Today (Thursday 31st August 2023) the AEMO has published the much-awaited 2023 update to the Electricity Statement of Opportunities (ESOO) for the NEM. That first article about this today was us was to collate the various news media articles that we’ve spotted with reference to the AEMO modelling, and the report.

What follows here (and in dribs and drabs in between) are 7 thoughts that jumped out at me, and which I had time to write up today, with respect to this headline market modelling report. More thoughts will need to wait until another day…

Observation #1) What’s the purpose of the ESOO?

First and foremost (really before I even open it up) I think back to that question we originally asked in GenInsights21 and then shared with a wider audience here on WattClarity … ‘What’s the Purpose of the ESOO?’ Let me explain …

It’s not that we think the ESOO has zero purpose … the complication is that at times its seemed to have too many different purposes, and that this can potentially be the point of confusion:

(a) Internally, in the process of completing the modelling and putting the report together;

(b) But also (and most importantly) externally, as different audiences read different things into the ESOO because they’re each assuming it is serving different purposes.

If you have not already read the article, you might find it useful to set the scene:

After scanning through the ESOO 2023, it seems to me that the AEMO has taken steps to address these (sometimes conflicting?) purposes within the document, which is a great enhancement!

Observation #2) A hockey-stick of USE projections … hence the media articles about ‘blackouts’ etc…

It’s not really any surprise to us that the AEMO projections are looking pretty dire … assuming just what is currently committed proceeds.

I’ve lifted out these thoughts as ‘With the 2023 ESOO report, different views about which USE figure should the AEMO have led with?’ but it’s worth highlighting them in here as Observation #2:

Observation #3) What’s the contingency plan?

My paraphrasing of the situation presented in the ESOO, and typified by the two charts above is that:

1) Based on current trajectory, we’re in for a world of pain ahead;

2) But this might be alleviated if (donning rose-coloured glasses) the trajectory somehow changes and developments proceed swimmingly.

… hence the increasingly strident calls from people like Daniel Westerman today (but really these are the same as what he’s been making for months (such as in June 2023 at Australian Energy Week), and one might wonder if anything has really changed?

I’ve been wondering for many months ‘what’s the contingency plan’ …

… note what follows was originally in-line in this article but has now been lifted out into ‘The 2023 ESOO again prompts the question … ‘what’s the contingency plan’?’ so it can be separately addressable

Observation #4) Three paradigms

As I have skimmed through the ESOO over the past few hours, it’s occurred to me that different readers will have been thinking in different paradigms … and conversations about the ESOO between different people may have been needlessly confused by ‘talking at mixed paradigms’…

It’s important to recognise that (whilst we would ideally like all three paradigms to be closely overlapping) it’s not necessarily true that this is the case:

Paradigm #1) What’s the underlying state of the grid (and the grid) – now, and into the future?

First and foremost, readers of the 2023 ESOO will most likely be concerned about what’s actually the case in terms of the state of the grid (and the market that supports it), now and into the future.

Paradigm #2) What do AEMO models show?

Keeping in mind Observation #5 (below) that ‘modelling is a mug’s game’ … and in particular that ‘any model’s just a model – it’s not reality’, it’s important to recognise that the AEMO models are not a perfect representation of reality in the grid. Just take two examples, quoted from the ESOO itself…

Example #1) Better modelling of actual wind conditions at times of high temperatures

I’ve lifted this one out as a separate (shorter) article here earlier today:

Example #2) Modelling only factors in ‘System Normal’ transmission constraints

I’ve also lifted this one out as another (shorter) article here earlier today.

Paradigm #3) How the AEMO describes the modelling results in the document itself

In my skimming through the document, I was pleasantly surprised at (what seems to me) a much richer document in terms of helping the reader to understand both:

1) The nuances of the model; and also

2) The differences in modelled results if changes in assumptions are made (such as in relation to the sensitivity cases identified above).

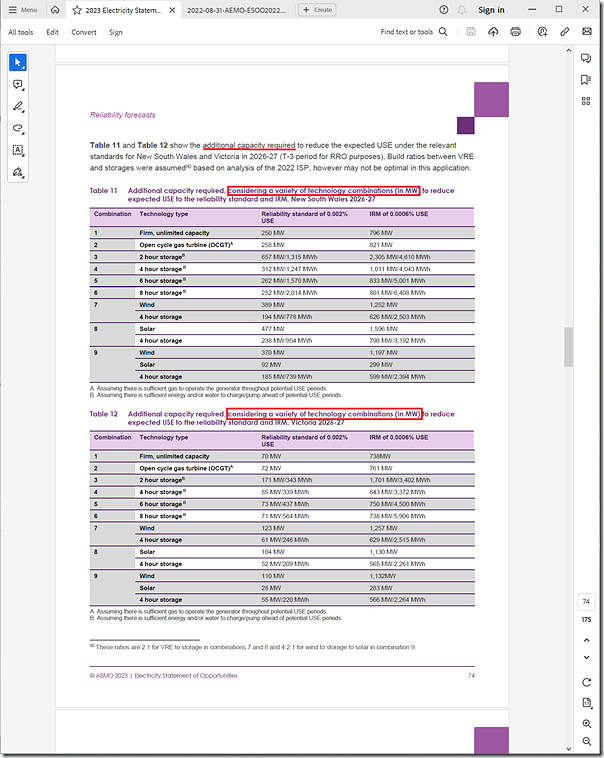

Almost like the team inside the AEMO have taken onboard some of the challenges we raised in the ‘What’s the purpose of the ESOO?’ article noted above … such as with respect to the challenge of a ‘Purpose #2: A genuinely focused ‘Summary of Commercial Opportunity’’ report … such as in Table 11 and 12 on p74/175 as copied below:

Whatever the genesis of enhancements like these, they are great ones!

Observation #5) Modelling is (still) a Mug’s Game

I’ve written before about how ‘forecasting is a mug’s game’ … and those who’ve not read that article before (or who have forgotten what I nominated as the three big gotchas)

Worth repeating these below…

Flaw #1: A Model’s just a Model – it’s not reality

… note comments above about some improvements in the modelling process (and in the presentation of results).

Flaw #2: Garbage In = Garbage Out

… note comments above about some improvements in the modelling process (and in the presentation of results).

Flaw #3: Humans are human … Everyone talks their book

… even the AEMO … and yours truly!

Observation #6) Coal (and large gas) unit EFOR is a large and growing issue

I’ve separately noted this earlier in ‘The 2023 ESOO report shows coal unit EFOR is still a significant factor’:

Observation #7) Challenges on the demand side

As one final observation today, in skimming through the 2023 ESOO, a number of things jumped out at me with respect to the demand side of the supply-demand balance.

So I have separately written this up as ‘With the 2023 ESOO report, some real head scratching about Demand Response!’ here:

More to come…

It’s been a long day today (including some time this morning helping the team with these Data Outages) and I have run out of time for today! More thoughts on the 2023 ESOO (and also on the Capacity Investment Scheme, as discussed yesterday) will have to wait until later…

Leave a comment