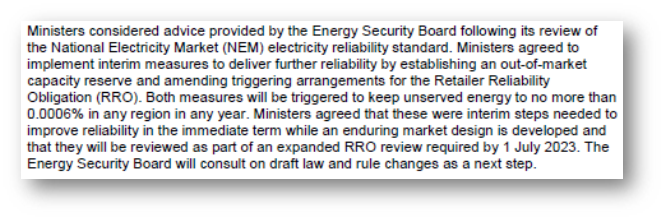

Amidst the tsunami of news and reports about you-know-what, it would have been easy to miss the communique from last Friday’s meeting of the COAG Energy Council – presumably held by video- or teleconference – which contained a cryptic paragraph announcing that this peak group of State and Federal energy ministers had agreed to some significant changes to the NEM’s reliability arrangements, including trigger arrangements for the recently-implemented Retailer Reliability Obligation and establishment of an “out of market capacity reserve”.

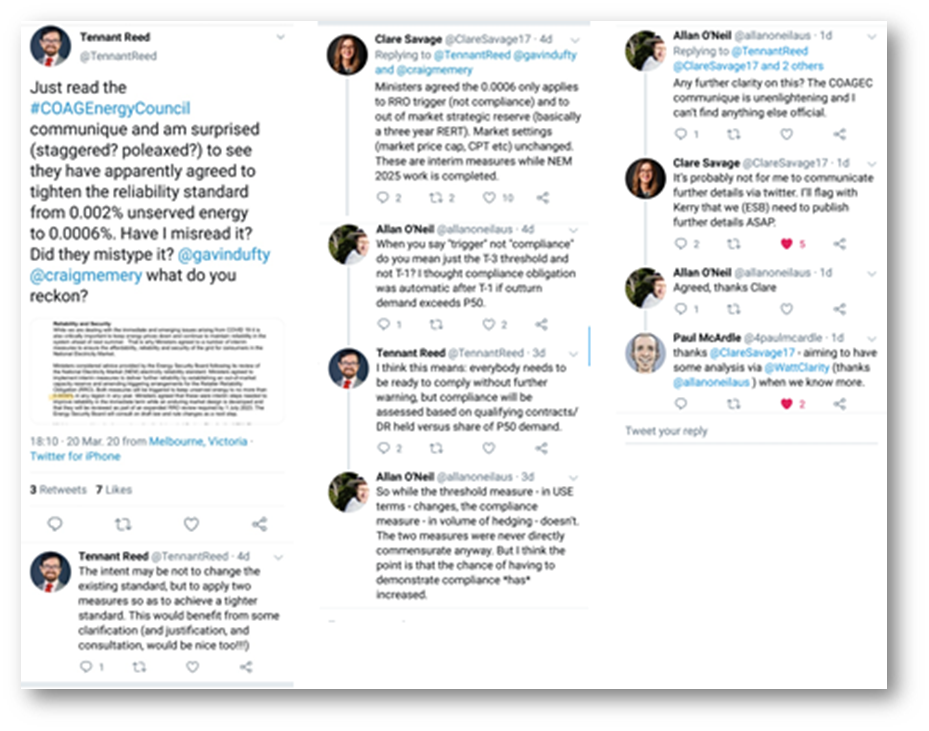

But there are some very keen observers of these things, one of whom quickly alerted the Twitterverse, leading to a small amount of additional information, but certainly far from full clarity

(see the thread above this comment here)

Although we are still a long way from certain about exactly what these changes entail, this note describes the little we know so far, based on very limited public information and some very shallow digging behind the scenes. But nothing here should be taken as definitive, pending those crucial further details from the ESB.

Three Key Changes

There appear to be three key changes signalled in the COAG EC decision:

- Elements of the Retailer Reliability Obligation are only triggered after AEMO forecasts risks to reliability (measured as “expected unserved energy” or “EUSE”) above a threshold level. This threshold would be reduced from its current 0.002% EUSE to 0.0006% EUSE, making it more likely that the RRO will be triggered.

- The RRO currently involves a two-stage process of “T-3” and “T-1” timelines nominally 3 years* and 1 year ahead of a given reliability assessment period. The T-1 stage, which triggers key compliance obligations upon retailers and certain end users, can only be enabled if an earlier “T-3 Instrument” had been issued. It now appears that the “T-1” stage can be triggered independently of any previous T-3 assessment – reducing the effective notice period for compliance.

(* In the special case of a T-3 instrument made by the SA Minister for Energy, a shorter timeline applies) - Creation of an “out of market capacity reserve”, described as “basically a three year RERT”. The RERT (Reliability and Emergency Reserve Trader) is a mechanism under which AEMO can contract with demand and supply-side resources not participating in the market in order to bolster physical reliability. AEMO’s current ability to do this is limited to a twelve month horizon and only when forecast reliability risks exceed 0.002% EUSE. It appears that the “out of market capacity reserve” will have a longer three year horizon and its procurement can be initiated at a more stringent reliability threshold of 0.0006% EUSE.

Readers who watch this stuff will know that the 0.002% EUSE threshold currently used for RRO and RERT triggering is the NEM’s formal Reliability Standard. Apparently this Standard itself is not being changed, but the COAG EC decision appears to supplant the Standard in important respects.

It also seems that there is no change to the various RRO compliance processes and obligations that are triggered if a T-3 or T-1 Instrument is made, although the likelihood of that triggering is clearly greater under a more stringent threshold, and the period of notice can be significantly shorter if the T-3 and T-1 RRO processes are indeed being de-linked.

The communique also emphasised that the signalled changes are “interim steps”, that the ESB will now consult on draft law and rule changes for their implementation, and that these changes would be rolled into an overall review of the Retailer Reliability Obligation due by July 2023.

Background Reading

An earlier WattClarity article outlined key aspects of the RRO mechanism, and provided a fairly detailed timeline of key dates and processes.

The out of market capacity reserve / extended RERT clearly ties back to fundamental changes to the NEM reliability framework that AEMO has been pushing for over the last couple of years, notably in a formal rule change proposal to the AEMC (most of which was knocked back), and also in its recent Electricity Statement of Opportunities (ESOO) projections of NEM reliability, discussed previously in multiple WattClarity articles.

Finally, it’s interesting to speculate on whether the 0.0006% EUSE threshold aligns in any way with one of AEMO’s earlier proposals to modify the NEM Reliability Standard itself so that unserved energy of 0.002% (of total annual load) would change from being a threshold for probability-weighted forecasts, to specifying a quantity of energy unserved by the market which is not exceeded more than once in ten years. AEMO’s analysis in the 2019 ESOO noted that under current settings with an EUSE threshold of 0.002% this might be something more like a one in five year occurrence. The changes agreed to by COAG EC may in effect be another way to partially implement AEMO’s proposals.

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be sporadically reviewing market events here on WattClarity Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

Leave a comment