Yesterday (Wednesday 18th October 2023), Origin Energy held its 2023 Annual General Meeting with information about the 2023 AGM currently posted here:

I’d just like to quickly highlight, for future reference, to pieces of information that jumped out to me in a very quick scan

(A) Eraring Power Station – Forced Outage Rate under 5% for the year.

Amongst the information contained at the link above is the 172-page Annual Report, from which I have highlighted one page:

As highlighted here, on p25/172 the company highlights for the 2023 year that:

‘Our generation fleet delivered exceptional performance, with over 98 per cent start reliability across our peaking fleet, and a forced outage at Eraring of less than 5 per cent.’

A useful data point for people to remember … albeit just for 4 units out of the 44 remaining coal fired units in the NEM, and just for a particular 12 month period.

(A1) Calculating forced outage rates … Method 1

Given that we’ve been working in conjunction with Greenview Strategic Consulting to calculate outage rates (both planned and forced) for the 44 remaining coal fired units in the NEM through the GenInsights Quarterly Updates series of analytical reports.

In doing this, we’ve had to use a particular method of interpreting data published by AEMO, and supplied by individual generators through the bidding process.

1) We’ll call this method ‘Method 1’

… we’ve had a client request more information about how Method 1 works (GR Case 6299) – when time permits in future we’ll include more in a subsequent article.

2) Note that this method is going to be able to change from Monday 9th October 2023 following enhancements to the MT PASA DUID Availability data set.

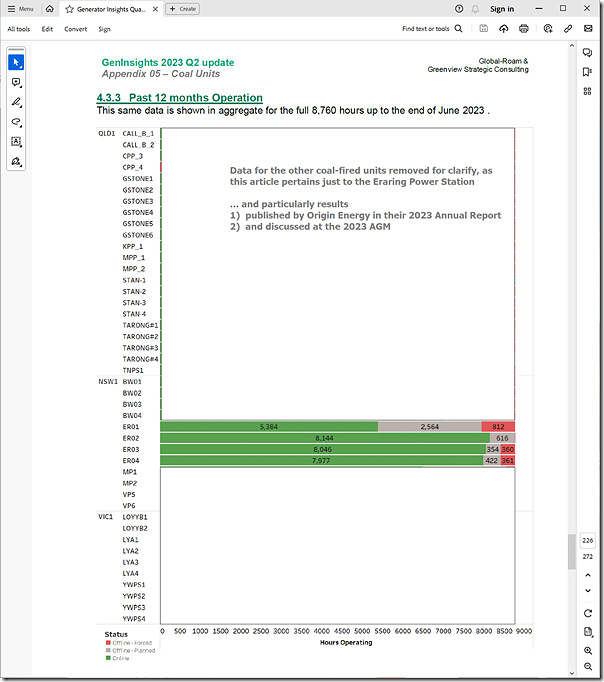

In the edition for 2023 Q2 we included (in Appendix 5) some interpretation of Planned Outage and Forced Outage hours through the year (using Method 1) for all 44 x operational coal units. Here’s (p226/272) has been included from the 2023 Q2 report, with a focus on the four Eraring units.

Note that ER02 experienced no forced outages through the 12 month period (July 2022 to June 2023), as determined by Method 1. This chart is an aggregate of what happened over a 12 month period, which we lay out on the following page in the edition for 2023 Q2 in chronological order:

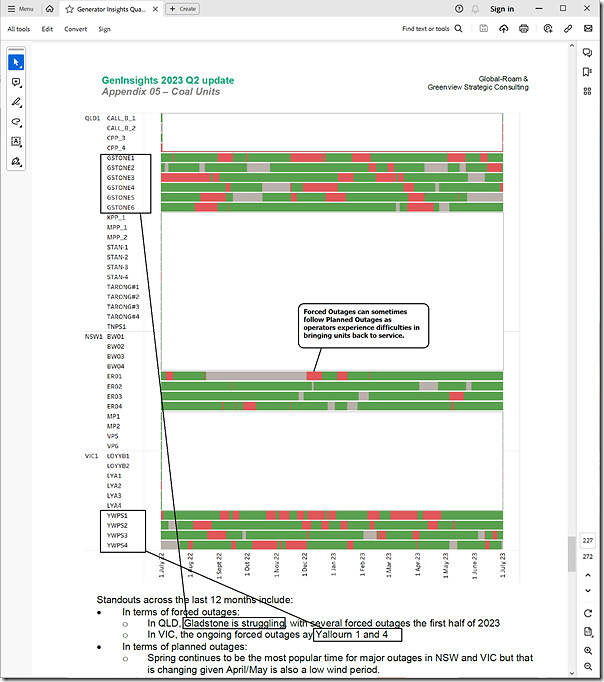

In this case, because some of the observations written into the report reference Gladstone and Yallourn*, we’ve also left them un-obscured.

* clearly Yallourn and Gladstone were, in contrast to Eraring across this 12 month period, much more operationally challenged from an outage point of view (i.e. many more red slices which adds up, in aggregate, to many more hours of Forced Outage across the year).

Note that the numbers shown above won’t line up perfectly** with what Origin has calculated internally (or any generator calculates internally for their own units) – but we believe it will be pretty close.

** Reasons for this include:

1) each generator has access to additional information not provided inside of the bids which might mean some nuance on our result calculated for each of the ~110,000 dispatch intervals across the year; and also

2) our method is automated, so perhaps misses some nuances.

But, even with the results shown above, we see that ‘coal generators’ are not a homogeneous bunch … some units are clearly more challenged than others!

(A2) Calculating forced outage rates … Method 2

From Monday 9th October 2023 the AEMO has begun publishing, after units (unfortunately*** fully Scheduled units only!) were required to start submitting, richer data sets in their MT PASA submissions … including

*** we’ve complained about the lack of coverage of Semi-Scheduled units before (such as on 21st June 2021).

This was discussed in the article ‘The *other* market change that went live today (Monday 9th October 2023)’ on the day – and will require us to update our method used for GenInsights Quarterly Update for 2023 Q4 and beyond.

It’s also meaning we’re progressively expanding the scope of the ‘Generator Outages’ widget in ez2view with successive permutations of the v9.8 release.

(B) Eraring Power Station – Negotiations over Closure Date continue

There was some commentary about machinations relating to NSW Government negotiations about potential (relatively short) delay to the slated 2025 closure date**** for Eraring Power Station

**** which was coincidentally mentioned by Linton yesterday in his ‘Low reserves projected post Eraring closure… and earlier?’ article.

Within the Annual Report, there were brief mentions – including:

1) p28/172:

‘Our Eraring coal fired power station continues to support the reliability and security of the electricity market. We have announced the potential early retirement of Eraring as our portfolio and the market transitions to cleaner sources of energy and new sources of supply enter the market.

Our existing thermal peaking generation will continue to play a critical role in providing capacity and firming as coal generators such as Eraring retire and are replaced by intermittent renewables.’

2) p31/172:

‘Underlying D&A increased by $78 million, driven primarily by accelerated depreciation following the reassessment of Eraring’s useful life. ’

3) p55/172:

‘Our path through the energy transition will have an impact on our people, communities and customers as our business changes, including the planned closure of the Eraring coal-fired power station as early as August 2025. There is a risk we fail to meet stakeholder expectations in relation to a ‘just energy transition’

4) p100/172:

‘In February 2022, the Group announced plans to accelerate its exit from coal-fired power generation submitting notice to the Australian Energy Market Operator (AEMO) of its intention to bring forward the closure of the Eraring Power Station (Eraring) to as early as August 2025. Prevailing market conditions will continue to be assessed which will help inform the final timing for closure of all four units at Eraring.

As at 30 June 2023 and consistent with the prior year, a closure date of August 2025, the end of the required three and a half year notice period to AEMO, remains the Group’s best estimate of useful life and has been used in the accounting assessments presented within these financial statements namely, the recoverable amount estimates in the Energy Markets Generation CGU (note C7), useful life assumptions of Eraring in calculating depreciation expense (note C3) and timing of associated restoration activities recognised in the provision balance (note C5).’

5) p101/172:

‘For Energy Markets, the application of the IEA NZE and AEMO “Strong Electrification” climate scenarios result in a net favourable position compared to the outlook from the base case assumptions used for impairment, benefiting existing assets such as the peaking generation fleet and Power Purchase Agreements (PPAs). Increased electrification of the National Electricity Market (NEM) and other growth areas such as electric vehicle penetration and an increase in connected services as customers decarbonise their homes will provide further opportunities for the retail business. The climate scenario valuation assumes closure of Eraring in August 2025, which therefore limits the exposure of the carrying value of assets in the Energy Markets segment to long-term commodity price movements. There is no expected impact to the useful lives of the remaining assets or restoration and rehabilitation provisions under the IEA NZE scenario.’

6) p119/172 ‘Key judgements and estimates’:

‘Eraring Power Station useful life: The useful life of Eraring remains unchanged at August 2025 for the purpose of accounting assessments presented within these financial statements. Prevailing market conditions will continue to be assessed which will help inform the final timing of closure of all four units at Eraring. Refer to the Strategy and climate change risks section in the Overview. ’

… and I probably missed others (and did not look in the presentation etc).

There were also comments about it in associated media articles.

Leave a comment