The results of the recent MTPASA (Medium-Term Projected Assessment of System Adequacy), published on 17 October 2023, led a declaration of low reserve conditions in Market Notice 110284.

The market notice provided advice on identified low reserve conditions projected in NSW, declaring low reserve conditions for:

- December 2024 – February 2025

- August 2025 – October 2025

Low reserve conditions are when AEMO considers that the balance of generation capacity and demand for the period being assessed does not meet the reliability standard as assessed in accordance with the reliability standard implementation guidelines.

This appears to be a rare occurrence – the last notice identifying low reserves in a MTPASA projection was in 2020, MN 81174, where network outages in VIC were the reason. We’ve decided to take a peek under the covers this time given, initially, the rarity of the occasion.

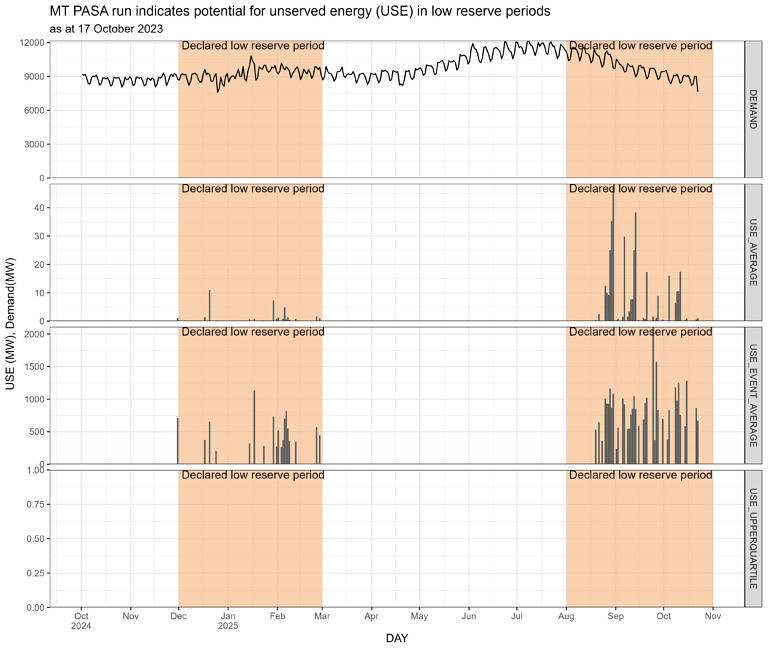

This time, the MTPASA run results indicate there is indeed potential for unserved energy, as the chart below captures.

The USE_AVERAGE

- Is the average MW value of unserved energy (USE) magnitudes (could be zero or greater than zero) across all across iterations and reference years in the run.

- We see low levels in the first period but in the second period, after roughly mid-August 2025, there is an increase in occurrences and levels are up to almost 50 MW (average).

The USE_EVENT_AVERAGE

- Is a similar measure to USE_AVERAGE, but only events where USE is projected are included in the average.

- We can see that, in the second period, when there is USE the level could be between 500 and 1000MW, but,

The USE_UPPERQUARTILE

- Represents the upper quartile of USE across iterations and reference years.

- It is is zero.

- This clarifies that any USE is projected to be a less-than 25% chance.

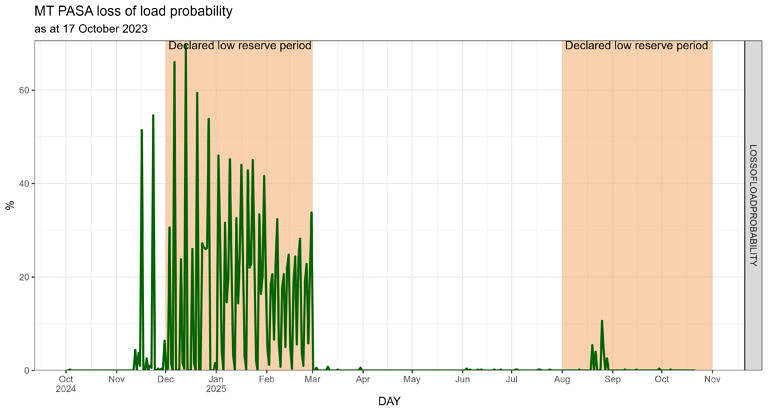

Yet there is a non-zero Loss of Load Probability as the following chart shows. The most prominent half-hour periods for loss of load are generally in the evening as the sun is setting.

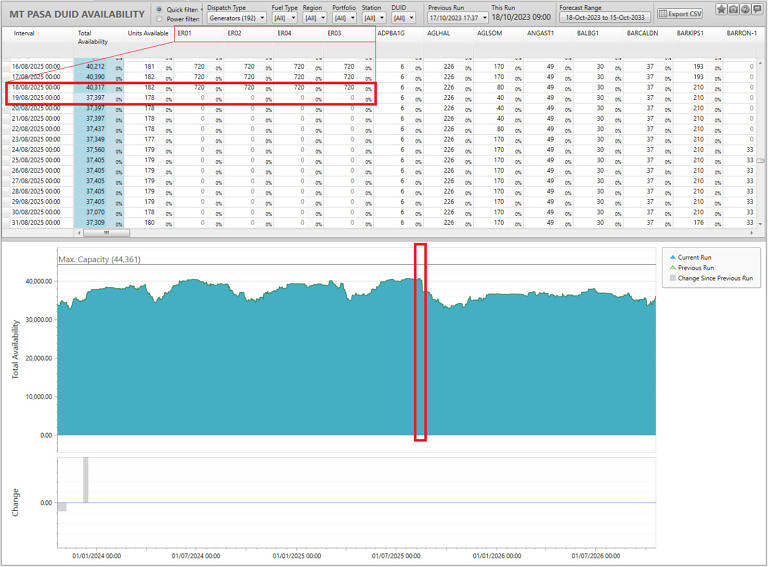

ez2view’s DUID Availability widget shows the closure of Eraring in NSW on the 19th August 2025. This timing clearly aligns with the increase in projected possible USE and Loss of Load Probability for August 2025.

No visibly large drops in availability appear to occur over the 2024-25 summer when the first low reserve period has been declared.

Such a result may well bolster support for postponing Eraring’s closure. On the other hand, the MT PASA run doesn’t yet include too much in the way of future generation projects due to expected full commercial use dates and commitment states.

This will be why the market notice makes explicit note of the fact that:

MTPASA informs the market of potential reliability issues to allow the market to respond in the first instance, potentially avoiding the need for any AEMO intervention event.

So, while committed projects are included in MT PASA runs as per the process description, as far as I can tell this is the list of new projects that are likely to be operating before summer 2024-25 (AEMO Generation Information, September 2023).

| Site Name | Nameplate Capacity (MW) | Fuel Type /Technology |

| Broken Hill (in commissioning) | 50MW/50MWh | Battery Storage |

| Riverina Solar Farm | 32 | Solar |

| Rye Park Wind Farm (in commissioning) | 396 | Wind |

| Stubbo Solar Farm | 400 | Solar |

| Tallawarra B | 320 | OCGT |

| Walla Walla Solar Farm (1&2) | 152 & 152 | Solar |

| Wellington North Solar Farm | 436.8 | Solar |

| Wollar Solar Farm | 280 | Solar |

That’s a good amount of MW but not a huge amount of dispatchable capacity. Kurri Kurri OCGT (750 MW) is expected to be at full commercial use by some time in December 2024 so is likely to assist with dispatchable capacity. Following that, the Waratah Super Battery comes on by March 2025 (850MW/1680 MWh).

This seems to ignore NSWs increased import capacity and declining grid demand. Not only have VNI and QNI been upgraded, but in the past when Liddell was operating, southbound capacity for imports was partially crowded out. With PEC on line and generous generation surpluses in Victoria and SA, NSWs practical import capacity will increase by 1-1.5 GW

Since 2019 grid demand in NSW has fallen by almost 6% and ongoing energy efficiency and behind the meter generation and storage will probably continue the decline. While annual demand is not directly related to the annual system peak, they do follow similar trends.

While AEMO is rightly conservative, it seems to me that this forecast is overly so.