency FCAS is procured (by AEMO) to manage frequency recovery and return the frequency back within the normal operating frequency band (50 +/- 0.15 Hz), following a contingency event affecting the power system (such as the loss of a generator, load or network element).

Contingency FCAS services are triggered automatically for enabled providers (based on dispatch enablement levels) to deliver responses (change in active power) when there is a frequency deviation outside the normal operating frequency band.

The key purpose of the new very fast services is: To arrest a change in System Frequency following a contingency event that takes it outside the NOFB within the first 1 s of a Frequency Disturbance and then provide an orderly transition to a Fast FCAS.

The Very Fast FCAS markets provide for a more efficient mix of FCAS services

The reasons for the new markets are neatly summarised in the AEMC’s final determination from 2021 [AEMC, Fast Frequency Response Market Ancillary Service, Final report, 15 July 2021]:

System inertia is expected to continue to decline over the period 2020 through 2035 in accordance with projections from AEMO’s 2020 Integrated system plan (ISP).

Under reduced inertia operation, the frequency nadir following a contingency event that results in a loss of generation is expected to become increasingly deep, increasing the likelihood of under frequency load shedding.

Increased quantities of fast (R6) contingency services will be required to maintain the frequency within the containment bands specified in the frequency operating standard.

Increased quantities of fast FCAS would generally mean increased costs.

Very Fast FCAS, because it operates at a faster timescale, can arrest the rise or fall in frequency more rapidly than the current fast service and therefore provides an avenue to mitigate the costs of needing to procure increasing levels of Fast FCAS.

Note that, regarding inertia, a useful resource on the topic can found here: Let’s talk about inertia. And AEMO provides a FAQ on Fast Frequency Response here.

Very fast FCAS provides an additional option for procuring the right level of contingency FCAS as cost-efficiently as the market offers. Very fast FCAS can’t and “isn’t trying to solve the problem of falling synchronous inertia” as noted in FCAS goes from fast to very fast in 2021.

Background

April 2021

The draft rule change determination was released back in 2021 and was noted by Marcelle in FCAS goes from fast to very fast.

July 2021

The AEMC’s final determination was released.

Between July 2021 and August 2023

AEMO revised the MASS (v8.0, October 2022) to specify the detailed description and performance parameters for the new very fast services. This was subsequently updated for one of the settings for Very Fast FCAS providers in the Tasmania region only (in July 2023) such that version 8.1 will be effective on 9 October.

AEMO also needed to do all the work, in consultation with industry, to make the system changes that would facilitate operation of and participation in new markets – thinks bids and offers, constraint formulations, dispatch, settlements, registration…

9 August, 2023

Applications to register for the new markets opened. Successful registrations added to preproduction.

17 August

Changes to settlements deployed to preproduction

25 September

Successful registrations from preproduction transferred to production.

25 September

VF FCAS offers can be submitted in production (with effective date of 9 October or later). The VF FCAS requirement is set at the ‘commissioning value’.

27 September

Settlements changes deployed to production.

2 October

7-Day predispatch commenced.

3 October

Market notice 110109 issued to confirm commencement on 9 October with the sentence

AEMO has reviewed the capacity registered and committed for Very Fast FCAS market participation and has determined that both criteria have been met to commence market operations on Monday 9 October 2023 at 1300hrs AEST.

9 October

Market start at 13:00 for the 13:05 dispatch interval.

Who can play?

The requirements for being able to participate in the new very fast FCAS markets are set out in the MASS (Market Ancillary Services Specification). In general, the high-level yet key requirement is that the facility must be able to deliver the enabled amount of power in 1 second and maintain it until the 6-second (fast FCAS) kicks in.

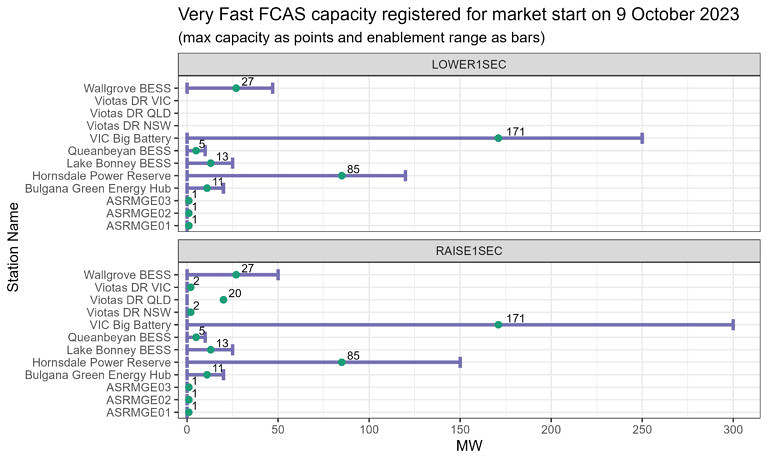

When we inspect current registration data (charted below, as at 5 October, effective 9 October), the main providers are batteries –the bigger the better it seems. The VIC Big Battery and Hornsdale Power Reserve provide the lion’s share, with Walgrove, Lake Bonney Queanbeyan and Bulgana batteries also registered.

Viotas and Y.E.S. Energy’s ASRMGE* units also appear as registered but, although having non-zero max capacities (Viotas up to 20 MW for R1 in QLD), their max/min enablement ranges (the horizontal bars) are currently 0 MW therefore this capacity is not anticipated to enabled at the same time as an energy service [edited 9 October to clarify that the enablement ranges reflect the energy output range that the unit needs to be running within in order to provide the FCAS service].

The Very Fast FCAS requirement levels are capped, for the meantime

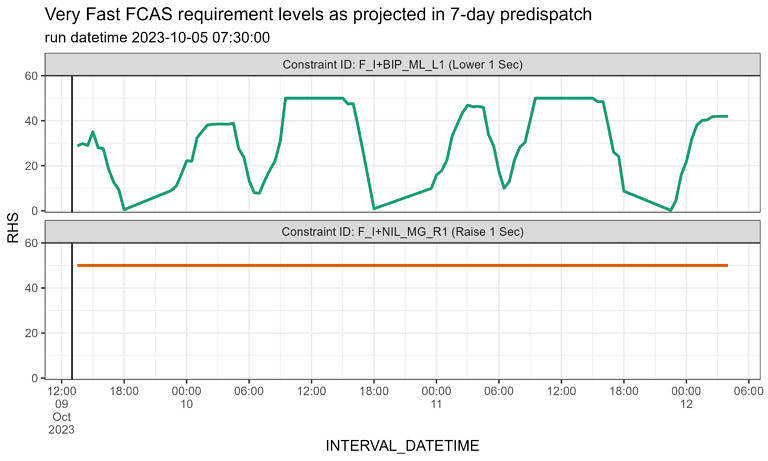

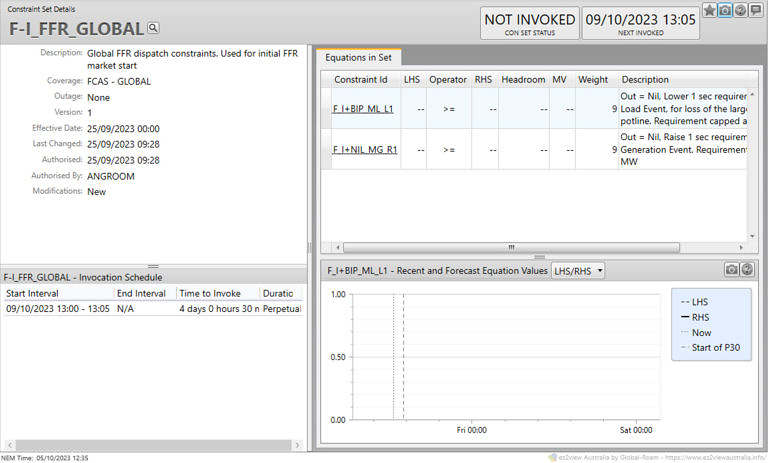

Currently there is one constraint, each, setting the requirement for the raise and lower services as the RHS of the constraint. These constraints are in the “F-I_FFR_GLOBAL” constraint set.

To ensure that the requirement levels can be met, as the number of registered participants is relatively low, the levels are capped at 50 MW.

The levels are dynamic reflecting, at times, the need for adjusting requirement levels as power system conditions change. We can see this in the changes for the Lower 1 Sec requirement. The Raise 1 Sec requirement stays steady at 50 MW.

7-day Predispatch provides an indication of prices

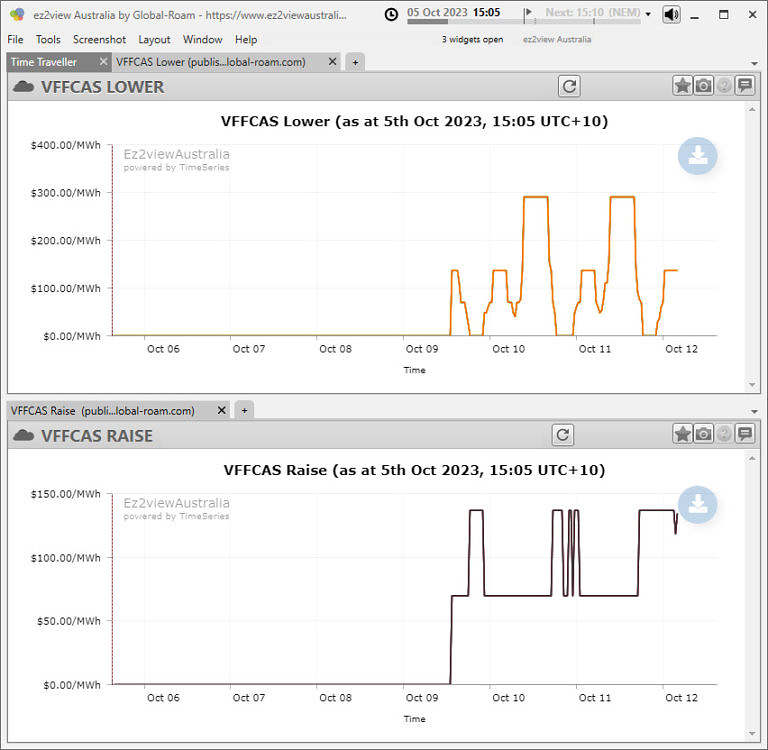

Market prices as projected by the 7-day predispatch runs suggest prices will be up to 300 $/MWh for 1-Second Lower and <200 $/MWh for 1-Second Raise.

The following chart summarises the prices, adding the 6-second markets for context.

1-Second FCAS prices are the same for all regions (chart lines overlap), by service, due to requirement being global. There’s no price separation among regions for the 1-Second services as sometimes seen in other markets (on the chart, TAS for example in the 6-Second markets).

ez2view v9.8 is released

To compliment the start of the new markets and make it easier to interpret what is going on, ez2view has seen an upgrade! Our summary of enhancements is contained in the release notes:

Note that the ez2view upgrades also cover changes to MTPASA DUID availability submissions and a host of other improvements.

Licenced users access the installer at the regular location: ez2view installer

Constraint set details from ez2view version 9.8 (the new version) shows details including the description of the constraints and the expectation that the set will be switched on (‘invoked’) on the 9th at 13:05.

ez2view’s user-defined trends also provides a way to view information on the new markets. This image captures the prices from the 7-day Predispatch:

Do you have to have an Australian energy retail license to participate in Very Fast FCAS (FFR)? I have invested in a community battery being built in Goulburn and I am wandering if, as shareholders, can participate in FFR with only a small and/or large BESS.

Hi Emilio, you have to be a registered ‘participant’, and there are different categories of participant to facilitate different involvement in the markets (including the VF FCAS markets). More information can be found on the market operator’s (AEMO’s) website https://www.aemo.com.au/learn/market-participants/electricity-market-participants