On Thursday 17 March 2022, I had the opportunity to present at the Clean Energy Council’s Wind Industry Forum in Melbourne. It was wonderful to be presenting in person. Having attended these events across the last 7-8 years, I know how important they are for networking and discussion.

Hence, it was great to have the opportunity to speak around the increasing role of auto-bidding and self-forecasting in the modern-day NEM – something we invariably called, ‘Rise of the Machines’.

At Overwatch Energy, we have a unique position and experience given our 24/7 coverage of operations and trading outcomes. We are staffed by experienced power sector specialists, and given our wide customer base, are fortunate to experience a wide range of auto-bidding and self-forecasting software from numerous vendors.

Automation in the NEM

The NEM has always been a place of big data and high levels of automation, and the recent developments in the trading space are the next stage of that maturing. In the last 3 years, we have seen the number of auto-bidding deployments move from the coal-gas fired generation space (where it was predominately used for FCAS/Energy optimisation) to BESS and now wind/solar, to help mitigate a range of increasingly complex operational challenges such as low price, high raise FCAS prices and constraint conditions.

Machine #1) Self-forecasting software

Having been around long enough, the genesis of the self-forecasting project run by AEMO and ARENA was seen as a great step forward for the industry, as we firmly believed the power station SCADA systems should have better information than a generic, albeit tuned, algorithm of AEMO for each specific wind site. This has certainly been the case in most cases, with improved accuracy of wind farm dispatch forecasts occurring much of the time.

The part that concerns us though is what appears to be purposeful deviations being added by some solar and wind self-forecasting solutions, to help achieve ‘net zero’ Causer Pays Factors (CPF) for their clients. As mentioned several times here on WattClarity:

- the CPF for some solar generators has been between 2-10% of total energy revenue (for example, see this review of costs for solar farms in 2020 from GSD2020),

- for many wind farms, between 1-3% (for example, see this review for wind farms, also using GSD2020)

This has created a significant incentive to get the dispatch bidding and self-forecasting right.

Is self-forecasting software more accurate?

AEMO is expecting all generation, not just wind and solar, to transition from each dispatch target in a linear fashion, to ensure all elements in the power system transition in a similarly controlled and steady fashion.

In order to measure this deviation every 4 seconds, the NEM has the CPF methodology:

- This rewards sites that contribute additional generation to their target when frequency is low (and penalises generation that is high to target at those same 4-second snapshots); and similarly,

- Rewards sites who reduce generation from their target when frequency is high (and penalises those sites that are producing more generation than target at those same 4-second snapshots).

Since the NEM is rich in high fidelity 4sec frequency and generation data, perhaps the data scientists saw an opportunity to predict, with reasonable certainty, when frequency was going to be high (and low).

- It appears that there is some regularity to frequency patterns, even with the changing mandatory primary frequency response.

- In this article on WattClarity from May 2021, Paul McArdle explored how there is a skew that varies by time of day.

Deliberate self-forecasting deviations?

Of course, the final key elements of the 5-min dispatch target that the linear trajectory is based upon are:

- the Availability that is bid by the unit for that dispatch interval; and

- where that volume is allocated, in which bid price bands.

For wind and solar units (i.e. given most are bid below $0/MWh and often down at -$1,000/MWh), whatever the availability bid is for a site will generally determine the dispatch target. For instance, if a site has all MW’s in Price Band 2 at -$80/MWh when the RRP is around $50/MWh, and the availability is 78MW, the unit will receive a dispatch target of 78MW and be asked to linearly ramp to that target from wherever it is at the start of the dispatch interval.

However, for Semi-Scheduled units alone (this does not apply to Scheduled units), if a self-forecast has passed AEMO’s Assessment Procedure, it effectively becomes the source of that Availability figure for each Dispatch Interval for the site. This has resulted in improvements in accuracy compared to AWEFS (and ASEFS for solar), but it has also appears to have introduced a new outcome that was not expected: purposeful over and under forecasting.

Using the predicted frequency response (particularly in the morning and afternoon periods when 8000MW rooftop PV is ramping in or out), it appears that:

Step 1 = some self-forecasting algorithms are now predicting when frequency is likely to be high or low,

Step 2 = then adding a positive or negative offset, to create a positive deviation (on a Causer Pays Factor basis) to offset the cumulative negative deviations that have historically occurred.

Therefore, accurate forecasting goes out the window at times because the offsets are added – with the intention apparently being to improve the site’s Causer Pays Factor.

Under Semi-Dispatch Cap

There may also be further implications under Semi Dispatch Cap (SDC) conditions, where these under-forecasts would lead to a situation whereby output could be ‘constrained down’ lower than might otherwise be the case – representing foregone generation for the site …

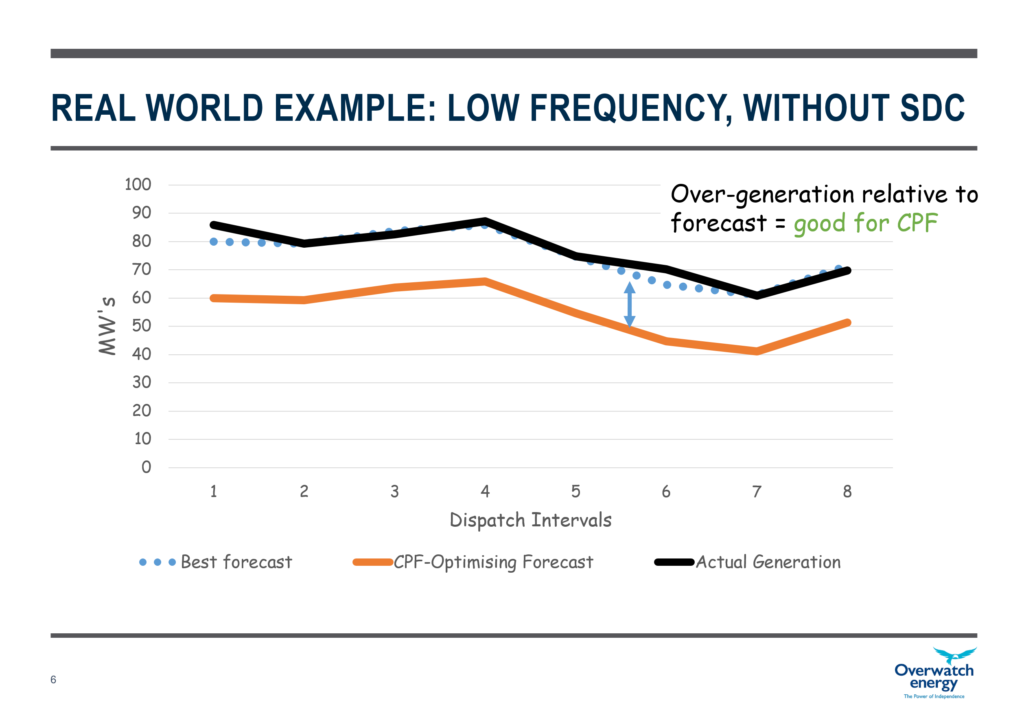

Real-World Example: Low frequency without Semi-Dispatch Cap = Over-generation

The above example shows a period when frequency tends to be low (e.g. an afternoon period as rooftop PV decreases and grid demand increases), with what appears to be a purposeful under-forecast in place.

Under these conditions, without a semi-dispatch cap, the CPF methodology indicates the generation is high (while the frequency is low), hence a positive LNEF/RNEF accrues, which contributes to a lower Causer Pays Factor.

This is what appears to be the objective behind the purposeful under-forecasting in situations like this.

Of course, if frequency deviates from the average and is high, then a negative LNEF/RNEF accrues. This is one of the reasons this method cannot be used all the time and is generally applied across set periods.

Lost energy?

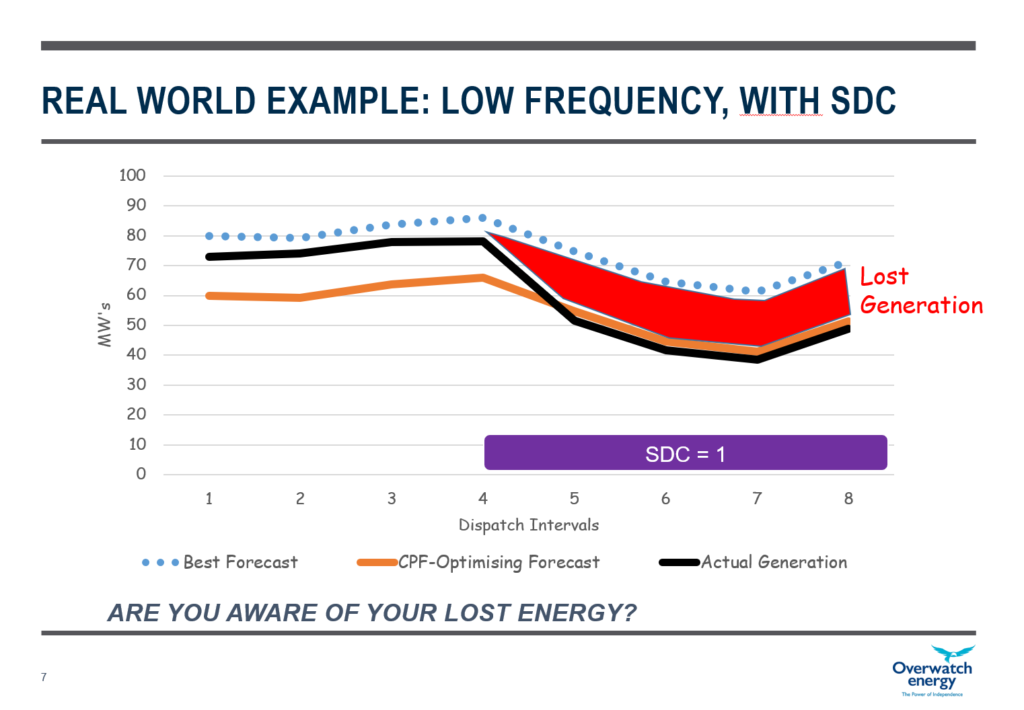

Real-World Example: Low frequency with Semi-Dispatch Cap = Lost Generation

However, when a semi-dispatch cap is applied (SDC = 1), AEMO require the unit to run to the under forecast level and the generation will decrease (readers might recall the AEMC Rule Change from March 2021 that clarified these obligations for Semi-Scheduled generators), as is shown in the above example with the red area of lost generation.

It appears that some self-forecasters may be aware of this, and are applying suppression algorithms on their (possibly biased) forecasts, thereby running back to the AWEFS forecast for 1 or 2 (or more) dispatch intervals after detecting this condition.

- When this happens, it completely mitigates the benefits of the self-forecasting regime that we as the as industry pushed for!

- The whole purpose of the self-forecast was to be a ‘better’ Unconstrained Intermittent Generation Forecast (UIGF): running back to AWEFS when SDC conditions occur seems to be the complete opposite of that objective?

- There was some discussion about this in Appendix 6 (‘A review of self-forecasting’) within the recently released GenInsights21 publication.

Another concerning aspect we have seen at times (and not necessarily with our clients), is that generation volume may be lost in this process – and it may also be that some site owners are not being informed this is the case. Improving the CPF is great, but we strongly suspect there are cases where more generation is being lost (hence revenue decreased) than is being saved by CPF improvements.

So we asked this question at the CEC’s Wind Industry Forum:

Are you aware of any lost revenue due to CPF under forecasting?

Machine #2) Auto-bidding software

As well as the rise of self-forecasting algorithms, we have also seen the widescale deployment of auto-bidding solutions.

- For instance, this article from 26th October 2021 speaks about ‘the rise of the auto-bidder’.

- In a very detailed Appendix 22 (‘A review of bidding busyness’) within the recently released GenInsights21 report, the bidding frequency of all DUIDs operational in the NEM was reviewed, and 15 different bidding technology providers were identified.

We define auto-bidding solutions as autonomous determination and submission of bids, but there are many definitions and capabilities associated with ‘auto-bidding’: no two auto-bidding solutions are the same!

We see some really sophisticated products in the market, and some we might classify more as automatic template submitters. Each end of the spectrum can be useful, but it is important to understand what they do and what they do not do!

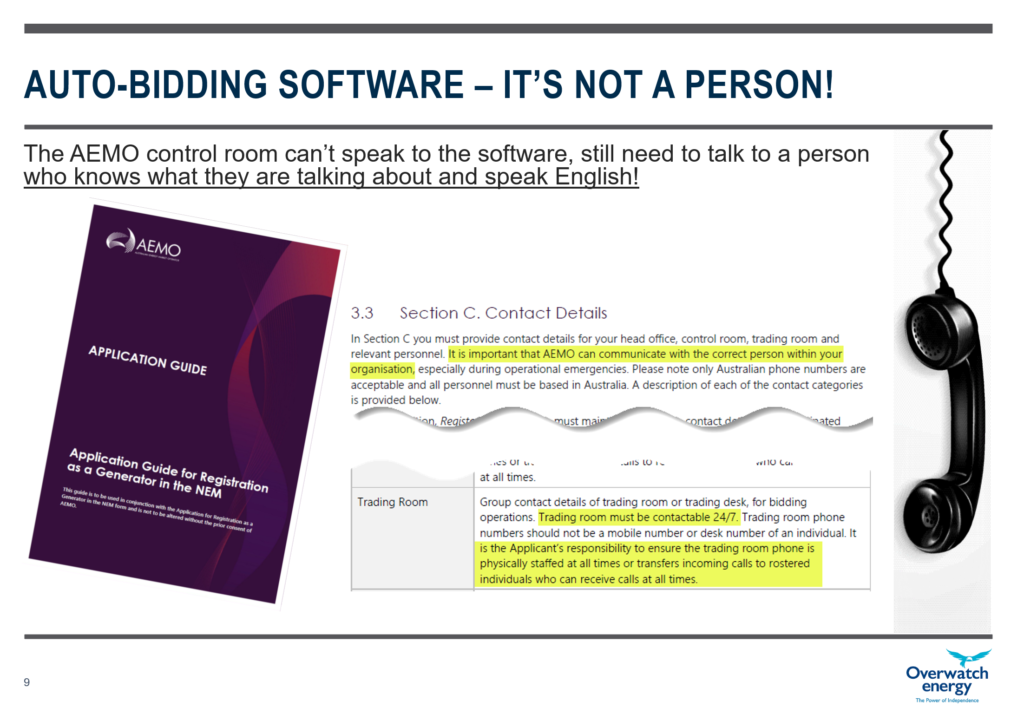

National Electricity Rules Clause 4.9.2(d) and 4.11.3

Autobidding Software is not a person, and therefore despite what some may tell you, just because a site has auto-bidding, it does not satisfy NER clause 4.9.2(d). This clause requires generators to have appropriate personnel available at all times to respond immediately to dispatch instructions issued by AEMO (be they electronic, written or oral), while clause 4.11.3 requires generators to provide contact details for those personnel.

Similarly, although it again seems silly to have to say this, it is not acceptable to have operations and trading contacts who cannot speak English. Several Registered Participants appear to be risking non-compliance with overseas control rooms that have a poor grasp of English, presumably to try to save costs.

Here at Overwatch Energy, we are big supporters and enablers of auto-bidding and self forecasting, and the role AI and ML in the trading experience – but it is not Auto-Bidding OR human oversight: it has to be human oversight and auto-bidding. Not just from a perspective of following the rules, but also for risk mitigation.

There are many conditions that auto-bidding cannot yet correct for, and although things will continue to improve in time, this is likely to be the case for a long time.

One such example (which is quite topical, given the increased latency the market has been experiencing in AEMO’s publication of P5 predispatch data on some occasions) is understanding whether the auto-bid has been submitted with the most correct and complete data set possible within the bidding window before ‘Gate Closure’ in each dispatch interval. If any rebid (automated or not) has been submitted without considering the latest P5MIN forecasts published by the AEMO, how can it be the best bid possible for that asset?

To use a commercial aviation example, auto-pilot rarely lands and (to the best of my knowledge) never does the take-offs – there are simply too many variables. And whilst auto-pilot may be good 80-90% of the journey, it is not designed to cover all scenarios, hence why we have two pilots in most modern commercial airlines.

Key takeaways

We know this space will continue to change, and we look forward to seeing the enhancements that occur. We look forward to working with our clients to enhance their deployment of some of the most sophisticated dispatch and trading software in any electricity market in the NEM.

Therefore, when planning your approach to software selection and deployment:

- Expect more software and integrations – and embrace good products

- Have them deployed to support power station operations

- Understand the limitations and side-effects of any automated software

- Commission to power operations standards – not software vendor specifications (e.g. think uptime and 24×7 support)

- Understand configurable elements and use them

- Do not ‘set and forget’

As always, there will still be a need for careful oversight and monitoring of the solutions that are deployed to ensure the most optimal, consistent, and rules-based deployment of the software and hardware solutions.

Even as the software gets smarter, owners and operators need to remember … there will always be a need for some form of human oversight, even with ‘the rise of the machines’.

————————————–

About our Guest Author

|

|

Jonathon Dyson is the Managing Director of Greenview Strategic Consulting and an Executive Director at Overwatch Energy.

Jonathon has over 20 years practical experience in the Australian NEM, having held senior operational and trading roles in participant organisations and now as the Director of a specialist market consulting organisation, with a specific focus on renewable energy integration. Current clients include some of Australia’s largest integrated utilities, market regulatory organisations, transmission system operators and not-for-profit market observers. Jonathon has spent considerable time working with AEMO, Australia’s energy market operator. You can find Jonathon on LinkedIn here. Overwatch Energy periodically shares information via LinkedIn – you might like to follow. |

Great article. Rules generally produce unintended consequences and unforeseen behavior.

Thanks Jonathon. Great background on the CFP arrangements to help understand forecasting behaviour.

Perhaps a naive question… but are the deliberate deviations necessarily bad behaviour?

From your description, it sounds like there is systematic error in AEMO forecasting that e.g. underestimates NEM demand on a typical afternoon, hence dipatches insufficient generation, hence under-frequency conditions. If a solar or wind generator anticipates this and responds by intentionally under-estimating generation, leaving some in reserve, then they would be benefitting from addressing that error. Sounds like a good thing??

Of course it would be preferable to fix the forecast errors in the first place or perhaps create a form of frequency regulation that VRE can formally particpate in (beyond contingency). But in the meantime, perhaps this self-serve proxy is useful??