On 5th December 2013 we released our* GenInsights Quarterly Update for Q3 2023 (as we noted in this Release Note), as the sixth update in this expanding series that builds from GenInsights21.

* as with prior iterations of this report, these are a collaborative effort between us at Global-Roam Pty Ltd and the team at Greenview Strategic Consulting. That’s what we mean here by ‘our’.

(A) After we have released

At that time, we will provide access to those clients who had pre-ordered (and arrange the Executive Briefing to those who also select that option).

Like the prior quarterly updates, this will be available to subscribers (as an integrated PDF) at the following address:

https://downloads.wattclarity.com.au/#/

(B) Some early information prior to completion and release

More details will come later – but, for now, you might like to refer to what we have published about the preceding GenInsights Quarterly Update for Q2 2023.

That report contained:

(1) An Executive Summary including some Key Observations; and

(2) Six appendices which each explore different aspects of the energy transition through the detailed analysis of historical data.

Those 7 components (i.e. for 2023 Q2) were explained more below:

| . | About this Component |

| Executive Summary

14 pages |

The Executive Summary includes 6 x Key Observations that have been gleaned from what has been observed through the evolution of Q4 2022.

These Key Observations follow in the vein of: 1) the 22 x Key Observations included in GenInsights21, and 2) the 14 x Key Themes in the earlier GRC2018. |

| Appendix 1

47 pages (more detail than 2023 Q1 and preceding Updates) |

NEM Heartbeat

In this appendix we take a look at a number of different ‘heartbeat’ metrics that help to identify the overall health of the NEM, including: 1) Weather factors (like temperature) 2) Prices 3) System inertia ——- With GVSC we’ve been analysing system inertia as far back as in the GRC2018, as highlighted with this article of August 2019. More recently the AEMO has been publishing its own derivation … which allowed us (beginning with the 2022 Q4 Update) to begin highlighting how the two different measures compare: With data from the 2023 Q1 update, on 20th July 2023 Jonathon Dyson published his article ‘Let’s talk about inertia’ via WattClarity – including a review the lowest inertia in Q1 202 (on 4th March 2023 both NEMwide, and in SA). Future Quarterly Updates continue this process. ——- 4) Frequency Performance, which is topical given exploration by others, such as Allan O’Neil in February 2023. 5) Instantaneous Reserve Plant Margin (IRPM) … following from its inclusion in the Q3 update: ——- With respect to the 2022 Q3 update, one small snippet of the content of that Update was shared with WattClarity readers on 6th November 2022 in the article ‘Long-range trend of Instantaneous Reserve Plant Margin (IRPM) and focus on Q3 2022 – from GenInsights Quarterly’. As discussed in Appendix 1 for the Q4 Update, what a different quarter this one was! ——- 6) as a new addition to the 2023 Q2 release, we added in analysis of LOR status (both actual and forecast). 7) as a new addition to the 2023 Q3 release, we added in analysis of NEM-wide % VRE on a 5-minute basis. ——- With respect to the 2023 Q3 update, one small snippet of the content of that Update was shared with WattClarity readers on 6th November 2023 in the article ‘Case Study (part 1) of low % VRE NEM-wide on 3rd and 4th July 2023’. … with the intent being that the Case Study will be progressively fleshed out afterwards (as time permits) ——- … + others. |

| Appendix 2

29 pages

|

The changing shape of Grid Demand

In this appendix we take a look at the changing nature of Grid Demand, which necessitates looking into: 1) Different shapes of demand: (a) Starting with ‘Grid Demand’ (b) But then also analysing Rooftop PV shapes to also assess ‘Underlying Demand’. 2) Beginning with the Q4 Update, we’ve also added in some analysis of the forecastability of ‘Operational Demand’ … this uses a method of ‘Forecast Convergence’ we introduced in GenInsights21 to assess the changing challenges of forecasting what ‘Operational Demand’ will be 24 hours from the point of dispatch.

|

| Appendix 3

77 pages (continues to expand in detail) |

Wind and Large Solar

In this appendix we take a look at different aspects of the performance of Wind and Large Solar assets (separately and together), including: 1) Production 2) Commercial Performance 3) Curtailment (a) Following the 2023 Q1 Update, we shared ‘Increasing curtailment of Wind and Solar across the NEM’. 4) Self-Forecasting … and in particular for Q1 what changes in usage patterns can we see for those Solar Farms and Wind Farms who have deployed self-forecasting – given: (a) AEMO upgraded its AWEFS and ASEFS forecasting systems on 23rd November 2022; and (b) The 3-month long ‘Grace Period’ ended on 23rd February 2023 5) ‘Forecast Convergence‘ for aggregate VRE Capability (a) how accurate are the AEMO’s forecasts of Wind + Large Solar capability across the NEM, 24 hours from the point of dispatch? (b) given the growing installed capacity, with more Wind and Solar Farms being developed, to what extent is this challenge growing? 6) Aggregate Raw Off-Target (i.e. AggROT) (a) in these Quarterly Updates, we continue to watch what’s happening in terms of collective deviation from Target across all the Wind and Solar Farms – updating and extending the analysis covered in WattClarity articles to 2020. (b) Following the 2022 Q4 Update, we shared ‘some revelations in GenInsights Q4 2022 about Aggregate Raw Off-Target for Semi-Scheduled Units’ (c) In conjunction with the 2023 Q3 Update, we shared ‘Case Study (part 1) of large collective under-performance for Semi-Scheduled assets on Friday 18th August 2023’, with the intention being that this Case Study will be progressively fleshed out as time permits. (d) In subsequent Updates we continue to explore… + more to come. |

| Appendix 4

35 pages |

Dispatchable Capacity

In this appendix we take a look at different aspects of the performance of (fully) Scheduled assets (at various levels of bundling), including: 1) Performance specifically through Q4 2) Aggregate Scheduled Target (AggSchedTarget): (a) In absolute terms ——- With respect to the Q1 update, there are three snippets to be shared here on WattClarity: i. On 14th May 2023 we shared how ‘We’re not building enough replacement dispatchable capacity’ ii. On Wed 31st May 2023, we shared ‘Digging further into ‘Aggregate Scheduled Target’, to understand what Dispatchable Capacity is actually required’ iii. On Wed 30th Aug 2023, we shared ‘Case Study of high AggSchedTarget on Thu 30th Jan 2020 and Fri 31st Jan 2020 (part 1!)’ to look into one particular (and recent) example of high Aggregate Scheduled Target. ——- (b) Ramping from one Dispatch Interval to the next 3) ‘Forecast Convergence‘ for AggSchedTarget |

| Appendix 5

34 pages |

Coal Units

The 47 x coal units still operational in the NEM in Q1 2023 (albeit with 3 units at Liddell closing soon) are a special subset of dispatchable plant that have been addressed in more detail in this particular Appendix – because: 1) They still provide a large share of the Energy consumed in the NEM (and also the ‘Keeping the Lights on Services’); 2) But suffer from the big drawback of high emissions intensity. What this contains includes: 1) Performance specifically through Q4 2) Coal unit ‘dependability’ In the 180-page analytical component of the GRC2018 we included an extensive focus on the changing nature of different aspects of coal unit ‘dependability’. This was extended and updated in GenInsights21. Now, in each quarter, we’re extending and updating further, with the inclusion of analysis of: (a) Changing levels of Unavailability … in particular note we shared (on 6th March 2023) how ‘Unavailability of coal units hits 24% across calendar 2022 (but they are *not* collectively tripping more often)’ following completion of the 2022 Q4 Update. (b) Three different metrics that help to indicate the changing rate of ‘Sudden Failure’: … number of Starts, number of ‘Sudden Trip’, and Aggregate Raw Off-Target. (c) From the 2022 Q4 Update (TO CHECK IF THIS IS THE START), we have been separating out all hours in the quarter for each of the remaining coal units into three categories (Operational, Planned Outage and Forced Outage), which makes it clearer which units appear to be struggling and which units don’t appear to be struggling. i. For instance, some of this data (from the 2023 Q2 Update) was shared on 19th Oct 2023 via the ‘Two pieces of information (about Eraring Power Station) from the Origin Energy 2023 AGM’ article. 3) We also look at ‘Forecast Convergence‘ for Aggregate Coal Unit Availability across the remaining units still operational in that particular quarter. 4) Each quarter we take an updated look at the Closure Schedule. |

| Appendix 6

35 pages (further new details) |

Network Dynamics

In this Appendix, we look at: 1) Regional Energy Balances 2) Regional Transfer Duration Curves 3) Specific interconnector operations (a) this includes (from the 2023 Q1 update and enhanced from the 2023 Q2 Update) identification of the type of constraints that are most significantly impacting on each interconnector; and (b) Further details to be provided HERE… 4) Renewable energy congestion … and in future Editions will add in other aspects.

|

Hopefully this has provided some sense of what’s included in this Quarterly Update for 2023 Q3.

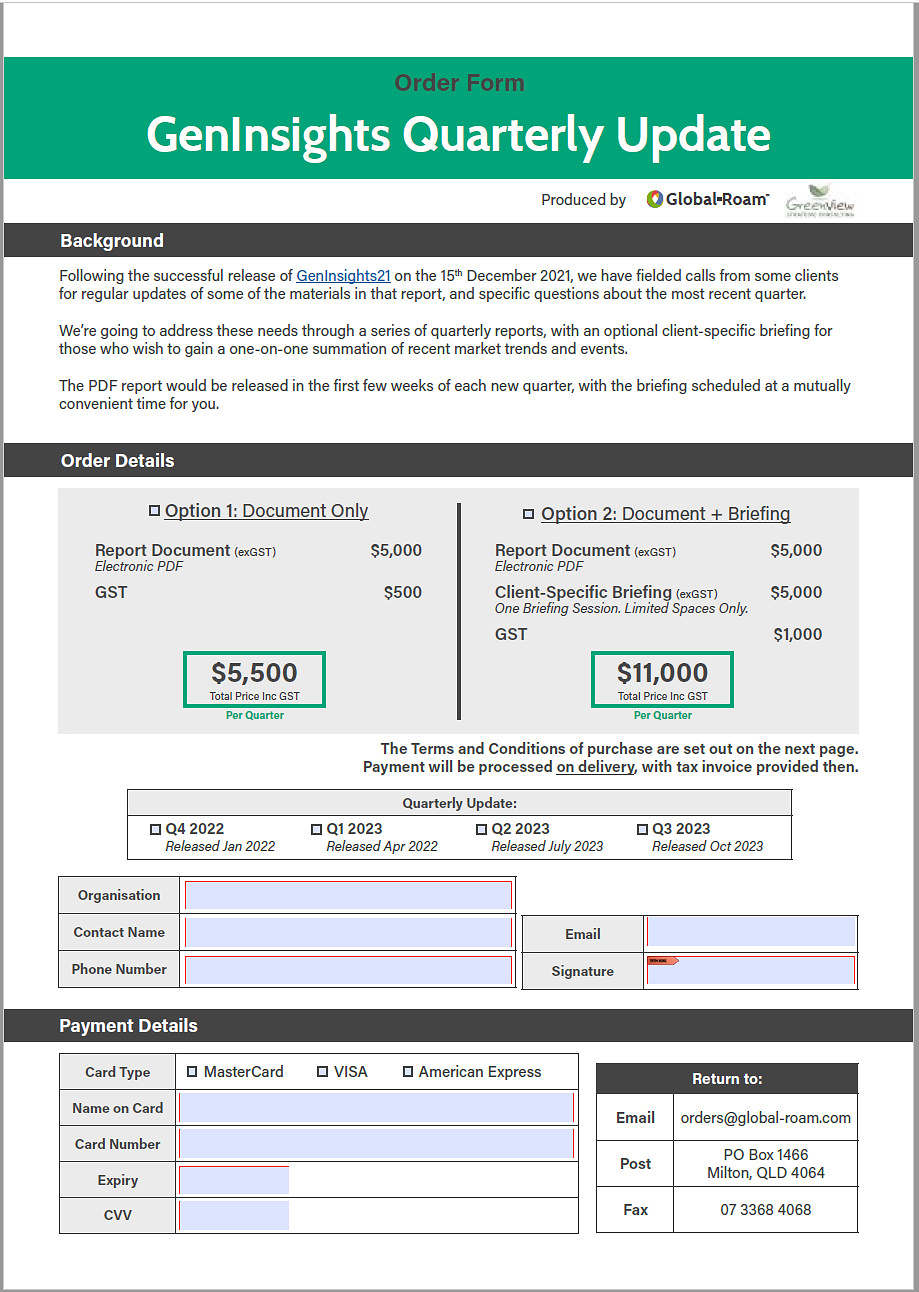

Please contact us if you have more questions on the above, and please complete this order form and return to us to secure your order, remembering to flag which option you prefer:

Option 1 = Document only (as integrated PDF); or

Option 2 = both:

(a) Document (as integrated PDF) +

(b) Executive Briefing (noting that this is subject to availability).

We look forward to receiving your order.