On Monday this week (7th October 2024) we noted that ‘AEMO forecasts ‘Minimum System Load’ (at MSL1 level) for VIC on Saturday 12th and Sunday 13th October 2024’, with reference to the coming weekend.

… though note that the warning for Sunday 13th Oct was cancelled yesterday, but then reinstated earlier this afternoon.

In Monday’s article we also noted that the AEMO had recently also issued warnings about ‘Minimum System Load’ for the Victorian region for Friday 27th and Saturday 28th Sept 2024 (i.e. two weeks ago) – hence we thought it would be worth this quick review of (our understanding of some of) what happened on those occasions in this article, as there might be lessons for the future…

In the lead up to Fri 27th and Sat 28th Sept 2024

In the following table we point back to prior articles (from the AEMO, and from us) that pertained to both of those days.

| Friday 27th September 2024 | Saturday 28th September 2024 |

|---|---|

|

With respect to Friday 27th September 2024, the following is what was noted prior to that day: 1) At 15:14 on Wednesday 25th September, the AEMO published MN118442 with respect to ‘Minimum System Load 1 (MSL1) in the VIC Region on 27/09/2024’. The key points were: (a) a timespan of ‘from 1300 hrs 27/09/2024 to 1330 hrs 27/09/2024’ (b) a lowest point of ‘1879 MW at 1330 hrs’. 2) Shortly afterwards, we documented that with the article ‘AEMO issues (its 3rd ever) ‘Minimum System Load’ alert for Victoria … for Friday 27th September 2024’. 3) After the fact, we noted that ‘On Friday 27th September 2024, VIC ‘Market Demand’ dropped as low as 1,878MW’. … notwithstanding the caveats about apples-to-oranges comparison noted below. 4) At 15:35 on the Friday 27th September 2024, the AEMO published MN118442 with respect to ‘Cancellation – MLS1 – VIC Region at 1530 hrs 27/09/2024’.

|

With respect to Saturday 28th September 2024, the following is what was noted prior to that day: 1) At 14:54 on Wednesday 25th September, the AEMO published MN118421 with respect to ‘Minimum System Load 1 (MSL1) in the VIC Region on 28/09/2024’. The key points were: (a) a timespan of ‘from 1100 hrs 28/09/2024 to 1400 hrs 28/09/2024’ (b) a lowest point of ‘1638 MW at 1400 hrs’. 2) Shortly afterwards, we documented that with the article ‘AEMO issues the (second ever) ‘Minimum System Load’ Market Notice for Victoria on Sat 28th Sept 2024 (AFL Grand Final Day)’. 3) Early morning Friday 27th September, using the ‘Forecast Convergence’ widget in ez2view, we posted ‘Low, getting lower … AEMO’s forecasts for ‘Market Demand’ on Saturday 28th September 2024’. 4) At 10:55 on Friday 27th September the AEMO published MN118475 with respect to ‘Minimum System Load 1 (MSL1) in the VIC Region on 28/09/2024’. The key points were: (a) a timespan of ‘from 1030 hrs to 1430 hrs 28/09/2024’ (b) a lowest point of ‘1420 MW at 1200 hrs’. … so wider and deeper. 5) Shortly afterwards on Friday 27th September : (a) We documented that with the article ‘AEMO updates ‘Minimum System Load’ alert for VIC on Saturday 28th Sept 2024 … trending down towards MSL2’. (b) In that article, we again used the the ‘Forecast Convergence’ widget in ez2view to highlight what the AEMO was looking at, in the STPASA run of 10:00 that morning. 6) Then later in the afternoon on Friday 27th September (with a snapshot of the ‘Forecast Convergence’ widget in ez2view at 13:35) we noted that ‘Forecast ‘Market Demand’ for 12:00 on Saturday 28th Sept 2024 in VIC falls below MSL2 alert level’. (a) Noting that this meant that we were (at that time) past Gate Closure #1 and so within the P30 predispatch time horizon for Saturday afternoon. (b) Hence triggering the apples-to-oranges comparison noted below. 7) At 14:30 on Saturday 28th September 2024, the AEMO published MN118493 with respect to ‘Cancellation – MLS1 – VIC Region at 1430 hrs 28/09/2024’. As it turned out, on Saturday 28th September saw System Load turn out to be significantly higher than earlier forecasts by the AEMO, for several reasons (which are the focus of this article). On the upside, it meant no distractions through the AFL Grand Final! |

During, and even after, the unfolding of these events, there has been much discussion (internally, one-on-one with clients, and in various corners of social medias) about what happened, why, and what to do about this.

This article is one of the next steps in our journey in finding answers to these (and other) questions…

Three questions…

In particular, we’d like to emphasise the following three questions…

Q1) How does the AEMO even measure ‘System Load’?

What might seem, from the outside, as such a simple question is unfortunately nowhere near the case in practice. In fact, approaching two weeks later and we’re still grappling with aspects of apples-to-oranges comparison that has reared its head again in relation to this issue (such as in relation to our articles about Saturday 28th September 2024).

1) One more reminder of the gory details of measuring electricity demand!

2) We are working with AEMO to try to clarify the specific measures that are used in relation to their evolving ‘Minimum System Load’ processes:

(a) we will update the ez2view software (including widgets like ‘Forecast Convergence’) when we know the specifics.

(b) we’ll also share more here … but in a subsequent article

For now, understand that:

1) We believe our use of the ‘Forecast Convergence’ (with the toggle called ‘Total Demand’) was correct when in the ST PASA time horizon;

2) But once within the P30 predispatch time horizon (i.e. after Gate Closure #1 the day before) the widget switched to using a data set from the P30 predispatch runs … but that was no longer the the same data set in the EMMS that the AEMO was looking at in issuing these warnings!

So let’s leave this here for now, as something to revisit in subsequent articles (once we have a clearer picture ourselves).

Q2) What’s the AEMO processes for managing concerns about ‘Minimum System Load’

We’ve noticed various threads of discussions on social media about this ‘Minimum System Load’ concern (and even been tagged into a few conversations as well). We’ll not explore in any detail in this article, but rather flag a few considerations as follows:

Consideration #1 … this is a relatively new concern

Whilst stakeholders across the NEM (and across electricity grids worldwide) have been familiar with the challenge of not enough available capacity (including of a certain type) for decades, the challenge of not enough grid demand (or too much available capacity, especially of a certain type) is a relatively new consideration:

1) driven firstly by the rise of what we termed ‘the schism’ back when we compiled the GRC2018 and enhanced in GenInsights21:

(a) Between the rise of ‘Anytime/Anywhere Energy’

(b) and the commercial challenges of retaining ‘Keeping the Lights on Services’;

2) But it’s been especially created by the incessant rise of the rooftop PV juggernaut.

As a result of this, we’re in a situation is essentially playing catch-up* in working out what to do (within the boundaries of technical and commercial considerations … and political considerations as well).

* That said, it’s interesting to note that it was back in September 2021 that we wrote how ‘With ‘Minimum Demand’ plunging across mainland regions, AEMO initiates new Market Notices relating to Rooftop PV’. So it’s not like it’s just in the past month or two that we’ve started thinking about this.

Consideration #2 … is it similar to the LOR framework?

Some comments we’ve seen on social media suggest some interpretations that the framework being operated under is similar to the Low Reserve Condition framework that has existed in the NEM for ~20 years, and has been refined over time.

1) There’s even specific data sets in the EMMS related to LOR

… though it’s important to remember that there have been participant calls to improve these data sets in recent years (like adding into the EMMS the AEMO data for instances of ‘Actual LORx’).

2) That’s certainly not the case with MSL at present. Over time it might evolve into something like that, but it does not seem that this is the case at present … other than some basic details like three levels of alerting:

i.e. LOR1 very loosely ‘like’ MSL1

LOR2 very loosely ‘like’ MSL2

LOR3 very loosely ‘like’ MSL3

Consideration #3 … some NEM-wide consistency, in terms of AEMO approach, would be nice (but beware politics)

It was firstly in South Australia (with respect to the NEM) that we first encountered these challenges:

1) During Calendar 2022:

(a) Sunday 16th October 2022 was one such case in point.

(b) Through November 2022 there were instances of curtailment of rooftop PV, such as:

i. On Monday 14th November

ii. On Tuesday 15th November

iii. On Wednesday 16th November

iv. On Thursday 17th November

v. Not, on Friday 18th November?

vi. On Saturday 19th November

… all of this happening, in large part, because of the frequency islanding following failure of towers near Tailem Bend in the ‘Heywood link’.

2) During Calendar 2023:

(a) There were instances on Saturday 16th September and Saturday 23rd September and on Sunday 1st October 2023

… the article ‘Has rooftop PV in South Australia recently been curtailed with these low points for demand?’ might be a useful reference

3) During Calendar 2024:

(a) In February 2024 we saw other instances, as Linton noted with ‘Too much rooftop PV in SA, almost, as forecast for 15th February 2024’.

More recently we’ve seen these issues appear in Victoria:

1) At the end of Calendar 2023 was (I believe) the first instance:

(a) On Sunday 31st December 2023 was the first instance;

2) Now in Calendar 2024 we have seen:

(a) Then 27th and 28th September, as noted above;

(b) Now (potentially) the coming weekend.

3) Alas the ‘don’t you touch my rooftop PV’ genie has raised its head in Victoria (and this might be compounded by different technology deployment already in place), so my understanding is that the AEMO is having to chart a different path than what was developed for South Australia.

This concern will eventually reach the other regions as well (QLD, NSW … and perhaps even TAS, eventually), but I’m not sure much thought has been given to what might apply in those circumstances.

Consideration #4 … what’s the role of the Solar ‘Backstop Mechanism’?

There’s been much discussion about this new mechanism on social media in various places … we’ll need to learn more to be able to provide any useful comments about this.

Q3) What happened to System Load on Fri 27th and Sat 28th Sept 2024

So that brings us to the third question, which we’ll start to explore below….

Why was System Load higher than earlier forecasts … on both Fri 27th and Sat 28th Sept 2024?

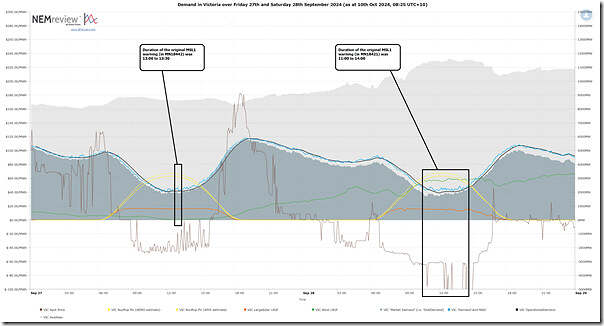

Keeping in mind the underlying challenges of apples-to-oranges comparison noted above (e.g. we are not yet 100% clear on the specific metrics the AEMO has used to assess ‘System Load’ in real time), we have trended three different demand-related metrics for both days in this chart from NEMreview v7 here:

With this background in mind …

| Friday 27th September 2024 | Saturday 28th September 2024 |

|---|---|

|

Below and two different snapshots of the ‘Forecast Convergence’ widget within ez2view when selecting the ‘Total Demand’ series (and the ST PASA time-range), to help illustrate how much (in rough times) the ‘actual’ level of System Load was higher than previous AEMO forecasts… Remember that this widget enables the user to ‘look up a vertical’ in order to see ‘that other dimension of time’. In this case we have chosen to show as ‘Chart’ view. |

|

|

With respect to Friday 27th September 2024, we’ve time-travelled back to 17:00 on the day, looking backwards to the ‘peak rooftop PV’ times in the middle of the day. Notwithstanding the apples-to-oranges issue, we can clearly see how the final measure of ‘Market Demand‘ is hundreds of megawatts higher than the ‘worst’ (i.e. lowest) forecasts produced earlier by the AEMO. Click on the image to open in larger-screen view. |

With respect to Saturday 28th September 2024, we’ve again time-travelled back to 17:00 on that day, looking backwards. Again (notwithstanding the apples-to-oranges issue) we see that the actual level of ‘Market Demand‘ is hundreds of megawatts higher than the ‘worst’ (i.e. lowest) forecasts produced earlier by the AEMO. The differences on Saturday 28th September 2024 were perhaps larger than they were for Friday 27th September 2024. Click on the image to open in larger-screen view. |

|

It’s our understanding that there were a number of responses in the system and market for this day – including: 1) We understand that one of more NSP in Victoria took action (such as switching the timing of controllable loads) to increase the size of the Underlying Demand during the times of concern. … we understand that the size of the response might have been ~120MW. 2) We also understand that there was a sizeable cohort of spot-exposed but medium-sized* PV installations that switched off in response to the (anticipated or actual) low spot prices in VIC on the Friday. (a) note * we call them ‘Medium Solar’ because they’re larger than the 100kW SRES cut-off that determines the ‘Small Solar’ but smaller than the 30MW registration threshold for (most) ‘Large Solar’ that AEMO has direct and real-time visibility of. (b) some of these solar installations will be controlled by clients of ours, who have automated triggers to switch them off when prices are below certain threshold (e.g. in some cases ‘negative LGC’) levels. (c) We have seen estimates that the size of the response might have been 30MW or 40MW in aggregate … but it’s important to note that this response is invisible (especially in real time), so these are just estimates. 3) We can also see quite low level of aggregate Wind UIGF on the day … this will have meant poor output for some smaller Non-Scheduled Wind Farms in the Victorian region (though perhaps this was also forecast in advance). 4) It’s quite likely there were other responses, as well. The extent to which these responses were triggered by AEMO’s warnings of ‘Minimum System Load’ (compared to how much response was spot-price triggered) one can only speculate. — The result of this was that the minimum level of ‘Operational Demand’ (shown in the NEMreview v7 chart above) was 2,029MW for the half hour ending 12:00 (NEM time) on this Friday. |

For the Saturday, we also understand that there were a number of responses in the system and market for this day – including: 1) Like on Friday, on Saturday (we understand) that one of more NSP in Victoria took action (such as switching the timing of controllable loads) to increase the size of the Underlying Demand during the times of concern. … we understand that the size of the response might have been ~120MW. 2) Like on Friday, on Saturday (we understand) that there was a sizeable cohort of spot-exposed but medium-sized* PV installations that switched off in response to the (anticipated or actual) low spot prices in VIC on the Friday. (a) See above that actual prices were lower on Saturday than they were on Friday (b) … we understand that the size of the response might have been up to ~90MW at times. 3) We can also above that the aggregate Wind UIGF on the day was much higher than on Friday … but we also understand that some Non-Scheduled Wind Farms in VIC still did not run (perhaps avoiding the low prices). 4) It’s quite likely there were other responses, as well. Again, it was the combined effect (i.e. AEMO’s warnings of ‘Minimum System Load’, and low prices, and other effects) that we’re speaking to here. — The result of this was that the minimum level of ‘Operational Demand’ (shown in the NEMreview v7 chart above) was 1,937MW for the half hour ending 12:00 (NEM time) on this Saturday. |

We’ll leave it here for now

Leave a comment