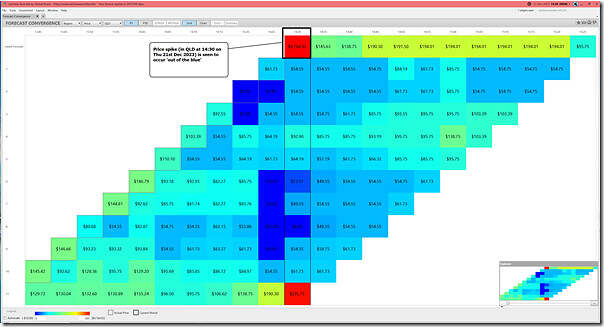

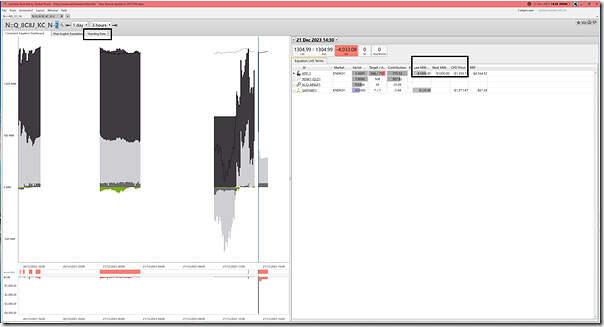

Yesterday I was working on other things, but was alerted to a price spike in QLD to $4,164.92/MWh at 14:30:

When it happened, my sense was it was ‘out of the blue’ … but did not have time to look, so (using the ‘Forecast Convergence’ widget in ez2view now) I can quickly see that this was the case:

Frequent readers will remember that you can use this widget to ‘look up a vertical’ to see ‘that other dimension of time’.

(A) Coincident trip of Middle Ridge 275kV circuit breakers

Now yesterday I had seen that AEMO had informed (via Market Notice 112579) of a trip of some circuit breakers in southern QLD just prior to the start of the 14:30 dispatch interval:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 21/12/2023 15:12:07

——————————————————————-

Notice ID : 112579

Notice Type ID : POWER SYSTEM EVENTS

Notice Type Description : Emergency events/conditions

Issue Date : 21/12/2023

External Reference : Non-credible contingency event – QLD region – 21/12/2023

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE.

Non-credible contingency event – QLD region – 21/12/2023

At 1424 hrs the H14 Middle Ridge 275 kV circuit breakers 5432 and 5422 tripped. This offloaded the H14 Middle Ridge No.2 and No.3 275/110 kV transformers.

AEMO did not instruct load shedding.

AEMO has not been advised of any disconnection of bulk electrical load.

The cause of this non credible contingency event is not known at this stage.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-’

I did not have time to (think further or) investigate at the time, but wondered if these might be related in some way?

So today curiosity* has gotten the better of me, so I’ve deferred what I should be doing (some preparations for the GSD2023) in order to take a first look at what’s visible in the market data, including the ‘next day public’ data set.

* and perhaps egged on a little by Dan’s challenge to me to reach a double century.

Incidentally, yesterday, AEMO followed up the above with this notice 5 minutes later:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 21/12/2023 15:17:22

——————————————————————-

Notice ID : 112581

Notice Type ID : RECLASSIFY CONTINGENCY

Notice Type Description : Reclassify contingency events

Issue Date : 21/12/2023

External Reference : Update – Non-credible contingency event – QLD region – 21/12/2023

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE.

Update – Non-credible contingency event – QLD region – 21/12/2023

Refer AEMO Electricity Market Notice 112579.

The cause of this non credible contingency event is not known at this stage.

AEMO is not satisfied that this non credible event is unlikely to re-occur.

AEMO has therefore reclassified this event as a credible contingency event until further notice.

Region: QLD

Elements: H14 Middle Ridge No.2 and No.3 275/110 kV transformers

Duration: 1443 hrs 21/12/2023 until further notice

Constraint set(s) invoked: Nil

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-‘

I’ve not seen anything further about the above (unless I missed it).

(B) An initial look at yesterday

Keeping in mind my time constraints, here goes for an initial review …

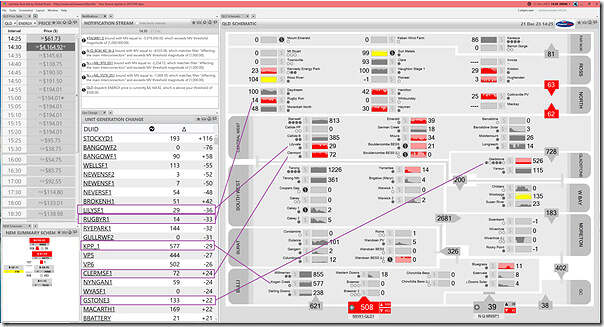

Using ‘Time Travel’ in ez2view, we can wind back the clock to look at what was happening at the time:

B1) The QLD Schematic

In this first snapshot we use the ‘QLD Schematic’ to gain an overview of the overall state of the QLD region at the end of* the 14:30 dispatch interval.

* remembering that the Schematic (and ‘Gen Change’ widgets) flip to show ‘FinalMW’ (i.e. end of interval SCADA values) when in time travel.

We see the largest changes in unit output are not in the QLD region … but the top 5 QLD changes are highlighted on the image. What role would this play in driving the price higher?

B2) The QNI interconnector

Given the price separated from the NSW price (stuck down at –$67.24/MWh) we know that constraints on the QNI interconnector will have played a significant role, so we take a look with this collage of the ‘Interconnector Details’ widget and the ‘Swim Lanes’ widget:

The key point here is that the QNI Target Flow north has been substantially reduced (dropping 115 MW … from 623MW at 12:25 to 508MW at 13:30) which would clearly seem to be one of the reasons for the QLD price spike.

We can see this matched an identical reduction in export limit.

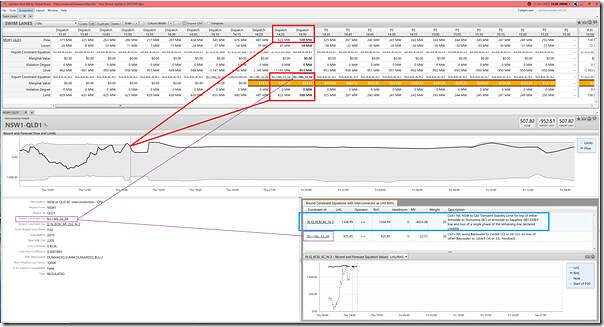

B3) Constraints limiting flow north

We’ll note that (though the AEMO in one MMS table identifies a single constraint equation that is setting the export limit on QNI), there are actually two different constraint equations setting the limit. We’ll have a look at both of these.

B3a) The ‘N>>NIL_33_34’ constraint equation

Let’s look firstly at the ‘N>>NIL_33_34’ constraint equation (which has been tagged before in articles here) via the ‘Constraint Dashboard’ widget in ez2view:

This one contains many terms on the LHS – of interest to readers might be such data including:

1) The ‘CPD Price’ …

(a) which is the price to be at-or-under to try to ensure some dispatch;

(b) Which (in conjunction with the two columns on the left of it) can help readers deduce which units are being ‘constrained down’ …

… though a note of caution that it might be more than just this constraint equation that’s limiting the output of those units where CPD Price is below or equal to ‘Next MW @’.

2) The ‘Target/Availability’ column, which shows (in pink) the volume of spare capacity unable to be (or not needed for) dispatch in this particular dispatch interval.

But we will leave this one here for now…

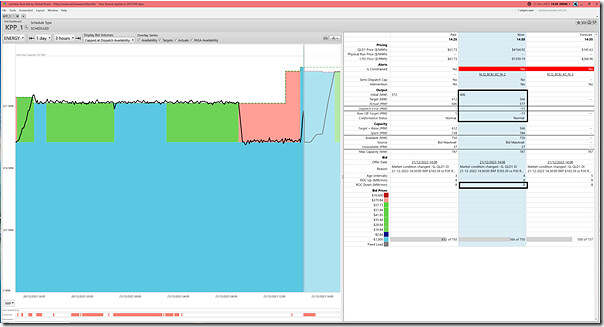

B3b) The ‘N::Q_8C8J_KC_N-2’ constraint equation

It’s the ‘N::Q_8C8J_KC_N-2’ constraint equation (first time it’s been tagged) that seems more interesting in this case, however. Here’s the equivalent view, which has a much simpler LHS form:

In this case we see Kogan Creek has spare capacity (566MW target of 750MW available).

B3) Kogan Creek output

Given that Kogan Creek is one of only 2 units on the LHS of that second constraint equation (and is the larger unit with the larger factor) I thought we’d take a look at the ‘Unit Dashboard’ widget to see what we could see there, for the unit:

So we see that:

1) The unit’s being ‘constrained down’ …

(a) Despite all volume being offered down at -$1,000/MWh (following a change in bid a few dispatch intervals ago)

(b) The unit has received a Target of 566MW down from an InitialMW of 606MW

(c) Which equates to a ramp down of 40MW in 5 minutes

2) But is limited in how much it can ramp down by a slow ROCDOWN rate:

(a) We see the ROCDOWN rate in the bid was 8MW/minute

(b) So 40MW per dispatch interval.

3) Thinking back to the the ‘N::Q_8C8J_KC_N-2’ constraint equation above, this means that QNI is then called on to take up the bulk of* remaining amount of the reduction on the LHS of the ‘N::Q_8C8J_KC_N-2’ constraint equation above.

* have not looked at the Directlink interconnector.

Note that I’ve not had time to look at the RHS of that constraint equation to see if it helps explain more.

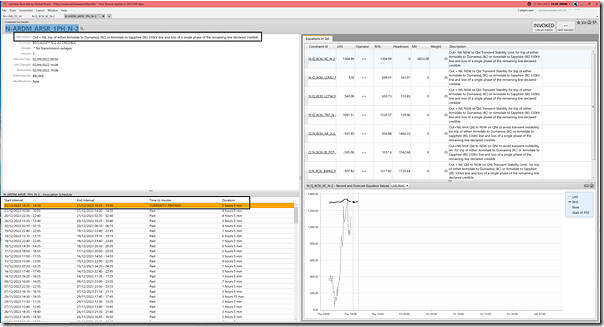

B4) The ‘N-ARDM_ARSR_1PH_N-2’ Constraint Set

The ‘Standing Data’ tab highlighted above on the Constraint Dashboard widget for the ‘N::Q_8C8J_KC_N-2’ constraint equation (not shown here) highlights that that constraint equation is a member of the ‘N-ARDM_ARSR_1PH_N-2’ constraint set … so we hyperlink through the ‘Constraint Set Details’ widget to see more about this.

In particular note that this constraint set has just become invoked in the 14:30 dispatch interval … and that this is a result of ’trip of either Armidale to Dumaresq (8C) or Armidale to Sapphire (8E) 330kV line and loss of a single phase of the remaining line declared credible’.

B5) Lightning around Armidale

That brings me back to another Market Notice published yesterday just before the spike, which (it turns out) was more directly relevant to the spike occurring:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 21/12/2023 14:19:40

——————————————————————-

Notice ID : 112578

Notice Type ID : RECLASSIFY CONTINGENCY

Notice Type Description : Reclassify contingency events

Issue Date : 21/12/2023

External Reference : Reclassification of a Non-Credible Contingency Event: Armidale – Dumaresq 8C 330kV line and Armidale – Sapphire WF 8E 330kV line in NSW1 due to Lightning.

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Reclassification of a Non-Credible Contingency Event as a Credible Contingency Event due to Lightning. AEMO considers the simultaneous trip of the following circuits to now be more likely and reasonably possible. Accordingly AEMO has reclassified it as a credible contingency event.

Region: NSW1

Lines: Armidale – Dumaresq 8C 330kV and Armidale – Sapphire WF 8E 330kV

Duration: 21/12/2023 14:19 until further notice

Constraint set(s) invoked:

N-ARDM_ARSR_1PH_N-2 Constraint set contains the following interconnector(s) on the left hand side:

N-Q-MNSP1

NSW1-QLD1

Auto-generated on behalf of Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-’

So it was this, and not what happened at Middle Ridge, that was the ‘culprit’.

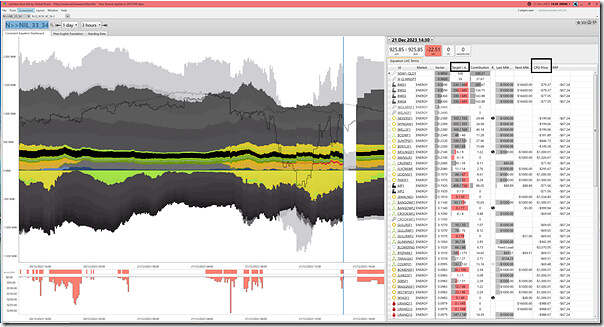

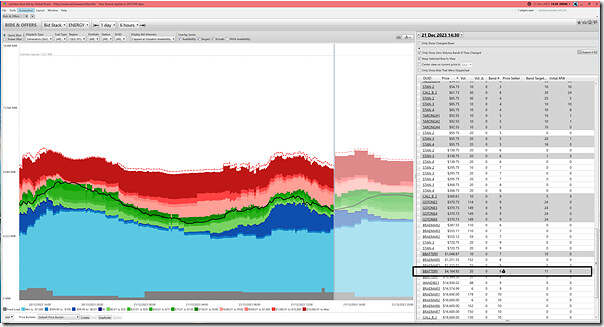

B6) A quick look at bids in QLD

Quickly rounding out this initial analysis we take a quick look at the ‘Bids & Offers’ widget inside of ez2view focused on the QLD region and the 14:30 dispatch interval yesterday:

Two point to quick note:

1) The rows not shaded grey are unit bid bands that had volume allocated but received no target:

(a) Of particular interest are the ones below the RRP.

(b) There are various reasons why NEMDE determine this as the optimal result – but I have not had time to check:

i. These might include ramp rate limitations … like for Kogan

ii. It might be that those units are unable to provide ENERGY because of provision of FCAS

iii. It might be that the units are unable to be dispatched because of FSIP limitations.

2) Bouldercombe BESS is the one determined by NEMDE to be price setter in the QLD region in this dispatch interval.

There’s more we could look into, but that’s it for today… back to the GSD2023!

Be the first to comment on "An initial exploration of QLD’s spike at 14:30 on Thursday 21st December 2023"