Last Saturday 16th September there were new low points set for ‘Market Demand’ (what’s used in NEMDE to set the price) and ‘Operational Demand’ (what AEMO sees in the grid, concerned with keeping the lights on) – as summarised in this article, and the linked earlier article.

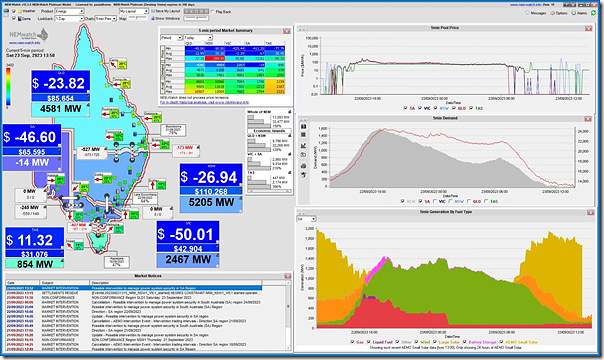

Levels have dropped further lower, to the point where NEMwatch captures –14MW as ‘Market Demand’ in South Australia at the 13:50 dispatch interval on Saturday 23rd September 2023:

Yep, that’s a negative number, and is possible based on how AEMO adds up certain inputs (remembering this this explainer of the gory details of this how AEMO adds up supply-side contributions to have a sense of what demand is (at the consumption side) in real time.

It’s actually not the first time ‘Market Demand’ has fallen below 0MW in South Australia* … but it is the first time it’s happened** since the minimum points were re-based with the addition of supply from some (formerly Non-Scheduled) wind farms now acting like Semi-Scheduled units (a change made because of the challenges of declining minimum demand!).

1) Re (*), earlier occasions were on Sun 21st Nov 2021 (down at -46MW) and Sat 27th Nov 2021 (down at -43MW).

… these ‘re-basings’ occurred at several points:

(a) it was 9th December 2021 when some Non-Scheduled Wind Farms (like Canunda, Lake Bonney 1, and Wattle Point) started operating like Semi-Scheduled units (so one reset on the measurement of ‘Market Demand’).

(b) others (like Cathedral Rocks, Mt Millar and Starfish Hill) changed their mode of operations from 1st February 2022 (so another reset on the measurement of ‘Market Demand’).

2) Re (**), using the same measurement basis, the minimum level today (-18MW at 13:55) was lower than the 5MW ‘previous lowest’ point set last Saturday 16th September 2023.

Interesting times ahead in the NEM…

PS1) SA ‘Operational Demand’ today not quite a new lowest point

Last Saturday 16th September 2023 the ‘Operational Demand’ turned out to be as low as 21MW (in the half-hour ending 13:30 NEM time) … which was 79MW below the previous ‘lowest point’ record (which was 100MW set on 16th October 2022).

The lowest point today measured by ‘Operational Demand’ was 23MW in the half-hour period ending 14:00 NEM time) … so not quite a new low-point record.

PS2) Other stats about today in SA

Not going to attach a snapshot from ez2view here, but (on a quick scan of the 13:55 dispatch interval in time-travel) appeared quite similar to what was d shown to be the case last Saturday 16th September at the lowest point:

1) Aggregate inertia in the SA region down at 6,121MW.s (same as last week), with two thermal units running, some syncons and deemed ‘inertia-like’ contribution from some BESS.

2) Two thermal units running (Torrens B3 and Mintaro) … presumably as a result of Directions, but that’s not visible until ‘next day public’.

3) Negative spot price (-$387.86/MWh … so well below ‘negative LGC’)

4) Lower Regulation FCAS price on the mainland quite elevated (+$270/MWh).

PS3) No curtailment of rooftop PV?

In October 2022 the low levels of demand raised concerns that might trigger curtailment of rooftop PV.

Today on Twitter (oops, X), Glenne Drover asked here:

‘Thanks Paul.

Q: AEMO docs refer to wanting a GW or more of min SA Demand to ensure adequate UFLS, but AEMO don’t seem to be making SAPN Curtail bulk PV when SA is well below that.

I assume AEMO, SAPN, ElectraNet are having ‘ongoing discussions’? Any thoughts on this?’

I have not seen anything official about such concerns today, or last weekend either. I’m presuming (though have not checked) that the one factor in consideration is the fact that Heywood was flowing SA to VIC last Saturday and now … so the thinking might be if there was some large-scale tripping of rooftop PV (some sort of coincident fault) that SA would remain stable because of a combined contribution of the syncons, the ability of Heywood to quickly reverse direction, and the fast response of some of the batteries in the SA under their contracts with the SA Government.

Last Tuesday 19th September Allan added this comment, which said:

‘Good illustration of the flexibility of large-scale solar (and no doubt wind) responding – via the price mechanism – to the inflexibility of its small-scale rooftop PV cousin.

It’s worth pointing out that *which* large scale generators reduce output in these events isn’t directed by AEMO for security or similar reasons – which is a common implication of the term “curtailment”.

What’s happening is normal market-based dispatch, driven by the prices at which generators have offered their output. We don’t say that there has been “curtailment” of coal-fired or other conventional generators in these events when they bid their output down to mingen, so I’m not sure why we should label large scale solar or wind bidding and responding to market prices as “curtailment” either.

If AEMO had needed to step in and have distribution companies reduce rooftop PV exports or trip inverters offline for stability reasons, that would certainly constitute “curtailment”.’

Perhaps someone else can add more?

Saturday 30th Sept appears some rooftop solar owners in Adelaide were being curtailed-

https://forums.whirlpool.net.au/thread/36yz02x6

(not my 6kW 3 phase producing 39kWhrs for the day)

A bright sunny day hitting 30 plus degrees but homes were still too cool for aircon so you could easily see why in some areas.