Following this morning’s article, I was using ez2view to have an updated look at the prognosis for Friday evening … but then I thought it might be worth sharing some snippets here with WattClarity readers…

(A) Updated forecast for LOR2

In this morning’s article I referenced AEMO Market Notice 105397, which warned of a forecast LOR2 level – with the key excerpt being as follows:

‘From 1730 hrs 03/02/2023 to 2000 hrs 03/02/2023.

The forecast capacity reserve requirement is 525 MW.

The minimum capacity reserve available is 431 MW.’

This was updated at 12:08 today by MN105398, with the key piece being:

‘From 1700 hrs to 2030 hrs 03/02/2023.

The forecast capacity reserve requirement is 525 MW.

The minimum capacity reserve available is 302 MW.’

… so the key points being the trough being longer and deeper.

A subsequent update was published at 12:53 being MN105399, with the key piece being as follows:

‘From 1630 hrs to 2130 hrs 03/02/2023.

The forecast capacity reserve requirement is 525 MW.

The minimum capacity reserve available is 287 MW.’

… so deeper and longer still!

It’s understandable that (given energy user experience in 2022 with RERT) there might be concerns rising that similar circumstances might unfold this week as well (i.e. Reserve Trader being triggered, at some cost to energy users) . Hence why I thought I would take a look.

(B) Are there any outages that might come back sooner?

That most recent market Market Notice (MN105399) included this comment:

‘AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.’

… it’s understandable that AEMO would be (it’s their role/responsibility!)

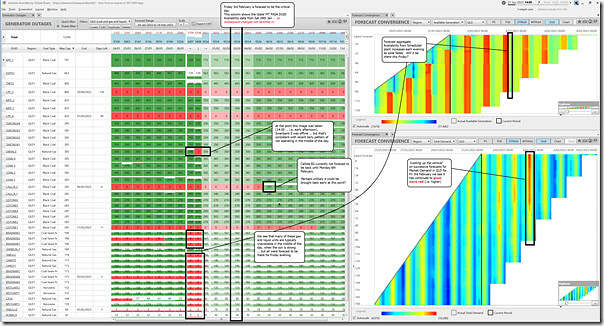

So I’ve attached this three-widget snapshot from ez2view this after noon at the 14:00 dispatch interval (NEM time) to highlight a couple of things:

Filtering the ‘Generator Outages’ widget to look just at the significant thermal plant within the QLD region, and sorting from biggest to smallest down the page, I have highlighted the key day in question … which shows primarily green (i.e. forecast to be available) except for:

1) Callide C3 … which we know is currently scheduled to be out till 30th June 2023;

2) Callide C4 … which we know is currently scheduled to be out till 1st May 2023;

3) Callide B2 … which we know is currently scheduled to be out till Monday 6th February 2023…

… as noted on the image, it does raise the question about the likelihood that this unit would be able to be brought back early (in time for Friday evening) – without looking any further, I suspect the answer would be ‘unlikely’ purely because of the short notice.

4) There are a number of (higher cost) gas-fired and liquid-fired plant that operate more in the ‘peaking’ mode these days.

(a) I’ve highlighted how they are typically bid unavailable during strong daylight hours (because of solar) – but then available again for each evening.

(b) Swanbank E is a case in point, as I have highlighted.

(c) Time will tell if they are all available this Friday evening.

5) Not annotated on the image, but visible there, we also see Gladstone unit 1 and Braemar 6 and Yabulu 2 on outages (remembering that the unit size gets progressively smaller down the page, because that’s how I have sorted them).

So in summary (for the units I looked at) it’s a handful of units (including the 3 x Callide units) currently expected to be unavailable.

(C) What level might demand actually land at?

In this morning’s article, I noted that the level of Market Demand (if it matched what was forecast at the time) would be a new all-time record for the QLD region.

… at the time the forecast peak Market Demand for Friday evening was 10,153MW in the half-hour ending 17:30

In the image above I’ve highlighted how ‘looking up a vertical’ shows a progressively redder picture, representing successively higher demand forecasts (at least at this point in time).

—

As I hit ‘publish’ on this article now, the ez2view ‘Forecast Convergence’ widget shows that most recent peak demand forecast (as at 14:00 today) is that it will reach 10,282MW in the half-hour to 17:30 on Friday evening … so it’s understandable that the level of LOR2 forecast is progressively growing tighter (at least until the current point in time).

PS1 at ~15:47 (forecast LOR2 cancelled)

A quick note before I move back to what-I-should-have-been-focused-on today, is that at 15:42 the AEMO followed with MN105413 as follows:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 31/01/2023 15:42:17

——————————————————————-

Notice ID : 105413

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 31/01/2023

External Reference : STPASA – Cancellation of the Forecast Lack Of Reserve Level 2 (LOR2) in the QLD Region on 03/02/2023

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

The Forecast LOR2 condition in QLD region advised in AEMO Electricity Market Notice No.105408 is cancelled at 1500 hrs 31/01/2023.

No LOR2 condition is currently forecast in the STPASA period.

AEMO Operations

——————————————————————-

END OF REPORT

——————————————————————-

A quick look at the ez2view ‘Forecast Convergence’ widget shows:

1) that there’s been a step increase in the Available Generation forecast for QLD for that evening (> 550MW increase in the ST PASA run published for 15:00), which would be one significant reason.

2) forecast for peak Market Demand, however, continues to climb.

PS2 at ~17:35 (forecast LOR2 reinstated)

In a conversation online about the challenges of forecasting QLD for Friday evening, I noticed that AEMO has published MN105417 at 17:30 with the following:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 31/01/2023 17:30:03

——————————————————————-

Notice ID : 105417

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 31/01/2023

External Reference : STPASA – Forecast Lack Of Reserve Level 2 (LOR2) in the QLD Region on 03/02/2023

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

AEMO declares a Forecast LOR2 condition under clause 4.8.4(b) of the National Electricity Rules for the QLD region for the following period:

From 1630 hrs 03/02/2023 to 1700 hrs 03/02/2023.

The forecast capacity reserve requirement is 726 MW.

The minimum capacity reserve available is 597 MW.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

A quick updated look at the ez2view ‘Forecast Convergence’ widget shows:

1) forecast for peak Market Demand, is now at 10,373MW for 17:30 … which would be well past the prior all-time record (if it eventuates).

2) the improved Available Generation level forecast for the same time (i.e. from 9,559MW to 10,139MW (published at 15:00, leading to the cancellation)) continues to improve (i.e. the forecast for 17:30 is now up at 10,282MW.

… so the ‘fun’ times continue…

Leave a comment