With respect to this morning, we noticed that Ben Domensino had written ‘Six Aussie states below zero degrees this morning, more to come’ earlier today.

—

It was quite a brisk 90-minute walk home from the office this evening, given the widespread ‘lingering cold air mass’ that Ben spoke about in his article. Throughout the walk, my phone was buzzing with a spell of SMS alerts notifying me that the NEM-wide IRPM had dropped below 15% … which is something that rarely happens, and is a sign of a relatively tight supply-demand balance.

Whilst I was walking, Dan Lee was able to post ‘Cold temperatures and low wind push NEM-wide IRPM down to 11.76% on Monday 17th June 2024’ capturing the lowest point for NEM-wide Instantaneous Reserve Plant Margin this evening.

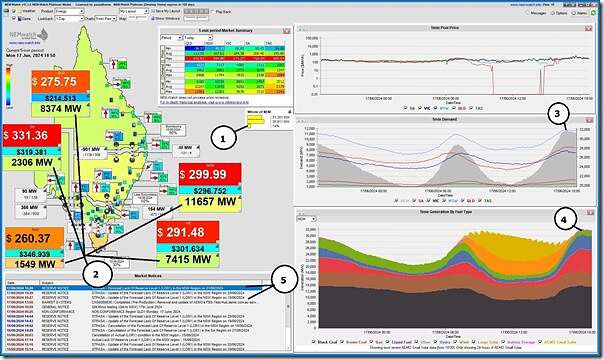

After arriving home (and keeping in mind we’ll end up reviewing this in more detail as part of the broader review of 2024 Q2, when we get to that), I took this snapshot from NEMwatch at 18:50 on which we’ve highlighted a number of things:

Specifically:

1) At this point we see three interesting things:

(a) that the NEM-wide IRPM is at 14.41% (rounded down in the display above);

(b) that the NEM-wide ‘Market Demand’ is 31,301MW; and also

(c) That none of the interconnectors are constrained … meaning:

i. no ‘Economic Islands’ formed; and hence

ii. Regional prices tightly tied together (separated just by dynamic inter-regional loss factors).

2) We see that the cold weather has enlivened ‘Market Demand’ in each region, driving it up out of the ‘green zone’ in each case (particularly in TAS);

3) We see that the NEM-wide ‘Market Demand’ appears to have come close to 32,000MW;

4) We see that the supply mix supplying this evening peak is relatively low on VRE:

(a) Obviously no solar at this point; and also

(b) Aggregate wind yield is ~1,700MW at this dispatch interval (compare this to the historical range recorded here for recent months to see that it’s below average).

5) We also see several Market Notices in which the AEMO is speaking about forecast LOR1 level tight supply-demand balance in the days ahead in various regions.

… noting again that AEMO issues these notices to encourage a market response.

—

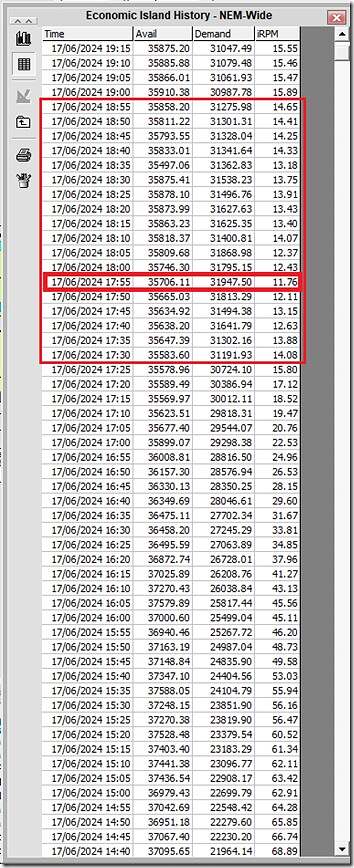

Because we’ll be coming back to this later (for GenInsights Quarterly Updates for 2024 Q2) I’ve grabbed the tabular record of NEM-wide IRPM from NEMwatch and highlighted the 90-minute stretch (17:30 to 18:55):

In this table we can see that the 17:55 dispatch interval (for which Dan noted the IRPM down at 11.76%) also saw the highest NEM-wide ‘Market Demand’ this evening … at 31,947MW.

When we are working through the broader review of 2024 Q2, I’ll also be interested in what this means for Aggregate Scheduled Target, as an indicator of the ongoing requirement for firming capacity. The numbers right now seem to indicate another period where >30,000MW of firming capacity was required.

Leave a comment