Whilst I was still thinking about Q2 2021 yesterday evening, I also happened to see Mike Davidson comment on LinkedIn that the AEMO saw a new winter minimum demand record on a NEM-wide basis, with Operational Demand down at 15,061MW at 13:00 on Sunday 15th August 2021.

It’s been a long time since we’ve had time to give away a BBQ for ‘best demand forecaster in the NEM’ during summer peak demand events – but, if we were to start this up again, the questions we’d be asking would be a whole lot more complex as it’s not just maximum demand that matters as a Key Performance Indicator anymore. As Mike implies, minimum demand is also quite important as well.

(A) Trended Minimum Demand

Understanding the shape of demand (including, but not limited to the extremes) is first step in understanding any market outcomes – which is part of the reason why it’s top of the table of Factors Contributing to Q2 2021 Volatility.

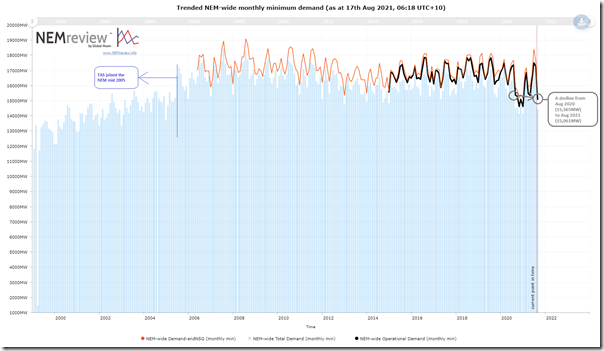

Spurred on by Mike’s comment, I opened up NEMreview v7 and had a look at how monthly minimum demand has trended since the start of the NEM:

(those with a licence to the software can open their copy of this query here).

(A1) Various AEMO Data sets

Note that AEMO talks mostly these days about the measure they call ‘Operational Demand’ – which they began publishing on a 30-minute basis from late 2014 and is their best measure of what might be called ‘Grid Demand’. To see a longer-range history we need to use ‘Demand and Non-Scheduled Generation’ (from mid-2006), which is quite similar – and only ‘Total Demand’ back before that it we want to see back to the start of the NEM:

1) For those who want to understand some of the complexities of measuring Demand, here’s some of the gory details (not as simple as it might initially seem)

2) Note that ‘Total Demand’:

(a) Has a name that is increasingly misleading!

(b) Could be thought of as a measure of ‘Market Demand’.

(c) But is (still!) the only measure that goes back to the start of the NEM; and

(d) Arguably (to some wholesale participants) still best reflects the ‘size of market’ available to them.

3) A couple questions about Operational Demand, whilst they occur to me:

Q1) I’m not sure if, or when, what AEMO publishes for Operational Demand would be upgraded to a 5-minute cadence as part of the Five Minute Settlement cadence?

Q2) If this is to happen, it would be quite beneficial for AEMO to publish back-dated Operational Demand figures on a 5-minute basis:

Q2a) Ideally all the way back to the start of the NEM to avoid confusion such as we need to encounter in the chart above because of the absence of long-range history;

Q2b) But I am not aware if there are any plans to do this?

Q3) Any plans to also publish the same in P5 Predispatch and P30 Predispatch?

… if someone knows answers to this, please let me know?

(A2) Observations in the Trend

With respect to the NEMreview trend chart above:

1) We see minimum Operational Demand for August 2021 (15,061MW – Sunday 15th August as Mike noted above) is 304MW lower than the low point seen in August 2020 (15,0365MW).

2) However in 2020 we saw minimum demand levels drop significantly further for the months of October, November and December 2020:

(a) Due to higher solar yield for the Small and Medium solar PV harvest which eats away at Underlying Demand to leave a low Grid Demand in the middle of the day; and

(b) Especially on cooler days when air-conditioning load is lower (and performance of solar panels are better).

3) So it seems clear that the minimum demand records will fall further still in the coming months … as Mike noted.

(A3) About Sunday 15th August 2021

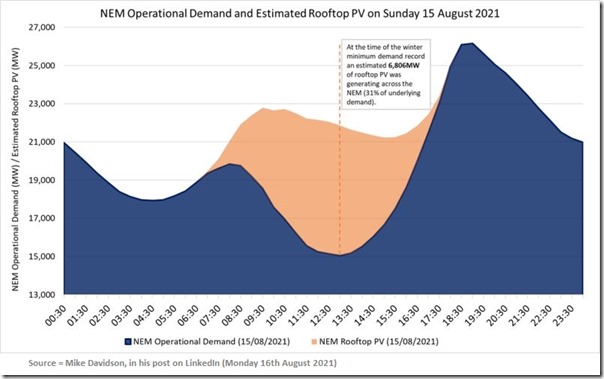

In Mike’s note, he included this trend of NEM-wide demand on Sunday 15th August 2021:

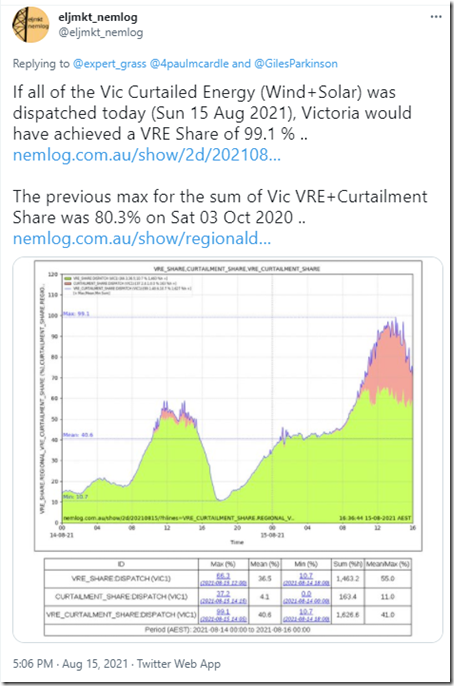

It was hard not to miss that others also reported (on the same day and related to the above) that others highlighted the milestone that the Victorian part of the NEM grid reached a high percentage of renewable supply on Sunday … and might have been ~100% of Victorian demand had it not been for curtailment of possible supply from Semi-Scheduled wind and solar plant in the region:

(A3a) How it was reported

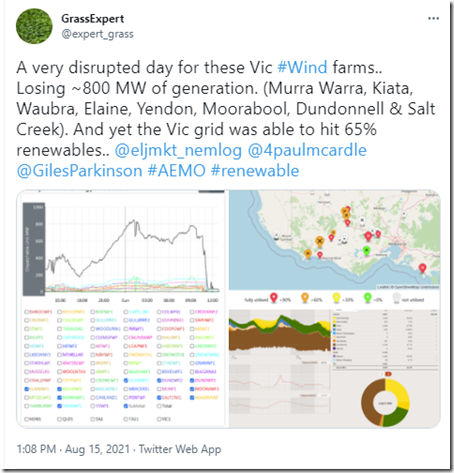

At 13:08 on Sunday 15th August (i.e. around the time Mike noted was the low point of Operational Demand above) ‘GrassExpert’* tweeted the following:

* Sorry, don’t know their real name!

As seen, the focus was on the Victorian Grid and determined a ‘percentage renewable’ measure* at 65% early in the afternoon:

** Note – I have not invested time to ascertain exactly how OpenNem treats interconnector flows in these metrics (there’s a number of different ways one could skin that cat).

Replying in that thread, at 17:06 on Sunday evening, Geoff Eldridge posted this on Twitter:

Difficult to miss these two updates, as they helpfully tagged me into the conversation 😊, so the thread continued to roll through (as these sorts of pronouncements do).

Another person who was tagged in at the start was Giles Parkinson – and it was no surprise (given the topic) that yesterday saw Giles publish about ‘The day wind and solar nearly met 100 percent of demand in Victoria’ … which itself is attracting a number of comments.

(A3b) Some quick thoughts

It’s completely understandable that these times when renewable penetration is high* there is a spurt of conversation start up.

* Does not really matter whether this is measured in actual supplied terms, or derived in terms of the counter-factual ‘what would have otherwise been’ scenarios (skipping over the complexities Marcelle has noted before about how estimating curtailment is not as easy as it might initially seem)

Also completely understandable that reference is made back to Daniel Westerman’s speech first public address (at CEDA on 14th July 2021) … which was probably part of the point of the speech, I guess, in terms of setting a ‘light on the hill’ (or a BHAG, for those who have read Jim Collins and Jerry Porras).

So it’s worth highlighting a couple of things:

1) High renewable penetration typically coincides with low demand

Seems perfectly logical, as renewable penetration grows, that the instances in time where percentage share is highest will first occur when Underlying Demand is lowest… and that seems to be what we saw on a warm (almost spring-like as Mike noted) winter’s Sunday.

That’s part of the reason why AEMO is investing increasing amounts of energy (pardon the pun) into understanding the implications of declining levels of minimum Grid Demand!

(a) This is where new ‘challenges’ will be experienced first

(b) See, for instance, ‘Operational management of low demand in South Australia’ from 22nd October 2020.

2) Business case, challenges, for greater penetrations?

Minimum Demand is, by its nature, a level of demand at which there will always be a market* for the product you supply … but once we build enough capacity to supply that, the size of market available for every additional MW declines progressively.

* Negative prices, network constraints, and requirement for ‘Keeping the Lights on Services’ notwithstanding!

We’re not there – in terms of raw numbers, yet**, but when the NEM reaches high percentages of renewables, then the business cases for any additional MW will need to also factor in declining volume of demand to be supplied. This ‘area under the demand curve’ will decline more rapidly as the renewable penetration grows. This is likely to heighten the (already present) conflict between those dealing with large-scale renewables and those dealing in small-scale renewables. Both have their advantages and disadvantages.

** As Geoff’s chart for Sunday afternoon showed, we are there already – when we factor in negative prices, network constraints and ‘Keeping the Lights on Services’!

3) How about we make Demand Response work properly?

Which brings me back to prior comments about how the Wholesale Demand Response Mechanism seems, to me, to be an attempt to solve ‘yesterday’s problems – but not a way that will work to address a tomorrow approaching very quickly!

It’s not even started operating, yet, but in some ways the WDRM is already out-of-date!

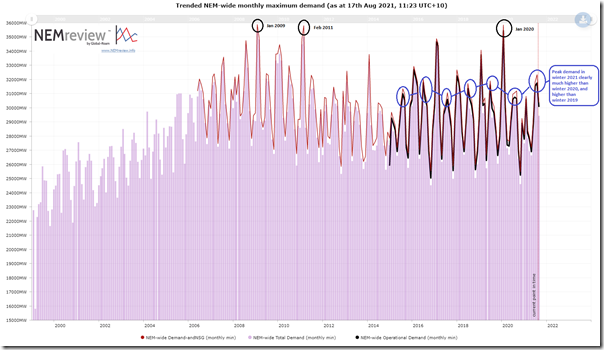

(B) Trended Maximum Demand

Given I had the query opened, and was just reviewing what AEMO noted about demand in the QED for Q2 2021, I flipped the NEMreview query to look at monthly maximum measures and include another chart (for those with a licence, here’s the query):

With respect to the above, we see:

1) Summer peak demand typically higher than winter – and sometimes very much higher.

2) Stand-out events shown in January 2009 (29th Jan 2009), February 2011 (1st Feb 2011) and January 2020 (31st Jan 2020) where demand peaks considerably higher than neighbouring summers.

3) Winter peak demand for 2021 was significantly higher than for (a more depressed) winter 2020, but also greater than winter 2019 and further back.

(C) About Solar PV

Mike’s note continues when he says …

“It’s worth noting that because there is a significant proportion of pool price sensitive, active, non-scheduled generation in the market and reacting to negative prices (self-curtailing) this minimum demand may have been lower.

Non-scheduled distributed PV between 100kW and 30MW is currently not visible to the grid operator in Australia (AEMO) so it’s tricky to know how low demand could have gone on the day.

Expect the pace of record setting to increase as the sun heads for asimuth down under.”

… and there are also comments starting to appear under Mike’s article that some might be interested to read.

(C1) Opacity of Solar PV

Mike’s comments touch on several aspects of what might be generally termed an ‘opacity, or invisibility, of small and medium solar PV’.

At a high level, it makes sense to me to think about solar PV systems in three general size chunks – small, medium and large.

(C1a) Small Solar

I’m thinking of ‘small solar’ as a category covering any solar system the is small enough to be eligible for STCs under the Mandatory Renewable Energy Target (i.e. which has a 100kW cap system). They are generally deployed on rooftops (predominantly residential – but increasingly commercial as well).

As others have reported in other locations, the pace of installation of these systems does not seem to show any sign of abating any year soon. Mike’s comments allude to the general challenge of understanding overall level of ‘Underlying Demand’ when the input side of the equation (e.g. production from rooftop systems) is not visible in real time … or even historically, on a systematic time-series basis.

Thankfully, though, the APVI (firstly) and then the AEMO developed their own processes for estimating the production of rooftop PV – and, whilst each is somewhat different, my understanding is that both use a form of ‘sample and extrapolation’ whereby:

Step 1 = time-series samples of gross output from a relatively small number of systems;

Step 2 = are converted to capacity factors by dividing by the registered capacity of the system;

Step 3 = then scaled to a region by using the total installed capacity of these systems. The reason there is a 100kW cut-off in this method is that this is the upper limit for awarding of SRES by the Clean Energy Regulator under the split MRET incentive.

In June 2016 I had written about ‘the opacity of rooftop PV’ and followed it up in December 2019 about ‘the (ongoing) opacity of rooftop PV’.

(C1b) Medium Solar

If there is opacity in terms of Small Solar, then there is outright invisibility of Medium Solar!

That’s why it’s missing in the NEMwatch Widget we produced with RenewEconomy sponsorship, for instance.

1) Medium Solar represents the growing amount of solar which Mike talks about in the range from 100kW up to 30MW

(a) note that there are a handful of plant smaller than 30MW which AEMO has some visibility of – like Royalla Solar Farm

(b) However that’s the exception, and not the rule

2) There’s currently nothing measuring (and no way used currently to estimate) the production of the rapidly growing number of solar systems being installed in that range for different purposes.

3) Where this gets especially tricky is that a growing number of these are spot-exposed, and so don’t just respond to the natural pattern of solar irradiance (more on that below…)

Read some of the comments on Mike’s article to understand the debate continuing about the need for visibility of (and sometimes also control of) these Medium Solar Farms.

(C1c) Large Solar

This last grouping encompasses a growing number of Solar Farms registered with the AEMO as Semi-Scheduled operators in the NEM (and a couple legacy Non-Scheduled ones as well), where AEMO has real-time SCADA readings from the plant on a 4-second basis, and which are used in the dispatch process.

These plant are visible, just like any other Scheduled and Semi-Scheduled plant (and a couple other Non-Scheduled ones as well).

(C2) Spot Exposed Solar PV

Mike’s comments allude to the challenge relating to any Medium Solar that is spot exposed, and which automatically switches off when the spot price falls below certain levels acceptable to the owner, or off-taker or operator. I’ve noted in other articles that we serve a number of these Solar Farms who:

1) Fit in the 100kW to 30MW ‘invisible’ Medium Solar category that Mike talks about in his article; and

2) Are spot exposed – so want to turn off automatically when prices drop below their ‘negative LGC’ threshold.

3) Think of it is ‘reverse Demand Response’, if you like – responding to negative prices instead of the traditional extreme positive prices (something that increased incidence of negative pricing suggests the NEM could benefit from a whole lot more of in the near future).

(C2a) What happened to larger solar farms

Frequent readers here will remember our coverage of the AEMC Rule Change that was made on 11th March 2021 (and which took effect from Monday 12th April 2021) relating to the same type of concern discussed earlier in the AER Issues Paper.

In this deliberation process, it was reasoned that it was not sustainable (or scalable) to have solar and wind generators switching off if they did not like the price if this was not visible (via Dispatch Targets) to the AEMO.

(C2b) Concerns about the aggregate effect of this behaviour

There is a similar debate continuing about what to do (if anything) about Medium Solar … and even Small Solar, if that were to respond to spot prices. Some comments on Mike’s article speak to this debate. We’ve had questions ourselves, as we speak to others about the need to curtail at times of negative price.

1) Are they one particularly challenging form of Invisible Man (Villain #8)?

2) Is this method of operation scalable, and sustainable?

(C3) Ticks and Traps of 5MS

One other point about these Medium Solar Farms that relate to Five Minute Settlement – which is rapidly approaching, and continuing to absorb much of our attention (occasionally bumping into some potential tripwires like this possible latency issue).

(C3a) Ramping issues for Energy Users (consumption side)

I’ve noted before that some of price-responsive energy user clients (where they have spot exposure and we help them manage this exposure as discussed here) are grappling with the physical reality that they require longer than 5 minutes to physically curtail … in which case we’re grappling with how to make them make curtailment decisions.

In this sense, 5MS is not ideal for these types of energy users.

(C3b) Ramping issues for Energy Suppliers (PV side)

Turns out that some of these will also encounter ramping constraints in the Five Minute Settlement land that will also impact on some of these Medium Solar Farms that we serve!

Hey Paul – thanks for this. Do you know (or can you explain the difference between) “Operational Demand” and “Demand and nonschedgen”. I actually thought they were analogues of each other – but checking out the data, that doesn’t appear to be the case! Cheers, Mick

Mick – there are many wrinkles to demand definitions, even the ones AEMO uses. If you hunt around you might find exactly how AEMO measures Operational Demand. I think the biggest difference between Operational Demand and the MMS DEMAND_AND_NONSCHEDGEN field is that the latter includes supply to Scheduled Loads (pumps and batteries) but Operational Demand excludes them. Allan.

This W/C article has some good references to AEMO’s definitions towards the end:

https://wattclarity.com.au/articles/2018/04/an-explainer-about-electricity-demand-take-1/

Thanks for that Allan – Make sense. Much appreciated!