The new 1-Second Raise and 1-Second Lower contingency FCAS markets have now been in operation since 9 October.

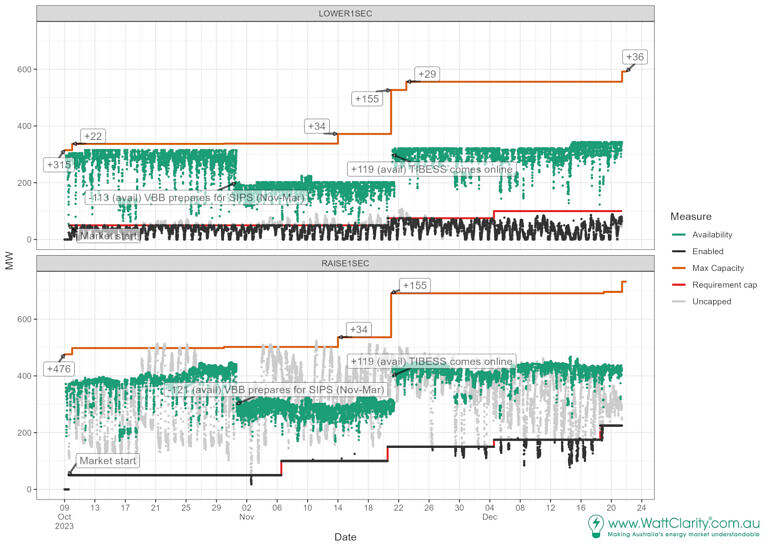

The following chart summarises how capacity, availability and volumes enabled have changed over this early phase, following on from a review of the first week’s activity.

We discuss six observations from the chart below.

1. Ongoing increases in aggregate capacity are occurring

- LOWER1SEC capacity is reaching just shy of 600 MW.

- RAISE1SEC capacity has grown above 700MW just this week (21 December).

- A peek into preproduction data suggests more is to come.

2. Several increases in the caps on the required levels have occurred

Following regular assessment by AEMO, the caps have been progressively raised since an initial increase in November. The caps are in place to ensure there is sufficient availability to meet required levels.

- LOWER1SEC’s requirement cap has seen two increases. It is now set at 100MW

- Enabled amounts have generally been at or under this capped level.

- RAISE1SEC’s requirement cap has seen four increases. It is now set at 225MW.

- Enabled amounts have generally been at the capped level.

3. Availability has generally been well above the requirement level

Requirement caps have helped limit required levels to within available capacity ensuring no supply shortfalls. To date:

- The closest LOWER1SEC enablement came to availability was in interval 2023-11-05 10:35, where availability was 75MW and enablement was 50MW. The price was 133 $/MWh.

- The closest RAISE1SEC enablement came to availability was in interval 2023-12-18 23:05 , where availability was 290MW and enablement was 225MW. The price was 96$/MWh.

4. Uncapped RAISE1SEC requirements remain high, relative to availability

- The role of the requirement cap stands out here. Without it, we’d be trying to procure more RAISE1SEC FCAS than is available on many occasions.

5. Uncapped RAISE1SEC requirements exhibit a strong diurnal pattern

- It is typically low around midday and higher in the evening.

- The RAISE1SEC requirement is for a NEM generation event (loss of generation). It is, for the most part, set by the NEM generator that is running at the highest MW level with some adjustments. Presumably this diurnal variability is linked to corresponding high PV generation and reduced grid demand, and also may be associated with periods of low energy prices.

6. Availability decrease, for SIPS, is evident

- The Victorian Big Battery (VBB) is obliged to reserve much of its capacity for the Victorian System Integrity Protection Scheme (SIPS) between November and March. The drop in availability due to this period commencing is evident at the end of October, in both markets.

- Somewhat compensating for what was removed by the VBB at the end of October, is the Torrens Island Battery Energy Storage System (TIBESS). This occurred in late November.

Past coverage

Readers may wish to explore our earlier articles on the topic:

Very Fast Raise and Lower FCAS markets to start on 9 October 2023

If I participate in the FCAS service, but happen to encounter a situation where I cannot provide the quantity as bid, will there be a fine? Is there any documentation on the penalty regulations? Thank you.

Hi Lu Ming, I’d suggest it is best to seek independent legal advice when it comes to regulations and penalties. But, by way of example, this article might also provide some food for thought: https://wattclarity.com.au/articles/2023/10/31oct-agl-fined-bayswater-loyyanga/