The new markets (1-second raise and 1-second lower) started on Monday 9 October, 2023.

The week prior we noted the imminent start on WattClarity and since go-live a number of observations and initial reviews have been noted.

One such online observation was made by Paul via LinkedIn that LOWER1SEC prices were higher than RAISE1SEC prices.

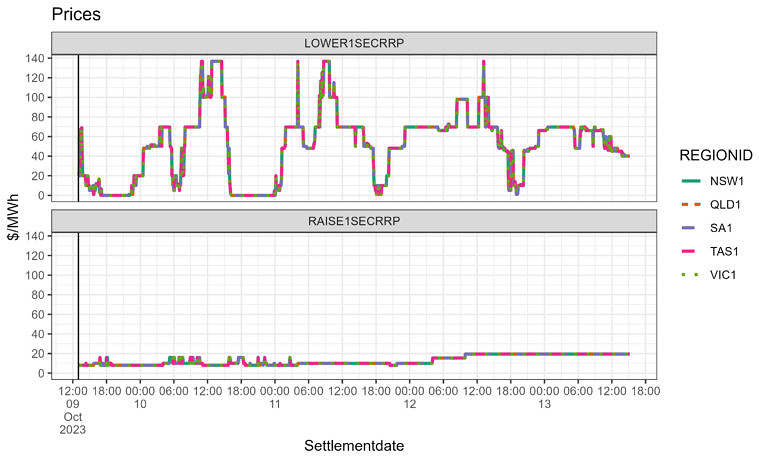

This now appears to be a consistent feature as shown in the chart below:

- LOWER prices are seen fluctuating regularly between 0 and 140 $/MWh. RAISE prices remained generally steady around 20 $/MWh.

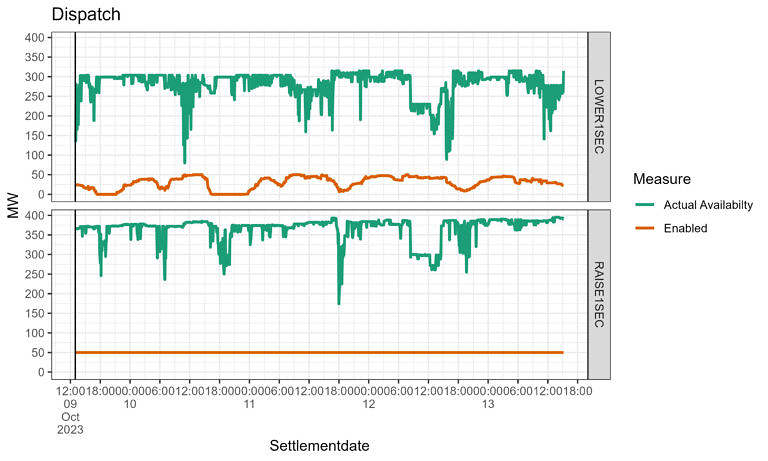

The associated enablement levels, which are currently capped at 50 MW, and availabilities over the week are captured as follows. There’s a healthy amount of capacity being offered to meet the 50 MW-max requirement

Nested in the comments of that LinkedIn post were some suggestions as to what is driving the difference between raise and lower. Mitch O’Neill, pointed towards C&I aggregators – they tend to be participating in RAISE1SEC only (not in LOWER1SEC) service and are offering that service at lower prices.

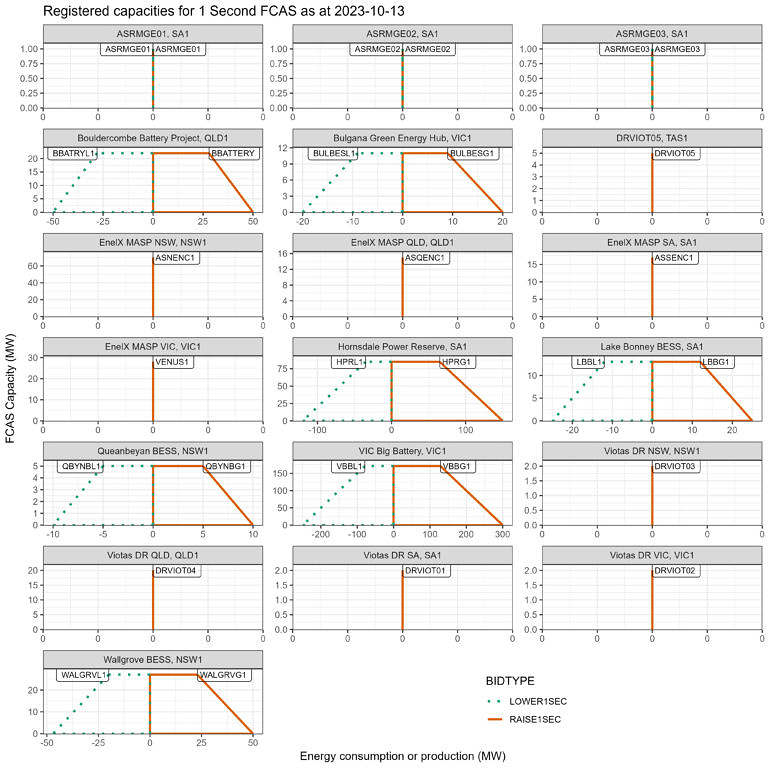

We can see in the next chart how the EnelX and Viotas units (I presume C&I aggregations, but difficult to know for sure) are indeed registered for RAISE1SEC only (by not having a trapezium for the LOWER1SEC bid type.

The chart above also captures the energy-related restrictions on capacity of the FCAS service, by drawing the trapezium informed by how the maximum FCAS capacity should be reduced as energy changes, using the registered upper limits.

We can see the batteries have reducing FCAS capacity once their energy service is committed above a certain level. Note these setting are upper limits and may be different for dispatch due to the submitted values of the unit’s relevant FCAS offer.

I’ve aimed to represent the capacities and enablement restrictions better than the earlier article with this chart (thanks to reader AB for emailing in a query that triggered awareness).

But coming back to the offers, the bid stack charts from ez2view provides a convenient way to inspect bids and offers.

The screenshot below captures enabled volumes (the light grey dashes) for:

- LOWER1SEC – hovering generally in the $40 – $150 offer range for most of the week. The enabled volume line is the light grey dashed line.

- RAISE1SEC – the enabled volumes line hovers over offers in the $1 to $40 range.

- We can also note the larger volume of RAISE1SEC offers in the min to $1 bucket, confirming that while enabled volumes are not appreciably different between the two markets (capped at 50MW) the offers underpinning them are.

Another observation – roughly half of the available capacity (both markets) is offered at prices above 10,000 $/MWh.

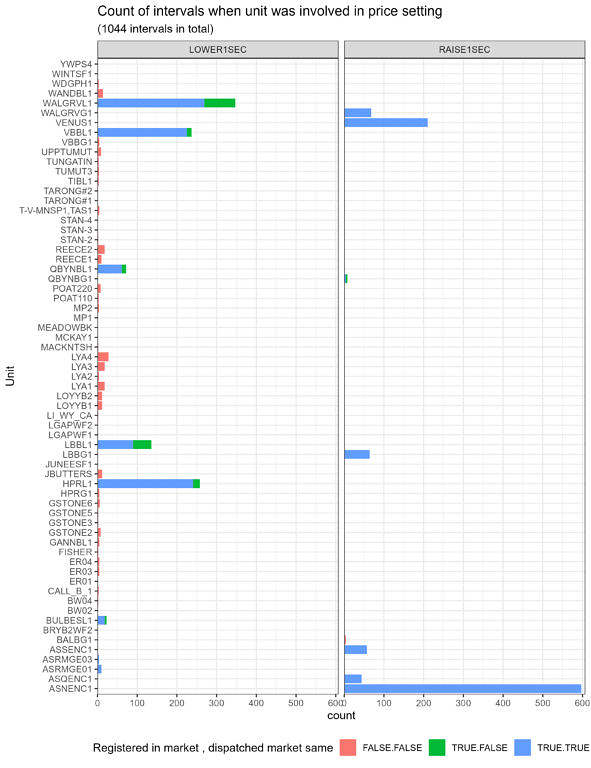

Price Setting

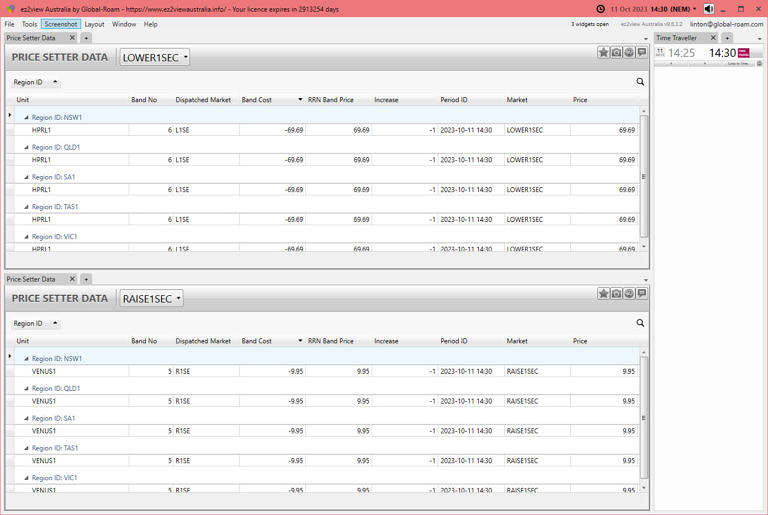

We can check which units are setting the prices in these markets using the price setter widget in ez2view.

For settlement date 14:30 on the 11th, by way of example:

- HPRL1 (the Hornsdale Power Reserve battery) set the price in the LOWER1SEC market with its offer in that market.

- VENUS1 set the price in the RAISE1SEC market, with its offer in that market.

But that’s just one interval. So we’ve tallied the numbers to ascertain which units are setting the price most frequently, across all intervals to-date.

- VENUS1 has set the price in the RAISE1SEC market just over 200 times (almost 20% of intervals). But it is EnelX’s ASNENC1 that is involved the most (over 50% of intervals).

- On the lower side, price setting is set most often by the batteries; Walgrove, Vic Big Battery, Hornsdale Power Reserve and Lake Bonney Battery. Notably, also, we can observe in the red and green bars that the price setting sometimes involves bids in other markets.

The counts can add up to a little more than the total number of intervals because more than one unit/offer combination can be involved in price setting for a given interval.

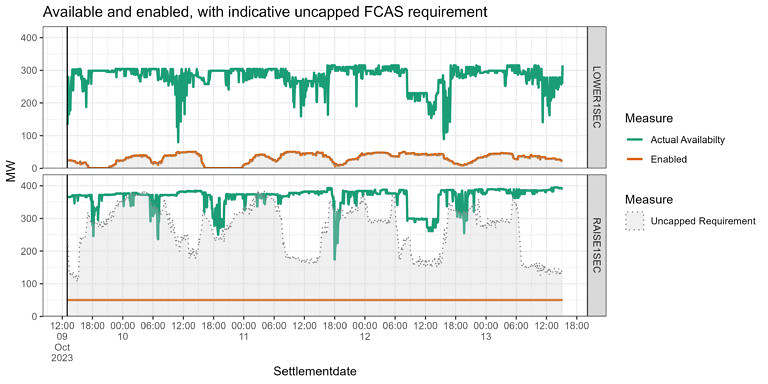

Just to come back to the total requirement again. Allan O’Neil noted in that same LinkedIn exchange that there are actually another two FCAS constraints now in the set for global 1-second FCAS constraints. They appear to be evaluation/monitoring constraints, configured never to bind. But the description informs us that they represent uncapped requirement levels.

Charting these, with some adjustment of the constraint’s raw RHS values, we can gauge how uncapped 1Second FCAS requirements compare to their capped versions:

- Lower: No change

- Raise: Between two to six times higher than the current cap of 50 MW.

It will be interesting to see how these current 50 MW caps change in the future, and how the corresponding registered capacity and offer stacks evolve to meet any new and increased levels.

Would be interesting to see what is being offered by coal units for the lower (runback) service. Prices seem to spike around middle of the day when solar is at maximum implying coal units are sitting at minimum load with nowhere to go backwards. Implies to do so would involve stinks like removing a mill from service incurring coasts in expensive auxiliary fuels to do so, or even decommitting a unit that will then be needed in the evening in the stack. Western Australia has been here for a while now. Runback is a bigger issue than spinning reserve.