On Friday 29th July 2022 the AEMO is releasing its Quarterly Energy Dynamics (QED) for Q2 2022.

Given what’s been happening with the ‘2022 Energy Crisis’ and earlier coverage here … particularly through the Administered Pricing and Market Suspension beginning 12th June 2022 … we thought it would be useful to publish this article for future reference. Of particular interest to us (as it will be to many) are the variety of factors that AEMO flags as contributing to the extremes of price outcomes (which we’d earlier reviewed for Q2 2022 here).

A quick review of an embargoed copy of the QED reveals a number of factors:

(A) Headline factors

In the Executive Summary of the QED (at the bottom of p3/66) the AEMO writes:

‘Key factors underlying the extraordinary rise in wholesale prices in Q2 included:

– The impacts in local fuel markets of extremely high international prices for traded gas and thermal coal.

– Reduced availability of coal-fired generation, due to scheduled maintenance as well as long- and short-duration forced outages, driving high levels of gas-fired generation, which both raised electricity prices and put pressure on local gas markets.

– Physical fuel supply and hydrological constraints at a number of thermal and hydro generators which further limited their operational flexibility.’

It’s likely that much of the commentary that follows will zero in on these various factors – which I have re-ordered as follows:

(A1) Reduced availability of coal-fired generation

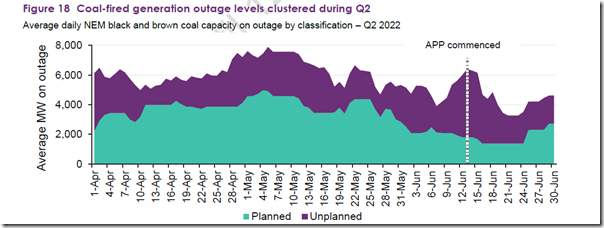

On p16/66 the AEMO notes:

‘While Q2 typically sees higher levels of seasonal planned maintenance on thermal generation units in preparation for winter (Section 1.3.1), unplanned outages of coal-fired units clustered at different points in the quarter, reaching highs of around 3.6 gigawatts (GW) in late April and then in the second week of June peaking at 4.6 GW leading into the period of administered price capping and market suspension (Figure 18).

… and here is Figure 18:

(A2) Physical fuel supply constraints for thermal generators

On p17/66 the AEMO writes about these for both coal and gas units as follows:

1) About Coal-fired units, the AEMO writes:

‘During the quarter some black coal-fired generators reported difficulties sourcing sufficient volumes of coal to generate at desired output levels, principally due to under-deliveries from key suppliers. Arranging alternative coal supplies can be logistically challenging or even infeasible at short notice. This increased reliance on other, often higher cost, generation sources.’

… and references this update from Origin Energy on 1st June 2022 and this update from Energy Australia on 18th June 2022.

2) About Gas-fired units, the AEMO writes:

‘Tight supply-demand balance in the east coast gas markets was also a limitation on fuel quantities available to gas-fired generators. As an extreme example, on 1 June AEMO invoked the Gas Supply Guarantee due to limits on gas supply available to generators and forecast lack of reserve conditions in multiple NEM regions on 2 June (Section 2.3.3). At other times gas supply limits caused dual-fuelled peaking generators to run on reserves of high-cost liquid fuel.’

(A3) Hydrological constraints for hydro generators

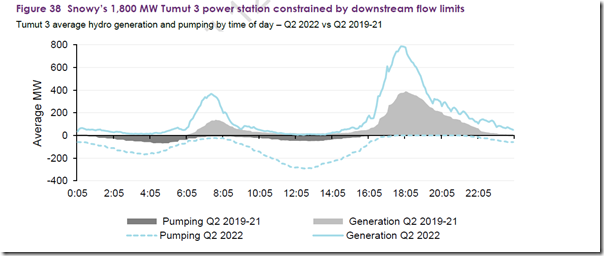

On p27/66 the AEMO notes:

‘At Snowy Hydro’s largest power station, Tumut 3 (1,800 MW capacity), high water levels in the downstream Blowering Reservoir and restricted release capacity into the Tumut River capped generation output despite record levels of pumping water back to its upstream storage (Figure 38).’

… with this chart presented as Figure 38:

(A4) Extremely high international prices for traded gas and thermal coal

The AEMO notes (p15/66) that:

‘Traded market prices for the NEM’s major thermal generation fuels rose to new highs in Q2. East coast gas market prices averaged $28.40/GJ, up from $9.93/GJ in Q1 and $8.20/GJ in Q2 2021 (Section 2.1). Export prices for Australian thermal coal averaged $514 per tonne in Q2 2022, up from $367/t in Q1 and $139/t in Q2 2021 (Section 2.1.1).

While generators may contract fuel supply in advance to match their expected output range, costs for purchasing additional fuel to support higher levels of generation, or for renewal of expiring contracts, can be strongly influenced by conditions in local and export markets for those fuels.’

(B) Other factors

However it’s important to note that those four factors above were not the only factors flagged by the AEMO in the QED Q2 2022. In a brief scan of this embargoed copy, I have seen a number of others – including these ones (added in no particular order):

(B1) Earlier/Colder weather

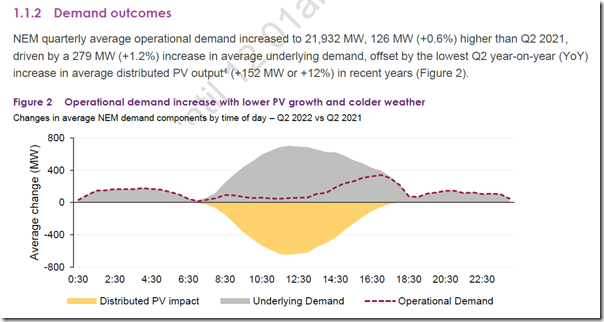

In various places in the QED the AEMO notes the rapid (and earlier-than-expected) arrival of colder weather drove Underlying Demand higher than in comparable periods … such as Q2 2021, for instance. The AEMO notes:

‘A series of cold fronts in early June over eastern Australia and extended as far as north Queensland, driving up heating demand across the NEM coinciding with record maximum demand in Queensland and spot prices rising.’

… and follows with this excerpt comes from p8/66:

(B2) Energy Limitations – such as protection of scarce fuel supplies, and sourcing additional fuel

Also on p16/66, when describing some impacts of the high level of coal unit outages, the AEMO notes that they had multiple compounding impacts on spot prices including:

‘• increased the dispatch of higher-priced supply from other generators, and

• raised fuel or water usage rates at those other generators which increased price pressures in local fuel markets and impacted short-term hydro storage levels.’

On p17/66 the AEMO notes:

‘Supply offers from gas-fired generators reflected high and rising prices in the east coast gas markets, discussed in Section 2, and the need to source additional gas in spot markets when dispatch levels increased…’

… and also:

‘Shifts in hydro generation offers generally follow overall changes in thermal generation offer pricing in order to manage limited water supplies, reflect the changing opportunity cost of water in storage, and maintain dispatch volumes within upstream and downstream flow constraints (Section 1.3.3).’

This factor was particularly visible to us when we wrote about Theory #2 in this article about ‘why capacity was withdrawn’.

(B3) Periods of low renewable generation

On p17/66 the AEMO notes that one of the reasons why additional gas procurement was required at these high (internationally-influenced) price was:

‘due to periods of low wind and solar generation’

… with a reference to this Media Update from Energy Australia on 21st June 2022, which also notes (as one of ‘four key issues affecting electricity supply and prices’):

‘weather patterns that have meant lower generation of wind and solar’

(B4) Network constraints

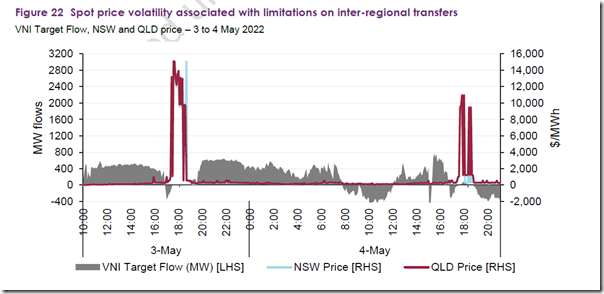

The AEMO notes (p18/66) that:

‘Network outages affecting inter-regional transfers contributed materially to a number of extreme spot price episodes, lifting spot price volatility and overall NEM average prices in Q2. Examples are covered in more detail in Section 1.2.3.’

… and further (p19/66) that:

‘A significant proportion of historically typical volatility events in Q2, where spot prices rose towards the MPC, were associated with transmission constraints which limited transfers of power between NEM regions. Figure 22 illustrates an example from early May where a transmission outage in southern New South Wales prevented northward transfers on the Victoria to New South Wales interconnector (VNI) during periods of extreme prices in the northern NEM regions.’

(B5) Others…

I’ve run out of time to extract more factors that the AEMO have noted…

(C) Hark back to GenInsights21?

We wrote in our own Executive Summary within GenInsights21 that…

‘As we worked through these questions via GenInsights21, several key data points led to the identification of three key challenges at hand:

1) Variability and Uncertainty are Increasing

2) Risks are Increasing

3) Complexity is Increasing’

… so, with that in mind, it was not a surprise to see how these four factors (and three challenges) were very much on display through Q2 2022 – with the AEMO highlighting at least eight contributing factors in the QED 2022.

If you read commentary that focuses on just one or two, be aware that those authors are just short-changing you…

Best suggestion would be to read through the QED for Q2 2022 yourself!

One big one is missing, and should be in bold and at number 1.

Seriously poor planning, on the eastern half of Australia.