Following yesterday’s warnings about the potential for a tight supply/demand balance in South Australia this week, it was not really a surprise when the SMS alerts from NEM-Watch began buzzing for the 07:20 dispatch interval this morning (NEM time), highlighting that the dispatch price in SA had jumped to $12,199.20/MWh. This has continued through the morning.

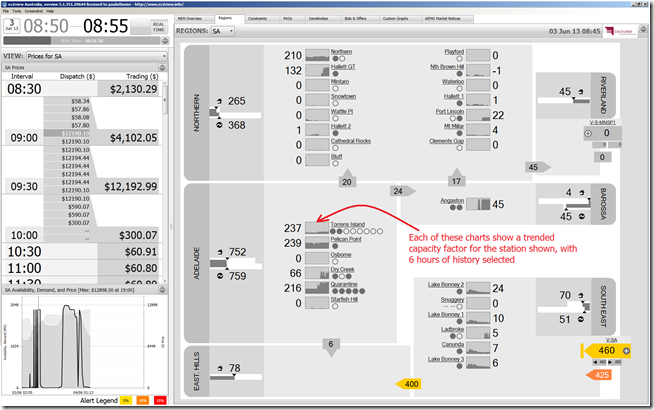

As seen in this snapshot from ez2view of one of many price spikes in the day (this one at 08:55) there is plenty of capacity around the state not performing at anywhere near its maximum registered capacity.

Throughout the day we noted a couple of interesting developments, as follows:

1) Price spikes yo-yo each half hour

The trading price for each half hour is made up of the time-weighted average of 6 x 5-minute dispatch prices in the half hour.

Throughout the morning we noted that there seemed to be, only one price spike in most half hours, meaning a trading price in each half hour of approximately $2,200/MWh. It’s particularly of interest that these spikes have tended to occur later in the trading period, as shown here:

Trading period

Trading price

Comments 07:30

$2,079.82/MWh

Dispatch price spike to $12,199.20/MWh at 07:20 – the 4th dispatch interval in the half-hour 08:00

$2,106.55/MWh

Dispatch price spike to $12,199.20/MWh at 08:00 – the 6th dispatch interval in the half-hour 08:30

$2,130.29/MWh

Dispatch price spike to $12,199.20/MWh at 08:30 – the 6th dispatch interval in the half-hour 09:00

$2,079.80/MWh

Dispatch price spike to $12,199.20/MWh at 08:55 – the 5th dispatch interval in the half-hour 09:30

$2,078.52/MWh

Dispatch price spike to $12,199.20/MWh at 09:05– the 1st dispatch interval in the half-hour 10:00

$57.39/MWh

No spike! 10:30

$2195.33/MWh

Dispatch price spike to $12,899.60/MWh at 10:05 – the 1st dispatch interval in the half-hour (a little higher than the first five spikes) 11:00

$2,079.44/MWh

Dispatch price spike to $12,190.10/MWh at 11:00 – the 6th dispatch interval in the half-hour 11:30

$94.18/MWh

No price spike! 12:00

$1,934.09/MWh

Dispatch price spike to $11,048.00/MWh at 12:00 – the 6th dispatch interval in the half-hour We’ll have to wait until tomorrow, when the AEMO publishes bid information (including rebid reasons) to understand more.

2) Installed generation capacity found wanting

There’s more than 5,500MW of installed capacity in South Australia registered with the AEMO (by Maximum Capacity) and yet today the region has been struggling, today, to supply even the modest demand of about 1,500MW.

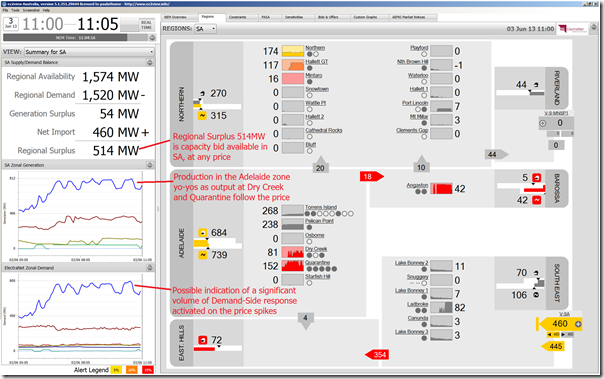

As shown in the second screenshot from ez2view below (from 11:05) there’s only 1,574MW of capacity bid available to the AEMO – this, when added to the import capability of the one link operational at present, means a regional surplus of only 514MW.

This appears to be as a result of a number of different factors, including the following:

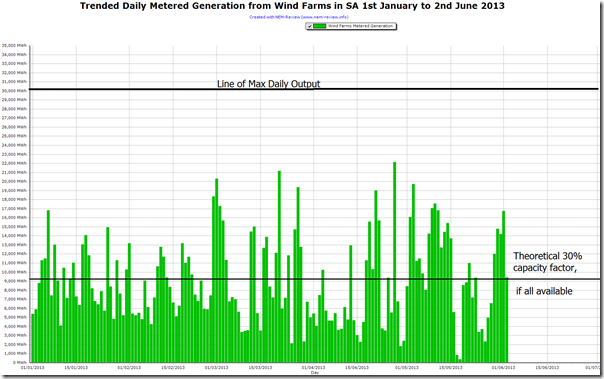

2a) Wind Generation sorely missed this morning

The screenshot above highlights how SA wind farms have been becalmed over the past 6 hours. To see a longer trend, we trend daily aggregate metered generation from SA wind farms over the calendar year to date (using NEM-Review):

We have included this trend for completeness, even though it is not as relevant for wind (as output is much more random than for the stations shown below). Unfortunately at present the randomness is one of the factors hurting prices in SA.

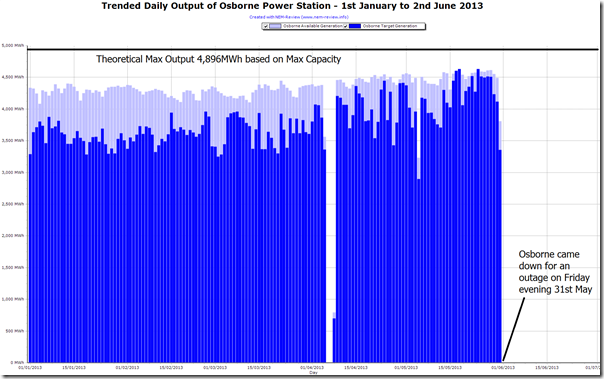

2b) Outage at Osborne

Coincidentally, the high capacity factor combined cycle plant at Osborne plant came offline on Friday evening 31st May and has not yet returned:

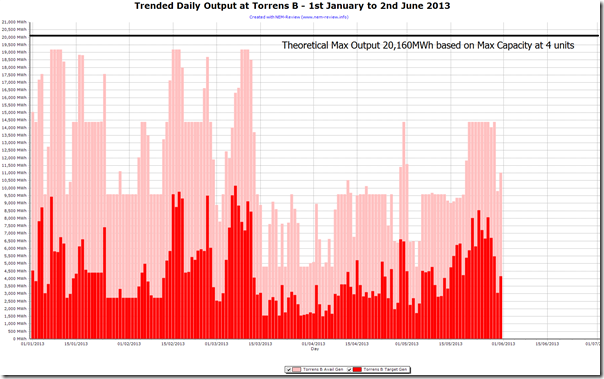

2c) Torrens Island capacity well down

Output at the Torrens Island plant has been low for a long period of time. Firstly, the higher efficiency station at Torrens B has been running with limited units online for a number of months – as shown in the trend below.

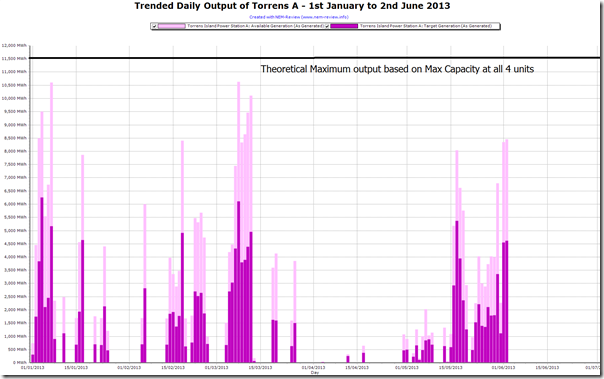

This morning it has only been B station unit 2 which has been running (and only at an output around 60MW). Over at the older A Station, output has been very sporadic – as shown below:

This morning there have been 3 units running (A1 and A2 strongly, and A4 barely).

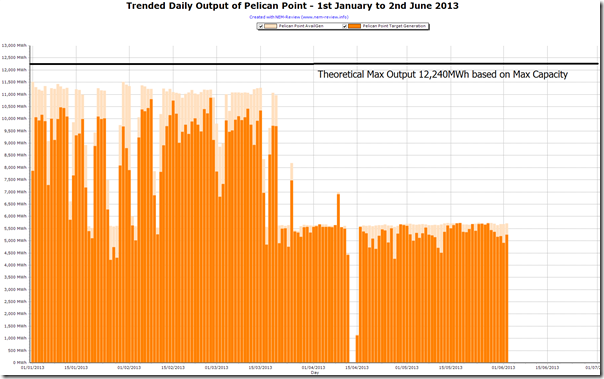

2d) Partial Outage at Pelican Point

Pelican Point, normally a consistent generator, has also been down at part-load for a number of weeks as a result of an outage onsite:

2e) Murraylink outage continues

The screenshots from ez2view above highlight energy flowing in from Victoria over the Heywood (AC) interconnector. They also show that the Murraylink (DC) interconnector in the north is still out of action (the current return-to-service expectation is this Friday 7th June at 17:55)

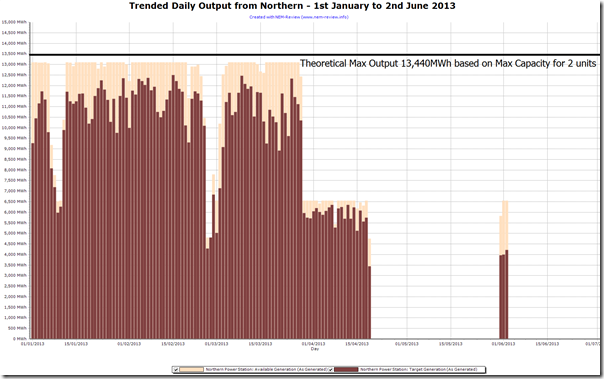

2f) Brown Coal saves the day

In something of an ironic “victory”, Northern Power station has returned to service this winter (contrary to some earlier indications that had it only running for Q1 summer months) to produce a much needed 200MW into the grid:

It promises to be an interesting/challenging/rewarding week for multiple parties in relation to South Australia – especially if the wind continues to stay away…

Leave a comment