Today I am feeling for all those electricity sector stakeholders in Texas (and other parts of the USA, including the Southwest Power Pool (SPP) and Oregon and many other places) who have endured a pretty rough period through their Monday 15th February 2021 … a situation that looks like it may well repeat this evening until the weather changes.

ERCOT (system and market operator) published this news release at 01:25am on Monday 15th February, and it helps to highlight some of the stresses:

ERCOT calls for rotating outages as extreme winter weather forces generating units offline

Almost 10,000 MW of generation lost due to sub-freezing conditions

AUSTIN, TX, Feb. 15, 2021 – The Electric Reliability Council of Texas (ERCOT) entered emergency conditions and initiated rotating outages at 1:25 a.m. today.

About 10,500 MW of customer load was shed at the highest point. This is enough power to serve approximately two million homes.

Extreme weather conditions caused many generating units – across fuel types – to trip offline and become unavailable.

There is now over 30,000 MW of generation forced off the system.

“Every grid operator and every electric company is fighting to restore power right now,” said ERCOT President and CEO Bill Magness.

Rotating outages will likely last throughout the morning and could be initiated until this weather emergency ends.

—

Back in the NEM, the current summer 2020-21 has been (thankfully) nowhere near as stressful as many will remember it to be the prior summer – not the least of which because of these Four Headline Challenges that each, in-and-of-themselves, would have been stressful enough.

So it was a little weird (in a ‘there but for the grace of God go I’ sort of way) to be watching – albeit remotely – it all unfold from the comfort of home yesterday evening, Brisbane time. But the more I watched, the more it occurred to me that there were so many parallels between what was actually unfolding on the ground in Texas (and also in the social media commentary world overlaying the physical reality), that I’ve allowed myself to become a bit distracted in putting this together:

Special Disclaimer – ‘L’ Plate definitely attached here…

|

Those who know me personally will know how I try to dissuade people from referring to me as an ‘Energy Expert’ in relation to the Australian National Electricity Market (NEM).

This is infinitely moreso when venturing into trying to understand what’s been going on inside Texas, where the sum total of my direct experience has been a week on the ground some decades ago followed by some reading from afar. Readers are reminded to keep this in mind! |

I hope what follows proves useful to some …

———————————

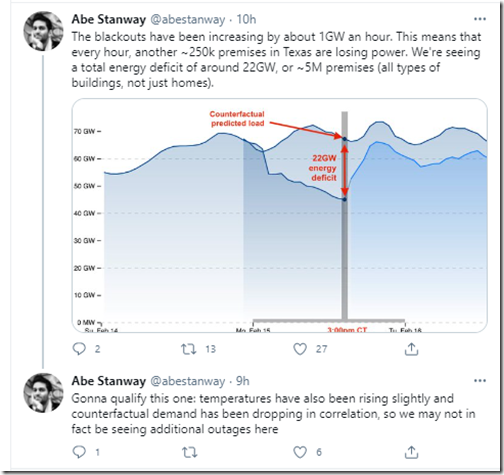

As noted below, if the load shed was ‘only’ 10,500MW then that would be a huge amount – but there seems conjecture that the actual number might be more than that … such as this estimate from Abe Stanway which brings the number to a peak of 22,000MW (though at 15:00 central time – so 13 hours after the ERCOT news release above)!

… of course (as Abe himself notes) estimating these kinds of things introduces the unavoidable problem of estimating ‘what might have otherwise been’. Here’s an earlier report by Abe on what was observed between 1am and 2am in the metered numbers. Jesse Jenkins here signalled the (very worrying) scale of the shortage:

(A) Electricity is an Essential Service…

Let’s start at the start … as we did in the in the GRC2018 where we noted:

‘The generation side of the electricity supply industry only exists to serve the needs of energy users. There are no energy users who seek supply of electricity as an end in itself – but rather because the electricity will enable some other product or service that the energy user values.’

Furthermore there is a significant portion but not all of the electricity consumption that is not discretionary, but rather is an essential service. So as the squabbling inevitably (though sadly) starts, with finger pointing at ‘the other guy (or gal)’ that’s to blame for what happened, we should all be mindful of why we all exist in the first place.

(A1) There are real implications in disruptions

The peak amount of load shed (10,500MW) is a huge amount – both in relative and absolute terms, as noted yesterday.

To put this in context of the Australian NEM – speaking firstly in absolute terms:

1) It’s roughly 7 times the amount of demand instantaneously disconnected in the SA System Black event in September 2016:

Remembering that a ‘Megawatt’ (MW) measures a rate of consumption, or production (bit like a velocity) – whereas a ‘Megawatt Hour’ (MWh) measures a volume of energy (like distance travelled).

2) That size of load shedding would be equivalent to the entire region of Victoria (or Queensland) being curtailed during a peak summer heatwave.

Speaking in relative terms, 10,500MW was more than 15% of what the peak demand was going to be on the day. Even during the bad days in the NEM in prior summers, I can’t recall any occasion where that percentage of peak demand has been subject to load shedding because of insufficient supplies.

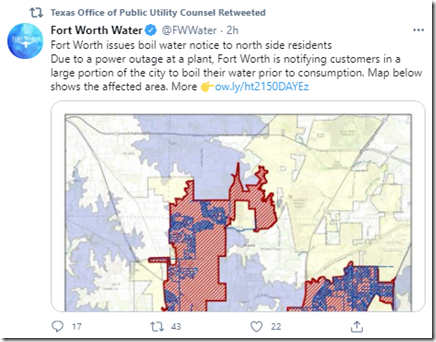

Because of the size of the interruptions, and because electricity is an essential service, there will have been a great many implications – not just commercial implications, but also in terms of quality of life. As just one example, this tweet from Fort Worth Water referred to this Facebook notice urging customers in a large portion of the city to boil water prior to consumption ‘due to a power outage at the Eagle Mountain Treatment Plant, and subsequent loss of water pressure in the system’:

Of course, did not take long for people to point out it would be difficult to boil water with no electricity (or gas presumably).

We’re thankfully in a position in Australia where we have avoided the worst of the COVID pandemic – but the USA (and Texas) has not. I can’t begin to imagine what a disruption like this might do to a population that’s already been impacted by the pandemic – both in terms of health and wellbeing, but also economically.

1) I’m not really thinking here about those in hospital ICU (as the load shedding might have spared those locations – and, even if it did not, back-up gensets should have kicked in).

2) Rather, I was more thinking of the order of magnitude more sick people who are positive and trying to recuperate at home, and would not have appreciated shivering through a cold night.

As such, it was no surprise to see the volume of commentary (and emotion) being expressed in the past 24 hours.

(A2) Supply and demand need to be balanced in real time

In recent years there have been an influx of battery storage facilities (small and large) added to the NEM – and also to Texas and elsewhere. Whilst that offers a buffer in the supply/demand equation, it still does not change the need for supply (including injections from a battery) to match demand (including withdrawals into a battery) at every instant of the day.

For those who need a refresher, the animated image included in Jonathon Dyson’s ‘Let’s talk about FCAS’ article helps to illustrate how supply and demand need to be matched instantaneously (at each second, and below) in order for system frequency to remain stable at 50Hz in the NEM (or 60Hz in Texas).

Watching last night the ERCOT ‘Real Time System Conditions’ page revealed frequency struggling below 60Hz for much of the period I was watching it – which seemed to me (and to other NEM junkies who also noticed last night) that the supply was struggling to meet (even the reduced) demand through the Texas night.

(A3) Load Shedding is an option used … to prevent something worse

Because of the risk of catastrophic system collapse, which is more severe and takes much longer to recover from (like the days following the SA System Black for full recovery), ‘Load Shedding’ is used as a pre-emptive measure (a bit like tossing things overboard to prevent the whole boat from sinking), but is not a measure that any system operator takes lightly.

In the NEM this is notified by Low Reserve Condition Notices – with LOR3 (Lack of Reserve) being the signal that Load Shedding has commenced in a region. In Texas last night, the load shedding was telegraphed by an ‘EEA 3’ (i.e. Energy Emergency Alert) notice, which was also notified in this tweet:

(B) Trading off between Cost and Risk

Because of several factors (including the above, but also the capital-intensive nature), any electricity grid is managed on the basis of a complex trade-off between cost and risk.

As the load shedding continued through the cold Texas night there were some comments I saw that seemed to imply an expectation that electricity would always be supplied, no matter the cost. However that’s just not possible because:

1) Even if you could invest infinite dollars, there are always risks to System Reliability; and

2) Being more realistic and accepting some risk is unavoidable, there is a point at which increasing System Reliability becomes increasingly expensive to provide for … which was the point of

(B1) The shape of Underlying Demand is very ‘peaky’

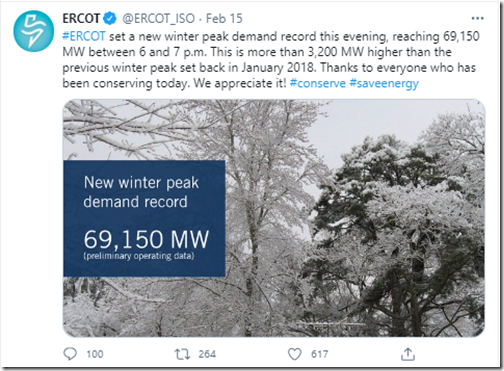

One reason that’s so is because ‘Underlying Electricity Demand’ is very peaky. That was especially so in Texas during this rare cold spell – here’s a note from ERCOT:

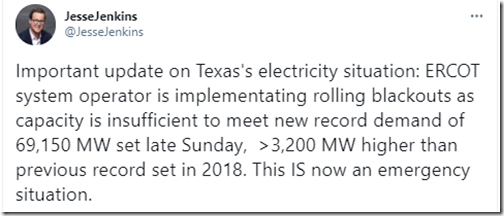

… and then followed by one from Jesse Jenkins that links from the peak demand to the load shedding:

What this inevitably means is that a range of supply options are required – some of which produce as much power as they are physically capable to do so, and other resources (which used to be called ‘peaking’ and now might be called ‘balancing’) to make up the difference when demand spikes … or other plant are unavailable.

(B2) It becomes increasingly expensive to increase system reliability further

The challenge is, because of the shape of demand and the underlying probabilities of the first choice plant being unable to deliver (it used to be ‘baseload’ but is increasingly low marginal cost renewables – but each have their own ‘probabilities of failure’) there’s no certain amount of capacity you need to have available to supply the gap.

It comes down to decisions about probability, and consequence – and also cost.

(B3) The level of risk is increasing?

In the GRC2018, we noted that ‘the level of risk in the NEM is increasing’, and explored what this meant in several ways:

… with some discussion following in various articles on WattClarity as well.

That the NEM is becoming increasingly dependent on the weather (which, in itself, is seeing more extreme conditions) is one of those risk factors.

It seems highly likely that the same sorts of factors are at work in Texas, and elsewhere, to mean that the job of organisations like ERCOT in managing supply and demand to avoid situations like this is becoming more complex and challenging.

(C) Climate change is a factor, in various ways

One of the reasons that risk is increasing is because of the way in which the climate is changing – but also because of the fraught political and economic processes that are being worked through to address climate change risks.

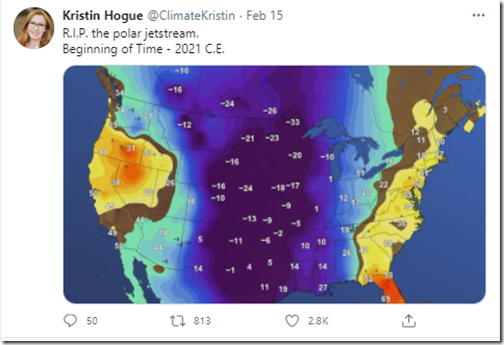

(C1) The ‘polar vortex’ all the way to the Mexican border

This tweet from Kristin Hogue provided a useful map of temperatures across Canada and the USA and into Mexico:

(for Australian readers, remember the temperatures are in Fahrenheit)

Others more learned than I will be able to explain better how changes to the Gulf stream (or other phenomena) have enabled the artic chill to proceed fully south through the USA to the Mexican border:

which links to this ‘Q & A: How is Artic warming linked to the ‘polar vortex’ and other extreme weather?’ article from January 2019.

… and yes, to those who might jump in (perhaps the ones on the ‘Rabid Right’ end of the Emotion-o-meter) with comments along the lines of ‘but it’s been this cold in Texas before!’, I know that there have been cold spells before (like in Jan 2014, and other times).

(C2) If the climate is changing, how should this feed into Risk Management?

There were quite a few comments I saw that went along the lines of ‘we have plenty of cold weather up in (some northern state) and our gas supply does not freeze, or wind turbines don’t freeze’. This thread by Tim Latimer is useful as a reminder that the challenges thrown up by climate in future might be different than those expected in the past:

What these comments trigger are thoughts about how the risk envelope of operating plant (of all types) are changing due to climate change … perhaps also in ways not even really understood yet. What steps should be put in place, now, to help manage for that changed climate in future?

(C3) Uneven legs of the ‘energy trilemma’

It’s also worth reminding that much has been made of the three different parts of the ‘energy trilemma’ – with this sometimes pictured as if they are equal legs on a stool:

Consideration 1 = Security of Supply;

Consideration 2 = Cost; and

Consideration 3 = Environmental Sustainability.

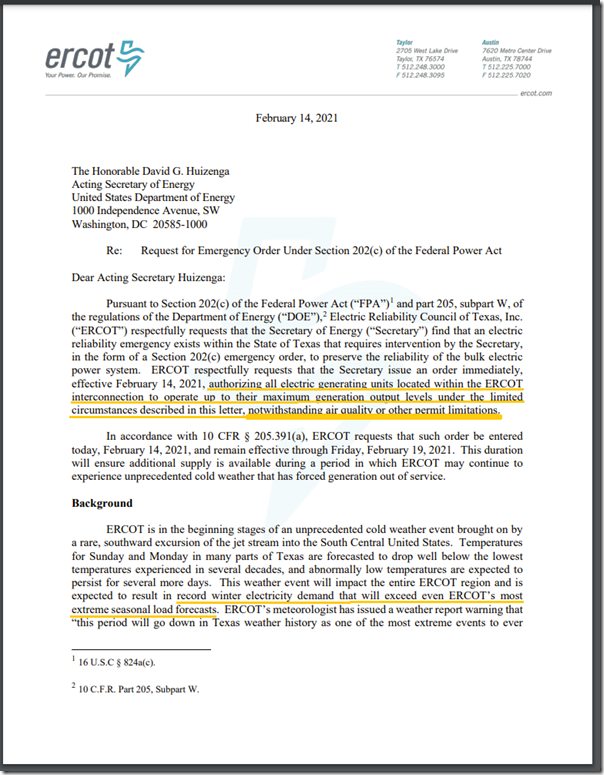

Others have noted (and I did also when I spoke here) that the reality is more nuanced than that – and this request from ERCOT on 14th February also illustrates that (at least in the short term in situations like this) concerns about Security of Supply trump concerns about Environmental Sustainability:

In the letter ERCOT notes its decision that it’s better to temporarily allow thermal plant to run through whatever (air quality and others) environmental limits might have been imposed on them – because, in situations like this, it’s better to have them doing what they can to keep as much power supplied as possible.

This is just one illustration of why thinking the legs on the stool are ‘equal’ is a misunderstanding that detracts from understanding why managing this energy transition is providing so difficult.

(D) Very quick to blame ‘the other guy (or gal)’

Whilst watching from afar, it seemed like the finger-pointing had begun even before the load shedding had begun … at least in some respects. Understandably, this tendency escalated when people started losing electricity (in some cases it seemed to be offline for hours – though the extent to which discrete cases were due to wholesale load shedding, or instead due to local (storm-induced?) network outage did not seem possible to ascertain on the information available).

There were several dimensions of the blame game, including the following:

Dimension 1 = it’s because it’s a liberalised market

There were some comments I saw that implied that it’s all because of liberalisation and market establishment that bad things happen (initially the astronomical prices – and then later the load shedding).

Of course we have seen the same thing in the NEM as well.

Dimension 2 = it’s because it’s an ‘Energy-Only’ market … not one with Capacity Payments.

Texas, like the NEM, operates with an ‘Energy-Only’ market design (most others in North America pay Capacity Payments). In the days leading into the load shedding, there was plenty of discussion about why the forward prices were sky-high, up to the market price cap ($9,000/MWh in Texas – though there is some arcane circumstances I don’t understand when they can go higher still). Some saw this as a sign that the market was not working correctly.

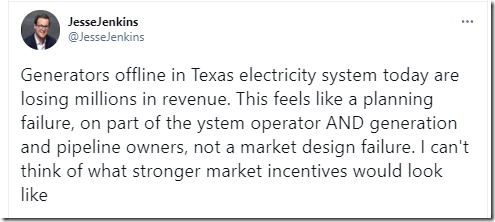

Jesse Jenkins covered why high prices are a necessary design feature of Energy-Only Markets, not a bug, in this thread:

It’s the same in the NEM … in that high prices when supply/demand is tight should not be viewed as a market failure.

Dimension 3 = it’s the Planner’s fault!

No matter whether the market has Capacity Payments, or not, the central Market/System Operator plays a role in forecasting a realistic range of what levels of demand might be in coming years – general in terms of both:

(a) Average demand (MW) … or annual aggregate Underlying Consumption (MWh); and

(b) Peak demand (MW) during coming summers and winters.

In the NEM it’s the AEMO that plays this role through forecasting/planning documents like:

(a) the annually updated, 10-year forward ESOO (Electricity Statement of Opportunities); and

(b) the more frequently updated (daily or weekly, depending) MT PASA process.

In Texas, the same sort of role is played by ERCOT (not sure of the names of the documents) – but, like in the NEM, with an ‘Energy Only’ Market the aim is to provide enough clear information to help participants make informed decisions about what type of capacity is being built, and where. Naturally, questions are being asked now:

With a Capacity Market, the planner’s role shifts (in some cases) to being a single advance buyer of capacity for some future year – however that model is also not a panacea (and, in the NEM, we can all remember how that type of thing worked in relation to over-built network capacity a few years ago with the networks effectively being their own single buyers).

In a way the NEM seems to be progressing to a very hybridised type of approach anyway, with so much additional support coming through a variety of mechanisms (through the Retailer Reliability Obligation, through UNGI, the Federal Government’s Kurri Kurri GT ultimatum and so on…)

Dimension 4a = it’s the fault of Gas Generation

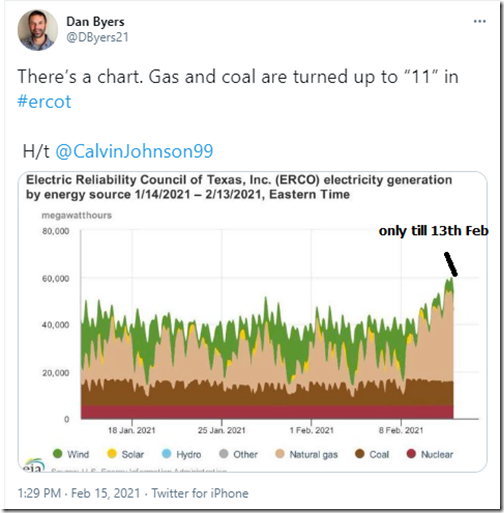

Here’s a chart from the EIA via Dan Byers that showed a ‘usual’ fuel type mix in the 4 weeks leading to 13th February:

We can see supply from gas ramping up to meet the increased demand that started ramping from 8th February, with wind and solar contributing variably (as they are expected to do). As more information became available through last night (my time) it became increasingly apparent that there were significant disruptions to gas-fired generation that were playing a significant role:

It’s been difficult to ascertain for certain (especially from afar) but it seems that the main contributing factor to this drop in gas-fired generation has been because of the impact of cold weather on supply of gas itself as a fuel:

1) Impacting on production and also impacting on delivery capability (e.g. wells freezing)

2) but also in terms of massively ramping gas-for-space-heating as a competing use for the fuel.

This tweet by Richard Meyer highlights how the cold snap has disrupted oil supplies

… and here’s a link to an article suggesting international markets might have depleted supplies even in the lead-in to winter:

There may be other factors (e.g. impact of cold weather directly on the gas-fired generators themselves) but I’ve not seen clear information on this … especially what the underlying technical causes might be, if it is happening.

—

With so much talk about ‘the need for storage’ in this energy transition, I wonder how much events like these will make people think about the need for ‘enough’ storage of fuel onsite for expected running operations (incl disruptions upstream)?

Dimension 4b = it’s the fault of Renewables

There was a variety of information I saw – but it does seem true that there is a significant amount of wind turbine capacity out of service because of ‘icing up’. Some sources put it at a couple thousand, whilst others more than 10,000MW – I am not sure which is closer to the correct number?

Some have speculated that this might be because some wind farm developers in Texas did not see value in building their projects to be able to operate in cold weather conditions (which they presumably thought were going to be rare enough to not make it justified):

I don’t know if this is true, or not – however it certainly does seem similar to stories we’ve heard in the NEM whereby some developers did not adopt European designs to (much hotter) Australian conditions with things like cooling on the gearboxes … as a result of which some wind farms demonstrate quite poor high temperature performance (which can be seen individually in the GSD2020 and prior GSD2019).

—

I saw plenty of commentary like this one noting others who were using the crisis in Texas to say that ‘these conditions prove renewables can’t work’ – this particular thread by Emily Grubert might be useful for some:

… as Jesse explains here:

Readers should remember that the actual contribution varied through the hours-long duration of the load shedding period (so Jesse’s tweet above is at a particular point in time), but ultimately the measure of ‘success’ seems to have been set relative to the Low Expectation set in ERCOT’s prior planning studies.

—-

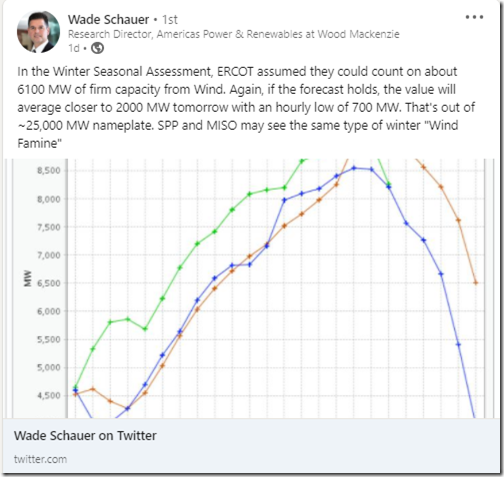

I wonder if there’s not a bigger picture issue at work here? According to the EIA, at the end of 2019 the capacity of installed Wind Farms in Texas had risen to 28,100MW. The EIA does not list how much was added in 2020, but assuming the same rate (>4GW in 2019) it seems certain that the capacity base would be well past 30,000MW at the start of 2021.

Taking the 6.1GW low-ball expectation of contribution at time of winter peak equates to an instantaneous capacity factor estimation of 20% or lower as the definition of ‘success’ if you think with this paradigm (again, don’t know the precise installed capacity).

Role play in the Energy Supply Family?

So the ‘overperformance’ in this instance might described by some (perhaps facetiously) as like that ‘special’ child returning from end-of-year exams with a smug look on their face in handing over the report card to the parents, whereby the parents comment along the lines of:

‘well Willie Wind, we only expected a C grade from you, so you have done quite well with a C+ on this occasion!’

… and in the meantime William is making smug faces at sibling Gertie Gas, who was expected to get an A on this exam but who has surprised all by performing quite poorly on this important test.

Is it any wonder that the two siblings don’t see eye to eye, when they are measured on different performance standards?

Perhaps I am reading what’s not there(?), but I think that’s part of the point Rod Adams might be trying to make here by referencing the installed capacity number in this update:

… and similarly by Wade Schauer on LinkedIn and Twitter here:

It’s a Systems-Level Issue!

A very good point by Tim Latimer here about it being a Systems Issue that is along the lines of what we made before in the Generator Report Card 2018 … … and which we will seek to extend the exploration of in the GRC2020 update.

… and also by Erin Overturf here:

Bickering siblings don’t help us solve it (especially with each pointing out the other’s flaws)!

(E) Miscellaneous other considerations

A few other random thoughts …

(E1) Interconnection

Other comments I saw raised the (valid, but complex) question about the relatively small scale of interconnection between ERCOT and other North American grids:

… and here are some more …

Sound familiar to discussions running concurrently in Australia about projects like Energy Connect, for instance, and whether they are still beneficial to customers if the cost of the project has risen from first estimates?

(E2) Spot Exposed Energy Users

Recently on WattClarity we included the guest authored article by Gordon Leslie ‘What’s it like being on a real-time electricity pricing plan? Observations from my poorly insulated townhouse’ … exploring spot-exposure (and demand response) as an option for residential energy users.

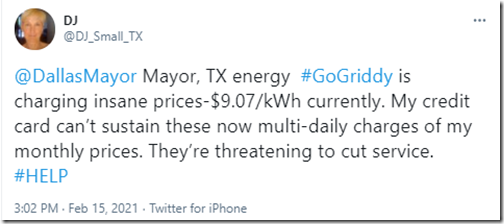

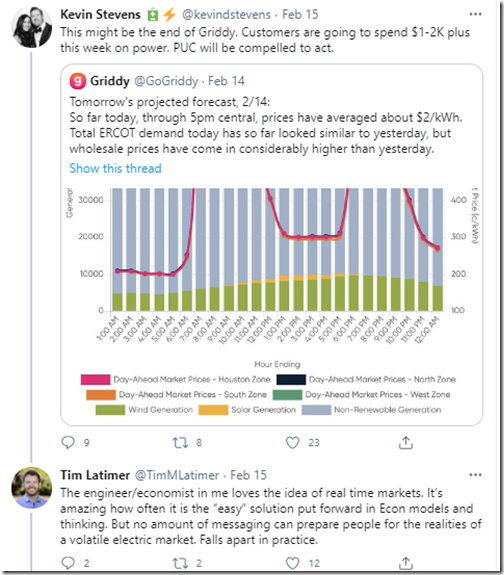

Following from the article there were conversations about how sustainable such a business model would be (for the company, or for the residential energy users) given the (admittedly rare) instance when prices can go ballistic for sustained periods of time. Well in Texas over the past couple of days, I’ve learnt that there is a similarly styled retail-focused company called Griddy, and that some of its customers are not all that happy at being surprised by a steep hike in bills:

… and others (like Kevin Stevens) are asking questions:

(E3) General trouble in retail land

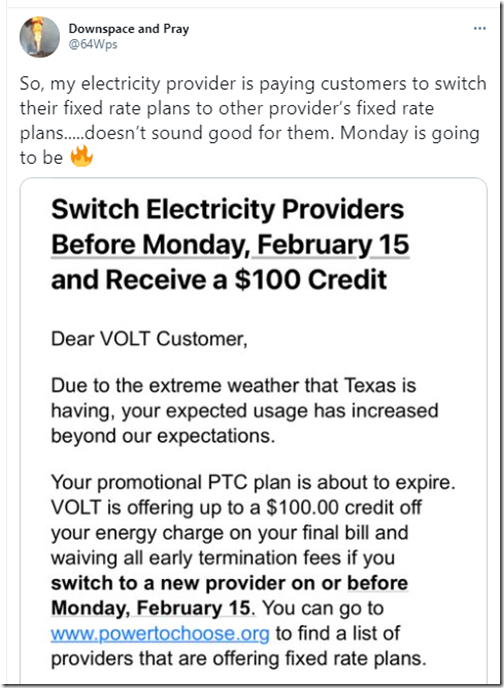

And (perhaps in a similar vein) there was this tweet from someone who noted that their retailer, Volt, was (a few days prior to Monday) offering their customers a cash incentive to actually churn away from them:

A worrying development, at various levels…

(E) Other reading

Here’s an assortment of articles I came across in scanning over the past ~24 hours or so.

12th Jan 2021 ‘Massive winter storm prompts disaster declaration and could stress Texas’ electric grid’ by Megan Menchaca and Mitchell Ferman in Texas Tribune.

14th Feb 2021 ‘Valentine’s Day Giving The Texas Electric Grid The Cold Shoulder’ by Joshua Rhodes and Caitlin Smith – in Forbes.

14 Jan 2021 ‘Millions of Texans without power as ERCOT declares highest level of energy emergency, outages could last for hours’ in WFAA

15th Jan 2021 ‘Winter storm forces blackouts across Texas’ by Jeff St John in GTM. This article interestingly noted:

ERCOT has been working with generators for a decade to improve winterization practices to forestall these kinds of cold-related outages, Woodfin said. Similar efforts to ensure an adequate level of supply amidst cold snaps have been instituted in the U.S. Northeast following the “polar vortex” storms seen over the past decade. But the unusual severity of the storm meant ERCOT’s efforts were not enough, according to Woodfin.

“This event was well beyond the design parameters for a typical, or even extreme, Texas winter that you would plan for,” he said. “This weather event is really unprecedented — all of us who live here know that.”

… and also quotes a figure of 16,900MW of load reductions.

15th Jan 2021 ‘Spot electricity at Texas’ West Hub surpasses $9,000 cap’ by Dan Murtaugh in Bloomberg. Interestingly this article noted:

‘About half of the state’s wind turbines were inoperable Sunday morning because of ice and cold, according to the Electric Reliability Council of Texas, the grid operator. Meanwhile demand is surging as people crank up heaters, with consumption setting a new winter peak record on Sunday.’

15th Jan 2021 ‘Cold snap leaves 8 million in Texas, Mexico without power’ by Maria Caspani in Reuters.

15 Jan 2021 ‘Frozen wind turbines hamper Texas power output, state’s electric grid operator says’ by Brandon Mulder in the Austin American-Statesman

16 Jan 2021 ‘Blackouts spread beyond Texas as frigid weather knocks out power plants’ by Gregory Meyer, Justin Jacobs and David Sheppard in the Financial Times. This article helps identify a sequence:

‘Ercot had announced “rotating outages” at 1:25am local time on Monday after the cold weather froze wellheads and interrupted supply to natural gas-fired power plants, and some wind turbines became encased in ice, curtailing electricity output.

But by later in the day, a second group of generators — the majority of them thermal plants fuelled by gas, coal or nuclear energy — had also malfunctioned in the cold, said Dan Woodfin, Ercot’s senior director of system operations.’

Updated 16th Jan 2021 ‘US energy crisis deepens with about 5 million in the dark ’ by Brian K Sullivan and Naureen S Malik in Bloomberg. This article notes the troubles extend beyond Texas:

‘Homes and businesses from North Dakota to Texas are losing power in the middle of an unprecedented deep freeze that has broken daily temperature records in hundreds of places. Grid managers can’t say exactly when the blackouts will end with the cold forecast to remain through Wednesday.’

… and

‘They’ve all underscored how vulnerable the world has become in the face of increasingly unpredictable weather brought on by climate change and are raising questions about the global push to electrify everything from transportation to heating and cooling.’

16th Jan 2021 ‘Massive Texas gas failure during climate extremes gets blamed on wind power’ by Ketan Joshi in RenewEconomy.

—-

Listing and linking to anything above should not be taken as endorsement, but merely an attempt to help people with a starting list of things to read!

This load shedding is caused by the US policy that requires Gas in times of severe cold to be diverted for home heating depriving gas generators of fuel. Gas generators do not store gas on sight. This exact scenario has been predicted by Meredith Joan Angwin in her Book Shorting the Grid.

It is a system problem in that generators are not paid anything for storing alternative fuels like oil on sight. As much as I would like to blame Wind for this Grid failure it is not a problem with renewables as such. It is indicative of poor grid management. Note Nuclear Plants do not suffer from this problem.

https://www.amazon.com/Shorting-Grid-Hidden-Fragility-Electric-ebook/dp/B08KZ51SDP

“It is a system problem in that generators are not paid anything for storing alternative fuels like oil on sight.”

So the FF generators work on just in time like wind and solar but somehow they’re to be scolded?

My take is unless tenderers of electrons to the communal grid can reasonably guarantee them 24/7/365 along with FCAS then they can keep them and use them themselves. But then I’m just a naive consumer of an essential service.

Correct. Meredith Angwin describes this problem. The gas burning generators are capable of burning oil instead. But no one wants to pay them for storing the oil on site. What is worse is that no one seems to be actually responsible for guaranteeing supply. The market system which is run by the Federal Energy Regulatory Commission (FERC) is a failure.

https://www.ferc.gov/

“What is worse is that no one seems to be actually responsible for guaranteeing supply.”

Well ironically that falls to ERCOT and watts in a name eh? Anecdotally there might be a strong mood for change and real answers-

https://wattsupwiththat.com/2021/02/16/hotel-in-austin-texas-sends-letter-to-guests-we-are-out-of-food-use-glowsticks-for-lighting/

Extreme cold can actually kill people.

some useful facts and figures here Paul. First question should be: is the planning standard designed to deliver reliable power at these extremes? If so, then yes, something has gone wrong, and Texas needs to find out what it is. but if not, and it does sound pretty extreme, then the question is does Texas want to pay for a higher standard of reliability?

on the subject of whether a capacity market would have saved them – well maybe, but a) at a cost and b) only if capacity was certified for operation at these extreme low temps and/or there was sufficient penalty for non-performance.

As for greater interconnection, well maybe but that didn’t help CA in the summer. its neighbours were also experiencing demand peaks and didn’t have enough to spare. i believer the cold snap extends beyond TX…

what about better insulation of buildings (weatherization in the US)? this would certainly help reduce the discomfort of rolling blackouts, but it wouldn’t prevent them alone. Logically it would just shrink the demand curve and the supply side would rebalance accordingly. you still fundamentally have the load duration curve issue to solve – are there sufficient incentives for those last few MW to be available just for those rare extreme weather events?

finally – blame the market. well having a single public utility is no silver bullet – you still have to have the standard, someone has to oversee/enforce it, and the extra kit (more capacity/gas storage/pipeline insulation…) costs money and has to be paid for.

And you don’t think all this incredible mess was entirely foreseeable ?

Well it has raised the political temperature with the finger pointing but I found this defence interesting-

https://www.msn.com/en-au/weather/topstories/fact-check-is-green-energy-to-blame-for-texas-power-outages/ar-BB1dLEIq

“Wind energy provides only about 25 percent of Texas’ total power throughout the year, according to ERCOT data—natural gas sources account for 35 percent—although the turbines tend to generate less power in the winter.

The Texas Tribune reported that only 7 percent of ERCOT’s forecasted winter capacity was expected to come from wind power sources in the state. Meanwhile, around 80 percent of ERCOT’s total winter capacity is generated by natural gas, coal and nuclear power.”

I’m reminded of the cautionary tale with statistics that the average adult has one large breast and a testicle.

It is now several days after this article was posted. I agree with the observations and analysis, including the forward projections included in it.

Congratulations for a broad, well presented summary of the situation which has now pertained in Texas for 6 days and for the balanced conclusions that (a) this is a system problem and (b) electricity is not optional – it is an essential service that warrants higher standards of reliability than, unfortunately, have been achieved in Texas.

Great post, thanks.

My comments are restricted to apparent parallels between extended weather driven price hikes in Texas compared to those in AUstralia.

Prices going ballistic for sustained period of time driven by extreme weather is less likely in Southern Hemisphere then Northern Hemisphere. Why? The polar vortex of the SH is much more stable than its NH counterpart. Whilst we can get big anomalies stable polar vortex means, they would be expected to be of much shorter duration (intensity?) then our friends up North.