As part of the number crunching for GenInsights Quarterly Updates for 2023 Q4 (as we have in preceding issues, and before that in GenInsights21) we look at the incidence of large instances of Aggregate Raw Off-Target (i.e. AggROT) across two sets of units:

1) In Appendix 5 we perform this calculation across all operational* coal units.

(a) For years we have chosen to focus on currently* operational coal units, to make it help make it easier to see if the performance of the fleet of coal units (by this metric) has changed in the ~15 years we can trend this data for the same set of units for

i. Following the closure of Liddell a year ago, there are now 44 x operational coal units remaining.

ii. Hence we run that same set of units back through till back in time to Q4 2001, which is when the relevant data started to be published

(b) Because of some questions that arose through that analysis (particularly with respect to 2023 Q4) earlier today we posted a hypothesis and some questions in the form of an the article ‘A 20-year trend of large instances of Aggregate Raw Off-Target (AggROT) across 44 x coal units to 31st Dec 2023’ here.

2) In parallel, in Appendix 3 we perform this calculation across the growing number of Semi-Scheduled units:

(a) both Wind and Large Solar units together

(b) In this case across the growing number of units,

i. as it’s the effect in aggregate that we’re most interested in (as it will be the one having the largest

ii. and to explore the validity of a chorus of people who seem to be thinking that geographical diversity will fix any problems.

Given we’d earlier shared in an article here on WattClarity about the 44 x coal units (and because we’d promised to do so) we’re sharing this view of the broader trend for Semi-Scheduled units here today. This article also follows on from almost exactly twelve months ago, when we published ‘Some revelations in GenInsights Q4 2022 about Aggregate Raw Off-Target for Semi-Scheduled units’.

Recapping the stats for the coal units

When we wrote about the coal units, we showed two trends:

1) The first was with respect to deviations greater than 200MW in either direction – noting that in 2023 there were:

(a) 270 dispatch intervals through 2023 with collective under-performance greater than 200MW; and

(b) 237 dispatch intervals through 2023 with collective over-performance greater than 200MW

… where the incidence in both directions is sharply higher than in 2022.

2) Stepping up, to deviations greater than 300MW in either direction – in 2023 there were:

(a) 31 dispatch intervals through 2023 with collective under-performance greater than 300MW

… which was much the same as prior years

(b) 28 dispatch intervals through 2023 with collective over-performance greater than 300MW

i. In this case much larger incidence than prior years; and

ii. For reasons not yet known, 18 of these incidences were in 2023 Q4 (something that will be investigated further, as time permits).

So with this as a reference point, we’ll now look at VRE units, collectively …

Long-range stats for Semi-Scheduled units

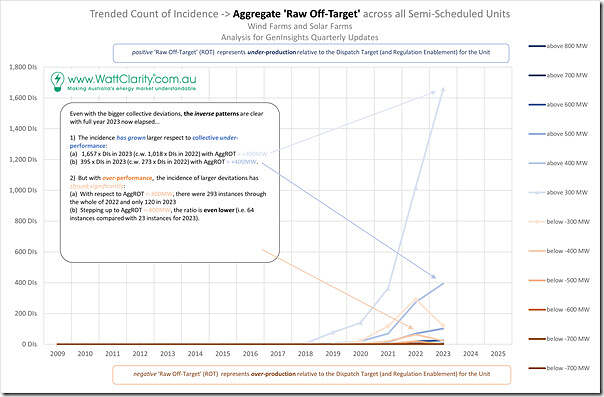

Most VRE units are registered and operate as Semi-Scheduled units, which offers a different mode of operation compared to being fully Scheduled. We’ll skip the smaller deviations (i.e. 200MW) and just look at this trend for deviations greater than 300MW in either direction:

Clearly the numbers are an order of magnitude (or more!) different. Particularly from 2022 to 2023 we see an interesting development:

1) Incidences of collective under-performance (i.e. AggROT > +300MW) have grown significantly:

(a) From 1,018 Dispatch Intervals to 1,657 Dispatch Intervals

(b) So averaging 4.5 instances per day in 2023

(c) Compared to 31 instances for the year with coal units.

2) Incidences of collective over-performance (i.e. AggROT < -300MW) have shrunk significantly:

(a) From 293 Dispatch Intervals to 120 Dispatch Intervals

(b) So averaging once every 3 days in 2023

(c) Compared to 28 instances for the year with coal units (after an increase from the year beforehand).

Frequent readers will recall we’ve asked the question ‘is the Semi-Scheduled category sustainable, or scalable?’ as Key Observation 13/22 within GenInsights21 (and then shared this with readers here on 9th March 2023).

1) This ongoing (and accelerating) growth in incidence of large under-performance is one of the reasons for this question …

2) But we note the decline in incidence of over-performance and:

(a) we infer that this has been as a result of the AEMC confirming tighter dispatch requirements for Semi-Scheduled units from 12th April 2021.

(b) we also take it that such an improved performance seems to have been technically possible … just a matter of ensuring the correctly aligned incentives

Specific Case Studies of particular incidents

Below I have tabulated (in reverse chronological order) some of the largest collective deviations across all Semi-Scheduled units that existed at each point in time.

We hope these particular Case Studies will help to reveal the variety of reasons why there might be a large collective exceedance:

| Year

(in reverse chronological order) |

Description of incidences of large AggROT across all Semi-Scheduled units during this year |

|---|---|

2024 y.t.d. |

We’ve only past 2 months into calendar 2024 but already we have experienced the case of Tuesday 13th February 2024 as a day in which there was large collective instances of under-performance across all Semi-Scheduled units. When we compile GenInsights Quarterly Update for 2024 Q1, it may preveal that there were other days, but for now we have already posted about ‘Aggregate Dispatch Error across all Semi-Scheduled units (NEM-wide) throughout Tuesday 13th February 2024’. |

2023 |

We’ve just completed the review of this particular metric for 2023 Q4 (completed report to follow soon). As part of that process we already published the start of two Case Studies 24 Dec 2023 … where we posted ‘Large instances of collective under-performance across all Semi-Scheduled units on Sunday 24th December 2023’ 31st Oct 2023 ‘… sees the only two instances (in Q4, and all year) of AggROT for Semi-Scheduled units < –500MW’ Earlier in the year (with the 2023 Q3 update) we flagged: 18th Aug 2023 … ‘Case Study (part 1) of large collective under-performance for Semi-Scheduled assets on Friday 18th August 2023’. Earlier in the year (with the 2023 Q1 update) we flagged: 3rd Feb 2023 … ‘Case Study of Friday 3rd February 2023 (Part 1) … two consecutive large instances of collective under-performance for Semi-Scheduled units’ … with the two instances being: (a) AggROT = +845MW at 15:35. (b) AggROT = +815MW at 15:40. 20th Jan 2023 … ‘Case Study of Friday 20th January 2023 (Part 1) … large instance of collective over-performance for Semi-Scheduled units’ … with AggROT = –497MW at 16:25.

|

2022 |

For the 2022 calendar year we’ve previously prepared the following: 27th Oct 2022 with four parts in this evolving Case Study with respect to an instance of AggROT = +866MW at 17:05. 23rd Aug 2022 about ‘… large instance of collective over-performance for Semi-Scheduled units’ for the AggROT = –650MW at 13:15.

|

2021 |

For the 2021 calendar year we’ve previously prepared the following: 16th Feb 2021 about ‘… large instance of collective over-performance for Semi-Scheduled units’.

|

2020 |

No Case Studies (yet?) prepared for incidences that occurred through 2020. |

Covering 2019, and years before that |

Worth highlighting the article ‘Extrapolating from the trend of ‘Aggregated Raw Off-Target’ results, to yield some clues to what the future might hold … and one challenge for NEM 2.0’ published in July 2020. (a) In that article we included a tabular section (covering 2013 to 2019) of ‘specific dispatch intervals where AggROT > 300MW’, complete with links to many Case Studies from these earlier years. (b) Given that that article provided a detailed reference to earlier Case Studies, I’ll just flag some specific ones below. |

Other Case Studies will be prepared for other instances (as time permits) in the months ahead.

Leave a comment