Requirement level to be increased for the very fast raise service

AEMO Market notice 110645 announced the intention to increase the requirement for very fast contingency raise services. This follows AEMO review of the new 1 second FCAS markets and existing requirement caps.

The notice, issued on the 31st of October:

------------------------------------------------------------------- MARKET NOTICE ------------------------------------------------------------------- From : AEMO To : NEMITWEB1 Creation Date : 31/10/2023 12:52:20 ------------------------------------------------------------------- Notice ID : 110645 Notice Type ID : GENERAL NOTICE Notice Type Description : Subjects not covered in specific notices Issue Date : 31/10/2023 External Reference : Fast Frequency Response Market - Increase in R1 volume 6 November 2023 ------------------------------------------------------------------- Reason : AEMO ELECTRICITY MARKET NOTICE Following review of the operation of the Very Fast FCAS market, AEMO will increase the cap on dispatch of Very Fast Raise (R1) Contingency FCAS from 50 MW to 100 MW on Monday 6th November from 1300 hrs AEST. The cap on Very Fast Lower (L1) Contingency FCAS will remain unchanged at 50 MW. A range of additional system-normal contingency risks will also be considered considered when determining Very Fast FCAS requirements from this time. For information on the Fast Frequency Response (FFR) initiative please visit the website at: https://www.aemo.com.au/initiatives/major-programs/fast-frequency-response Andrew Groom AEMO Operations ------------------------------------------------------------------- END OF REPORT -------------------------------------------------------------------

Since 9 October 2023

The very fast markets were introduced on 9 October 2023.

- The commencement was noted on Watt Clarity in Very Fast Raise and Lower FCAS markets to start on 9 October 2023.

- Initial outcomes of registration, bidding and dispatch were highlighted in Very Fast FCAS – a week in review.

AEMO has been clear that caps in both raise and lower requirements have been set intentionally from the beginning. This is to ensure that sufficient capacity is registered and can be enabled to meet the required levels:

A market transition approach is intended to support the start of these markets by progressively increasing the allowed requirement volumes, while ensuring that sufficient capacity is registered and committed for VF FCAS market participation. This is being done with the objective of avoiding extended periods of supply shortage.

AEMO also advises, on its Very Fast FCAS Market Transition webpage, that the requirements will be reviewed fortnightly. Increases are to be communicated via market notices. Less than a week ago however, AEMO communications advised that “AEMO has reviewed levels of registered capacity that are committed for Very Fast FCAS (VFFCAS) market participation and has decided not to increment the requirement volumes at this (that) stage”. The notice discussed in this article (above) marks the the first occasion where the caps have been increased.

Very fast (1-second) raise caps to be increased, 1-second lower caps to remain unchanged

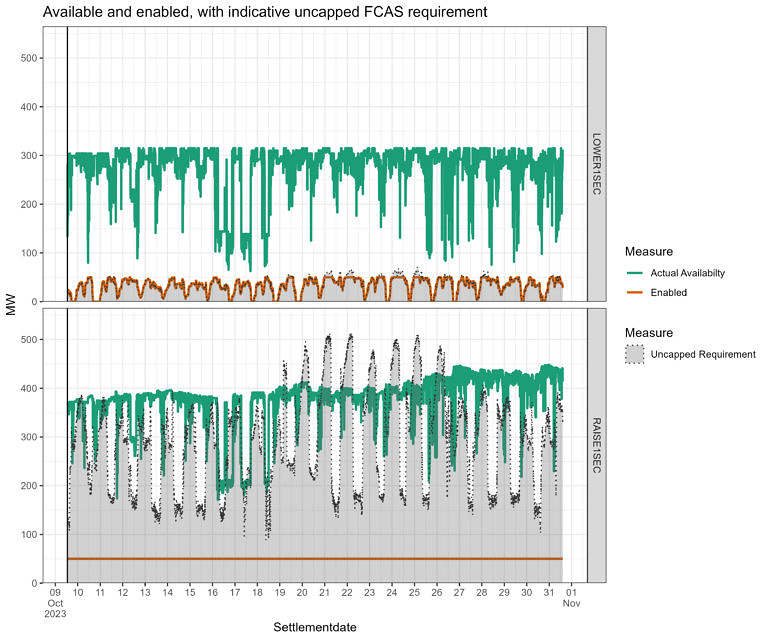

The chart below summarises how available capacity (at dispatch) compares against the capped (enabled) requirements and the indicative uncapped requirements.

For Lower 1 Sec, we see that the uncapped requirement has rarely exceeded what has been enabled. This suggests there would be little additional value (with current constraint formulations) in increasing the cap.

Additionally, we can observe periods where availability (green line) dropped below 100 MW, yet was still sufficient to meet the requirement as represented by the enabled level.

From this short history, if the LOWER 1SEC cap was raised to 100 MW there could be periods where availability might be insufficient. Yet, we haven’t seen any uncapped requirements reach those high levels yet so it seems unlikely we would end up in that situation. Nevertheless, this may be a component of the reasoning for not raising the cap for Lower 1 Sec at this stage.

For Raise 1 Sec, apart from three days early on, availability has not dropped below 200 MW providing confidence that there is sufficient capacity to meet the future 100 MW upper limit. It also seems clear that when the cap rises to that 100 MW level (on November 6) dispatch requirements and consequently enablement will hit that new level immediately. This is because the uncapped requirement has almost never dropped below 100 MW since market start and there appears to be sufficient availably to meet it.

Can current bids provide a signpost about prices?

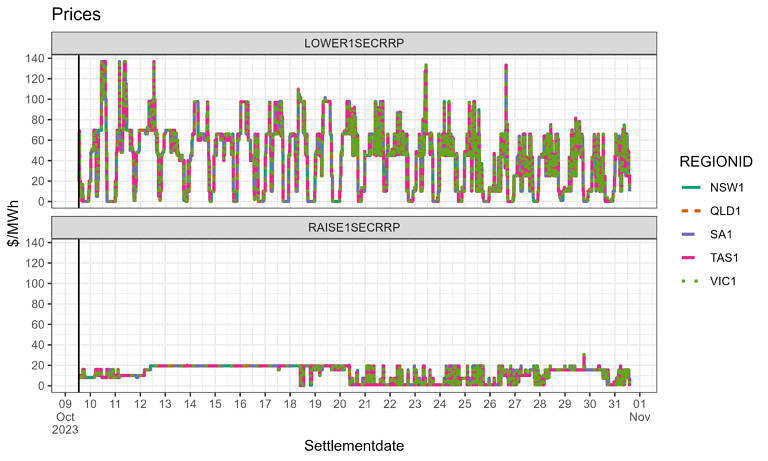

The existing record of dispatch prices is as follows and shows how the Raise 1 Sec prices have rarely spent time above $20/MWh.

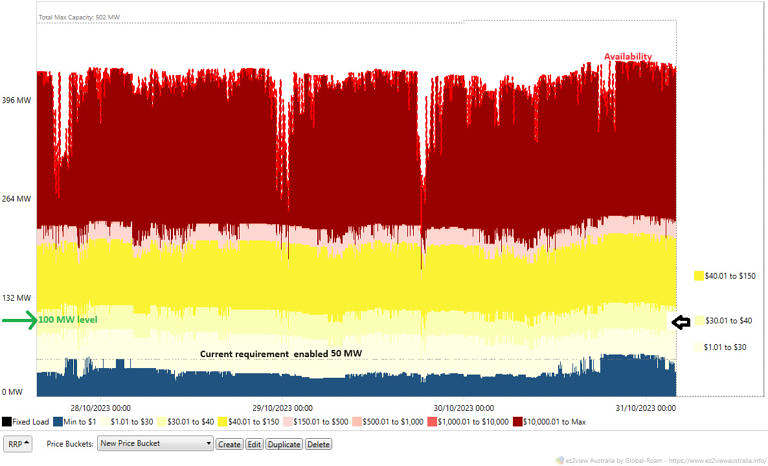

Inspecting the recent bid stack using ez2view, and assuming all else but the requirement (which will move from 50 to 100 MW) remains the same, prices appear likely to reach into the 30 to 40 $/MWh range.

We’ll be keeping an eye on developments as the change is implemented on the 6th of November.

PS Market notice 110647 adds detail on constraint changes

An additional market notice (following on from the one discussed above, published later that day), describes constraint changes and additions to come on the 6th of November.

We understand that the new changes will move the configuration towards the usual FCAS constraint setup where the Basslink state is accounted-for (Basslink In, Basskink Out, and Basslink In But Possibly Limited).

FCAS market watchers and those seeking more detail on the constraints will be able to look up constraint set ‘F-I_FFR_GLOBAL_2‘, to be invoked on the 6th, in ez2view’s Constraint Set Details widget.

The relevant market notice:

------------------------------------------------------------------- MARKET NOTICE ------------------------------------------------------------------- From : AEMO To : NEMITWEB1 Creation Date : 31/10/2023 14:14:14 ------------------------------------------------------------------- Notice ID : 110647 Notice Type ID : GENERAL NOTICE Notice Type Description : Subjects not covered in specific notices Issue Date : 31/10/2023 External Reference : Fast Frequency Response Market - Increase in R1 volume 6 November 2023 - Additional Constraint changes ------------------------------------------------------------------- Reason : AEMO ELECTRICITY MARKET NOTICE Refer to market notice 110645 Additional system normal contingency risks, including trip of APD load, potential operation of the GFT and TTS control schemes, and trip of Basslink will be included when determining FCAS requirements from 6th November. These constraint equations have been added to the constraint set F-I_FFR_GLOBAL_2 which is now invoked from 1300hrs on 6th November. Ben Blake AEMO Operations ------------------------------------------------------------------- END OF REPORT -------------------------------------------------------------------

Leave a comment