Today I’ve been crunching analysis for GenInsights Quarterly Update for Q1 2023 – but managed to get briefly distracted when seeing this update on social media by Giles Parkinson:

The update linked to today’s article ‘Australian solar farm hit by grass fire burning under modules’ that references the ‘110MW Beryl solar farm – managed by RES Australia on behalf of Banpu Energy’.

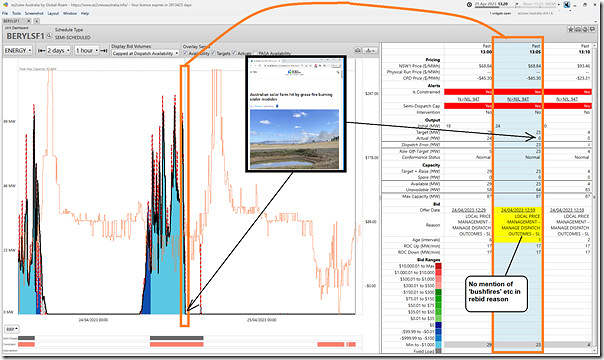

Curious to know more, but wary of being too distracted, I quickly opened the ‘Unit Dashboard’ widget in ez2view and found that the unit had come offline fully by 13:05 Monday 24th April (yesterday):

Apart from a bit of an aberration at 15:20 and 15:25 when the plant was briefly given a target, we see it’s been offline since that time – including into today.

Readers will see I have highlighted the rebid reason placed at the time:

1) Which does not reference ‘bushfire’ or what’s apparently (according to the RenewEconomy article) the real reason for the outage:

(a) which (as noted before) is because the MaxAvail in the bid, which would typically be used for this process, is ignored by NEMDE for Semi-Scheduled units.

(b) Instead, it’s just used a pro-forma rebid reason by the particular type of auto-bidder used for the plant:

i. Which we categorised by vendor market share in Appendix 22 within GenInsights21 at the end of 2021; and

ii. Which were discussed by Jonathon Dyson in March 2022 in the article ‘Rise of the Machines’.

2) Indeed we see the plant has rapidly come offline (i.e. ‘Actual’ = 0MW) before it’s been adjusted in the bid.

3) Frequent readers here will recall we’ve asked ‘is the Semi-Scheduled Category sustainable or scalable?’ because of these types of special carve-outs that mean operators of Semi-Scheduled units utilise the availability forecast (from ASEFS or increasingly from a self-forecast) to set the actual capacity offered in a bid – even when the availability has been reduced due to physical limitations on the plant, not cloud cover:

(a) Based on Giles’ reporting, the case from ~13:00 onwards seems a case where it’s physical limitation not cloud cover that will have set the plant’s capability;

(b) Even beforehand the frequent oscillations in output make me wonder to the cause … how much of this will have been due to grass fire under panels even before they took the plant offline?

(c) There are steps being taken to reduce these quirks (carve-outs), however…

i. In a couple months there will be some narrowing of the gap, with AEMO working to re-enable MaxAvail in the bid for Semi-Scheduled units, as a number of people have been asking for … including Marcelle in this article here from April 2020 (three years ago now), where she wrote:

‘A further improvement that would give flexibility to the participant in providing availability information would be to enable optional submission of a limit on availability through the MAXAVAIL column of the energy offer, to be used as a cap on the AWEFS/ASEFS forecast. This would be particularly useful in the dispatch timeframe where the Local Limit SCADA signal is the only option currently to cap the dispatch availability. As the SCADA signals are generally calculated in vendor-specific industrial plant controllers, there may be limitations on the complexity of calculation that can be implemented and how readily it can be changed, and overriding in unusual circumstances may require tedious manual intervention in the SCADA system interface.’

ii. When this goes live, we’d hope to be seeing more of these physical limitations of plants reflected in rebids (including with salient rebid reasons), not more opaquely in the Local Limit SCADA signal.

iii. At some point someone might lodge a Rule Change request with the AEMC to further merge the Semi-Scheduled and Scheduled categories, in terms of responsibilities.

Now it’s back to analysis for GenInsights Quarterly Update for Q1 2023, where we’re currently working through other aspects of the same question…

Leave a comment