As part of the number crunching for GenInsights Quarterly Updates for 2023 Q4 (as we have in preceding issues, and before that in GenInsights21) we look at the incidence of large instances of Aggregate Raw Off-Target (i.e. AggROT) across all operational* coal units.

* following the closure of Liddell a year ago, there are now 44 x operational coal units remaining. To make this analysis ‘apples-for-apples’ through time, we have calculated AggROT across those same 44 x units:

(a) back in time to Q4 2001, which is when the relevant data started to be published

(b) notwithstanding that there were 6 x supercritical units introduced in QLD in the first few years of that period.

In crunching the numbers for the 2023 Q4 update, it became apparent that it would be useful sharing some of what we’ve been increasingly seeing, particularly as for 2023 Q4 it’s become more apparent.

There’s a hypothesis below – but it’s really more of a question, so would be interested in considered thoughts from the more knowledgeable readers here at WattClarity?

… and for comparative reference, you might like to compare these results with those shown in ‘A long-range trend of large instances of Aggregate Raw Off-Target (AggROT) across all Semi-Scheduled units’, also published today.

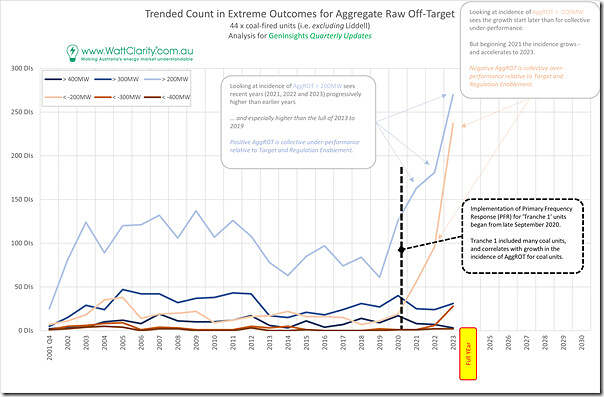

Long range trend of AggROT for coal units

Here’s two charts that trend a count (per year) of how many dispatch intervals exceed certain levels of AggROT for these 44 x coal units.

Remember to click on any image in WattClarity articles to open as larger resolution in a separate tab for easier reading …

Also remember that there are 105,120 dispatch intervals in a (non-leap) year, so we are talking some pretty small percentages of time.

In the first chart we count the incidence greater than 200MW – remembering that:

1) Negative AggROT corresponds to over-performance relative to collective Target and Regulation Enablement levels; whilst

2) Positive AggROT corresponds to under-performance relative to collective Target and Regulation Enablement levels; whilst

Counts for greater exceedances are also included, but we can skip those for now, as they are also shown below at larger scale. Focusing just on the 200MW below, and 200MW above, we see that:

1) From 2002 to 2019 the numbers are largely similar … leading to a sense that (in terms of this particular metric) coal units were (at least until 2020) collectively not performing ‘worse’ within a dispatch interval than they have historically

2) From 2020 we see the incidence begin to grow:

(a) Firstly for AggROT > +200MW and then for AggROT <-200MW.

… not sure why one lagged the other, at this point.

(b) With growth in the 2023 year particularly rapid.

3) Here’s one hypothesis:

(a) We’ve annotated this chart in 2020 to remind that:

i. Implementation of Primary Frequency Response (PFR) for ‘Tranche 1’ units began from late September 2020; and

ii. Tranche 1 included many coal units, and correlates with growth in the incidence of AggROT for coal units.

(b) This development coincides with when incidence larger than 200MW (in both directions) began to grow;

(c) So it seems a logical question to ask about the extent the one caused the other?

4) Interested in considered thoughts from readers about:

(a) The possibility that this might be true (or not); and

(b) How we might verify that?

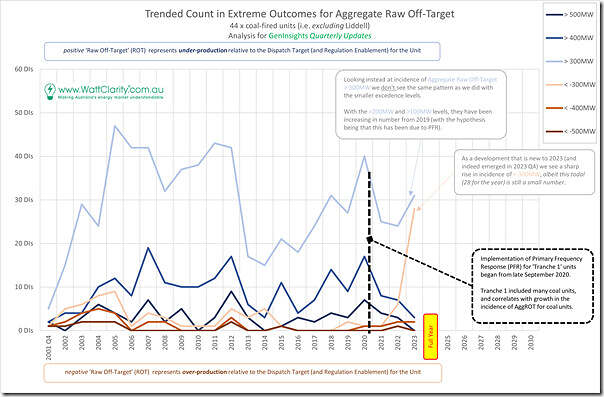

Deleting both 200MW trends from the chart above we’re left looking at incidences greater than 300MW, and see a few other interesting developments:

In this case we see that:

1) Excepting some interesting developments for the full year 2023 (which were not present even when we crunched the numbers for 2023 Q3!) there’s not been a growth in incidence at this larger level.

2) However what’s appeared out of the blue in 2023 Q4 is that the incidence of AggROT <-300MW:

(a) Albeit that the total (i.e. only 28 dispatch intervals) is still a small number;

(b) It’s much greater than any earlier year and really stands out.

(c) Which begs the question … whether this is the start of a new trend?

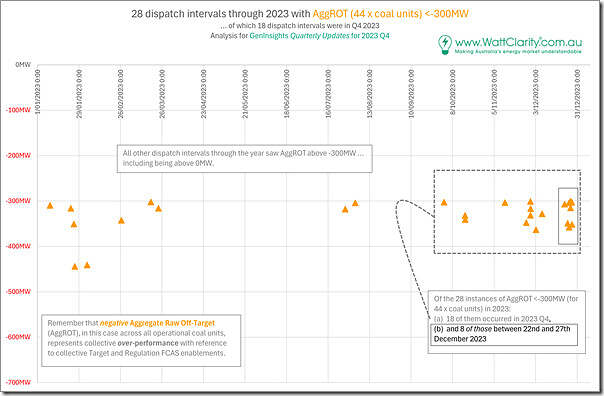

A focus just on calendar 2023

I mentioned above that this only became apparent when crunching the numbers for 2023 Q4 (i.e. not even for 2023 Q3), and that is because 18 of the 28 instances appeared in Q4.

Plotting just those 28 x Dispatch Intervals on a timeline through 2023, we see the following:

There’s a cluster in 2023 Q1, and there’s a larger cluster in 2023 Q4, but not much in between. Of the cluster in 2023 Q4, we see:

1) There are two dispatch intervals on 16th October 2023 with AggROT <-300MW, as follows:

(a) 09:05 = –332MW

(b) 13:05 = -341MW

2) There are three dispatch intervals on 29th November 2023 with AggROT <-300MW, as follows:

(a) 10:50 = –301MW

(b) 13:25 = –331MW

(c) 13:45 = –317MW

3) But there are also 8 instances over a 5-day period being 22nd December 2023 to 27th December 2023.

4) Plus 5 discrete instances on other days through Q4.

We wonder, what’s going on?

Not shown here, but all 28 x instances through calendar 2023 occurred through daylight hours, and mostly at times of the day when we’d expect strong sunlight. We wonder if that suggests some part of the cause, or whether it’s just correlation?

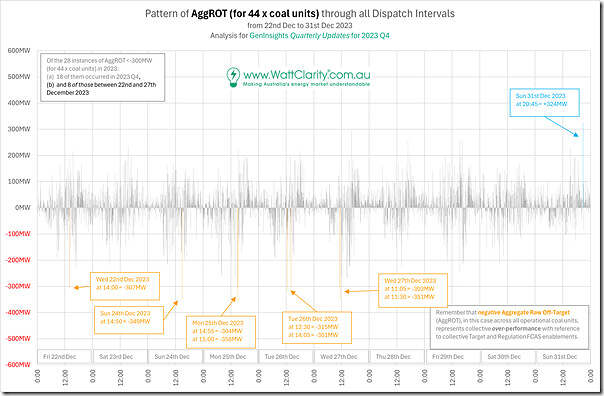

Zooming in to just the end of 2023

So here’s a chart of all the calculated AggROT metric for all dispatch intervals between 22nd December 2023 to 31st December 2023 (i.e. the last 10 days of the year):

The 8 x DIs during this 5-day period seeing AggROT < –300MW are all individually identified … plus one on 31st Dec 2023 that was AggROT > +300MW.

We might come back later at some point (time permitting) to drill into some specific examples via Case Studies to understand more about what went on, and hopefully why.

… but that’s all I have time for now.

Leave a comment