The forecast for Friday (3 February 2023) evening’s demand was that a new all-time maximum would occur and a lack of reserve was expected.

To maintain the grid in a reliable operating state AEMO signaled to the market that the Reliability an Emergency Reserve Trader (RERT) would be triggered on Friday 3 February 2023. This would provide capability to lower demand to a satisfactory level.

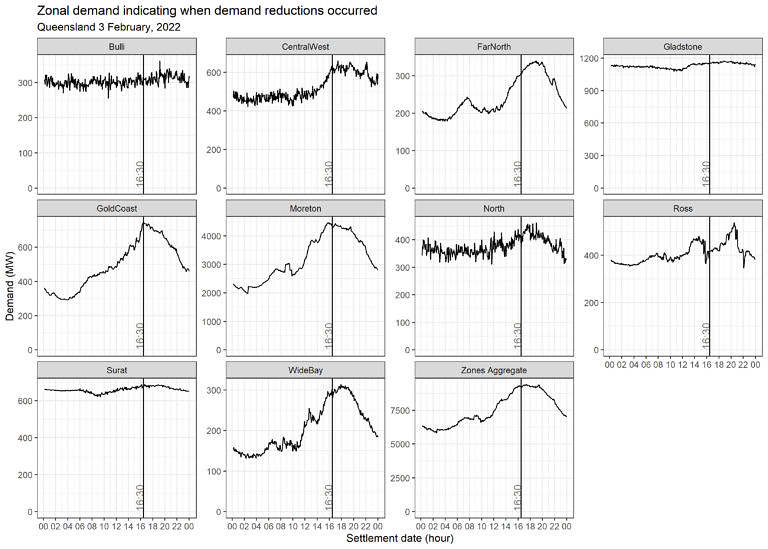

Across Queensland TNSP zonal demand had been climbing throughout the day. In aggregate the region was on track to meet the forecast levels.

Yet by 16:30 demand had begun to decline sooner than anticipated in load zones with large residential populations in the south-east of the state (Moreton, which includes Brisbane, and Gold Coast). Some rain and cloud cover was observed to be contributing. The resulting demand level reached was well under the current maximum.

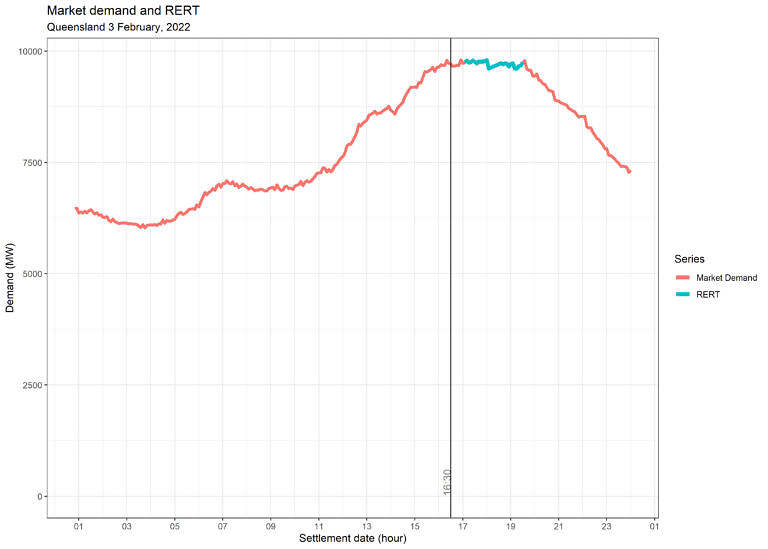

When it came to dispatch targets, RERT was dispatched across intervals 17:05 to 19:30 (2 and a half hours).

Wholesale demand response was dispatched for three 5-minute intervals at a maximum of 1 MW.

Initially RERT dispatch was set at 11 MW (to 17:30) then increased to 21 MW (for 30 minutes), then reduced again to 10 MW from 18:05 to 19:30.

The following chart captures the dispatch of RERT in the context of total (market) demand.

All up RERT was dispatched for 30 dispatch intervals. Based on the targets we can estimate this equated to a total of 31 MWh.

For context, 10 MWh was activated on 5 July 2022. The cost to activate those reserves was $71,161. Additionally, there was also pre-activation of reserves that were subsequently not activated, taking the total to $639,016 for the 5 July event.

We’ll have to wait for AEMO’s quarterly RERT report to understand the costs of this 3 February 2023 event.

Maybe also customers are getting smarter and using simple timers and manual interventions to minimise peak demand. Peak grid demand this summer has been 29.8GW well down on previous years

It would be interesting to know if, and by how much, Energex triggered the demand management on residential air conditioners. There would be significant number of air conditioners in SE QLD that Energex can ramp down the compressors on. This program was/is an opt in program with an up front incentive paid.

Hi Craig and Peter. Thanks for the comments. It appears Energex’s PeakSmart program was indeed activated on 3 Feb. Participating AC units were capped to operate at 50%. This would have definitely helped.

Thanks for the analysis Linton. A quick query for you and the other smart folks at WattClarity. It seems that the spot price peaked at $1,297/MWh, well below the market price cap (MPC). And this was only for one dispatch interval (DI), before RERT was activated. During the period of RERT activation, the spot price barely topped $300/MWh. This implies there was in fact more supply available which surely have been a lot cheaper than RERT. I appreciate AEMO has to make the call on RERT in advance and that we don’t know yet how much they paid. But is this the lowest price (outside of market suspension or CPT situations) at which RERT has been activated?

Kieran on a very quick scan it looks like there was a RERT event with lower outturn prices in Vic on 30 November 2017, and another on 30 Dec 2019. Quite possibly there are others as well. As you point out AEMO has to make the call in advance.

Pricing under RERT uses intervention methodology and doesn’t perfectly reflect what might have happened without RERT being called – I’m sure that’s not an issue last Friday, but may have been on those earlier episodes I mentioned.

It would be interesting to know if in the most recent case AEMO had other RERT options ready to go with shorter lead times, which they were able to avoid activating when demand fell short of forecast. The 21 MW dispatched last Friday seems hardly worth bothering with by itself.

Regards

Allan

Thanks for your detective work Allan!