Note that I have this out as a separate, short article for several purposes – including that it will be more directly referenceable in future.

It’s meant to tie in with today’s broader review of the 2023 ESOO here (which is still being completed).

————————

Let’s start with a full disclosure that we’ve been a keen supporter of large energy user providing a form of Demand Response into the NEM for almost 20 years now:

1) On 3rd January 2019 we wrote about ‘Some highlights on our Demand Response journey (to 31 Dec 2018)’ on a more focused site; and then

2) On 7th January 2019 we wrote about ‘Real Barriers we’ve experienced in the growth of Demand Response in the NEM’.

————————

So it was with keen interest that I kept an eye out for the assumptions AEMO was making in the 2023 ESOO with respect to Demand Response (which they now call Demand Side Participation … or DSP for short).

And, wow, there’s some head scratching to do here…

(A) A miniscule number of Negawatts in the WDRM!

Remember how, with great fanfare (and some cost to the market – including the introduction of Tripwire #3) and with the urging of a particular aggregator we established a Centralised Negawatt Dispatch Mechanism almost 2 years since 24th October 2021 (the AEMC in their wisdom called it ‘the WDRM’).

Out of curiosity, and in the context of what was presented in the 2023 ESOO, we firstly delved into some details of what was seen in terms of participation:

1) On 4th November 2022, celebrating one year since it started, Linton wrote ‘Wholesale Demand Response in the NEM – One year on by the numbers’.

(a) a key point Linton made then was that ‘To-date, we’ve seen the registration of 66 MW of response capacity from 12 demand response units’.

(b) That article also covered a bit about their operations.

2) Time permitting we’d look to do a similar thing in November 2023, but

(a) Want to guess how many MW are registered as negawatts now 10 months after Linton’s articles above?

(b) It’s only 67MW registered … a single megawatt higher than a year ago.

How underwhelming … (or some might say a joke).

————–

As an aside, one of our team members has pointed out that EnelX wrote (on 25th October 2022) that:

‘Enel X has seen a strong and growing appetite from businesses to participate in the wholesale market, signing up more than 100MW3 of wholesale demand response capacity to date.’

… but it’s important to read the footnote (3) there, which says:

‘Registered capacity and capacity to be enabled’

Also notable was the $3.7M grant from ARENA (which EnelX notes here in July 2023) …

‘to support flexible demand solutions in the small commercial and industrial refrigeration sectors’

… and

‘an estimated 500 MW of potential flexible demand in refrigeration across Australia’s National Electricity Market. ’

… but it seems that funding has (at least initially?) a much lower target:

‘Enel X’s ‘Unlocking Flexible Demand in the Commercial Refrigeration Sector’ program will aggregate more than 20 MW of flexible demand from businesses across the National Electricity Market’

————–

(B) What’s assumed by AEMO, in relation to Demand Response?

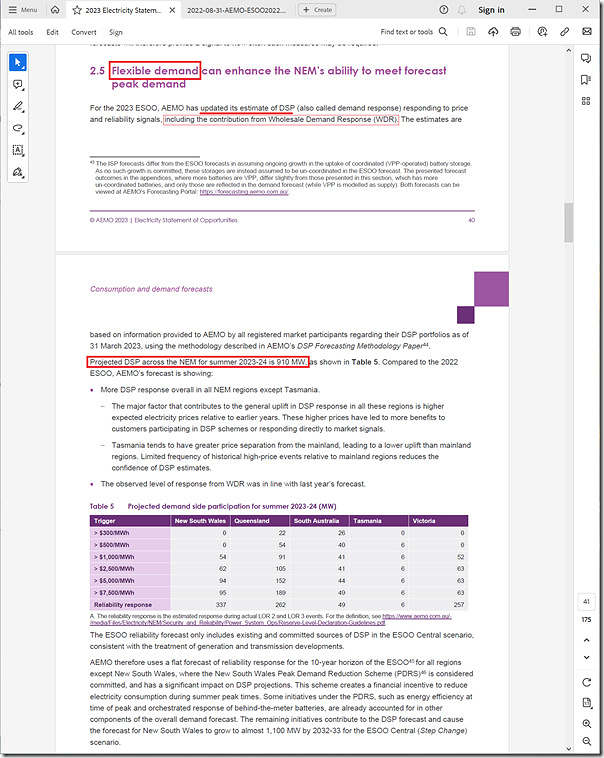

In the meantime, Table 5 in Section 2.5 from the AEMO (p41/175) provides some context:

Key points here, in AEMO’s words are:

‘AEMO has updated its estimate of DSP (also called demand response) responding to price and reliability signals, including the contribution from Wholesale Demand Response (WDR).’ [including, but clearly not limited to]

… and

‘Projected DSP across the NEM for summer 2023-24 is 910 MW,’

Clearly the lion’s share of this Demand Response does not come from the WDRM.

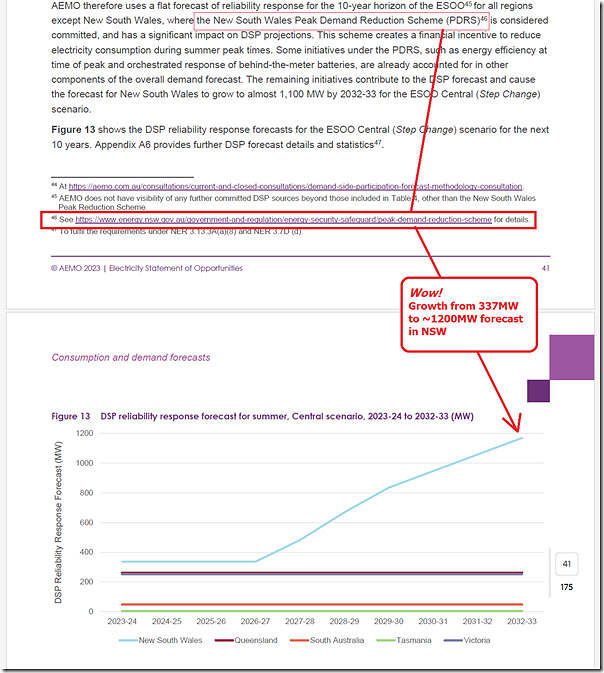

(C) A big growth trajectory forecast for NSW?!

So it was with particular interest that we read on, to see a significant (i.e. three-fold!) expansion in Demand Response forecast for the NSW region as follows:

Wowee!

A growth from 337MW (assumed now) of Demand Response in NSW to ~1,200MW (assumed in 10 years) as a result of the NSW Government’s Peak Demand Reduction Scheme is the standout here. Will need to invest some time to read through this material to learn what this is all about…

On their website they note:

‘The scheme started with a demand reduction target of 0.5% in 2022. This will increase to 10% by 2030. ’

Aiming for a 10% reduction in peak demand is a laudable goal … will need to review the details to see how credible with think it is …

(a) especially given AEMO has assumed this in some of the scenarios in the ESOO 2023

(b) but also because we might be able to help in some way?

That’s all for now…

Leave a comment