Perhaps there is something big that I am missing (if you can see where it is, please do let me know!) … but it does seem that there is an almost visible aura of unresolved cognitive dissonance washing across the NEM in recent times.

Only this morning I saw Mark Ludlow from the FinReview quip the following:

… and whilst the case of Stanwell CEO (it seems, to me and to others – though maybe we’re all missing something big?!) being moved aside for stating the bleeding obvious is quite obvious to poke* holes at, it’s far from the only example…

* for instance, I also did quip about the potential Position Description for his replacement as CEO.

(A) Suspending Logic and Reason?

In addition to a very banana-bender version of ‘squaring the circle’, we have the super-secret financial support being provided by the Victorian Government to EnergyAustralia to ensure that the Yallourn station remains open until its (somewhat earlier) retirement date of 2028.

More generally, though, there’s been a degree of hyperventilation that’s followed on from the ESB noting in their Options Paper just last week about some form of broader ‘capacity payments’ (see this article from 2015).

Though there is some mystery surrounding the departure of Brett Redman as CEO from AGL Energy, I wonder what the Board’s view would have been had Brett’s preference would have been to run what might be named as NewSexyGreenCo, and not the unwanted sibling the OldCrapAndUnSexyButStillEarningTheRevenueCo?

… and, of course, there is Angus Taylor’s ongoing crusade to build a gas-fired generator at Kurri Kurri. Since it was added into our Asset Catalog as a specific prospective project it’s been tagged with reference in 85 discrete news articles (a few more to add this week, no doubt).

Thankfully talk of a HELE coal plant at Collinsville (not the place you really need to build anything, let alone coal) seems to have gone the way of the dodo.

It’s almost as if we’ve reached the point where more people are recognising what we wrote about in the GRC2018 … that the methods that have been used to support entry of new supply options have been (in some ways) hindering, and not supporting, the energy transition.

As announced on 20th April 2021, we’ve* commenced the massive analytical exercise that is the compilation of the follow-on to the (very well received) Generator Report Card 2018 report, released 2 years ago now.

We’re enjoying the ability to deeply explore some of the issues and challenges apparent in what’s been happening recently (not being commissioned by any particular stakeholder), and look forward to having ‘Generator Insights 2021’ released sometime in Q3 2021.

—————————–

* Readers should be clear that the ‘we’ here is much more than our team at Global-Roam Pty Ltd :

(a) the GenInsights21 release is being co-developed with Jonathon Dyson’s team at Greenview Strategic Consulting

(b) and also with the assistance of a growing number of external analysts who we see deliver useful independent perspectives … that can help to provide a broad, and a deep, piece of analysis that confronts many of the challenges in this energy transition head-on (using detailed analysis of 22 years of NEM history to identify what we can learn).

(c) so please do let us know if you know of others who could also help us deliver an even-more-useful piece of analysis!

If you don’t know of people who can help us, you could still help us by providing your suggestions as to the types of analysis we should be including (i.e. the types of questions we should be addressing) in GenInsights21?

—————————–

Don’t forget the opportunity to send in your pre-order today to secure your discounted access to the final copy, when it is released.

(B) How mothballing was done in the past…

In today’s article that Mark links to above he wrote (with respect to mothballing):

Stanwell did the same thing with its Tarong power station in 2013-14 – when wholesale prices were also low – helping to reduce their fixed costs. The unit was then brought back online a year later when the Swanbank E power station was closed.

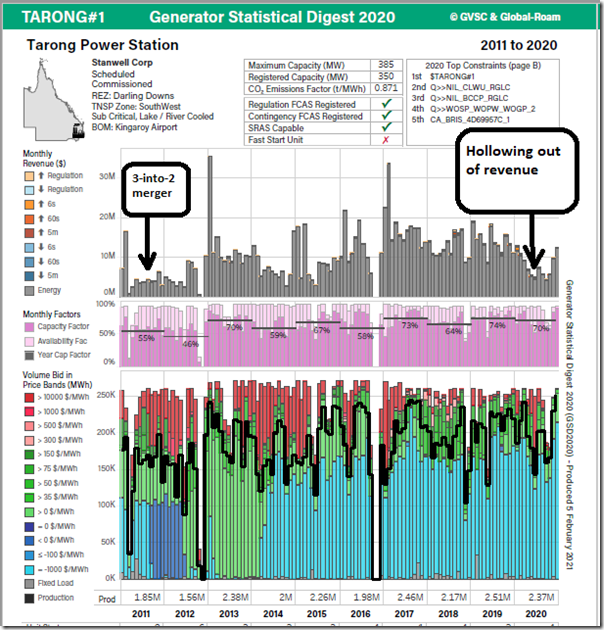

Flipping open our electronic copy of the Generator Statistical Digest 2020 onto the 10-year historical view that’s part of the ‘A’ Page supplied for each unit, we can quickly see what Mark is talking about:

(B1) Tarong Unit 1

Here’s the top half of the ‘A’ page for Tarong unit 1:

We can see a period of healthy revenues, in historical terms, from 2017 to 2019 (approx) but 2020 revenues being hollowed out – not least because of the rise in negative pricing due to waves of new capacity being induced to enter the daylight periods of the market. Almost exactly 10 years ago today the QLD government engineered a ‘3 into 2 merger’ across its GenCos to address struggling revenues … which led to the ability to mothball two units at Tarong (amongst other initiatives) as we will see below…

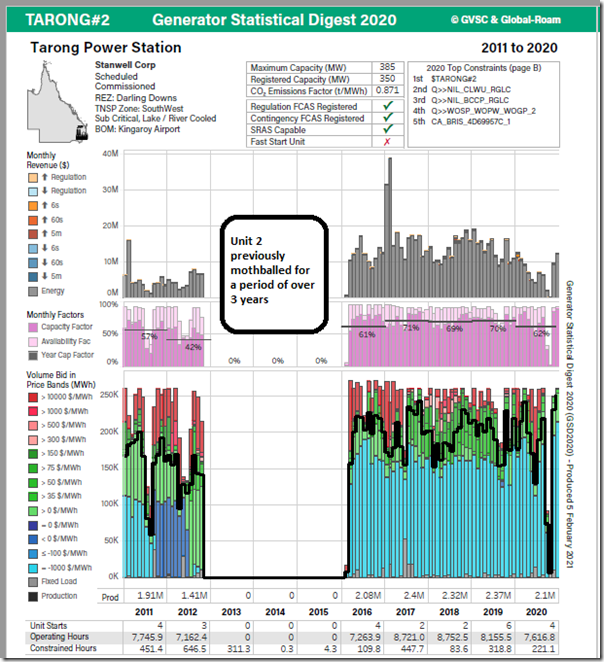

(B2) Tarong Unit 2

Here’s the same page for unit 2, showing the 3-year-long period during which it was mothballed:

As noted back in 2017, the 3-into-2 merger was one of the 3 main reasons why QLD spot prices rose in the period since that time.

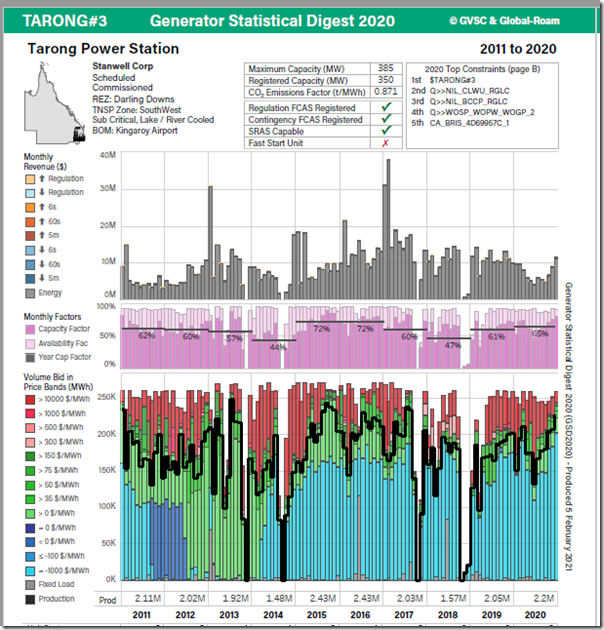

(B3) Tarong Unit 3

Here’s unit 3:

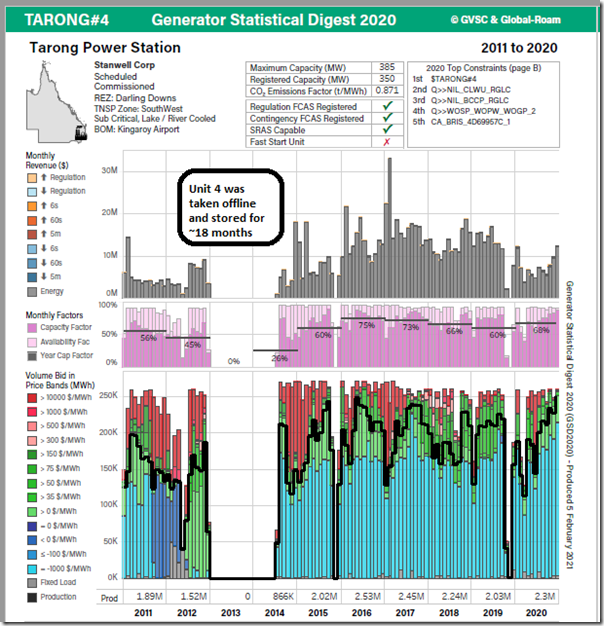

(B4) Tarong Unit 4

Here’s unit 4, which was mothballed for only ~18 months:

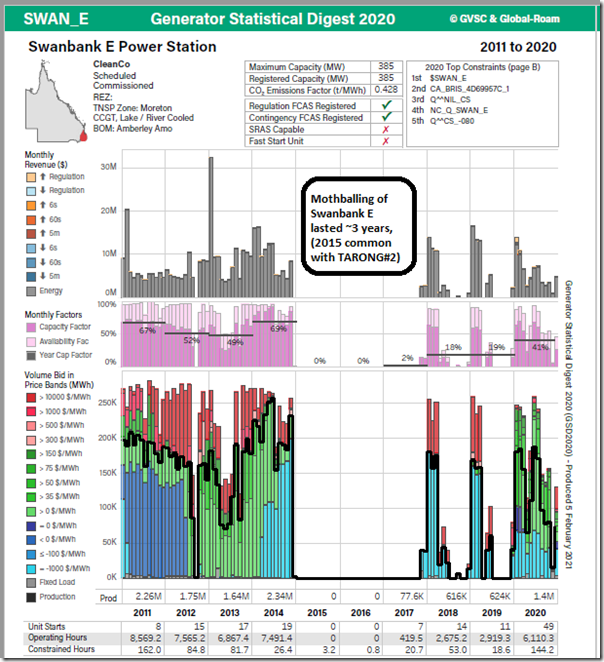

(B5) Swanbank E

Given that Mark also mentioned Swanbank E in his news article, I have added this in for some context for the readers:

Given that the (newly merged) Stanwell Corporation used mothballing as a tactic back in 2013 to confront precarious profitability (amongst other approaches), it seems entirely logical that they would have been thinking of doing the same to confront the pain coming down the pipeline at them as the energy transition continues.

Of course, given the accelerating energy transition (which the QLD Government is helping to sponsor with it’s own challenging 50% renewables target), it seems quite plausible that some units would never return (the seasonal closures for Northern Power Station in SA did not ensure longevity).

Very strange that (it seems on this occasion – unless I am missing something big?!) that this has already been ruled out as an option this time?!

The only thing being ‘ruled out’ is talking about mothballing, or closing down, the Stanwell generators.

QLD total annual demand is about 60 TWh per year. The 50% RET means 30 TWh has to come from wind and solar. Currently about 8 TWh come from wind and solar. The government requires at least another 22 TWh of wind and solar.

In 2019/20, gas generated 5 TWh and coal 46 TWh.

To get wind and solar up to 30 TWh, and keep the 5 TWh of gas, requires 20 TWh of coal to be displaced by wind and solar.

Stanwell operates about 3000 MW of coal generation, delivering 18 TWh in 2019/20.

To make the 50% target, Stanwell has to close all its coal power stations.

But I’d put money on Stanwell building a wind or solar farm, or at least entering more long-term contracts to underwrite wind and solar.

100% of QLD wind farms are underwritten by the state, and 30% of solar farms. That public ownership rate will continue, and likely increase, as the deadline for the 50% RET draws nearer.

This gov has free reign until at least 2024, with no senate to reign it in. We’ll see a big public spending splurge shortly on wind and solar, plus the transmission necessary to connect it all.

Wholesale is negative more often, demand is not increasing. There is no incentive for private investment.

The existing public-owned generators will run at a loss, and the new RE will run on over-priced fixed price contracts. Subsidies both ways, plus ongoing subsidies for rooftop solar, plus public spending on transmission, plus distribution costs rising.

So much to look forward to.

Working from the consumer back, all consumers want is reliable, available & affordable energy.

In the absence of empirical evidence proving the case against CO2, I believe all Australia therefore needs is a simple, easy to understand, sensible Energy Policy that’s;

• Technology neutral (eg fossils fuels, hydro, the ‘Unreliables’ of wind & solar, Bio-mass, batteries including the nuclear option – ALL on the table),

• NO subsidies ie a level playing field.

• Generators choose their own technology in a free, fully transparent, competitive market place where market forces prevail.

• Generators simply contract in advance (auction?) executing a firm commitment to deliver guaranteed power 100% 24h/day to meet forecast demand (by the likes of the AEMO) for the next day/week/month market needs at their BEST competitive price(s).

• Substantial financial penalties to apply for ANY generators failure to meet contractual commitments in accord with clearly defined 100% QOS standards (not withstanding force majeure in the unlikely event of natural disasters eg earth quakes, floods & bushfires etc).

If those T’s & C’s don’t appeal to the power generating industry, tough. Just revert the power generation industry back to whence it came ie respective State Governments & be done with it.

“If those T’s & C’s don’t appeal to the power generating industry, tough.”

But that’s the point. The problem is not technical but political because you’re outlining the level playing field we as consumers needed all along with this ‘energy transition’ as it’s euphemistically described. Instead we have State sponsored dumping by solar and wind driving out dispatchable coal with a Catch 22 situation evolving.

Normally the ACCC would be all over such market behaviour like a rash but they know their politics and hence their stony silence. To implement the level playing you propose is the only logical and rational position. However somebody has to break it to all the voters with rooftop solar they’ve been led up the garden path and their highly correlated and fickle reactive electrons are no longer wanted by their equally generating neighbours. If they don’t like it tough but that’s the tough political message no politician wants to be the bearer of. So we all continue ‘transitioning’.

What exactly are we transitioning to in the absence of telling it like it is? Well that’s continually trying to disprove a fundamental axiom of engineering. Namely that you can’t construct a reliable system from unreliable componentry and count me a skeptic that we’ll manage to disprove it.

a wealth of knowledge but the presentation and embedded logic is very hard to follow, for me at least. In providing the information, please don’t assume the reader knows all the background to your concise points.

Could the QNI upgrade works which have restricted daytime exports in late 2020 be a factor in the reduced Tarong revenue in that period?

Instead of “the super-secret financial support being provided by the Victorian Government to EnergyAustralia”, why not be above board and pay them to close coal fired stations down provided they use the funding to support the development of renewable energy?

It’s not a question of paying coal to close down but a question of timing as they’re going one by one anyway because the deck’s been stacked against any reinvestment returns. They’re simply running on sticky tape and string now to eke the last returns from their stranded assets. As they go it leaves a gaping hole with dispatchability and that’s one thing politicians understand. Or rather they understand the punters won’t be happy chilling in the dark with warming fridges etc.

Suddenly a unicorn Tesla big battery appears pronto to take the spotlight off the diesel gennys guzzling copious tankers full of refined fossil fuels. What that’s really exposing (along with backhanders to coal to stay afloat) is the dire lack of storage to make wind and solar dispatchable here and now. That’s the inherited problem can that’s being kicked down the road politically. No matter the clever technical folk at the AEMO have it all in hand as they can work miracles can’t they?

Interesting development but my first thought was Tesla owners beware of Greeks bearing gifts-

https://www.agl.com.au/get-connected/electric-vehicles/smart-charging-trial

Meanwhile I note at the global level some battery enthusiasts are concerned about scarcity for the first time as well-

https://www.msn.com/en-au/news/uknews/insufficient-recycling-of-rare-metals-could-hinder-climate-efforts-experts-warn/ar-BB1gzmnW