We’re in the midst of the process of finalising GenInsights Quarterly Updates for Q1 2023.

As we have done for prior updates, we’re expanding our look into Aggregate Raw Off-Target (AggROT) across both:

1) The growing number of Semi-Scheduled units (in Appendix 3); and contrasting against

2) The declining number of coal-fired units (in Appendix 5).

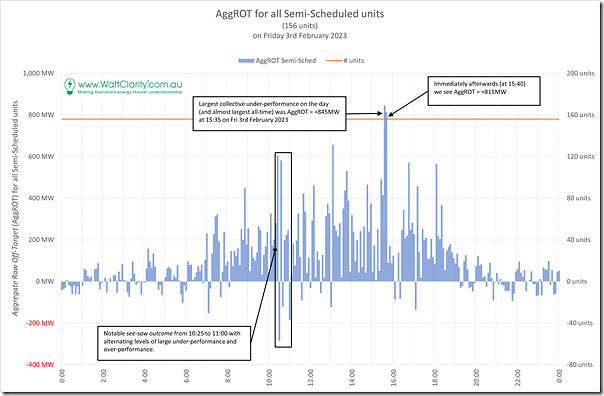

Subscribers to GenInsights Quarterly Updates for Q1 2023 will be able to read more details in the report when it is released in the next week or two, but I thought I’d just leave readers here with this trend of one particular day, being Friday 3rd February 2023:

As time permits we might drill into this particular day in more detail (and in particular the 15:35 and 15:40 dispatch intervals) in a sequence of Case Studies … as we have been doing for 27th October 2022 (where the AggROT peaked at +861MW).

—

Keen readers might remember that Friday 3rd February 2023 has already featured a number of articles (categorised here) given that Queensland almost reached a new all-time maximum for Grid Demand and Market Demand on that day.

Leave a comment