On Friday evening I’d posted ‘Aggregate Dispatch Error across all Semi-Scheduled units (NEM-wide) throughout Tuesday 13th February 2024’ looking at some quite large instances of collective under-performance across all Semi-Scheduled units (not just in VIC, but NEM-wide) through Tuesday 13th February 2024, the day of Victoria’s ‘Significant Power System Event’.

That seemed like a good segue to shift my focus back to the completion of the delayed GenInsights Quarterly Update for 2023 Q4 in spare moments over the weekend.

Appendix 3 within these Quarterly Updates is focused on Large-Scale VRE … it’s the largest individual appendix, as there is lots to cover. Amongst other things we take a more systematic review of Aggregate Raw Off-Target for all Semi-Scheduled units, NEM-wide*, through the focused quarter.

1) It won’t be until April 2024 that we start looking at Q1 2024, and seeing 13th Feb 2024 in context.

2) But it was useful to take a look at 2023 Q4 in that context, as well.

* note that in Appendix 5 within these Quarterly Updates we focus specifically on the declining number of coal units left supplying the NEM.

(a) Amongst other metrics, we also look at Aggregate Raw Off-Target across the remaining coal units through the quarter, NEM-wide.

(b) There’s a stark comparison about the relative levels of performance (by this metric) across the two different types of assets.

… more in the GenInsights Quarterly Update for 2023 Q4 when we release it.

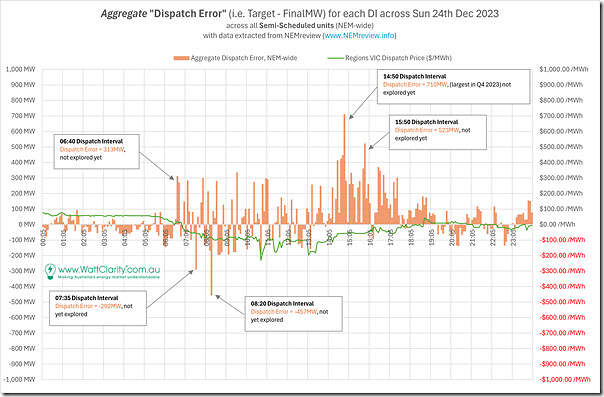

I don’t have time to explain in detail here, but am choosing to post this single chart of Aggregate ‘Dispatch Error’** through all 288 dispatch intervals on Sunday 24th December 2023, right at the tail end of 2023 Q4.

** ‘Dispatch Error’ is not quite the same as ‘Aggregate Raw Off-Target’, but it’s easier to calculate quickly and is quite close to AggROT for Semi-Scheduled units.

There’s more explanation in GenInsights Quarterly Update for 2023 Q4 and, time permitting, we might come back and drill into some specific (high under-performance) dispatch intervals in Case Studies under this Category here on WattClarity.

For now, key insights readers can see include:

1) Many more dispatch intervals saw collective under-performance than collective over-performance

… no time for explaining in detail here, but suffice to say that this is not a surprise – a result of all three factors:

Factor 1 = The underlying properties of the variable energy resource and difficulties in forecasting this;

Factor 2 = Super-charged by the way in which the Semi-Scheduled category is allowed (indeed, encouraged) to operate

… remember that we asked the question ‘is the Semi-Scheduled category sustainable, or scalable?’ as Key Observation 13/22 within GenInsights21 (and then shared this with readers here on 9th March 2023).

Factor 3 = And driven further to a lop-sided distribution by the current causer-pays methodology for apportioning Regulation FCAS costs that introduces a motivation to ‘game***’ self-forecasts:

*** some might choose to replace ‘game’ here with ‘optimise commercial outcomes’.

i) note – not Contingency FCAS costs;

ii) a useful segue to remind readers that in the recently released GSD2023 we unpick FCAS costs in three bundles for all DUIDs apportioned by each month through 2023.

2) Large collective under-performance instances are more common (and larger) than large collective over-performance.

3) These instances of large collective under-performance are clustered in sunlit hours … understandably.

4) There’s many big deviations through this particular day:

(a) Just in one day, there are 14 dispatch intervals with deviations larger than 300MW (i.e. size of a small coal unit), of which 5 are larger than 400MW, of which 2 are larger than 500MW

… though those on the coal boosters of the Emotion-o-meter should remember that these deviations are slower, whereas any unit trips are faster (whether coal or other).

(b) Largest deviations (remembering this is ‘Dispatch Error’) were:

i. A massive +710MW at 14:50 on Sunday 24th December 2023

… so not far below the 813MW Dispatch Error at 11:40 on 13th Feb 2024 due in part to the the unexpected loss of 501MW from Stockyard Hill Wind Farm as part of Event 1 on that day.

ii. Second largest was +523MW at 15:50.

iii. With these two clumped in the middle of several hours in the middle of the day showing consistent under-performance (many intervals large).

5) The VIC price was in the query (a legacy of this article about 13th Feb 2024) but I left it there as it’s useful to provide some hints about one factor contributing to the collective deviations … but remember there are others!

If we have time in future, we might drill into 14:50 to see what might have contributed, on this instant?

Leave a comment