The recent announcement that the Capacity Investment Scheme will award underwriting contracts to batteries and demand response projects in NSW delivering 1075 megawatts and 2980 megawatt-hours of power raises serious questions around the need to bail-out Origin Energy’s Eraring Power Station. All of this new capacity is planned to be operational in advance of the peak summer demand period after the exit of Eraring Power Station in August 2025.

A deep concern ignited – losing Eraring means losing a big part of NSW’s power supply

When Chris Minns flagged the prospect during the NSW election campaign that he might take back control of Eraring rather than let it close he let a genie out of the bottle. While Minns was playing to the general public’s lingering distaste for privatisation, it ended up being like a call to arms for conservative media outlets and political commentators deeply concerned over plans by state and federal Governments across the country to phase out coal. ‘How on earth could NSW get by with closing the Eraring which is the largest power generator in the land at 2,880MW’, they thought. Especially when this would come off the back of another large NSW coal generator, the 2,000MW Liddell Power Station, shutting down in April this year.

One can understand the concern. The combined rated capacity of these two power stations is equal to a third of NSW’s peak electricity demand. Over 2022 these two power stations produced 17,000 GWh, equal to almost a quarter of NSW’s overall electricity consumption.

While the exit of Liddell has unfolded reasonably smoothly, Eraring Power Station has needed to ramp up its output, and over winter it was regularly called upon to deliver close to its maximum capacity in the evenings.

At the same time NSW is facing serious constraints to the expansion of new renewable energy projects due to an onerous and slow planning approval system and transmission infrastructure constraints. The new transmission to support the 4,500MW Central-West Orana Renewable Energy Zone in particular is running several years late and is not expected to be finished until the 2027-28 financial year. In addition the Snowy 2.0 project is also several years delayed.

This has led to strident and confident demands from a range of media outlets and commentators that the NSW power system cannot cope without Eraring and the NSW Government must ensure the power station remain online. These calls became particularly loud with the release of the Australian Energy Market Operator’s assessment of power supply adequacy in August called the Statement of Opportunities. This report stated that NSW would breach the “Reliability Standard” after the exit of Eraring, which many media outlets reported as meaning NSW would suffer severe blackouts.

Yet AEMO says the reliability gap left behind from Eraring closing is small

Yet what the media failed to notice was a table hidden away on page 74 of the Statement of Opportunities which noted that NSW could avoid this breach of the Reliability Standard (which equates to just 0.002% of annual energy demand being unmet) with the addition of 657MW of batteries with maximum duration of just 2 hours. Which, it turns out has now been addressed by the projects just announced as the winners under NSW and Federal Government’s Capacity Investment Scheme tender.

No doubt many media commentators would be incredulous that the exit of a 2,880MW coal power station could be covered by 657MW of batteries capable of lasting just 2 hours. Over last year Eraring generated almost 11 million megawatt-hours of electricity. 657MW of batteries discharging for 2 hours per day across every day of the year delivers you just 479,610MWh (657 x 2 x 365) – how on earth is that an adequate replacement for Eraring?

The answer is it’s not, because there’s two other parts to replacing Eraring. The first is that there is a very large amount of wind, solar and battery capacity that is already in the process of being constructed which is not hindered by the delays to building new transmission. The second is that a lot of the existing fossil fuel generators have underutilised capacity which can be ramped up to fill gaps which haven’t been filled by all the extra wind, solar and batteries which are on the way.

The surge in supply from renewable energy will be greater than that lost from Eraring and Liddell’s closure

Firstly in relation to wind and solar, Green Energy Markets maintains a database of all renewable energy projects in Australia in their various phases of readiness from fully operational, under commissioning, being constructed, contracted and in development. By 2026 there will be around 10,000MW of wind and solar farms in operation in the National Electricity Market that in 2022 were either still undergoing commissioning, under construction or under long term contract. In addition, according to Green Energy Markets’ Solar Market Report installations of solar on rooftops in the NEM states have been running at around 250MW per month this year. If this continues then by the beginning of 2026 we’ll have 6500MW more rooftop capacity in place then we did in 2022.

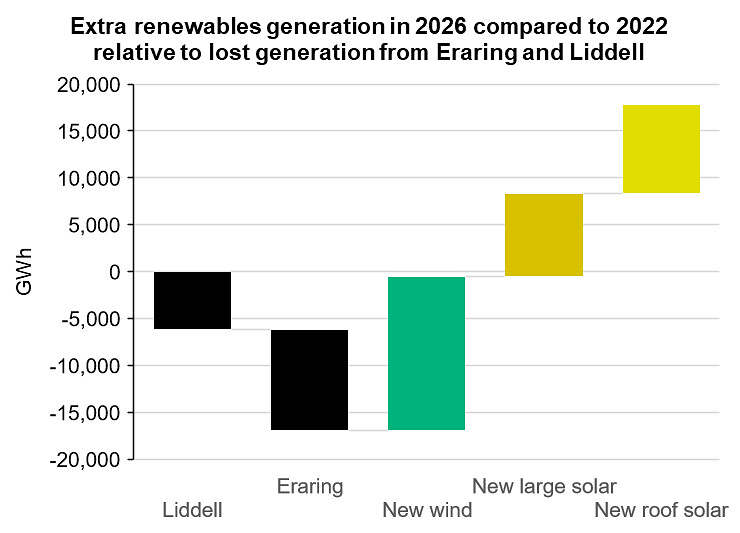

This extra capacity will deliver vastly more generation than has been lost by the exit of Liddell and Eraring power stations. In the chart below we’ve illustrated the amount of generation produced by Liddell and Eraring over 2022 as negative values. Then we’ve added on the extra generation we’re likely to get in 2026 relative to 2022 from all the new wind and solar farm capacity and rooftop solar that will be in place by 2026 across the NEM. All up we’ll have almost 17,000GWh more electricity generation from new renewables than was generated by Liddell and Eraring in 2022. That’s quite a lot of extra supply by the standards of the NEM – it’s almost a quarter of NSW’s entire annual electricity demand.

Source: Green Energy Markets Analysis prepared for our LGC and Carbon Credit Price Drivers Report

What about the fact renewable energy varies with the weather?

Now it’s undeniably true that this new generation is all weather dependent and can’t be controlled to be there when we command it. To examine this weather variance we took hourly NEM solar and wind generation from the 2022-23 financial year and scaled it up in line with how much extra overall annual generation we’re likely to have from each of these fuel sources in 2026.

We also scaled up utility-scale battery output to reflect the extra battery capacity that is either currently under construction or soon will be as a result of the joint Federal and State government Capacity Investment Scheme tenders. Many people might be surprised to know this gives us 5,500MW of utility-scale battery capacity in the NEM by the time Eraring exits. Although at the time we prepared this analysis we assumed the NSW tender would induce 930MW rather than the 1,075MW that has actually been contracted under the tender. So we’ll actually have a tad more than what we’ve estimated.

This scaling up of last financial years generation to reflect the extra capacity in 2026 is admittedly a simplistic approach which doesn’t take into account interconnector constraints and also doesn’t take into account that batteries will behave differently once there is more than 5,500MW worth of them on the grid. Much of the 5,500MW of future battery capacity actually remains unused in this simulation. This is because over last financial year batteries were mostly used for frequency control (which isn’t part of the scale-up simulation) rather than energy, with the maximum capacity dispatched from the batteries in this scale-up simulation being 3,040MW. In this respect one could suggest this analysis understates our ability to fill the gap from Eraring, although the lack of interconnector constraints operates in the opposite direction. So this is far from perfect, but it is a useful supplement to AEMO’s more sophisticated analysis to help explain how all this extra supply is likely to cover for the lost generation from Liddell and Eraring.

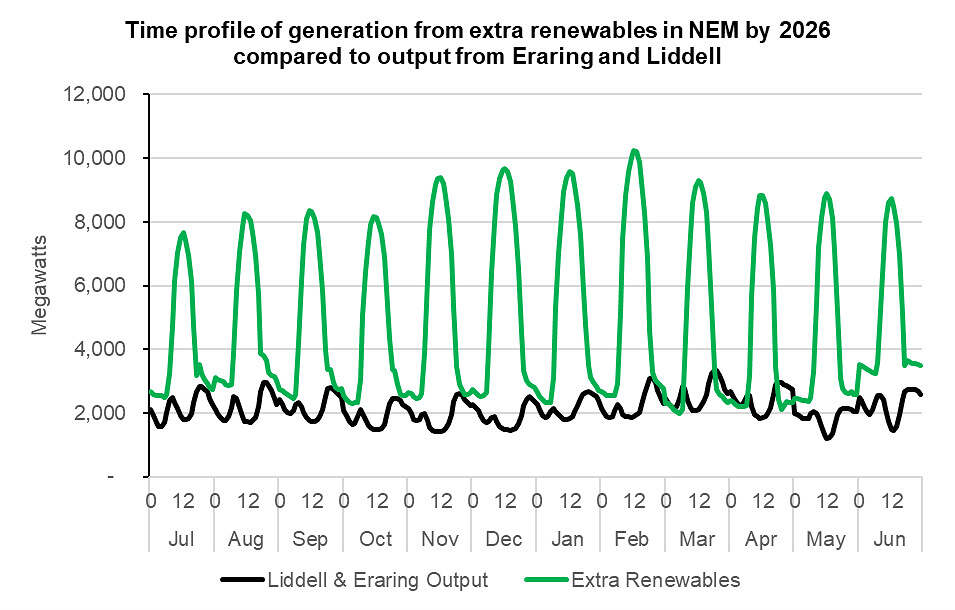

The chart below shows in the green line the time profile of the generation from the extra renewables and battery capacity we’ll have in 2026, which wasn’t fully operational in 2022, based on this simple scaling-up exercise. Then in the black line we’ve provided the time profile for the combined generation from Liddell and Eraring over 2022-23 financial year. It shows that the extra renewables output exceeds the output from Liddell and Eraring across every month with just the exception of March and April, where during the night time, output from Eraring and Liddell exceeded the extra renewables.

Source: Green Energy Markets analysis using NEM Review data service

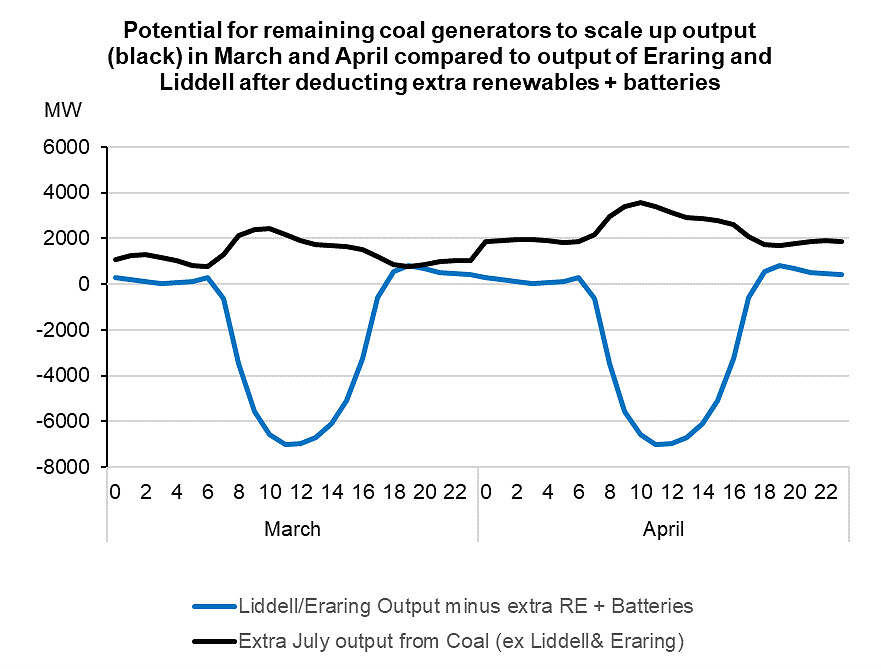

Yet even in these two months of March and April there is no cause for alarm because there was plenty of slack capacity from other coal generators over these months that could cover for the exit of Eraring (not to mention gas generators too). March and April are usually months of low power prices so a range of coal generating units were taken out of service or elected to scale back output, Liddell and Eraring meanwhile chose to increase their output above normal in these months to cover the gap. In the chart below we’ve illustrated in the blue line the average combined hourly output of Liddell and Eraring over March and April after deducting the extra output from renewables and batteries. For much of the daytime period values are negative because the scaled-up renewables + battery output exceeds the combined output from Liddell and Eraring. However, there are some positive values in the early hours of the day and in the evening. Then in the black line we’ve illustrated how much the other coal generators could have increased their output in March and April if they’d run at similar levels each hour to what they did in July 2022. As you can see the remaining black coal generators can cover the gap left behind by operating at similar levels to what they did in July last year. Although in reality we are not limited to coal and could also draw upon gas generators who were also operating with large amounts of slack capacity over March and April.

Source: Green Energy Markets analysis using NEM Review data service

Eraring – is it any good as insurance?

If we put aside the more shrill media commentary, which would have you believe the grid will melt down without Eraring, there are some more rational voices suggesting a temporary propping up of Eraring would provide some insurance until we can get other things in place like new transmission or construction of even more batteries.

There is little doubt that it’s a good idea to have some insurance because things can go awry. Also this simple scaling up of one year’s generation misses out a range of complexities and variations we need to plan for. But then we need to ask is a bail out of Eraring going to provide the kind of insurance that we need?

At this point it’s worth looking back at the two charts above. Anything stand out to you?

You’d have to be Blind Freddy not to notice that the huge surge in extra renewables output in the middle of the day means it won’t just be Eraring struggling to remain online, but just about every coal generator in the National Electricity Market. Unfortunately Eraring, like every other coal generator has serious constraints around how quickly they can vary its output. We can’t just switch it off during the daytime and then switch it up to maximum output at 6pm. For it to be ready to respond to any kind of surprise event where it would be good to have some insurance, it needs to be kept online throughout the day. If Eraring is kept online, then some other generator will have to move aside to make room. Who will that be and how will it be decided?

No doubt those demanding the NSW Government prop up Eraring will glibly say just switch off the renewables. But even if all the utility scale wind and solar farms switched off in the middle of the day, by 2026 there will be more than 25,000 megawatts of rooftop solar in place that is not subject to central dispatch by AEMO. So we’ll still have a mammoth surge of generation in the middle of day that means many of the NSW coal generators will be hanging on for dear life over this period in order to be capable of ramping up output in the evening.

Therefore, if Eraring is kept online then it probably just means other coal generators will elect to switch off some of their units instead. Therefore, our insurance isn’t actually doing much to mitigate our risks. This inflexibility problem was unfortunately never properly addressed by the NSW Electricity Supply and Reliability Check Up conducted by Cameron O’Reilly.

Those demanding that Eraring be propped open also need to ask themselves – if there is a clear market need for Eraring then why on earth would Origin Energy want to shut it down? Outside of Eraring, Origin’s power generation assets in NSW are inconsequential relative to its ongoing very large customer load. It’s not as if spiking up the cost of power in NSW will deliver a windfall to Origin. Yet the management of Origin Energy aren’t stupid, and wouldn’t shut down Eraring without a good commercial reason. That good commercial reason is that they can see what the charts above illustrate incredibly clearly – by August 2025 there just isn’t much room left in the market for Eraring.

Chris Minns might have thought it would be clever during the heat of an election campaign to glibly claim he might partially unwind electricity privatisation. But he’s created a rod for his own back and that of his energy minister now that he has the conservative media hounding him to rescue Eraring. The question is will NSW Labor govern based on rational quantitative analysis, or be governed themselves by the dictates of radio shock jocks and newspaper headlines?

About our Guest Author

|

Tristan Edis is Director of Analysis and Advisory at Green Energy Markets. Green Energy Markets provides analysis and advice to assist clients make better informed investment, trading and policy decisions in energy and carbon abatement markets.

You can find Tristan on LinkedIn here. |

Common sense surely dictates that if it actually shuts down in August 2025, the Eraring Power Station should be kept in some form of “care and maintenance” state.

It will be a massive tragedy if the first action following closure was to be the spectacular dropping of its huge chimneys – something that coal’s detractors typically find absolutely delightful.

In the potential event that Energy Minister Bowen’s fanciful meddling backfires on us all, Eraring would become a vital asset whilst new options were needing to be brought forward.